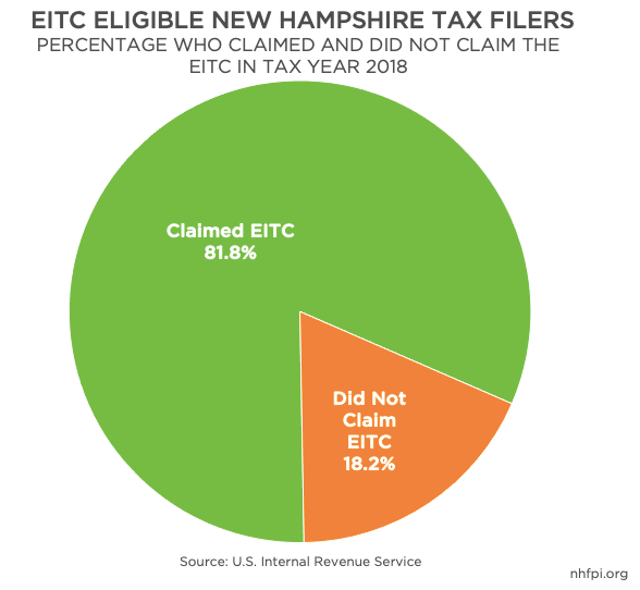

Prior to the pandemic and temporary credit expansions, nearly 1 in 5 eligible Granite Staters did not claim the Earned Income Tax Credit. Data published by the U.S. Internal Revenue Service for tax year 2018 show that 18.2 percent of likely eligible tax filers in New Hampshire did not claim this key credit. The EITC assists working individuals with relatively low incomes, providing federal tax relief while incentivizing employment. Learn more about the EITC in NHFPI’s March 2022 Issue Brief: Expansions of the Earned Income Tax Credit and Child Tax Credit in New Hampshire.