New Hampshire’s shortage of available housing units has contributed to rapid rental and house price increases in the State since the beginning of the pandemic. Renters and potential home buyers are very likely to face serious challenges in finding suitable and affordable housing in the Granite State. The 2023 New Hampshire Statewide Housing Needs Assessment noted that the State will need almost 90,000 more housing units by 2040, which includes the more than 23,500 additional units needed to meet the current housing demand.

The shortage has pushed New Hampshire housing prices to record highs. Interested home buyers must also consider added costs stemming from the highest 30-year fixed-rate mortgage interest rates since July 2006, with the exception of a sharp spike in late 2022 that briefly brought the average interest rate to above seven percent. A lack of affordable housing increases the number of families and households who are cost-burdened by housing, limits the ability of individuals and families to pay for other needs, increases evictions and the unhoused population, and constrains the growth of the State’s workforce.

While State- and federally-funded initiatives helped address pandemic-related housing costs, and may help address future housing challenges, the immediate need for housing units is acute. Given the scale of the housing shortage, more investments and policy interventions may be needed to accelerate initiatives and address high construction costs due to ongoing demand for housing units across the country.

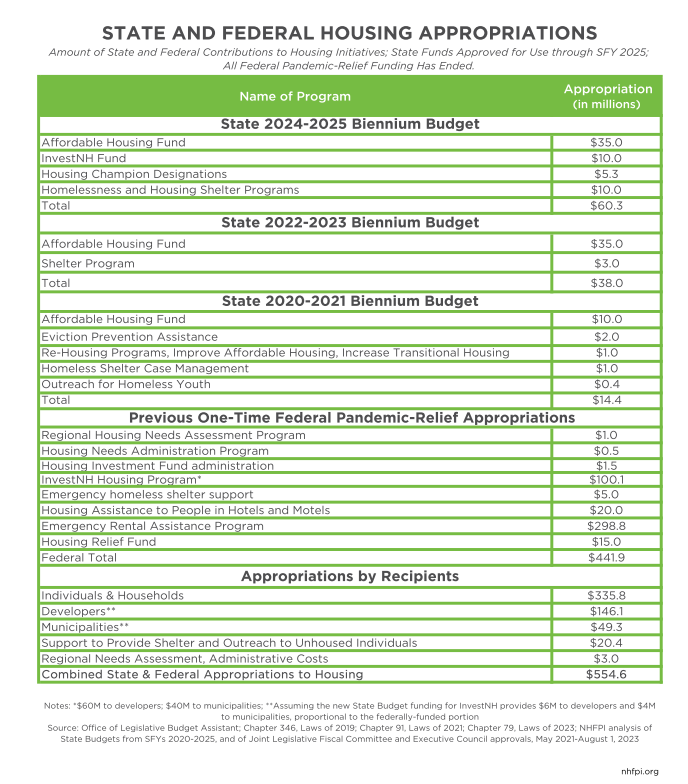

Recent Federal and State Housing Investments

Including both pandemic-related federal and State funds, New Hampshire has spent or allocated $554.6 million on housing initiatives since 2020. Over $335.8 million of this aid has been used to provide direct aid to New Hampshire residents in need of housing assistance through programs like the New Hampshire Emergency Rental Assistance Program and New Hampshire Housing Relief Program, both of which were supported with federal funds.

Over $195 million has been allocated to developers and municipalities for long-term investments intended to increase housing units through key programs, including the Affordable Housing Fund, InvestNH, and the Housing Champion Designation and Grant Program Fund, as well as a regional housing needs assessment and related administrative costs. The Affordable Housing Fund provides grants and low-interest loans for building or acquiring housing affordable to people with low-to-moderate incomes. The InvestNH Fund was originally created from flexible American Rescue Plan Act (ARPA) funds to support the development of multi-family rental properties and to encourage municipalities to add units and update zoning regulations. The Housing Champion Designation and Grant Program Fund provides resources to encourage municipalities to increase housing units through changes in zoning and infrastructure upgrades. The voluntary program allows municipalities to apply for “housing champion designation,” and in exchange for the designation, municipalities have preferred access to State housing-related resources.

The current State Fiscal Years (SFYs) 2024-2025 biennium budget helps to address the housing shortage and homelessness through $60.3 million in combined contributions to the Affordable Housing Fund, InvestNH, and the Housing Champion Designation and Grant Program Fund, as well as support for unhoused individuals and shelter programs. This total is significantly more than in the SFYs 2020-2021 biennium budget, which allocated approximately $14.4 million toward housing, mostly related to eviction and homelessness prevention. The 2020-2021 biennium budget also established the Affordable Housing Fund with a dedicated revenue stream of $5 million each SFY from the Real Estate Transfer Tax. The SFYs 2024-2025 contribution toward housing is also more than the SFYs 2022-2023 biennium budget’s, which allocated $38 million toward the Affordable Housing Fund and the Department of Health and Human Services’ Shelter Program.

