After the Governor introduced his State Budget proposal in February, the House Finance Committee has been working to understand and make amendments to the next State Budget. These changes to the Governor’s proposal made by the Committee will go before the full House of Representatives for consideration before the State Budget process moves to the Senate.

The House Finance Committee proposed a wide variety of changes, including altering the budgets of 25 out of 40 State agencies, eliminating most of the Governor’s proposals for licensing and regulatory reforms, adding separately-passed House bills to the State Budget, and undertaking new initiatives.

Below are five key changes made to the Governor’s proposed State Budget by the House Finance Committee. To learn about all the changes the Governor had proposed in his budget and more about the House Finance Committee’s changes that are not in this list, see NHFPI’s Issue Brief summarizing the Governor’s State Budget proposal and NHFPI’s webinar reviewing the House Finance Committee’s changes, both available on www.nhfpi.org.

The Budget Gets Bigger

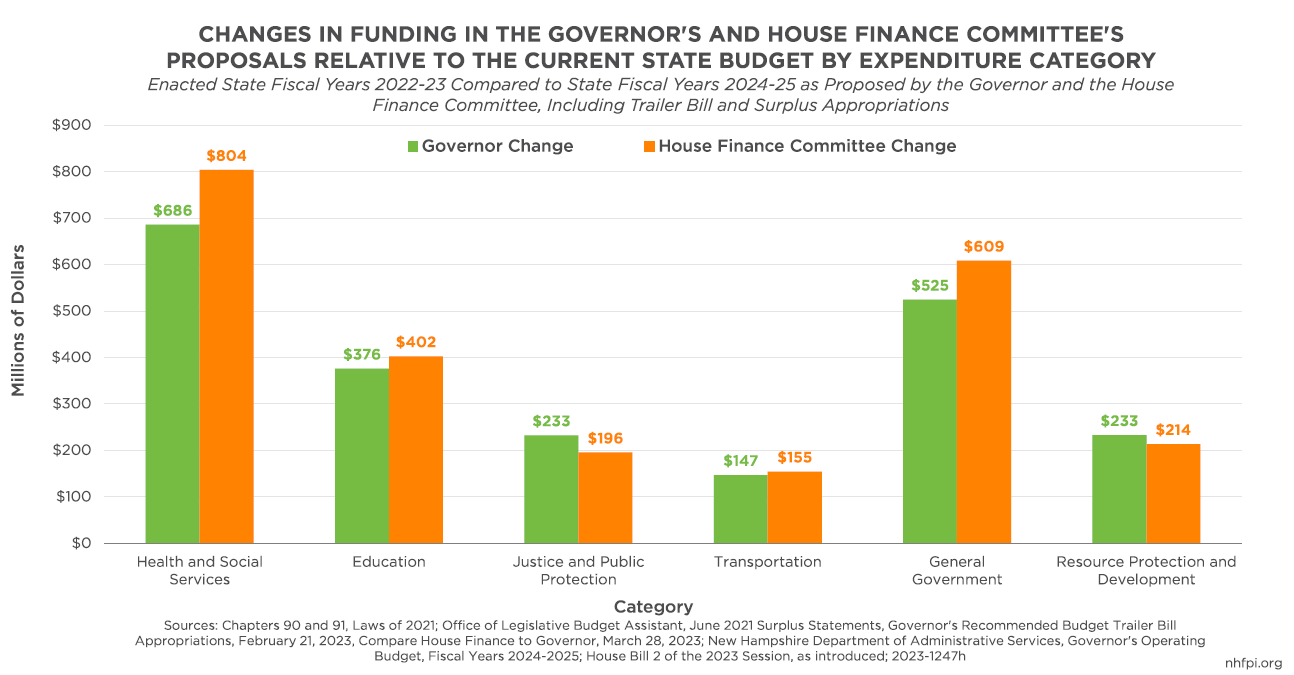

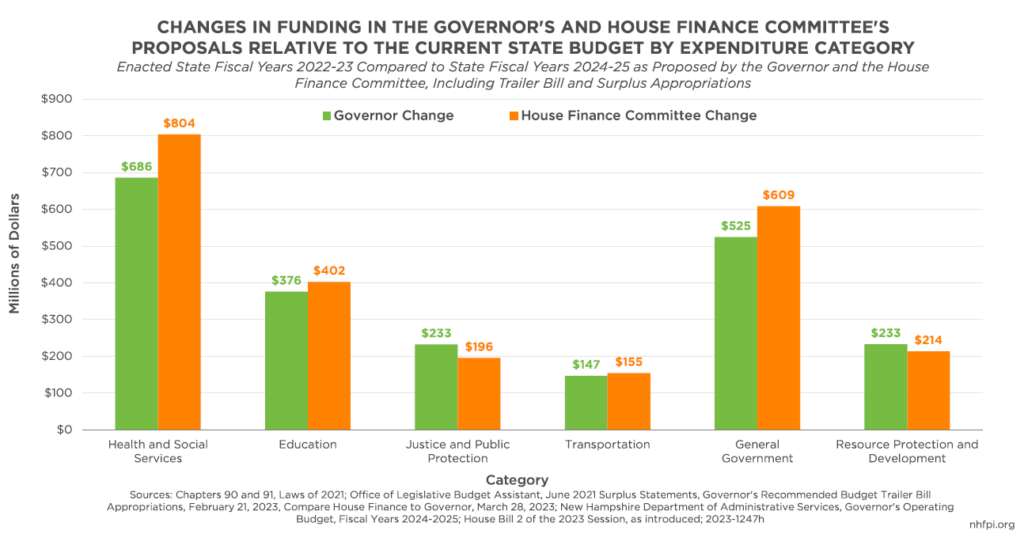

The House Finance Committee would boost the size of the next State Budget a bit more than the Governor’s proposal, which was already a substantial increase over the current State Budget. Inflation has impacted the costs of State services, and significant revenue surpluses, generated in large part by substantial increases in national corporate profits since the COVID-19 pandemic’s beginning growing State Business Profits Tax revenues, have enabled the continued funding of those services.

The House Finance Committee’s proposal would add about $180 million (1.3 percent) to funding for State agencies over the Governor’s State Budget. The Governor proposed increasing funding at most State agencies in the first year of his budget proposal even before applying his proposed 10 percent State employee pay increase.

