Homeowners urged to submit initial applications by June 30 and while funds are still available

The COVID-19 crisis will likely have the greatest economic impacts on Granite Staters with low and moderate incomes. Direct forms of aid, such as economic and nutritional assistance, are critical in providing relief and support to affected individuals and families. New Hampshire’s existing program targeted at property tax relief for lower-income homeowners can help offset immediate costs, and the State has extended the deadline to apply for a tax rebate this year.

New Hampshire and the federal government have recently bolstered programs, such as the Supplemental Nutrition Assistance Program (SNAP) and unemployment insurance, to provide direct support to those most in need. For 2020, the State has enhanced access to the Low and Moderate Income Homeowners Property Tax Relief program, which provides a small rebate for property tax relief to eligible homeowners. This program’s application deadline, which is typically June 30, has been extended to November 1, 2020 for those who have not filed a federal tax return before June 30. The Department of Revenue Administration is requesting applications from those who have not filed federal tax returns by June 30, and requiring the accompanying tax returns be provided before November 1. Application forms for this program can be found on the Department’s website.

In order to be eligible, homeowners must earn $20,000 per year or less for a homeowner who is single or $40,000 per year or less if a person is married or a head of a household. Most property taxes are paid to municipalities, counties, and school districts, but a small portion is collected through the Statewide Education Property Tax. Rebate amounts for these homeowners with lower incomes are based on the first $100,000 of the assessed property value and are relative solely to the homeowner’s Statewide Education Property Tax liability. Homeowners with lower incomes receive higher rebate amounts, depending on which of the defined income brackets they fall within. These brackets range from less than $12,500 for a single person up to a $35,000 to $40,000 bracket for a married person or head of a household. These brackets are the same as when the program was created in 2001, and are not adjusted for inflation. Rebates do not reduce the local property tax base, as the rebate is paid out of the State’s Education Trust Fund.

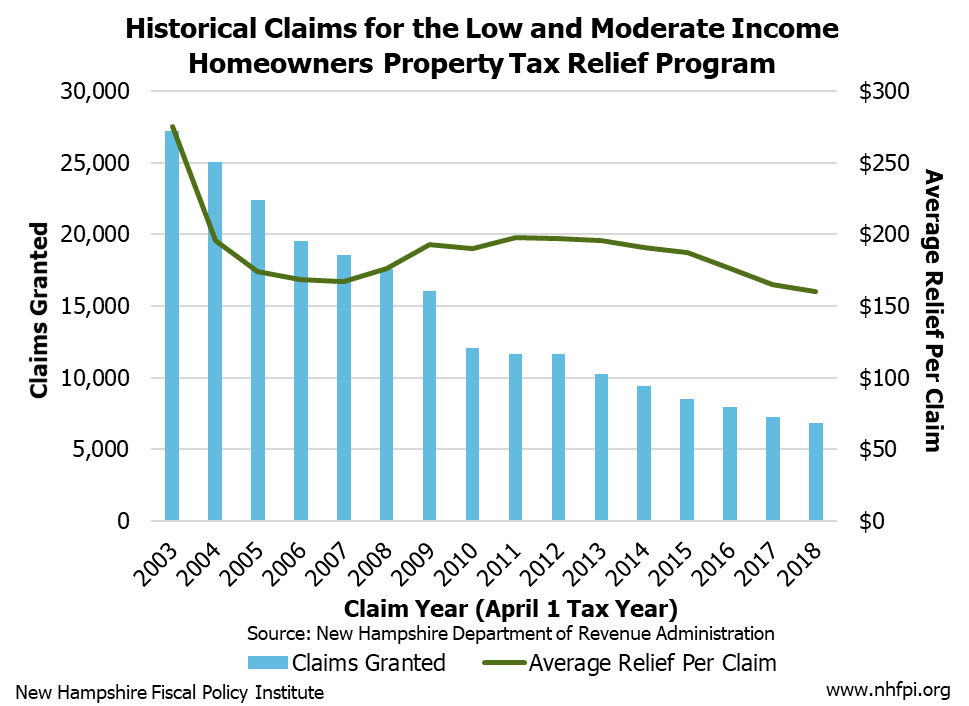

The average rebate has been decreasing since the program’s inception, as has the number of relief claims granted each year, according to historical data. Property tax levies in New Hampshire in 2018 were approximately $2,800 per capita, while the average property tax relief rebate totaled $160 among the 6,865 granted relief claims for tax year 2018.

Property tax obligations will likely be difficult for many homeowners with lower incomes in New Hampshire given the economic instability stemming from the COVID-19 crisis. With many individuals and families in New Hampshire facing additional hardships, the extended application deadline for this program may allow for more Granite Staters to receive this tax relief during the crisis. Enhanced awareness of this program may also help ensure that this targeted relief reaches more eligible homeowners. Additionally, an expansion of this program’s rebate amount, as well as adjustments to factor additional property taxes into rebate calculations, may be beneficial in providing aid to Granite Staters while still preserving local tax bases.

– Michael Polizzotti, Policy Analyst

Revision, June 4, 2020: This post was updated to reflect the Department of Revenue Administration’s request that individuals seeking a property tax rebate file applications, even if they do not have a completed federal tax return, by June 30, 2020, and that those who have filed a federal tax return prior to June 30, 2020, should apply for the property tax rebate by that date.