The State Budget, signed into law on June 28, 2017, includes a provision that requires certain Medicaid enrollees to engage in work-related activities to be eligible for Medicaid. New Hampshire’s Medicaid program includes both traditional Medicaid and expanded Medicaid under the federal Affordable Care Act. The Medicaid expansion in New Hampshire is structured as the New Hampshire Health Protection Program (NHHPP). The State Budget directs New Hampshire to seek a federal waiver to require certain NHHPP participants to engage in specified work-related activities for at least 20 hours per week.

The Work Requirements

To receive benefits, NHHPP enrollees who do not qualify for any exemptions must engage in certain activities outlined in statute for set periods of time. The qualifying work-related activities identified in statute include:

- unsubsidized or subsidized private or public sector employment

- work experience if sufficient private sector employment is unavailable

- job search or job readiness assistance

- on-the-job training

- job skills training or education, for recipients without a high school diploma or equivalent, related directly to employment

- vocational education training, limited to 12 months

- satisfactory attendance at secondary school or equivalent coursework for recipients who have not completed secondary school or a generally equivalent certificate

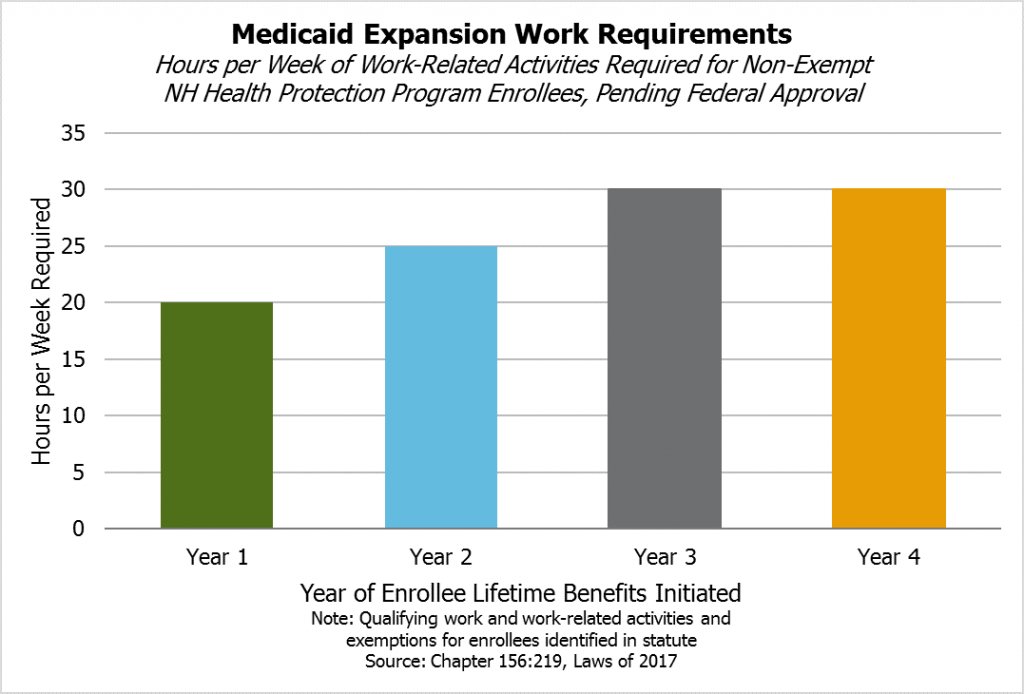

During their first year enrolled in the NHHPP, non-exempt participants must engage in these requirements for at least 20 hours per week. During the second year, the requirement increases to 25 hours per week, and the threshold increases again to 30 hours per week starting at the beginning of the third year that benefits are received. The amount of time enrolled in the program may be discontinuous and is measured over the lifetime of the enrollee. If a non-exempt individual in a family receiving benefits refuses to participate in these work requirements, assistance shall be terminated.

Although no exceptions are provided explicitly for those newly obligated to meet the requirements or with temporarily reduced work hours to fewer than the threshold number of hours per week, the Department of Health and Human Services (DHHS) has the authority to, through the administrative rulemaking process, “determine good cause and other exceptions to termination.” Once completed, DHHS rules will likely provide much greater detail about qualifying educational and work-related programs.

