The State revenue figures from June show continued strength in business taxes, but suggested that other revenue sources may be faltering, such as lottery and liquor sales revenues, or just meeting their targets. The data release for June showed the cash revenues for the last month of the State fiscal year from tax and non-tax revenue sources, as well as tallies for the entire year. Final, audited figures will not be available until December, but the cash figures suggest a substantial surplus for the fiscal year, both relative to the State revenue plan and to State fiscal year 2017.

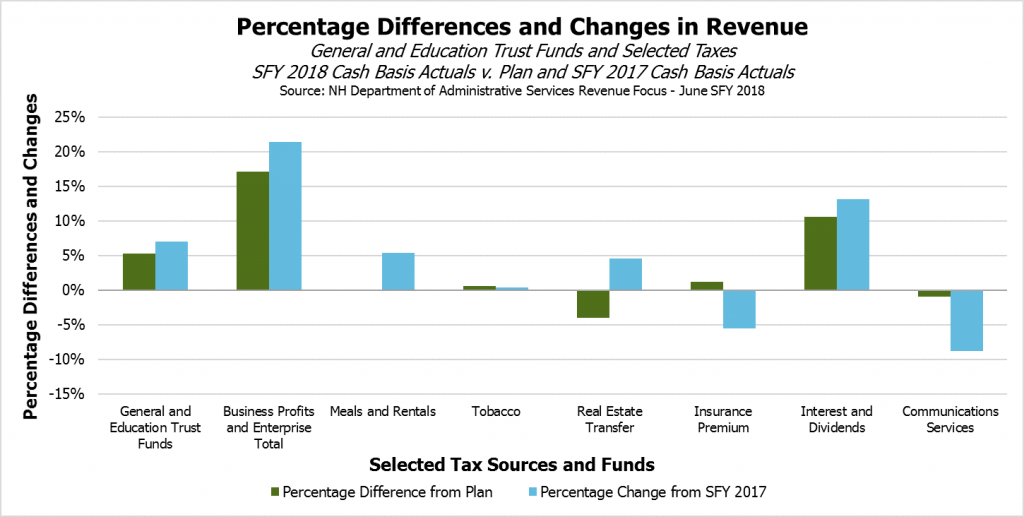

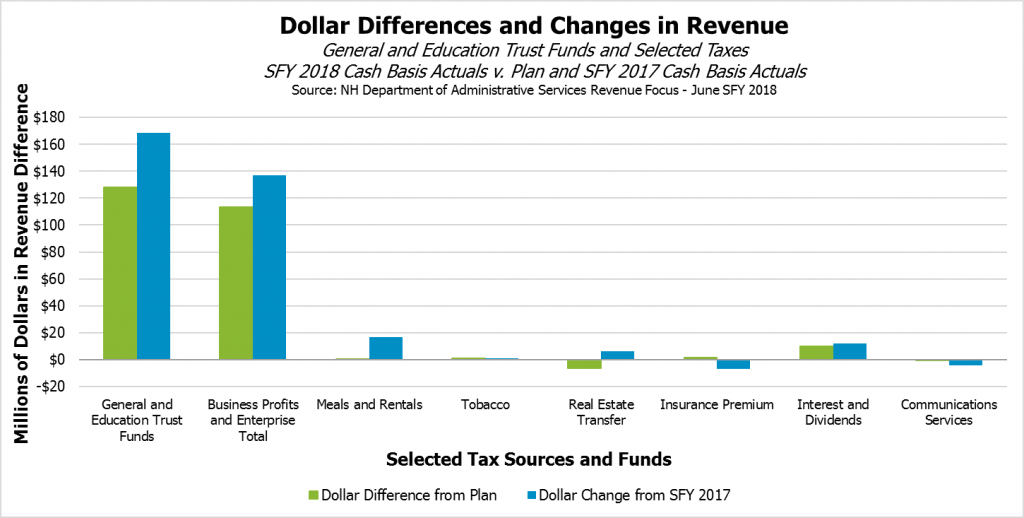

June is an important month for receipts from the Business Profits Tax and the Business Enterprise Tax, the State’s two primary business taxes, as most companies must file quarterly estimated payments based on a calendar year. These two business taxes brought in $129.6 million, which was $21.8 million (20.2 percent) over plan. The June surplus is roughly in line with the business tax revenue surplus for the year in aggregate, which had a cash basis surplus estimate of $113.6 million (17.2 percent). The entire surplus for the General and Education Trust Funds was $127.9 million (5.2 percent) on a cash basis, with other significant surpluses generated by the Interest and Dividends Tax (with $10.2 million, or 10.6 percent above plan) and a tobacco settlement agreement ($10.9 million or 31.1 percent).

The Lottery Commission and the Utility Property Tax each provided several million dollars more revenue than planned for the Education Trust Fund. Estimated Lottery Commission revenues were down relative to plan, however, during the month of June. Liquor Commission revenues were also lower by $3.7 million (22.2 percent) for the month of June, ending the year $6.8 million (4.7 percent) below plan on a cash basis.

Abandoned property was more valuable than anticipated in June (the month when the Legislature requires abandoned property to be transferred), but most other revenue sources were roughly on target for the month, leaving several on target or just short of their targets for the year. The Meals and Rentals Tax matched plan in June and the State fiscal year, and the Tobacco Tax had another good month, with a $1.1 million (5.5 percent) surplus, pushing the cash surplus for the year to $1.2 million (0.6 percent). The Real Estate Transfer Tax met the planned amount of revenue in June, with roughly equivalent transactions and higher transactions values compared to the prior year, but cash revenues for the year fell $6.2 million (4.0 percent) short of plan.

The State revenue surplus, most of which was used to fund several end-of-session spending bills in May, continues to be the result of higher than expected business tax receipts. Although not as abnormally high as earlier in the year and supplemented by robust Interest and Dividends Tax revenues, relying on a single source of revenue for balancing the State Budget with additional surplus spending introduces risk, particularly when higher business tax receipts may be fleeting. As companies continue to react to changes in the federal tax code, particularly large multinational companies that provide significant portions of State Business Profits Tax revenue, they may adjust expenditures or ask for refunds from the State. Significant refunds, should they occur, would mean the state faces not only the risk of lower revenues in the future, but also that revenues already collected may have to be repaid later through refunds.

For more information on State revenue sources, see NHFPI’s Revenue in Review resource.