According to data from the U.S. Census Bureau, more than one in three Granite Staters found paying for usual household expenses somewhat or very difficult between June 29 and July 11. This represents a notable increase relative to the comparable survey time in 2021, when only one in four Granite Staters reported paying for usual household expenses was somewhat or very difficult in the prior seven days. While residents in neighboring states may have fared slightly better, the overall trend in the first half of 2022 demonstrates increasing financial difficulties for many individuals and families.

Household Financial Health Nationally

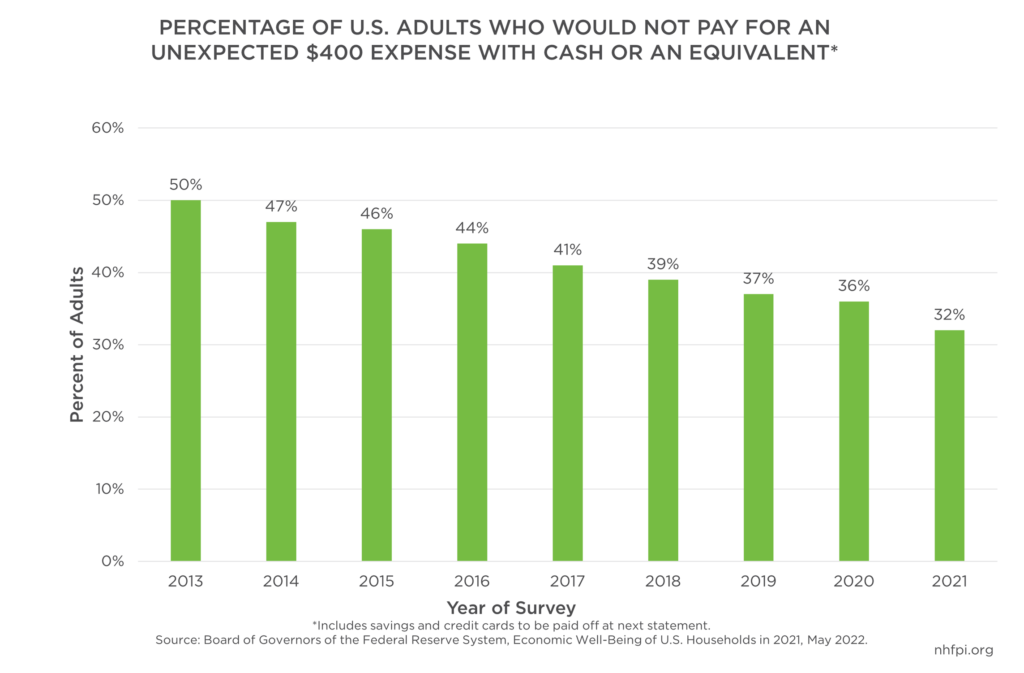

The U.S. Federal Reserve’s Survey of Household Economics and Decision-making (SHED) provides insight into the economic well-being and financial lives of individuals and their families throughout the country. The most recent survey interviewed more than 11,000 people in October and November 2021. A key barometer of financial well-being is the percentage of adults who could cover a $400 unexpected expense using cash or equivalent means, such as a credit card to be paid in full at the end of the month.

When the survey began in 2013, only 50 percent of adults reported being able to cover a $400 expense using cash or an equivalent. In the Fall 2021 survey, this number rose to 68 percent. The U.S. Federal Reserve’s survey indicated an eight percentage point increase in the share of parents who could cover these unexpected expenses with cash or an equivalent between the 2020 and 2021 surveys. At the same time, adults not living with their own children under age 18 saw a smaller increase of only three percentage points. This difference is likely due to the Advance Child Tax Credit (CTC).

The Advance CTC was established by the American Rescue Plan Act (ARPA) of 2021 as a temporary, one-year enhancement to the existing CTC, which is typically claimed annually on individual tax returns. The Advance CTC payments provided monthly disbursements to families within certain income limits totaling half the full CTC amount for which those families were eligible. In December 2021, the U.S. Treasury Department issued a monthly CTC payment to the households of 61.2 million children nationally, which helped reduce the nationwide monthly child poverty rate by 29 percent. Advance CTC payments ended in December 2021. Research from both the Center on Budget and Policy Priorities and Urban Institute suggests that about 8,000 to 11,000 children, respectively, would be lifted out of poverty in New Hampshire if the expansion had been made permanent.

According to the U.S. Federal Reserve’s survey research, the most common way that parents used their CTC payments was to save them, with 43 percent of parents reporting saving at least a portion of the monthly CTC payments. The Advance CTC likely improved the ability of households to cover their costs, including unexpected expenses.