Exemptions

NHHPP enrollees do not need to comply with work requirements if they qualify for certain exemptions. The work requirements only apply to those considered able-bodied adults under the federal Social Security Act, which excludes those who are 65 years of age or over, pregnant, or entitled to certain other benefits, and other groups. New Hampshire statute also exempts those who are certified by certain licensed medical professionals as temporarily unable to participate in the work requirements; the medical professionals must use a DHHS-provided form to specify the duration and limitations of the disability. Statute also exempts:

- parents or caretakers of a dependent child less than six years old

- parents or caretaker relatives required to be in the home to provide care to a household member considered necessary by certain licensed health professionals, who certify the duration of the required care

- people participating in state-certified drug court programs

Statute provides the DHHS with administrative rulemaking authority for exceptions to participant termination from the NHHPP, but administrative rules may not add to, detract from, or modify statutory law and are meant to implement or interpret a statute, or make a statute’s requirements more specific.

Recipients Impacted by the Requirements

If they go into effect, work requirements would be imposed on those NHHPP participants who do not qualify for the exemptions or exceptions. If the work requirements are not accepted by federal regulators at the Center for Medicare and Medicaid Services (CMS) by April 30, 2018, the State Budget language requires all NHHPP participants be notified the program will end December 31, 2018, when it is set to expire in statute.

The NHHPP supported health coverage for approximately 52,000 Granite State adults at the end of July 2017. Qualifying enrollees are aged 19 to 64 with incomes up to 138 percent of the federal poverty guidelines, or $16,243 for an individual, $21,983 for a household of two, and $27,724 for a household of three. NHHPP assistance is divided into three options, depending on enrollee eligibility.

- The Premium Assistance Program (PAP) uses federal Medicaid reimbursement funds to pay for private sector health care premiums for low-income adults buying health insurance on the individual marketplace. Certain benefits are provided directly through fee-for-service Medicaid in cases where they are not provided by private health insurance. The DHHS reported that, as of July 31, 2017, the NHHPP had 45,434 PAP participants, constituting most of the people served through New Hampshire’s expanded Medicaid framework.

- The Health Insurance Premium Payment Program assists individuals and families in paying for employer-provided insurance, when at least one family member is enrolled in Medicaid, by providing reimbursements for certain premium, co-payment, and deductible costs. The DHHS reported that on August 1, 2017, this option included 81 enrollees.

- For enrollees who are medically frail, such as those with physical, mental, or emotional conditions that limit their ability to perform daily activities or those who live in a long-term care facility, NHHPP support is provided through an enrollee’s choice of the standard Medicaid benefit package or an alternative plan combining certain Medicaid and qualified health plan services. These medically frail individuals are covered through Medicaid managed care and not through the PAP on the marketplace. According to the DHHS, as of July 31, 2017, the medically frail portion of the NHHPP served 6,513 individuals.

DHHS data, as presented on August 28, 2017, show that approximately 76 percent of NHHPP enrollees were below 100 of the federal poverty line. Participation as a percentage of the population tends to increase with distance from southeastern New Hampshire, with a low of 2.72 percent Rockingham County residents enrolled in NHHPP as of August 18, 2017, and a high of 6.17 percent of Coos County residents on the same date. Enrollment by municipality also shows similar geographic trends, with the highest number of enrollees as a percentage of populations in cities and towns from the Lakes Region north and the lowest percentages in the western Merrimack River valley, southeastern and Seacoast communities, and in certain places near Lake Sunapee, Lebanon, and Hanover. Manchester had about 7,500 enrollees during August 2017, while Nashua had over 3,800 and Concord had about 2,200.

Researchers at the University of New Hampshire’s Carsey School of Public Policy estimated that, for adult Medicaid recipients nationwide in 2015, about 31.3 percent would be potentially impacted by a work requirement. This estimate is based on national survey data and may vary for New Hampshire’s population and the specific work requirements and exemptions in New Hampshire’s statute.

NHHPP enrollment skews young and includes a significant amount of turnover among participants. DHHS snapshot data for August 2, 2017, indicate about 48.7 percent of NHHPP enrollees were between 19 and 34 years old. DHHS data for a two-year window found about 70.7 percent of recipients were not continuously enrolled throughout the time period, with DHHS data from November 2016 suggesting recipients tend to disenroll due to their incomes rising beyond the qualifying threshold. Historical data analysis from the Congressional Budget Office also suggests relatively high turnover and discontinuous enrollment rates among expanded Medicaid enrollees nationally. These fluctuations include people who are on the program for a period of time and never return as well as those who leave the program and return at a later date.

