At the start of the 2018 Legislative Session, several bills were filed that would likely reduce New Hampshire’s available revenue. When considering changes to revenues, policymakers should be cognizant of the revenue shortfall risks the State presently faces. As of December, revenues are meeting the monthly plan based on estimates set forth by the Legislature to pay for State Budget expenditures. However, the revenue surplus is significantly smaller than it was at the start of the last two legislative sessions.

The State’s two key business tax rates have been reduced for 2018, but the amount of revenue legislators estimated to pay for State Budget expenditures continues to increase relative to the last fiscal year’s actual receipts. The impact of these rate reductions on two of the State’s most important revenue sources is not known with certainty, but the reductions are likely to lead to a decrease in revenue relative to the amount of revenue that would have been collected under the higher rates. Additionally, the level of Keno gaming receipts heavily depends on the actions of municipalities and individuals, which are difficult to predict and may not lead to sufficient revenue to pay for the spending obligations associated with the full-day kindergarten subsidy Keno is intended to fund.

Given these uncertainties and the current status of the surplus, legislators should consider proposals to reduce revenues with caution, as significant reductions in revenue could lead to a budget shortfall and compromise the State’s ability to pay for its obligations.

Most Recent Fiscal Year’s Confirmed Receipts Trigger Business Tax Rate Reductions

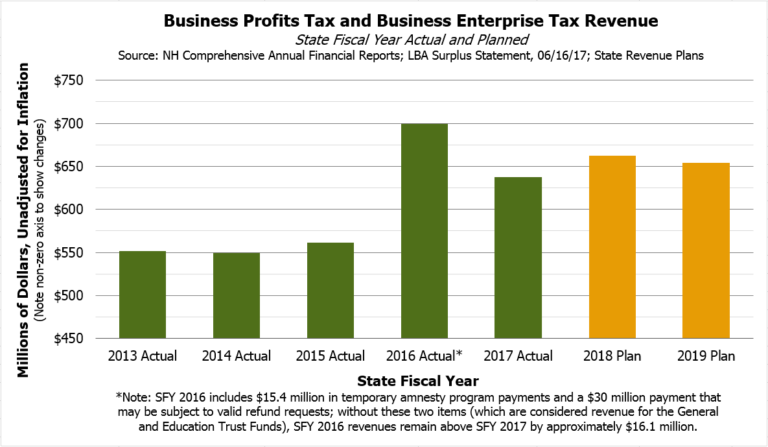

The release of the State Fiscal Year (SFY) 2017 Comprehensive Annual Financial Report (CAFR) on December 22, 2017, confirmed the expectations of many observers for much of the last year: the revenue threshold that triggered rate reductions in the State’s two primary business taxes, the Business Profits Tax (BPT) and the Business Enterprise Tax (BET), was reached and exceeded. The law, part of the 2015 State Budget compromise, required the General Fund and Education Trust Fund receive a combined revenue of $4.64 billion during SFYs 2016 and 2017 before lowering the business tax rates. Actual receipts during this time were $4.87 billion, which triggered the reduction of the BPT from 8.2 percent to 7.9 percent and the BET from

0.72 percent to 0.675 percent.[1]