Household Financial Health in New Hampshire

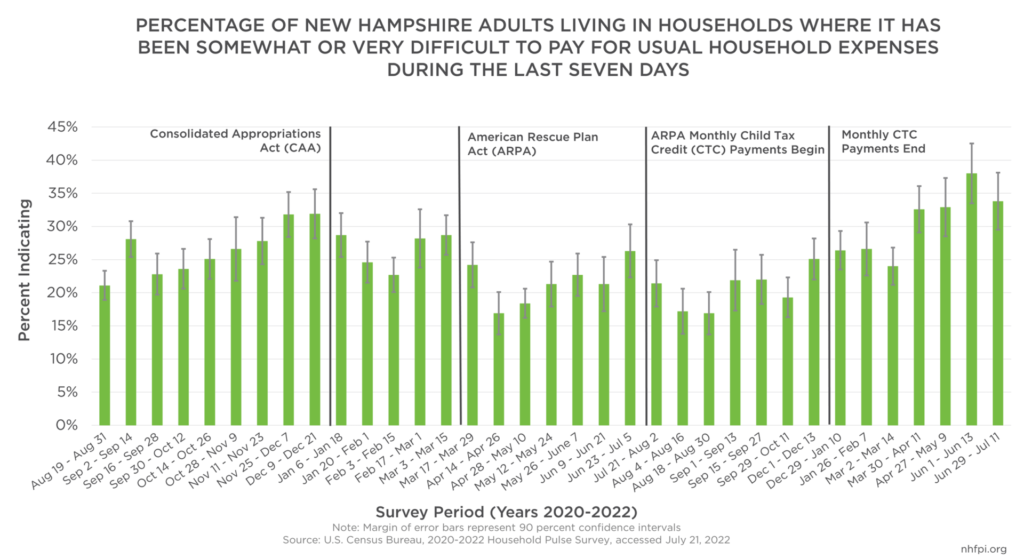

According to data from the U.S. Census Bureau, 36.1 percent of Granite State adults reported struggling to pay for usual household expenses between June 29 and July 13, 2022. This number is a significant increase from the comparable June 23 to July 5, 2021 period, when 26.3 percent of Granite Staters reported that it was somewhat or very difficult to pay for usual household expenses.

The data for this lower 2021 figure was collected in the initial phases of ARPA’s implementation. ARPA provided $1.56 billion through 684,778 one-time payments of $1,400 per person to Granite State households, extended enhanced unemployment payments and food assistance benefits, and added support for rental assistance, enhancing the financial well-being of many households.

Since the conclusion of the Advance CTC monthly payments, the percentage of Granite Staters who reported difficulties paying for usual household expenses has increased. In survey data collected between December 29, 2021, and January 10, 2022, the first round of data collection following the end of the Advance CTC payments, 26.4 percent of Granite State adults reported difficulties paying for usual household expenses, well below the 36.1 percent reporting similar difficulties in late June and early July 2022.

