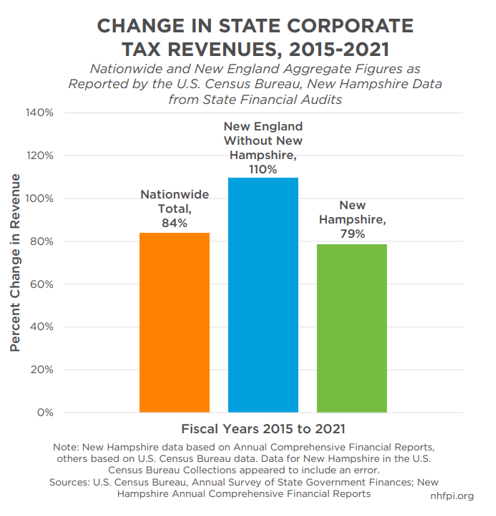

NHFPI analysis indicates that recent reductions to State business tax rates have not spurred sufficient economic activity to offset revenue losses from rate reductions and, as such, are not a positive contributing factor for recent State business tax revenue increases. Combined state-level corporate income tax revenues in other New England states, as well as nationally, rose 110 percent and 84 percent, respectively, between fiscal years 2015 and 2021; New Hampshire business tax revenues increased 79 percent in the same period. The Granite State’s recent revenue increase is far from unique, which makes the increase unlikely to have been caused by State policy changes. Learn more in NHFPI’s August 2023 Issue Brief State Business Tax Rate Reductions Led to Between $496 Million and $729 Million Less for Public Services.