The State of New Hampshire may not use $1.25 billion in recently received federal funds through the Coronavirus Aid, Relief, and Economic Security (CARES) Act to offset revenue losses created by the economic impacts of the pandemic, according to guidance issued by the U.S. Department of the Treasury. The guidance, released April 22, effectively prevents the State from deploying this funding to support the existing State Budget, even as State revenues fall short of expectations during the COVID-19 crisis.

New Guidance for Federal Funding

The CARES Act established the $150 billion Coronavirus Relief Fund to provide payments to state, local, and tribal governments. The CARES Act required that these funds be used for necessary expenditures incurred due to the COVID-19 public health emergency, be used between March 1 and December 30, 2020, and support expenses not accounted for in budgets approved before the Act was passed. New Hampshire received $1.25 billion from the Coronavirus Relief Fund.

The new federal guidance clarifies that qualifying expenditures include direct spending on emergency and public health needs, as well as responding to secondary impacts of the crisis, such as economic supports for those who have lost employment or income. The funds can be used for unemployment compensation, but cannot be used for the State’s share of Medicaid costs, benefits or payroll for employees whose work duties are not dedicated to responding to the COVID-19 crisis, workforce bonuses other than hazard pay or overtime, and certain other expenses. Funds can be used for transfers to local governments to support qualifying expenditures related to the COVID-19 crisis. However, losses of State revenue due to the crisis are not considered qualifying expenses, and therefore the funds cannot be used to back fill a budget shortfall.

Substantial Revenue Losses Expected

The massive economic impacts of the COVID-19 crisis are expected to lead to significant reductions in State revenue. Key revenue sources, including receipts from taxes on business profits and payroll, restaurant meals and hotel rentals, interest and dividend payments, and real estate sales, will likely be dramatically reduced in the short-term, and may not recover for the remainder of the State Budget’s duration.

Any projection of State revenue impacts is complicated by currently unpredictable factors, including the duration of the public health crisis, the speed of the economic recovery as the health impacts recede, and the responses of taxpayers to shifted tax filing compliance timelines. Too little is known about the nature of this crisis to say what will happen with certainty.

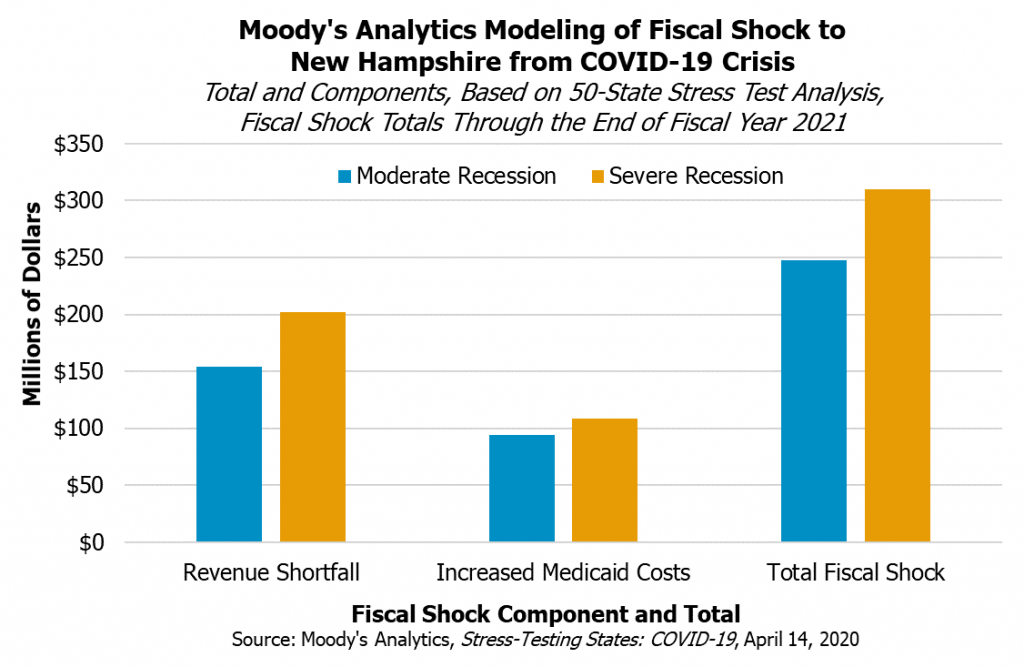

In an effort to provide some insight, Moody’s Analytics updated their fifty-state fiscal “stress test” for the COVID-19 crisis on April 14. The updated stress test modeled two different recession scenarios: a moderate recession and a severe recession. The major adjustment from prior stress tests was the timeline of the economic impact, as this economic contraction appeared much more quickly than recessions previously modeled. The projected fiscal shocks in the stress test accounts for tax revenue shortfalls and increases in Medicaid expenditures.

Moody’s Analytics estimated New Hampshire would see revenues drop between $153.9 million and $201.9 million through the end of State Fiscal Year 2021. The additional increased Medicaid costs projected would bring the combined fiscal costs to between $247.9 million and $310.27 million, depending on the severity of the recession. While these figures are the result of a 50-state analysis and are not a detailed look at New Hampshire’s revenue system, they provide some indication of the revenue shortfalls the state may face.

New Hampshire‘s Rainy Day Fund currently holds $115.3 million, which can help offset these revenue losses and pay for needed services. New Hampshire may also receive approximately $140 million in additional federal Medicaid assistance from enhanced federal matching funds implemented prior to the CARES Act that is not incorporated into the Moody’s analysis. However, the undesignated General Fund surplus at the end of March 2020 was only $0.9 million, indicating little financial cushion exists beyond the Rainy Day Fund.

Without federal support to offset revenue losses, New Hampshire must increase revenue to pay for currently-budgeted services, reduce or eliminate some services, or implement a combination of both. The current State Budget made needed investments in health services and the healthcare workforce, mental health infrastructure, education and training, affordable housing, and services to protect children and assist older adults. These investments will remain key to the health and well-being of Granite Staters during and after the COVID-19 crisis.

– Phil Sletten, Senior Policy Analyst