The House Finance Committee reduced funding to a few agencies relative to the Governor. The largest reductions included fewer funds to support affordable housing construction through two State agencies, reducing the initial appropriation at the Department of Corrections for a new State prison for men, and moving funding for a new parking garage for the Legislature entirely outside of the State Budget. Beyond those changes, every State agency saw relatively little change or a budget increase relative to the Governor’s budget in the House Finance Committee’s proposal.

More Funding for Medicaid

One key agency receiving more funding is the Department of Health and Human Services, which administers the Medicaid program. Medicaid is a federal-state partnership that helps ensure people with low incomes, limited resources, or in need of long-term care have better access to health services. Medicaid usually behaves like private insurance, reimbursing health care providers for services to enrollees who would likely not be able to afford them otherwise. However, Medicaid reimbursement rates are typically lower than those funded by private insurance or the federal Medicare program for older adults. NHFPI research published last year determined that key New Hampshire reimbursement rates for home and community-based long-term care have fallen behind inflation over time.

The House Finance Committee proposed substantial Medicaid reimbursement rate increases beyond the amount included in the Governor’s budget. The proposed rate increases include $24 million in State funds for general rate increases and another $70.2 million for targeted rate increases. State fund totals allocated toward this purpose will be at least doubled by federal matching dollars. Areas with the most substantial targeted rate increases would include community mental health services, developmental services for those with disabilities or acquired brain disorders, home health and personal care aides, and both nursing homes and assisted living facilities.

Coverage for Medicaid would also be expanded. The federal government has offered to match funding for additional postpartum health coverage, and the House Finance Committee’s budget would adopt the policy and fund the State portion of that match. Under the Committee’s proposal, mothers who had their births covered by Medicaid could continue to stay on Medicaid for 12 months after the birth, rather than the 60 days currently provided.