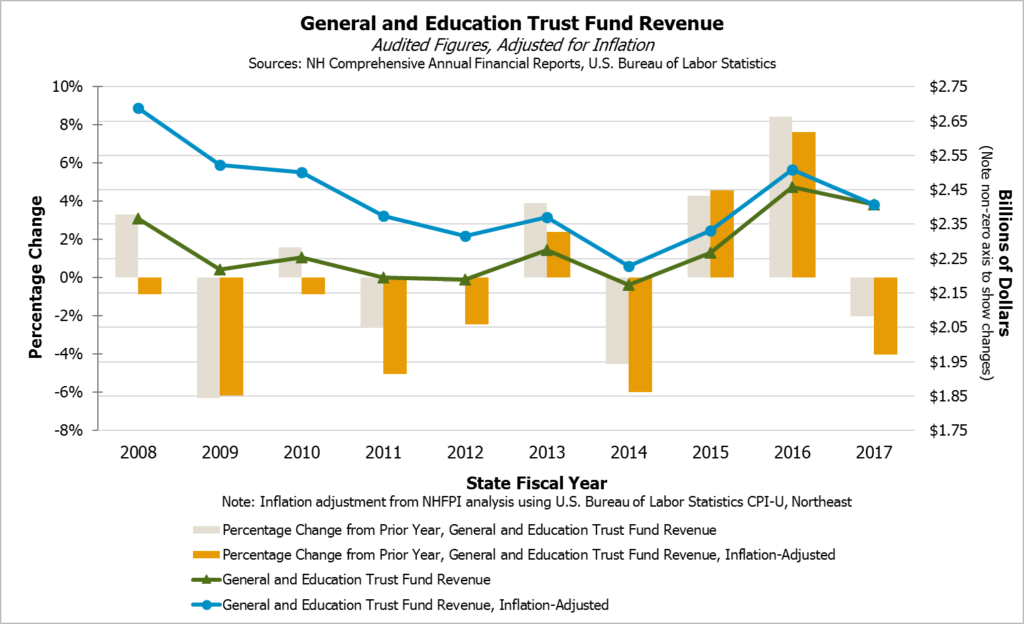

The $4.64 billion figure was set based on revenue expectations from budget negotiations in 2015 that occurred before a rise in General and Education Trust Fund receipts during SFY 2016.[2] This rise, which followed increases in corporate income tax revenue in other states after a period of slow economic recovery, pushed revenues well above the planned revenue for the SFYs 2016-2017 State Budget.[3] This planned revenue amount is set by legislators in the course of negotiating each State Budget, and the Department of Administrative Services translates those amounts into a set monthly revenue plan; amounts above that plan for the General and Education Trust Funds are commonly referred to as the surplus.[4] In SFY 2016, revenues above plan created a significant surplus. However, in SFY 2017 revenues declined from their SFY 2016 highs. The SFY 2017 CAFR confirmed this drop, showing the General and Education Trust Funds had approximately $50.1 million (2.0 percent) less revenue in SFY 2017 than SFY 2016; adjusting for inflation between the second half of SFY 2016 and SFY 2017’s second half, this drop grows to 4.0 percent.

Adjusting for inflation also reveals that the General and Education Trust Funds continue to have total revenues below the higher levels prior to the Great Recession.[5] This historical comparison remains true even when revenues from the Medicaid Enhancement Tax, which formerly provided a portion of its receipts to the General Fund, are removed.[6]

The Surplus Heading Into the 2018 Legislative Session

The SFYs 2018-2019 State Budget, set during the 2017 Legislative Session, designates uses for all except $672,000 of planned General and Education Trust Fund revenue during the biennium.[7] As such, legislators looking to use unrestricted revenue to fund other priorities without modifying the State Budget will likely rely on a revenue surplus over plan in the sources funding the General and Education Trust Funds.

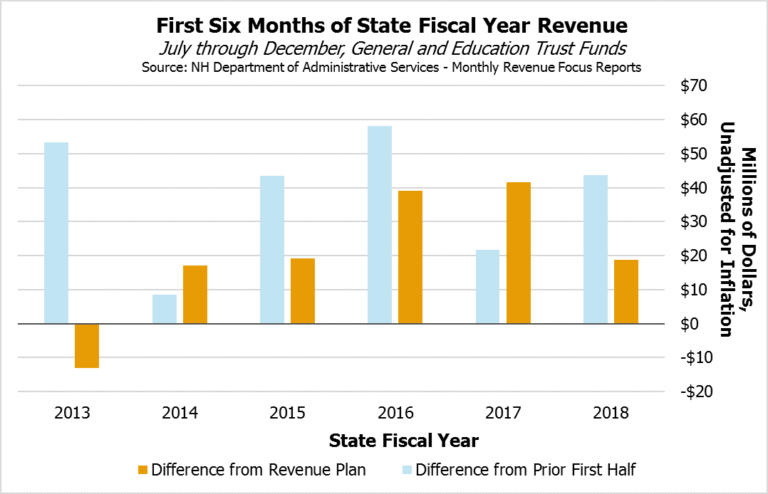

Entering the 2018 Legislative Session, the revenue surplus built up from July to December of SFY 2018 is substantially smaller than those from the same periods in SFYs 2016 and 2017. The SFYs 2016-2017 State Budget’s revenue plan did not anticipate the rise in revenue, but the current State Budget assumes higher levels of revenue, leaving a smaller margin between planned and actual revenue without similarly significant revenue growth. While cash receipts were $39.0 million over plan as of December SFY 2016 and $41.6 million over plan after December SFY 2017, December SFY 2018 left about half those amounts ($18.7 million) of revenue over plan, which was closer to the SFY 2015 ($19.2 million) and SFY 2014 ($17.0 million) amounts than the larger, subsequent amounts legislators may have become accustomed to during the last two legislative sessions.[8]

Additionally, about $7.3 million of the $18.7 million surplus as of December SFY 2018 is due to higher-than-planned payments of Interest and Dividends Tax revenue in December. This increase over plan and the prior year may reflect the prepayment of certain taxes in anticipation of federal tax law changes. If all this higher-than-planned revenue is due to shifted payments and Interest and Dividends Tax payments were below plan by $7.3 million in the remainder of SFY 2018, the surplus as of the end of December SFY 2018 would be $11.4 million. However, Interest and Dividends Tax revenue has been slightly higher than plan for the year without this December boost, indicating other factors may have led to December’s increase as well.[9]

