State revenues in September, the first major month of collections for New Hampshire’s two primary business taxes in the new fiscal year starting July 1, were behind planned amounts for two key State funds by about $27.9 million (7.8 percent). This shortfall generated a small deficit of $20.1 million (3.2 percent) for the year thus far, and revenues were behind last year’s cash-basis collections by $39.2 million (6.1 percent).

While this current cash-basis shortfall could easily be absorbed by last year’s cash surplus of approximately $146.5 million (4.6 percent), revenues falling below planned amounts and below last year’s collections, even without adjusting for inflation, suggest State policymakers may face additional challenges funding the next State Budget. If they persist, these challenges will likely be compounded by the planned disappearance of a key tax revenue source, the Interest and Dividends Tax, next year under current law.

Lower Business Tax Receipts Bring September Revenues into Deficit

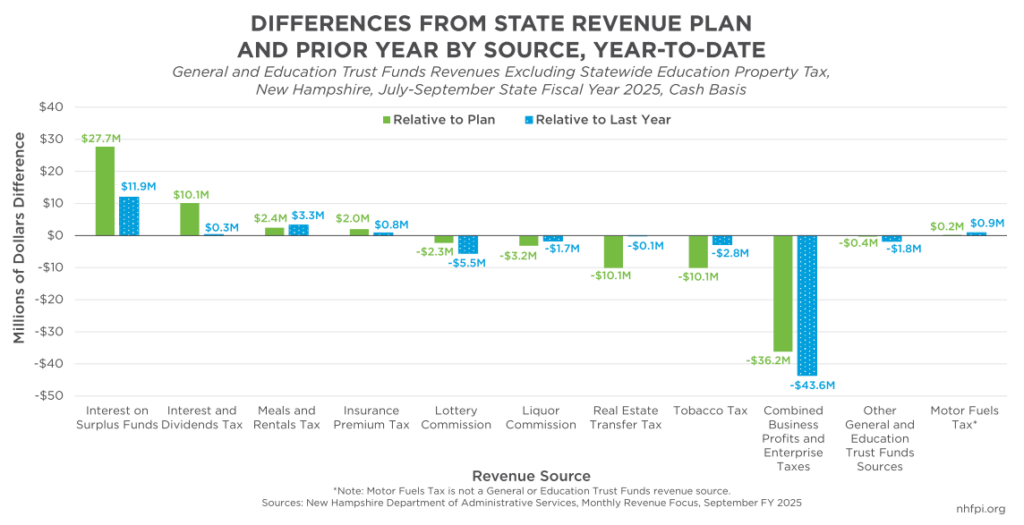

While September receipts as a whole were $27.9 million below the combined State Revenue Plan for the General Fund and the Education Trust Fund, revenues would have been in surplus if receipts from the combined business taxes were on target. However, combined business tax revenues in September, a month when most taxpaying businesses have quarterly estimate payments due, were $33.7 million (15.4 percent) below the $219.2 million expectation for the month in the State Revenue Plan. The two separate business taxes are reported together because businesses typically pay them together, and may not be differentiate between payments for the two taxes until filing final returns for the year. Combined business tax receipts were $40.9 million (18.1 percent) below last September, and were below planned amounts for State Fiscal Year (SFY) 2025 so far by $36.2 million (13.1 percent).

Other revenue sources for the General and Education Trust Funds had mixed performances relative to the State Revenue Plan. Tobacco Tax and Real Estate Transfer Tax revenues were both well below expectations for the month, by $2.9 million (15.7 percent) and $4.8 million (24.0 percent), respectively. Revenues from the Interest and Dividends Tax, which will be repealed next calendar year under current law, were $8.5 million higher than planned in September; income from interest on State cash holdings also generated $6.0 million more revenue than expected. These two likely temporary revenue sources continue a trend from recent months of acting as the primary drivers of revenue growth while other revenue sources, particularly the two business taxes, fall short.

