The State’s two primary business taxes have brought in significantly more revenue than expected thus far in 2018, raising questions about the sources and durability of this boost in receipts. Businesses are changing their behaviors in response to corporate tax reform at the federal level in ways that generate more revenue within the existing state business tax structure, but some changes are likely to be temporary and have limited long-term effect. Legislators should be cautious regarding the use of these revenues, given the lack of assurance that higher-level revenues will continue and other uncertainties surrounding the State’s longer-term revenue.

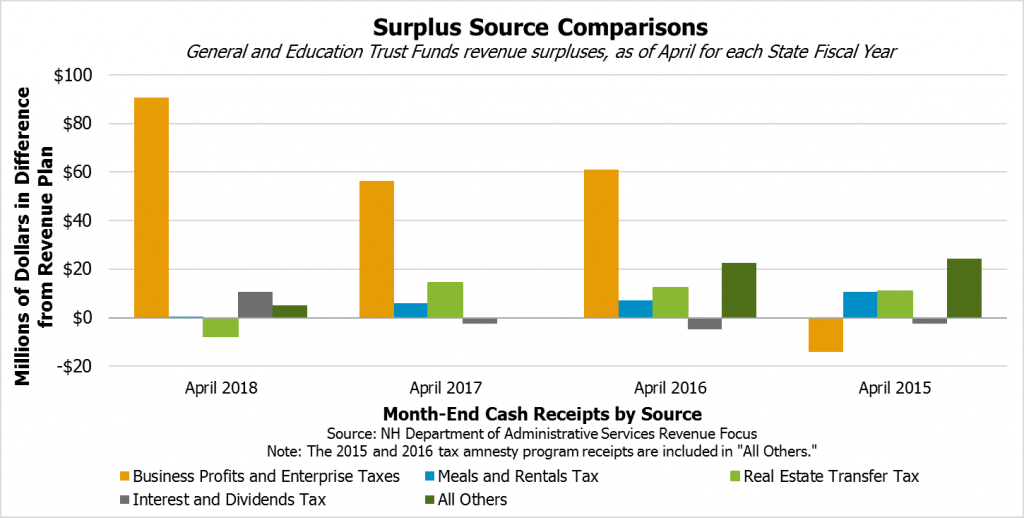

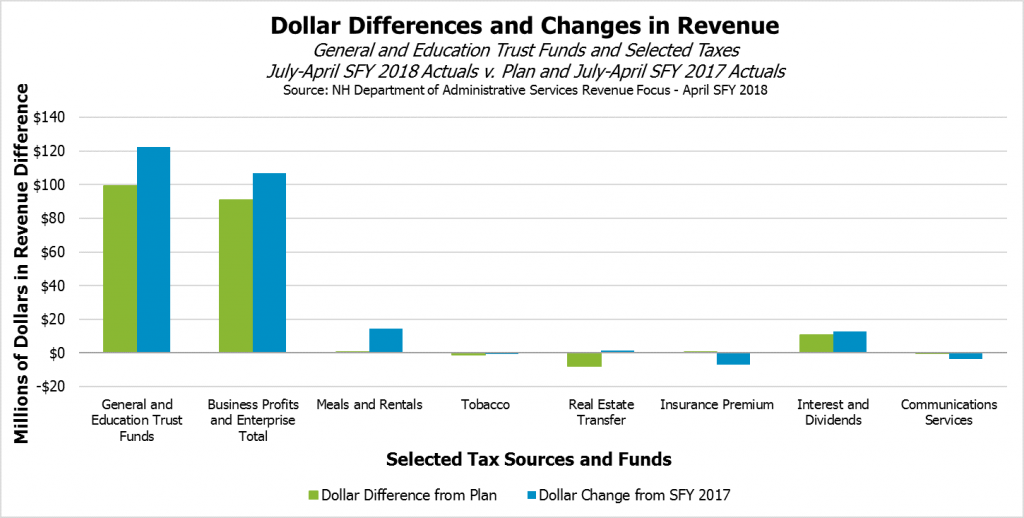

Revenues to the General and Education Trust Funds were $46.1 million higher than the State Revenue Plan in April alone, which brought the running total for the unrestricted revenue surplus to $99.3 million for the year through the end of April. This represents a dramatic rise from the first portion of the fiscal year, when surpluses were much smaller. Revenues between the start of the State fiscal year, which began July 1, 2017, and the end of January were $23.8 million (2.3 percent) higher than plan, and only $5.5 million (0.9 percent) higher at the end of October.