Revenue from the Two Business Taxes

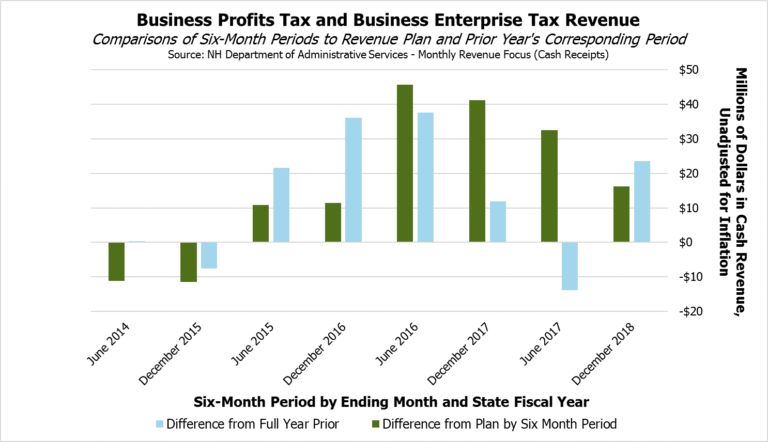

Combined BPT and BET revenues are ahead of the State’s revenue plan, which is offsetting some key sources that are lagging or bringing in approximately the planned amount of revenue. The two business taxes together are $16.3 million (5.6 percent) ahead of plan, with the BPT contributing $14.5 million (8.3 percent) more than its individual plan compared to the BET’s $1.8 million (1.6 percent) higher receipts than planned. Growth in these two business taxes has slowed considerably in the last year and a half, and the lower surplus relative to the SFYs 2018-2019 State Budget’s revenue plan suggests smaller changes in business activity or decision-making may have a larger impact on the relative availability of the surplus.

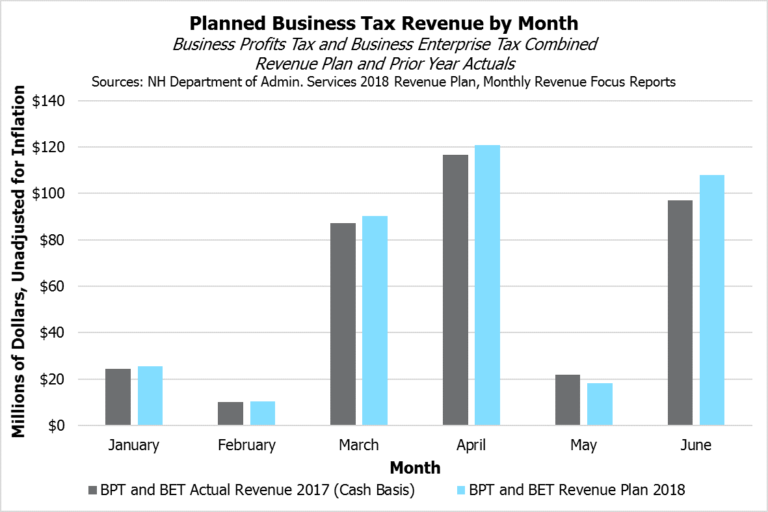

However, a major variable going into the second half of SFY 2018 and into SFY 2019 is the now-effective reduction the BPT and BET rates. The Legislature generally anticipated these rate reductions, but estimated BPT and BET revenues would remain higher for SFYs 2018 and 2019 than those in SFY 2017. The rate reductions are only in effect for the second half of SFY 2018, and returns from the rates in place during calendar year 2017 will continue to flow to State coffers in the second half of SFY 2018. The State’s monthly revenue plan, however, still anticipates higher revenue from the BPT and BET in June 2018, when the major boost to monthly receipts is due to quarterly estimates and not returns based on the prior year’s tax rate.[10] This may present a significant unknown for the size of the revenue surplus relative to plan after the Legislature will have likely completed its work for the 2018 Legislative Session.

If revenue growth does not continue after rate reductions, the General and Education Trust Fund surplus may be further reduced or disappear. The New Hampshire Department of Revenue Administration estimated the BPT and BET rate reductions effective following the SFY 2017 CAFR may result in approximately $9.2 million less in SFY 2018 and $20.9 million less in SFY 2019.[11] The current surplus from the two business taxes could be reduced by $9.2 million and still register as a surplus if revenues are collected at plan levels otherwise. However, if receipts fall below plan, a surplus could be difficult to maintain.