The drop in business tax receipts is significant not only because of the size of the decline in September’s revenue, but also because of the implications for longer-term revenue trends. During the last four State Budget cycles, the State collected significant revenue surpluses driven primarily by rising national corporate profits that bolstered the Business Profits Tax (BPT). The BPT is the State’s largest tax revenue source; it collected more than twice the revenue of the next-largest tax revenue source, the Meals and Rentals Tax, in State Fiscal Year (SFY) 2023. The companion Business Enterprise Tax (BET) has had much more limited growth, in part due to more aggressive tax rate reductions since 2015 relative to the BPT’s rate reductions. Both the BET and the BPT have had their rates reduced incrementally since 2015, including a 2023 BPT rate reduction, which have likely led to state revenues being more than half a billion dollars lower than they would have been since 2015 without the tax rate reductions.

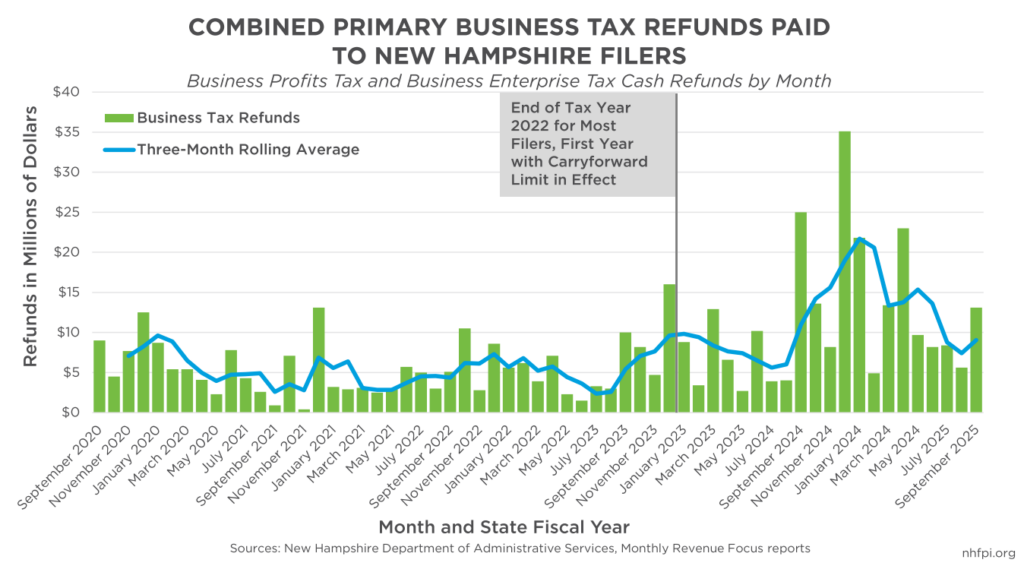

However, components of the impacts from those rate reductions are included in the State Revenue Plan; as a result, the rate reductions may be reflected in lower actual revenues relative to prior years, but as they are incorporated into the revenue amounts planned by policymakers, reductions should not generate a significant deficit relative to target amounts. Changes made to reduce the liability from tax overpayments made by businesses may be more likely than rate changes to impact actual State revenues compared to planned revenues. Starting in Tax Year 2022, State legislators capped the amount of money a business taxpayer can hold, or carryforward, as credit with the State to 500 percent of its liability, and the rest must be refunded; that carryforward cap will drop to 250 percent of tax liability in Tax Year 2029 under current law. The cap starting in Tax Year 2022 likely had the greatest impact on SFYs 2023 and 2024 revenues.

The cap appeared to result in increased refunds requested, as businesses that otherwise may have stored their money with the State, which does pay interest, were required to shift their dollars elsewhere. Refunds totaled $64.6 million, averaging $5.4 million per month, during SFY 2022, and rose to $83.9 million, averaging $7.0 million per month, in SFY 2023. The total refund amount more than doubled, to $169.8 million, in SFY 2024, and averaged $14.2 million per month during that year.