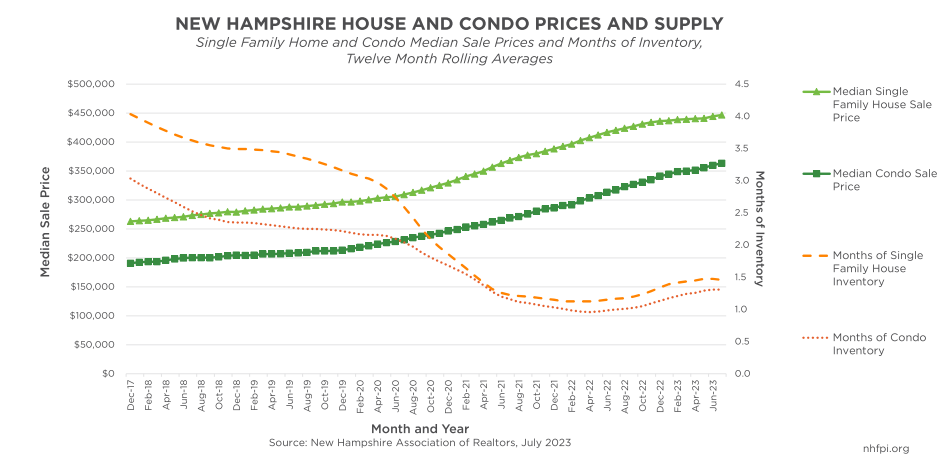

Shortage of Single-Family Homes Increases Prices to Record Highs

Limited housing inventory has contributed to record-breaking home prices that are not affordable to many New Hampshire households. The median sale price for a single-family home in the Granite State peaked in June 2023, when it reached $499,450, a 51.3 percent increase from June 2020, according to the most recent report from the New Hampshire Association of Realtors. Initial calculations for July 2023 show a 4.0 percent decrease from June in the median sale price of single-family homes to $480,000. Affording a median-priced single-family home, even with the preliminary decline from the June peak, is out of reach for most Granite Staters. Using a 6.84 percent 30-year fixed-rate mortgage, the average for July 2023, with a 5 percent down payment of $24,000 and the 2021 average annual New Hampshire property taxes per household of $7,470, a homebuyer would need to pay a monthly mortgage of $3,607; this does not include homeowners insurance or private mortgage insurance. A household would need to spend nearly 49 percent of its monthly income ($7,372, the median monthly household income estimate) in order to afford a median-priced house.

Months of inventory, a key housing industry metric, is defined as the number of homes for sale at the end of a given month divided by the average monthly pending sales from the last 12 months. The Real Estate Center at Texas A&M University estimates a balanced housing market has about 6.5 months of inventory. This level would indicate that the buyer and seller would have roughly equivalent negotiating power in a sale. New Hampshire only had an average of 1.5 months of housing market inventory from July 2022 to July 2023. While inventory is slightly higher than the lowest levels of 2021 and 2022, far fewer homes are on the market than would be required for buyers to have balanced negotiating power and an array of options.

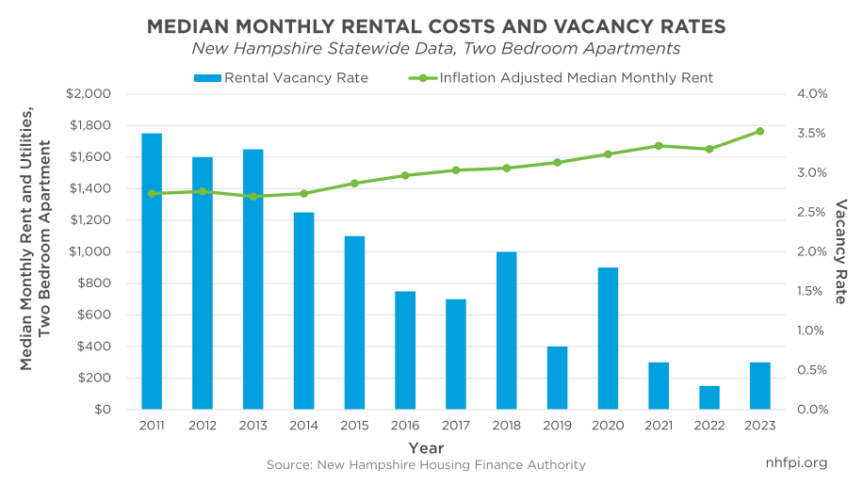

Challenges for the Rental Market

As the rental market is a critical component of the overall housing market and does not function independently from the buyer’s market, the high cost and limited supply of homes drives up housing costs for everyone. Higher-income renters previously planning to purchase a home may remain in the rental market in response to high prices and rising interest rates, meaning fewer rental units are available for lower-income individuals and families who could not otherwise afford a home.