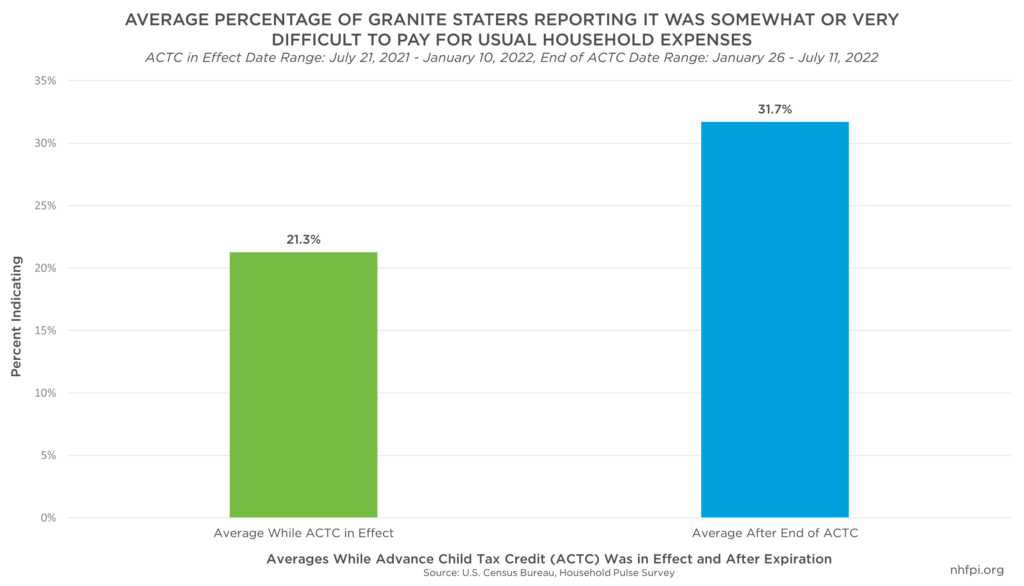

The average rate of New Hampshire respondents reporting these difficulties while the Advance CTC was in effect was substantially lower than the rate after the monthly payments ended. While the Advance CTC was in effect, an average of 21.3 percent of Granite Staters reported that it was somewhat or very difficult to pay for usual household expenses. In the reporting periods following the conclusion of the monthly payments, 31.7 percent indicated these difficulties, an increase of ten percentage points.

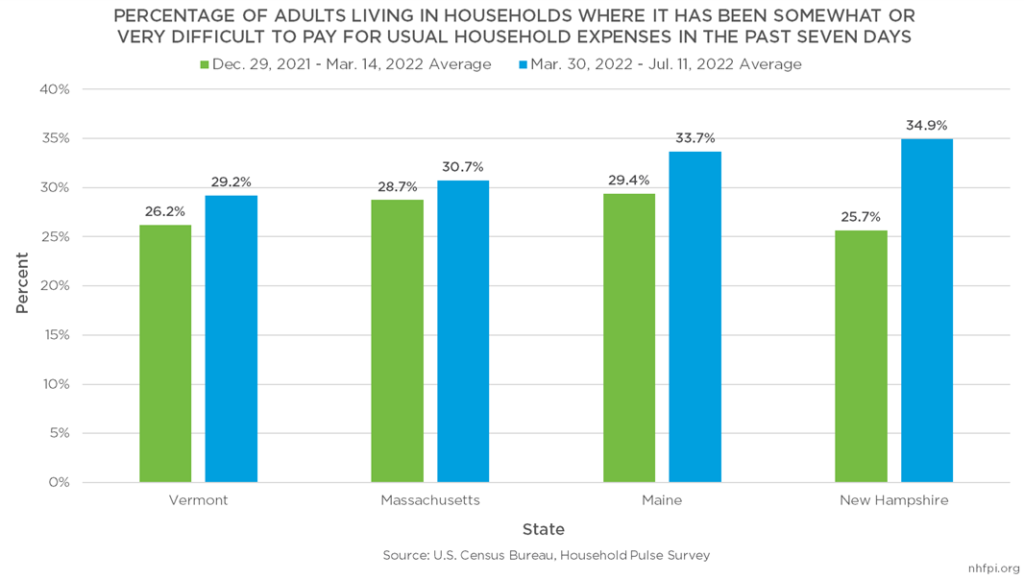

Comparing the data collected between December 29, 2021 and March 14, 2022, encompassing three survey periods, and March 30 to July 11, 2022, shows the average rate of those reporting serious difficulty paying for usual household expenses in New Hampshire rose by 9.3 percent, from 25.7 percent to 34.9 percent. This estimated increase was larger than the changes in neighboring states over the same period. In Maine, the increase was 4.3 percent, while in Vermont, the increase was 3.0 percent, and about 2.0 percent in Massachusetts.

Another key factor that has been affecting the financial well-being of Granite Staters during these time periods is the high rate of inflation. Inflation is the increase in the prices of goods and services over time, measured by overall price levels in the economy. The U.S. Bureau of Labor Statistics reported that consumer prices increased by 9.1 percent between June 2021 and June 2022, the largest 12-month increase in inflation since December 1981, with energy prices increasing 41.6 percent from the prior year. When price increases outpace wage growth, the purchasing power of consumers is decreased, thereby increasing pressure on household finances.

Policies Help Families Face Economic Challenges

Overall, the state of household financial well-being remains mixed. National data shows that, as of late 2021, many more Americans can afford an emergency $400 expense with cash or an equivalent than could earlier in the long, slow recovery from the 2007-2009 recession. However, more recent data shows that an increasing percentage of Granite Staters are having difficulty covering their usual household expenses than were earlier in the pandemic. This information indicates individuals and families are likely struggling more due to rising costs for consumer goods and the end of key pandemic-era supports, including the Advance CTC. New Hampshire has access to significant and flexible State and federal resources that may be used to support these struggling Granite Staters and promote a more equitable recovery.

– Bobby Koolis, Policy Analyst