The initial imposition of the carryforward cap likely spurred the substantial increase in refunds, and the new policy likely required some time to reach full awareness and compliance among business filers, particularly the large filers that operate in many jurisdictions. However, so far in SFY 2025, refunds are averaging $8.4 million per month. While that average is higher than in SFYs 2022 and 2023, it is substantially lower than SFY 2024’s average, suggesting the pace of refunds may be slowing. The New Hampshire Department of Revenue Administration reported that refunds in September SFY 2025 were 47 percent lower than in September SFY 2024. Despite this slowing pace of refunds, combined business tax revenues were substantially lower in September, suggesting that lower amounts of taxable economic activity, particularly corporate profits, might be the cause. Quarterly estimate payments in September were 22 percent below the same month last year, while both return payments and extension payments, for the minority of businesses with those payments due in September, were down 27 percent and 15 percent, respectively.

Foreshadowing or False Signal?

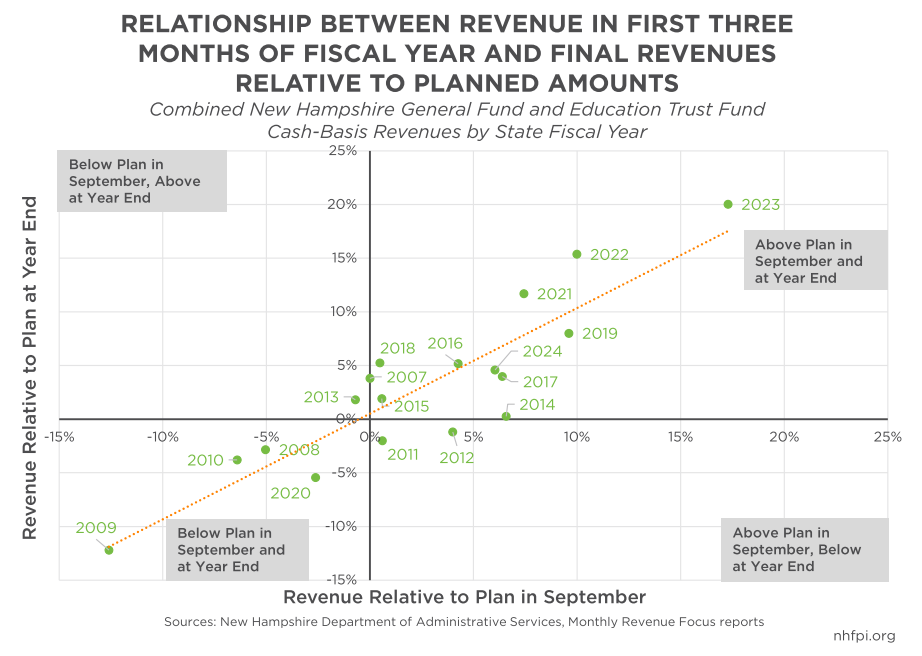

With nine months remaining in SFY 2025, receipts through September may not be indicative of State revenue performance during the rest of the year, or during the following two years of the next State Budget. However, historical data suggest they may give us a relatively reliable signal about the potential status of revenues at the end of the fiscal year.

In only three of the 18 years (16.7 percent) from SFYs 2007 and 2024 did the first three months of the year end with a deficit when the year ended with a surplus, or vice versa. During SFYs 2011 and 2012, early in the recovery from the Great Recession of 2007-2009, both Septembers ended with a surplus, but the full year ended with a deficit. The next year, SFY 2013, September ended with a deficit for the first three months of the year, while the year end was a surplus. In all other cases, a deficit as of the end of September was followed by a deficit at the end of the fiscal year, except for 2007, when September was exactly on target with the State Revenue Plan and the year ended with a surplus.

Each year brings different economic circumstances, and both revenue policies and budgeting practices can change as well. There is no guarantee that a revenue shortfall by the end of the first quarter of the fiscal year indicates revenues will fall short at the end of the year. Even when first-quarter revenues match the direction at the end of the fiscal year, the relative magnitudes of the deficits or surpluses vary considerably. However, given the historical record, policymakers may anticipate crafting strategies to manage a deficit in SFY 2025, and to plan carefully to fund critical services and bolster revenues as needed to support Granite Staters with the next State Budget.

–Phil Sletten, Research Director