Updated September 25, 2019 at 3:45 p.m.

The New Hampshire Legislature today approved the new State Budget agreement, which now goes to the Governor for his signature.

The table below identifying business tax rate revenue triggers has been updated to incorporate new information from the New Hampshire Office of Legislative Budget Assistant.

The newly-proposed State Budget agreement to be considered by the Legislature today would boost funding for local public education, with a substantial increase during the budget biennium and a smaller increase continued over time, and includes upward adjustments to Medicaid reimbursement rates, one-time aid to cities and towns, and support for affordable housing. The agreement, finalized by budget negotiators on September 24, would fund these initiatives in part by deploying current surplus revenues, including revenues from reduced spending and increased lapse during the continuing resolution. Funding would also stem in part from freezing business tax rates at 2019 levels. However, future business tax rates would be contingent on a revenue-based trigger and could move up or down for Tax Year 2021 depending on the strength of receipts during the first year of the budget biennium.

The agreement proposes key changes from both the Legislature’s June budget proposal and the Governor’s February budget proposal. These revised provisions have the potential to make substantial impacts on the well-being of Granite Staters.

Education Funding and Other Local Aid

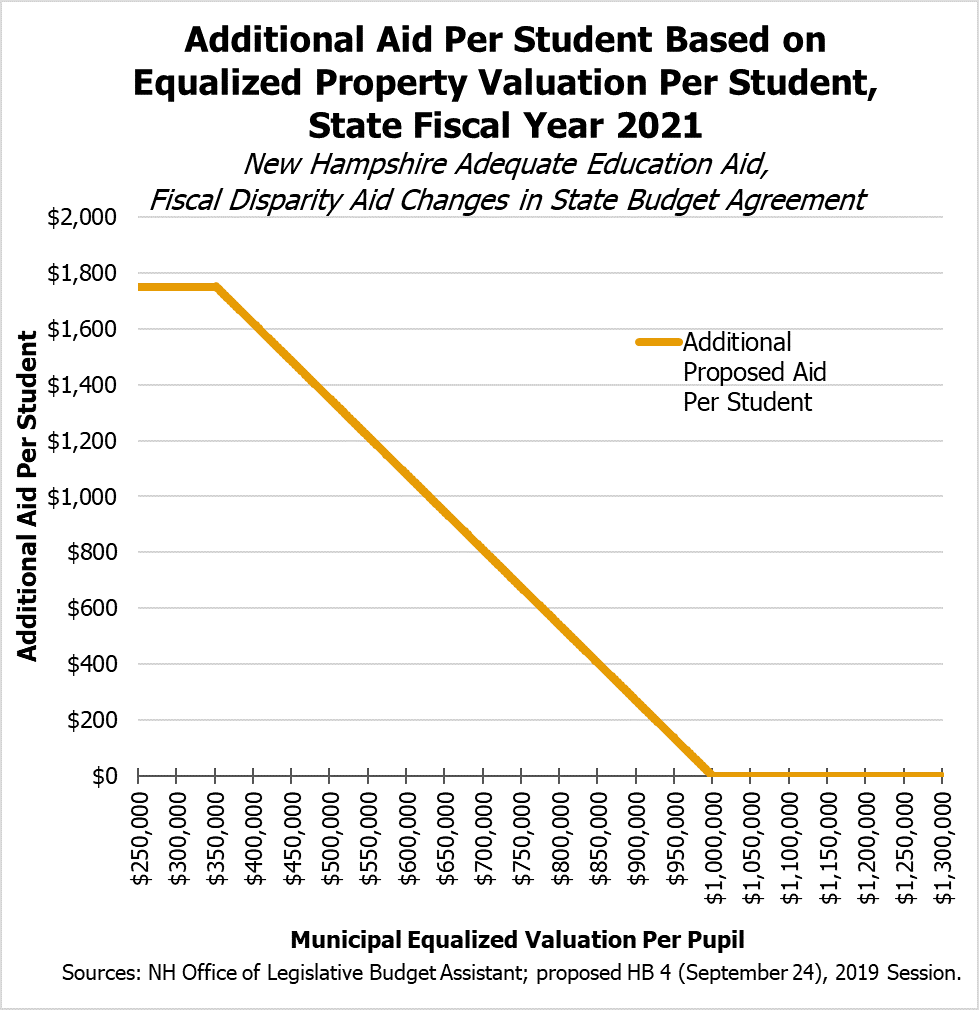

The State Budget agreement retains the Legislature’s proposed funding structure for supporting additional Adequate Education Aid to local governments. The agreement would add higher levels of State aid, up to $350 per free and reduced-price meal eligible student, for districts with higher concentrations of free and reduced-price meal students. Districts with less than 12 percent of eligible students would not receive new additional aid. The proposal also retains fiscal capacity disparity aid, adding up to $1,750 per student in additional aid based on the taxable property value per student in their home municipality; municipalities with up to $1,000,000 in property tax base per student would receive aid based on a sliding scale, and those with less relative property wealth would receive more aid. These additions to the education funding formula would supply up to $62.5 million in new aid to local governments for public education.

One crucial difference from the Legislature’s June budget proposal is the repeal of the additional aid based on free and reduced-price school meal-eligible student concentration and fiscal capacity disparity at the end of the budget biennium. This change likely reflects the funding mechanism, which relies on a $68.1 million appropriation of surplus dollars to the Education Trust Fund from the General Fund in State Fiscal Year (SFY) 2020. While certain Education Trust Fund revenue streams are expected to initiate or grow in SFY 2021, the proposal anticipates the Fund will deplete its current surplus by the end of SFY 2021. However, stabilization grants would be restored to their full, original levels in SFY 2020 and in every year thereafter.