The House Finance Committee included a two-year extension of the Granite Advantage program, also known as Medicaid Expansion, in the State Budget. The program, which had 95,845 enrollees at the end of February 2023, is scheduled to end after this calendar year when the current five-year extension expires. The Senate has unanimously proposed authorizing the program permanently in a separate bill.

Enhanced Targeting for Education Aid

The Governor proposed an expansion of State-funded public education aid to communities, boosting the base per pupil amounts received by school districts and making other key changes to the funding formula. About 70 percent of funding for school districts in New Hampshire comes from property taxes raised locally, while State funding accounts for about 20 percent of school district revenue. The House Finance Committee recommended keeping most of the Governor’s proposed changes, making slight increases to aid for students who are English language learners and with special education needs relative to the Governor’s proposal.

The House Finance Committee would substantially boost the aid targeted to communities based on a combination of the number of their students eligible for free and reduced-price school meals, typically due to low incomes at home, and the taxable property value in a community. Lower taxable property values would lead to more aid provided by the State per low-income student, but that additional aid is capped. The Governor would hold the maximum amount at $650 per student provided to school districts, and the Committee decided to boost that figure to a maximum of $3,750. While the Committee’s proposed amount would grow at a slower rate than the Governor’s over the next ten years, it would effectively provide more targeted resources earlier to communities with a combination of low property values and high student poverty than the Governor’s proposal.

Eligibility for the Education Freedom Account program would also be expanded, with the one-time income eligibility test lifted to a higher income level, and removed entirely for students in certain other situations, such as in foster care, with a disability, or within the geographic boundaries of certain schools that score low on performance metrics. The House Finance Committee also removed some of the Governor’s proposed school building aid, and would expand both funding for public charter schools and the access charter schools have to school building aid.

Food and Care for Children

More students would become eligible for free meals at school through two key policy changes. First, the House Finance Committee would expand eligibility for free or reduced price school meals at school from 185 percent of the federal poverty guidelines, or about $45,991 for a family of three, to free meals for all students below 300 percent of the federal poverty guidelines, or $74,580 for that family.

Second, the House Finance Committee’s State Budget amendments include a provision that would allow all children enrolled in Medicaid to be automatically certified for a free meal at school. This step, reflecting policy already in place for children enrolled in the New Hampshire Food Stamp Program, would reduce administrative barriers to children in families with low incomes having access to food during the school day.

State support for child care would become available to more families, and be more substantial for child care providers, under the House Finance Committee’s proposal. Eligibility for child care scholarship assistance would be raised to 85 percent of the statewide median income, increasing access to aid for more Granite State families. Also, State reimbursement payments to child care providers would rise to 75 percent of the market rate or be based on a formula used to estimate the true cost of care; currently, New Hampshire’s reimbursement is set to 55 percent or 60 percent of the market rate, depending on the age of the child, according to University of New Hampshire researchers.

Reducing Tax Revenues in the Future

The Governor’s State Budget proposal included an elimination of the Communications Services Tax, which is charged on certain two-way communications services, including both landline and cellular phone bills. The House Finance Committee retained the Communications Services Tax in its budget proposal, using it to fund certain changes in the State’s retirement system. That increased tax revenues by an estimated $57.8 million, relative to the Governor’s proposal, in the Committee’s plan for the biennium.

However, the House Finance Committee would speed up the elimination of the Interest and Dividends Tax. This tax generates revenue from income based on wealth, rather than through the sale of assets or through salaries and wages. About half of the tax revenue in Tax Year 2020, the most recent year with published data, was collected from filers who had more than $200,000 in interest, dividends, and distribution income generated by assets they owned, which likely exceeded $4 million to generate that much income in those forms.

Under current law, the Interest and Dividends Tax is being phased out, and is set to be eliminated in 2027. The House Finance Committee would eliminate this tax in 2025. Official State estimates suggest that earlier elimination would cost the State Budget $17.4 million during this biennium and $82 million during the next biennium, reducing the revenue available for subsequent State Budgets to fund services for Granite Staters.

– Phil Sletten, Research Director