About the Business Enterprise Tax

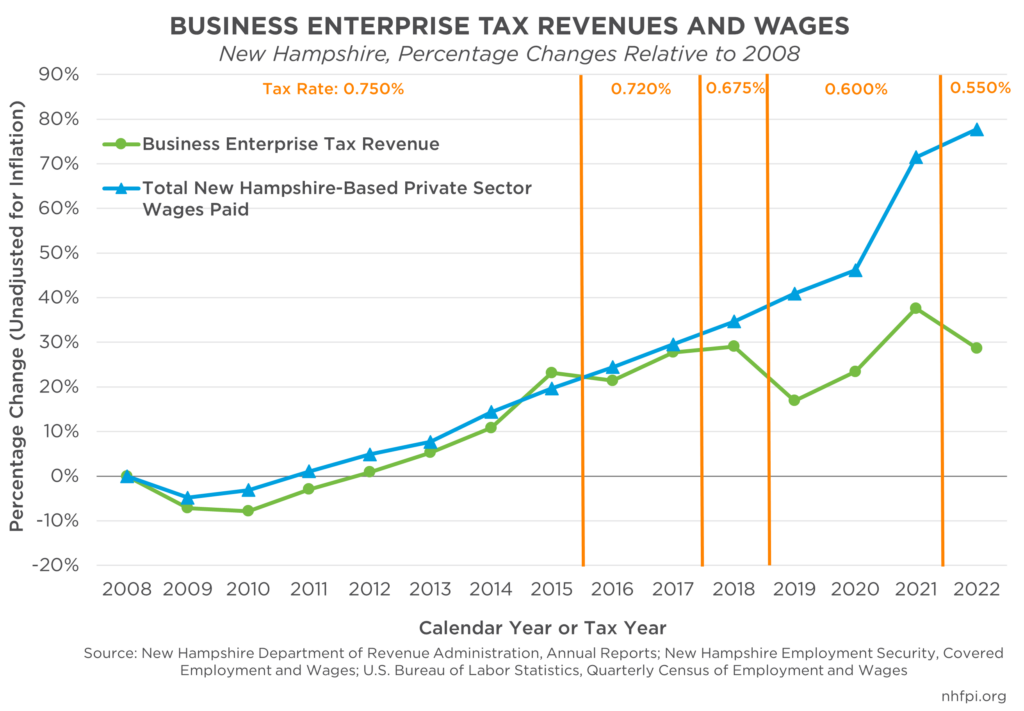

The Business Enterprise Tax (BET), which is based on the compensation businesses pay to employees as well as interest and dividends paid, has faced a series of rate reductions since 2015. The rate has been reduced from 0.75 percent to 0.55 percent in four steps, which in total lowered the tax rate by nearly 27 percent relative to the 2015 rate. Between 2008 and 2015, BET revenues, isolated after analysis of final tax returns from the Business Profits Tax (BPT) receipts also collected by the state, correlated closely with total private sector wages and salaries paid in New Hampshire.

Breaks in the Correlation: Wage Growth and BET Rate Changes

After each year of tax rate reduction, BET revenues broke from the trend of growing with aggregate wages and salaries paid in New Hampshire. Between 2008 and 2015, private sector wages paid by businesses increased 20 percent, and BET revenues increased 23 percent. Between 2015 and 2021, however, private sector pay increased 43 percent, while BET revenues increased only 12 percent. Preliminary Tax Year 2022 data show that, while private sector wage growth was 49 percent from 2015 to 2022, BET revenue grew 4 percent during this period, with a decline from 2021 revenues that followed a tax rate reduction. Unadjusted for inflation, BET revenues in 2015 were higher than they were in 2019, and about the same as in 2020.

Business Tax Rate Reductions Did Not Increase Revenue

Analysis of BET and BPT rate reductions in New Hampshire from 2016 to 2022 found no evidence that the decrease in tax rates spurred enough economic growth to offset the forgone revenue from the tax rate reductions. This research did not find correlations between BPT rates and key economic indicators, or an increase in the number of business tax filers that would indicate sufficient economic growth to explain the increase in business tax revenues.

Analysis of existing peer-reviewed research of tax rate changes in other states and countries also did not reveal any indication that corporate tax rate reductions would lead to increases in corporate tax revenue. Additionally, state corporate tax receipts nearly tripled nationwide between fiscal years 2015 and 2023, following a surge in corporate profits nationwide; these data indicate the increase in overall (BPT and BET combined) business tax revenues in New Hampshire was not unique among the states. The percentage increase in New Hampshire’s business tax revenues lagged behind the growth rates in all other states combined during this period.

To learn more about New Hampshire’s business tax revenues and the impacts of State tax rate reductions since 2015, see NHFPI’s August 2023 report State Business Tax Rate Reductions Led to Between $496 Million and $729 Million Less for Public Services.