The State Budget agreement also includes $500,000 for a Commission to Study School Funding and outlines the duties of the Commission.

Non-education aid provisions for local governments, including $40 million in municipal aid during the biennium, were unchanged from the Legislature’s June budget proposal.

Medicaid Reimbursement Rates

The Legislature’s June budget proposal included Medicaid reimbursement rate increases for nearly all Medicaid providers of 3.1 percent in the first year of the biennium and 3.1 percent in the second year. The newly-proposed State Budget agreement also increases Medicaid reimbursement rates by 3.1 percent per year, but does so starting on January 1 of calendar years 2020 and 2021. The total additional appropriation decreases from $60 million to $31 million. The $8 million appropriation for mental health and substance use disorder inpatient and outpatient services from the Legislature’s June proposal was retained as a separate appropriation.

Mental Health Infrastructure

The State Budget agreement retains the Legislature’s June proposal to construct a 25-bed secure psychiatric unit on the grounds of New Hampshire Hospital for people currently housed at the secure psychiatric unit of the State prison. However, the appropriation for this facility was reduced from $17.5 million to $8.75 million, and the funding was shifted to the current biennium rather than appropriated in SFY 2019.

Funding for the repurposing of certain beds at New Hampshire Hospital to support adults and to expand capacity was shifted to $4 million in General Funds. The Legislature’s June budget proposal would have appropriated $3 million in General Funds and an additional $1 million in New Hampshire Hospital trust funds.

Business Taxes and Revenue Triggers

Business tax rates were key issues in the State Budget discussion this year, as revenues were expected to decline for both the business taxes and the overall General and Education Trust Funds during the biennium. As such, whether tax rates would be sufficient to support budgeted services or not, especially in an environment in which revenue from the business taxes had been behaving abnormally, was critical for determining funding available for ongoing services.

The rates for the State’s two primary business taxes, the Business Profits Tax (BPT) and the Business Enterprise Tax (BET), are both scheduled under current law to decline for tax years 2019 and 2021. This budget proposal would make future rate changes contingent on revenues relative to projections.