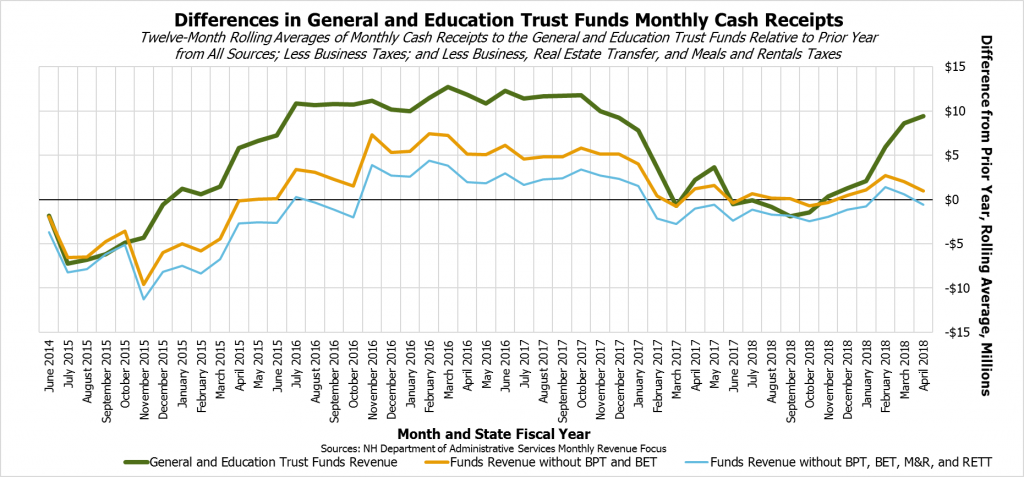

A twelve-month rolling average of cash receipts relative to the prior year shows that, after about a year of stalled growth, revenues have jumped back to nearly the levels of increase seen during the post-recession economic growth of 2014, 2015, and 2016. Parsing through these figures show the growth has been disproportionately driven by the last three months of receipts from Business Profits Tax (BPT) and the Business Enterprise Tax (BET), which followed the federal tax changes passed in December 2017 in the Tax Cuts and Jobs Act (TCJA).

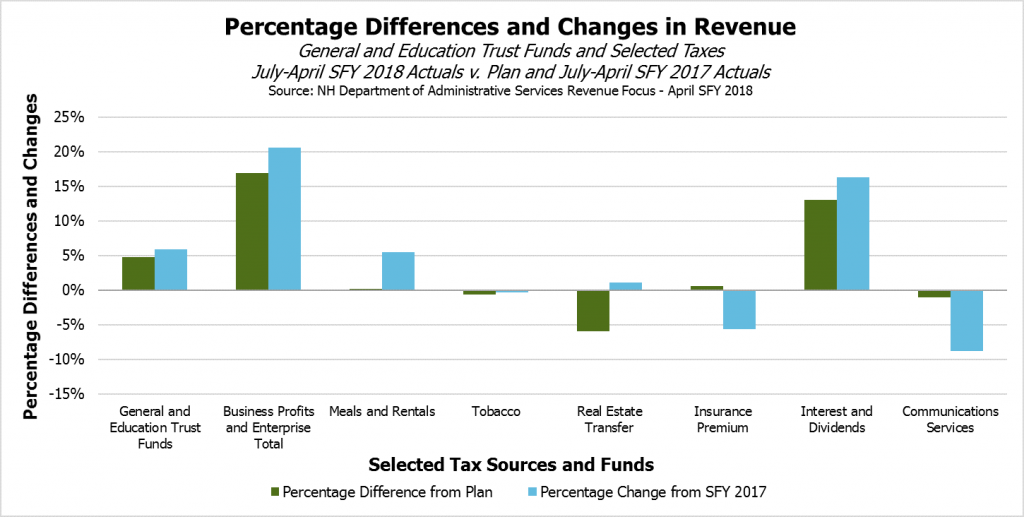

As of the end of April, the BPT and BET together are about $90.8 million (16.9 percent) above plan for the year, and $107.0 million (20.6 percent) above April 2017. Although these two business taxes have been the primary source of the surplus during the year, the post-TCJA rise has dwarfed other revenue sources, even those that are major contributors. The Interest and Dividends Tax has held the ground it gained last December relative to plan, ending April with $10.5 million (13.0 percent) in surplus, and revenues stemming from a tobacco settlement agreement also boosted the surplus by $10.9 million. Transfers from the Lottery Commission were up $6.0 million (9.9 percent) over plan. However, the remaining revenue sources were not major contributors to the surplus, with other primary revenue sources growing as expected or lagging behind. As a result, the current revenue surplus is much more dependent on the success of the two business taxes relative to recent years.

