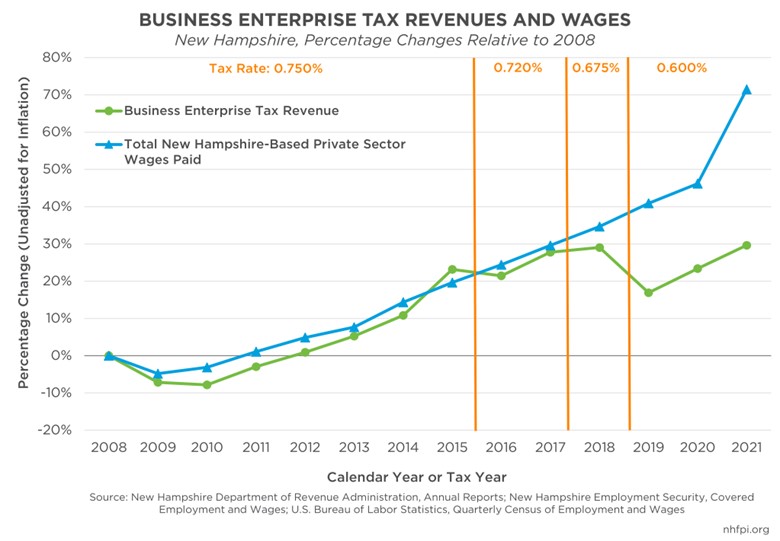

The Business Enterprise Tax (BET) is based largely on compensation paid to employees, as well as interest and dividends paid, by businesses. The tax rate was lowered in Tax Years 2016, 2018, 2019, and 2022. Data by tax year available through 2021 show BET revenues typically correlate with the value of wages paid by businesses in the state, but fell 1.4 percent in 2016 and 9.4 percent in 2019, while wages grew by 4.0 percent and 4.6 percent, respectively. BET revenues grew 1.0 percent in 2018, below the 3.9 percent growth in total wages paid. Combined revenues from the Business Profits Tax (BPT) and the BET grew during this period, but BET rate reductions appear to have had a direct, negative impact on revenues. Contemporaneous BPT receipts were aided by federal tax law changes and rapidly rising national corporate profits in recent years.