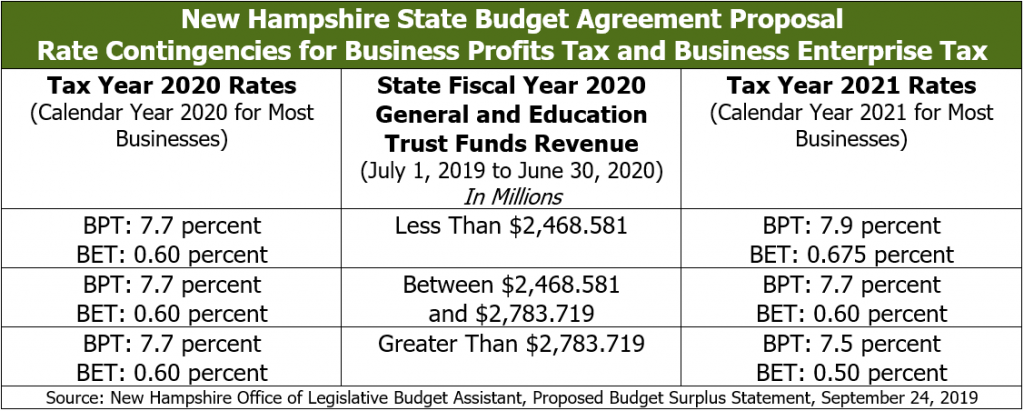

The newly-proposed State Budget agreement includes proposed revenue estimates, which have been revised downward by $64.9 million for the total revenue flowing to the General and Education Trust Funds from the Legislature’s budget proposal in June. Under the new agreement, business tax rates would drop as scheduled for Tax Year 2019, with the BPT rate applied to 2019 at 7.7 percent and the BET rate at 0.60 percent. Those tax rates would continue through Tax Year 2020. Should combined revenues be more than six percent higher than the official estimates for the General Fund and the Education Trust Fund in State Fiscal Year 2020, then tax rates for Tax Year 2021 and beyond would drop to 7.5 percent for the BPT and 0.50 percent for the BET, as scheduled under current law. If revenues were more than six percent lower than the projections in State Fiscal Year 2020, the BPT rate would increase to 7.9 percent in Tax Year 2021 and for each year thereafter, and the BET would increase to 0.675 percent, the same rates that applied to Tax Year 2018. If revenues fall closer to the estimates than those differences of greater than six percent, tax rates would continue at Tax Year 2020 levels into Tax Year 2021 and beyond.

The new State Budget agreement also retains the Legislature’s June proposal to move to market-based sourcing apportionment, and move to single-sales factor apportionment in Tax Year 2022, based on the recommendation of a new legislative committee. The new agreement builds on the level of New Hampshire business tax base conformity with the recently revised federal corporate tax code proposed in the Legislature’s June budget. The new agreement would include global intangible low-taxed income in the tax base, but add a deduction for such business income. This provision was estimated to add $15 million in revenue over the biennium from increased taxation of businesses with certain types of earnings in other countries.

Additionally, the State Budget agreement would hire two more multi-state tax auditors, a change which is projected to increase net revenue by $0.91 million.

Other Key Policy Changes

The proposed budget includes dozens of policy changes, both related and unrelated to State expenditures. The policy and funding changes from the Legislature’s June version of the budget include:

- Applying a $25 million “back-of-the-budget” funding reduction to the New Hampshire Department of Health and Human Services, specifying that such a reduction cannot be made to developmental services, county programs, or Medicaid rates, and must be submitted in a plan for approval. The proposal also preserves the approximately $1.65 million back-of-the-budget reduction to the Sununu Youth Services Center from the Legislature’s June budget proposal.

- Raising the age for the legal purchase of tobacco and e-cigarettes to 19 years old, up from the current 18 years but lower than the 21 years proposed by the Legislature in June.

- Increasing scholarships and grants, funded through the UNIQUE program, by $5 million.

- Transferring $5 million from the SFY 2019 surplus to the Rainy Day Fund, carrying forward $211.5 million in surplus revenues for the General and Education Trust Funds into SFY 2020.

- Reducing funding for travel and tourism development and highway rest area support.

- Preventing potential shortfalls in the expanded Medicaid funding structure by drawing on revenue from the Liquor Commission Fund if needed.

- Removing startup funding for paid family and medical leave insurance, which was included in the Legislature’s June budget proposal.

- Dedicating $6 million to cover costs associated with reaching an agreement with State employees in the collective bargaining process.

- Appropriating $9 million to support and diversify the nursing program, add occupational therapy programs, and bolster the speech and language pathology programs at the University of New Hampshire.

- Reducing the additional appropriations from the General Fund to support the Highway Fund by $2.5 million.

- Eliminating the proposal for a Sunny Day Fund to support business research and development.

The Legislature will vote on the State Budget agreement on Wednesday, September 25.

Visit NHFPI’s NH State Budget web page for additional resources.

– Phil Sletten, Policy Analyst