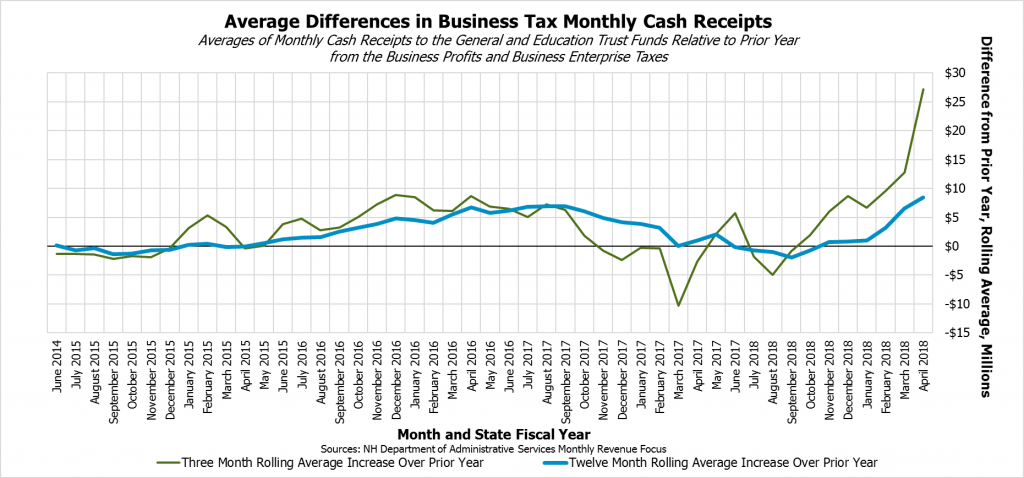

Business tax receipts are not only higher than recent years, but the increase relative to prior periods is historically and abnormally high. The twelve-month rolling average shows levels of increase similar to the largest business tax revenue increases in 2016, but the three-month rolling average indicates the outlier nature of the recent increase. Although business taxes were starting to perform reasonably better during the first half of State fiscal year (SFY) 2018, the months of February, March, and April have by far the highest three-month rolling average increase relative to the prior year since the end of SFY 2014. This average is boosted significantly by the anomalous payments in February.

The most likely rationale for this change in taxable business behavior is the TCJA, the recent federal tax reform, which has spurred significant speculation as to the impacts these changes may be having on state revenues. In New Hampshire, specific information on potential causes is limited, as many businesses have not yet filed completed returns detailing their payments to the New Hampshire Department of Revenue Administration (DRA). Tax returns are due for businesses in April based on the prior year’s activities for calendar year businesses, which are the vast majority in New Hampshire. Businesses are required to fully pay the amount they owe even if they file extensions, which permit a delay of the information associated with the payment. While the number of dollars paid through completed returns fell 14.3 percent from April 2017 to April 2018, dollars filed through extensions increased 85.5 percent. Among other indications, this may suggest businesses faced additional complexity in filing returns relative to last year, so more took advantage of the extension option. The Rockefeller Institute of Government noted in a May 2018 report on state revenues that “[i]t will take a long time until states can sort out the behavioral responses of business entities to TCJA provisions.”

The DRA has offered several potential explanations in its analysis of the federal tax overhaul. As the State bases the BPT on certain parts of the federal corporate tax code as it was prior to the TCJA, some provisions will not affect New Hampshire revenues directly. New Hampshire would have to alter the BPT to conform to the TCJA for some changes to have an impact. However, the payments of foreign dividends to U.S.-based companies by foreign subsidiaries are exempt from federal taxation following the TCJA but not exempt from New Hampshire taxation, suggesting the incentives set up by the tax overhaul may bring more revenue to State coffers through the BPT. This may include companies based outside of New Hampshire that have taxable operations in the state.

In aggregate, the DRA projects these anomalous payments stemming from the federal tax overhaul and economic growth will diminish over time. In SFY 2018, DRA estimates these payments will account for 12 percent to 15 percent of the total business tax payments, declining to 5 percent to 13 percent in SFY 2019 and dropping to between 0 percent and 2 percent in SFY 2020. The effects may diminish as behavior settles into new patterns following the tax overhaul and, separately, as the probability of a recession increases. There is also risk of businesses requesting more refunds, if the extensions filed were overpayments in the face of complexity and seeking to ensure compliance, or if businesses are provided with new incentive to request or use the $171.8 million in overpaid business taxes provided to the State but credited to the businesses.

These new questions come in an environment with uncertainty around business tax rate reductions and Keno revenue. The durability of these higher business tax receipts is critical to the continuation of the revenue surplus, but these short-term fluctuations are very difficult to predict and not guaranteed to continue in a universally positive manner.

However, some legislators appear poised to make use of the surplus, with significant Senate amendments to House bills authorizing tens of millions of dollars in new spending to be drawn from the revenue surplus, as well as changes to tax laws that would likely reduce revenues. The estimated number of new expenditures, funded through the revenue surplus and $74.7 million in other revenues in Medicaid expected to lapse to the General Fund, totals $120.6 million over two years for 2018 Legislative Session bills, with additional proposed changes that are expected to reduce revenue in SFY 2019. Legislators should be cautious around making changes based primarily on three months of positive receipts, especially considering the uncertainty as to the sustainability of these revenues.

For more information on State revenue collections, see NHFPI’s Revenue in Review resource. For more information on revenue uncertainties going forward, see NHFPI’s Issue Brief Business Tax Rate Reductions Add to Uncertain Revenue Picture.