State revenue collected by the General Fund and the Education Trust Fund met the combined target amount in January, leaving the State’s revenue deficit for the year slightly smaller than it was at the end of December. January revenue was above the State Revenue Plan by $2.2 million (1.1 percent), leaving the total State Fiscal Year 2025 revenue deficit at $39.0 million (2.8 percent) below planned amounts.

Those topline figures are better for State finances than December revenues, which fell $20.4 million (6.6 percent) short of their target. But the underlying composition of the revenue totals continues to be a warning sign for future revenues, as the State’s surplus in January was due, in large part, to temporary sources.

Sources of Surplus

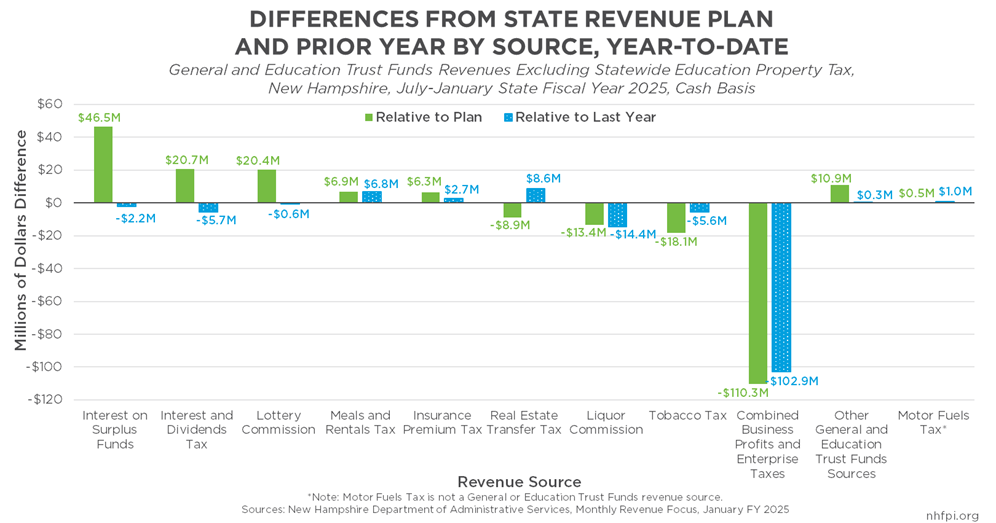

The Interest and Dividends Tax was a tax on income generated from ownership of assets and wealth that collected most of its revenue from households with high incomes. This tax was formally repealed in January, but collections based on last year’s activity, when the tax was in effect, will continue through April, followed by a small amount of revenue from reconciliation and auditing. Revenue from the Interest and Dividends Tax was $9.1 million (74.0 percent) above the planned amount for January, making this disappearing revenue source the second-largest generator of surplus over planned amounts among the revenue sources.

The largest source of surplus in January was the Lottery Commission, which is not a tax revenue source. Lottery revenue has been rising substantially in recent years following several expansions of gaming options. However, lottery revenues can be difficult to predict; they were $13.5 million (90.0 percent) above the State Revenue Plan for this month because of a large Mega Millions jackpot.

The third-largest source of surplus revenue was also not a tax revenue source, but one that is likely to disappear. Interest earned on State cash holdings came in $5.9 million above planned amounts. State cash holdings are declining as the State spends one-time federal funds and as tax revenues that previously generated surpluses to contribute to cash holdings no longer do so.

Business Tax Shortfall Widens

The primary source of the substantial revenue growth the State has experienced since the start of the COVID-19 pandemic has been the Business Profits Tax, the larger of the two business taxes. Business tax receipts are reported together each month due to data limitations, but the information available continues to indicate that the traditional volatility of state corporate tax revenues is not working in the State’s favor this fiscal year.

Combined business tax receipts were $26.6 million (41.2 percent) below the target set in the State Revenue Plan for January. Receipts were $19.6 million (34.0 percent) below last January’s revenues, and for the year thus far, business tax revenues were $110.3 million (18.2 percent) below plan and $102.9 million (17.2 percent) below prior year.

Other revenue sources have either been near their targets or have added to the revenue deficit. The largest shortfalls relative to expectations have been in the Tobacco Tax, which is $18.1 million (14.0 percent) below target thus far this fiscal year, and Liquor Commission revenue to the General Fund, which is $13.4 million (18.4 percent) below expectations.

Impacts on the State Budget

January is not a key month for State revenues, as quarterly business tax estimate payments are not due for most businesses, and most returns are not due until March and April. A business tax revenue shortfall in January does not definitively indicate the next State Budget will be challenging to fund. The State also has an estimated $126.4 million revenue surplus from last fiscal year to offset the current year’s shortfall.

However, these January revenues show that the State is continuing to rely on two key disappearing sources of income for the majority of revenue growth, as it did in State Fiscal Year 2024. Policymakers will be using recent revenues to inform their revenue projections for the next two fiscal years. If business tax receipts continue to fall this far short in March and April, that would signal significant challenges ahead for funding the next State Budget.

– Phil Sletten, Research Director