The New Hampshire 2023 Residential Rental Cost Survey Report, published by the New Hampshire Housing Finance Authority, notes monthly rent for a two-bedroom apartment is $1,764, an annual increase of 11.4 percent. A large driver of this increase was utility costs; data collected by the New Hampshire Housing Finance Authority suggested those costs were approximately $315 per month for a two-bedroom apartment unit in which the tenant pays for heat, compared to only $197 per month in 2022, a 59.9 percent increase.

Like the housing market inventory, rental vacancies are at historic lows. While a balanced rental market vacancy rate is approximately 5 percent, the vacancy rate for two-bedroom apartments in New Hampshire was 0.6 percent in data collected during early 2023, an increase of 0.3 percent from 2022 but considerably lower than the 5 percent rate that would produce a balanced market, according to the New Hampshire Housing Finance Authority.

In 2021, 27.5 percent of New Hampshire households rented their homes. Renting households had lower median incomes ($53,114) than owner-occupied households ($103,743). Paying high rental prices disproportionately impacts low-income New Hampshire residents. A Granite Stater who earns the current $7.25 an hour minimum wage would need to work over 56 hours a week to afford a median-priced two-bedroom apartment, without consideration for any other living expenses. High rental prices made nearly 45 percent of New Hampshire renters cost-burdened by housing in 2021, the most recent year data is available. Individuals who spend 30 percent or more of their household income toward housing costs are considered housing cost-burdened and are more limited in their spending for other household expenses.

While the federal Housing Choice Voucher Program is available to qualifying New Hampshire residents with low incomes, the New Hampshire Housing Finance Authority reports individuals and families may wait five to seven years before a voucher becomes available. Once a voucher is available, an individual or family may struggle to find suitable housing; a 2022 House Bill intended to prevent landlords from refusing housing vouchers was tabled by the House.

Consequences of the Housing Shortage

Homeownership is out of reach for most low-income households, and financially challenging for many middle-income and upper-middle-income households in the current market. High rental costs paired with steep climbs in house prices and rising mortgage interest rates make saving for a downpayment increasingly difficult for renters. According to the 2023 New Hampshire Quality of Life survey, 53 percent of Granite Staters between 20 and 40 years old reported affordable housing was somewhat or much worse than in other states. Low housing stock paired with low vacancy rates is a workforce constraint, as out-of-state individuals seeking employment in New Hampshire may not be able to find housing, and young New Hampshire residents may move to other states in search of more affordable living arrangements.

Starting in 2021, individuals could receive pandemic-related housing assistance from the New Hampshire Emergency Rental Assistance Program (NHERAP), funded by ARPA’s State Fiscal Recovery Funds; however, NHERAP ended June 15, 2023, transferring costs of emergency housing back to local municipal welfare offices. Due to low vacancy rates, municipalities in some cases have needed to house individuals and families in hotels and motels, which may cost substantially more than housing individuals in shelters or rental units.

The ongoing housing shortage, paired with the end of pandemic-era moratoria on foreclosures and evictions and direct federal aid programs like NHERAP and the expanded Earned Income Tax Credit, may be contributing to increased rates of homelessness in New Hampshire. Point-in-Time estimates, which are counts of all individuals experiencing homelessness who are both sheltered and unsheltered, documented by locally organized Continuums of Care programs, suggest rates of homelessness in New Hampshire increased by 7.6 percent between 2021 and 2022. During a similar timeframe, foreclosures and evictions also increased. According to ATTOM Data Solutions, a for-profit property data company, foreclosures in New Hampshire increased 12.72 percent in the first half of 2023 relative to the prior year. Moreover, based on reports from the New Hampshire Judicial Branch, Writs of Possession, which are used to remove tenants from rented properties, increased 13.5 percent between 2021 and 2022.

Looking Ahead

The New Hampshire housing shortage continues to make suitable housing difficult to find, and for some Granite Staters, to afford. While the current biennium’s State Budget provides investment for new and ongoing housing initiatives, more policy responses may be needed to address the shortage. Using a multi-pronged approach with a variety of strategies, including project-based vouchers, construction of multigenerational homes, and Accessory Dwelling Units (ADUs) with revised parking requirements may effectively help increase housing units, lower costs, and reduce the number of unhoused Granite Staters.

– Nicole Heller, Senior Policy Analyst