February brought a revenue boost for New Hampshire, with collections substantially exceeding expectations. However, this surplus stemmed primarily from early Insurance Premium Tax payments, rather than revenues that are more likely to be sustained, and other tax receipts continued to indicate potential shortfalls ahead.

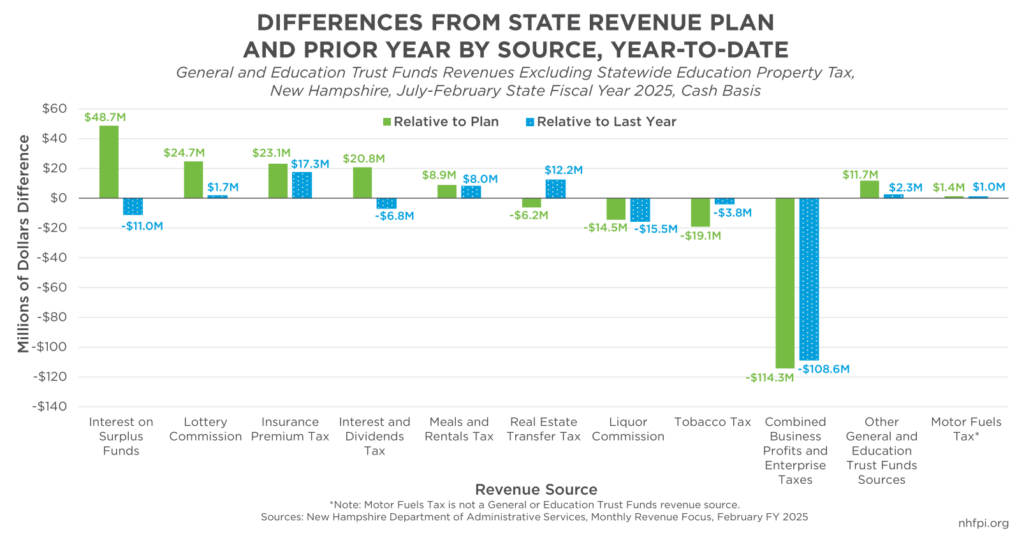

Combined February revenue to the General and Education Trust Funds was above the State Revenue Plan by $22.8 million (21.2 percent), leaving the total State Fiscal Year 2025 revenue deficit at $16.2 million (1.1 percent) below planned amounts.

While neither January nor February are particularly significant months for State revenues, especially relative to March and April, both months have exceeded the State Revenue Plan’s expectations. While January had lower collections than January 2024, February’s collections were higher than last year’s by $8.8 million (7.2 percent).

Early Insurance Premium Tax Revenues Drive February Surplus

The largest sources of surplus in February were Insurance Premium Tax revenues ($16.8 million more than the planned amount), Lottery Commission transfers ($4.3 million more), and Real Estate Transfer Tax revenues ($2.7 million over the planned amount).

Insurance Premium Tax revenues were 275.4 percent of planned amounts for February, according to the Insurance Department, because a new electronic filing platform allowed more companies to file their payments early. Of the planned $143.0 million to be collected by the Insurance Premium Tax for the General Fund during State Fiscal Year 2025 in the State Revenue Plan, $127.6 million (89.2 percent) is scheduled to arrive in March. Early February payments may have simply displaced payments that would have otherwise happened in March. The State’s reporting of March revenues will provide insight into the extent to which the $16.8 million surplus generated by Insurance Premium Tax revenues in February represents new activity or is solely time-shifted relative to expectations.

Real Estate Transfer Tax revenues outperformed expectations, however, because January sales activity was higher than anticipated. The number of transactions reported in January sales were 0.9 percent higher than in January 2024, and the transaction values were 17.7 percent higher. While the number of sales likely remains constrained by very limited housing supply, the higher values combined with the continuing incremental rise in sales increased tax revenue. Taxable sales, however, are not only from single-family houses, and also could include land, commercial properties, or transfers of ownership interest in properties. The Governor’s revenue projections anticipate significant Real Estate Transfer Tax revenue growth during the next State Budget biennium.

According to the Lottery Commission, lottery receipts were higher primarily because of sports betting and historic horse racing gaming rising above expected levels.

Continued Underperformance of Business Taxes Ahead of Key Spring Months

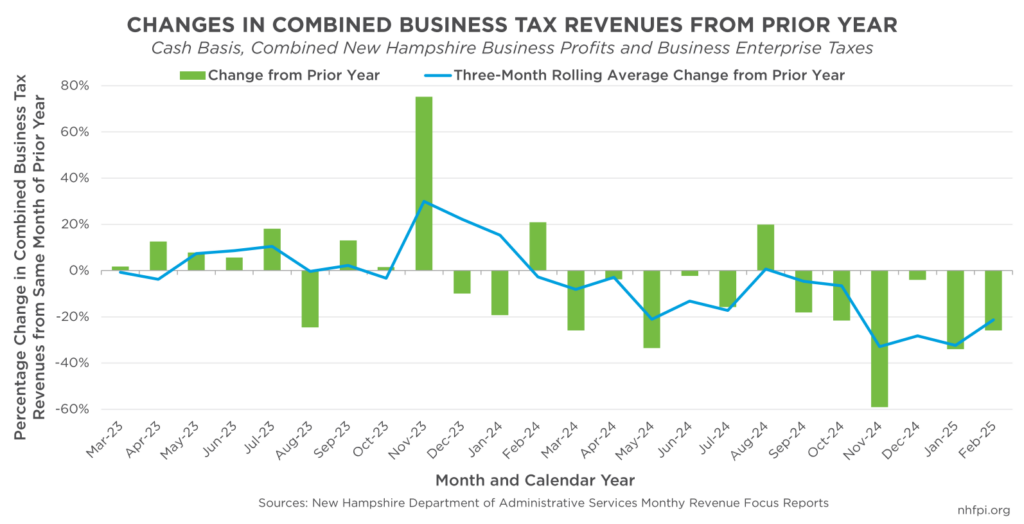

February is not a key month for business tax receipts. However, Business Profits Tax revenues, which likely account for about three quarters of the combined receipts, have been the primary source of State revenue growth during the last ten years. April is the most important month for business tax revenues, as it includes both tax returns from last year’s activities and the first quarterly business tax estimate payment from businesses for the new year. Some business types need to file in March, rather than April, and also pay their quarterly estimates that month. As a result, the State Revenue Plan projected that 33.5 percent of all business tax revenue expected for the year would be collected the during the months of March and April.

While state corporate tax receipts are often volatile, recent trends in business tax revenues do not suggest March and April revenues will be robust. On average this fiscal year so far, business tax receipts have been about 19.8 percent lower each month than they were in the same month last year. The three-month rolling average for the most recent data shows receipts are 21.3 percent lower on average. Business tax revenues can swing substantially across years based on activity at a small number of large businesses. However, there have only been two months in calendar years 2024 and 2025 thus far during which business tax revenues have been higher than they were in the same month of the prior year.

Some factors impacting business tax receipts during this time period, such as higher levels of refunds resulting from State policy changes, may be temporary. National corporate profits may also rebound and push New Hampshire’s business tax receipts higher. However, recent trends from these smaller collection months have not provided reassurance that revenues will rebound.

With business tax revenues underperforming ahead of two critical months, State policymakers will likely be closely monitoring March and April and looking for hints about implications for future revenues. Policymakers will rely on these revenue data to determine the size of any fiscal gap, and the magnitude of any policy adjustments used to close it, in the next State Budget.

– Phil Sletten, Research Director