Previous Attempt to Impose Work Requirements

The New Hampshire State Legislature included similar work requirements in the last extension of the NHHPP, passed in 2016 as House Bill 1696 and contingent upon the CMS approving a waiver or state plan amendment for those requirements. Alongside these similar work requirements, House Bill 1696 permitted community services and certain child care duties to help fulfill the work requirement of 30 hours per week regardless of time enrolled in the program. House Bill 1696 also required NHHPP enrollee and participants to verify their United States citizenship and New Hampshire residency with at least two forms of identification, and required hospitals serving the newly eligible Medicaid population to also provide medical and medical-related services to veterans who are New Hampshire residents.

The CMS denied the waiver request in a November 2016 letter to the DHHS. In the letter, the CMS indicated these requirements would likely not further the objective of the Medicaid program, as they would likely not improve health outcomes or coverage for low-income individuals or increase access to providers. The proposed citizenship requirement appeared to be in conflict with federal statute relative to refugees, certain people granted asylum, and other selected groups. Both the citizenship and residency requirements would have heightened barriers to entry as well, potentially leading to lower enrollment among eligible residents, and may have created certain redundancies with the existing eligibility verification process.

The CMS rejection of these requirements did not bring the entire NHHPP to a halt. House Bill 1696 allowed these requirements to be decoupled from the rest of the NHHPP if the CMS did not permit them, enabling the NHHPP to go forward without the requirements. However, the language in the SFYs 2018-2019 State Budget does not include a decoupling provision.

House Bill 1696 also established a Commission to Evaluate the Effectiveness and Future of the Premium Assistance Program, which must submit a final report to the Legislature’s leadership and the Governor’s office by December 2017. The Commission is scheduled to meet on September 6, 2017.

Potential Federal Changes

Several states have explored work requirements in recent years, but the CMS has not yet accepted any Medicaid waiver requests that require work to be eligible. However, the U.S. Department of Health and Human Services has signaled, both through the fiscal year 2018 budget proposal and a March 2017 letter from the Secretary and CMS leadership, greater openness to permitting state work requirements for Medicaid eligibility. The Center on Budget and Policy Priorities notes that waivers under this portion of Medicaid statute have been used for experimental demonstration projects to promote Medicaid’s objectives in the past, but have not been used to narrow eligibility requirements. Recent proposed federal health legislation has also included specific statutory permissions for state work requirements.

National Research

Research from the Center on Budget and Policy Priorities found that work requirements for low-income cash assistance programs did not increase long-term employment rates and did not reduce poverty. The Kaiser Family Foundation calculated 60 percent of non-elderly adult Medicaid recipients without Supplemental Security Income (designed to help elderly, blind, or disabled people with little or no income) in New Hampshire were working in 2015 and 74 percent were in working families. The Foundation concluded that Medicaid work requirements might have a narrow reach beyond the already-working Medicaid population and could negatively affect those who are not working if their situations do not qualify for specified exemptions.

Researchers affiliated with The George Washington University and writing for Health Affairs calculated that, of the able-bodied population enrolled in expanded Medicaid nationwide in 2015, 87 percent were working, seeking work, or in school, and three quarters of the remaining 13 percent indicated they were caring for family members. The authors also found non-working Medicaid beneficiaries often had greater health care needs than those who were working. Separately, a researcher from Baruch College interviewed 79 low-income Kentucky adults in June 2017 regarding Medicaid work requirements and found non-working Medicaid beneficiaries included those who were homeless and self-described as mentally or physically disabled.

Timeline

The Commission to Evaluate the Effectiveness and Future of the Premium Assistance Program will report any findings to the Legislature’s leadership and the Governor by December 1, 2017; these findings may inform any relevant deliberations during the 2018 legislative session, and members of the Commission have expressed an interest in finishing their work in October to help inform draft legislation.

The DHHS has also presented a draft waiver amendment request for public comment. The public input period lasts until September 29, and the DHHS will host two public hearings in Manchester and Concord on September 14 and September 21, respectively.

The State Budget requires a waiver or an amendment establishing the work requirement be in place by April 30, 2018. If the waiver or state plan is not approved by the CMS, the Governor, and the Executive Council by that date, the DHHS is required to immediately notify all NHHPP participants that the program has not been reauthorized beyond December 31, 2018.