Even if low levels of revenue growth persist, lower levels of BPT and BET revenue may not be counterbalanced by additional growth from other sources. The Meals and Rentals Tax and Tobacco Tax have both performed slightly under plan on a cash basis in SFY 2018 thus far, and the Real Estate Transfer Tax is performing significantly below plan. The majority of the existing SFY 2018 surplus is due to the BPT and the BET, with the December increase in the Interest and Dividends Tax providing additional, but potentially temporary, assistance.[12]

Another additional variable in BPT and BET revenue collections, which is a longstanding consideration for policymakers projecting business tax revenues, is overpayments by businesses that may be requested through refunds. As of SFY 2017, $171.8 million in overpaid BPT and BET remained with the State and had not been requested as refunds.[13]

Keno Revenues Adds An Additional Uncertainty

Revenues may hold to plan from the traditional sources of funding for the General and Education Trust Funds, but the new revenue source of Keno gaming presents an additional uncertainty. The Legislature committed the State to paying for $1,100 in additional adequacy grant aid per full-day kindergarten pupil in school districts and chartered public schools starting in SFY 2019, paid for from the Education Trust Fund. The Legislature planned this additional aid to be funded with Keno gaming revenue, but the $1,100 per pupil requirement applies regardless of Keno revenue collections or whether Keno is legalized within a municipality.

If Keno is rejected, kindergarten is adopted, or some combination of the two occur in more municipalities than anticipated, surplus revenue may be required to cover a lack of Keno revenue to fund the full-day kindergarten subsidy. The outcomes of these individual municipal decisions, and other variables on the expenditure side, may lead to more constraints on a revenue surplus with an uncertain future.[14]

Conclusions

The State’s revenue picture is relatively healthy, but revenue growth is not nearly as robust as it was several years ago. The SFYs 2018-2019 State Budget so far has not benefited from the significant revenue growth above plan that permitted legislators to allocate substantial surplus funds to priorities during the 2016 and 2017 Legislative Sessions. The BPT and BET rate reductions in effect for 2018 will likely have a negative impact on revenue, and uncertainties around Keno and other revenue sources also raise questions about whether revenues will be adequate for upcoming expenditures. These variables should give legislators considering actions that might reduce State revenue pause, particularly if such likely decreases are not offset by other policy changes.

Endnotes

[1] New Hampshire Comprehensive Annual Financial Report, Fiscal Year 2017, pages 9 and 10; New Hampshire Department of Revenue Administration, Technical Information Release TIR 2018-001, January 5, 2018. For more information on the State’s revenue collection system and each of these individual taxes, see NHFPI’s Revenue in Review resource.

[2] See the State Budget agreement language in Chapter 274, Laws of 2015 and the Office of Legislative Budget Assistant’s FY 2016-2017 Operating and Capital Budget web page for more information. For more details on the General Fund and the Education Trust Fund, see NHFPI’s Building the Budget resource.

[3] National Association of State Budget Officers, Fiscal Survey of the States, Fall 2016, page 44.

[4] State Revenue Plans are published by the New Hampshire Department of Administrative Services. Those plans are produced using fiscal year amounts determined by the Legislature and written into the State Budget. The Department of Administrative Services also publishes the Monthly Revenue Focus, which compares cash receipts for the month to plan.

[5] Inflation adjustment used was the U.S. Bureau of Labor Statistics Consumer Price Index, Northeast Urban, for all items (CPI-U, Northeast), which is used for (among other purposes) adjusting the Business Enterprise Tax filing threshold, per RSA 77-E:5.

[6] Based on NHFPI analysis using the CPI-U, Northeast inflation adjustments. For more on the history of the Medicaid Enhancement Tax and the historical contributions to the General Fund, see the New Hampshire Treasury Department’s Information Statement, pages 19 to 22.

[7] See the Office of Legislative Budget Assistant’s Comparative Statement of Undesignated Surplus for the General and Education Trust Funds dated June 16, 2017. For more on the SFYs 2018-2019 State Budget, see NHFPI’s Issue Brief The State Budget for Fiscal Years 2018 and 2019.

[8] New Hampshire Department of Administrative Services Monthly Revenue Focus Reports.

[9] For more on the Interest and Dividends Tax and the December SFY 2018 increase, see NHFPI’s Common Cents blog post from January 5, Early Interest and Dividends Tax Payments Boost Surplus.

[10] See RSA 77-A and RSA 77-E for more details on the timing of returns and estimates. See also the State of New Hampshire Monthly Revenue Plan for FY 2018.

[11] The Office of Legislative Budget Assistant supplied the document “NH Department of Revenue’s Revised Fiscal Impact for Senate Bill 9.” For figures from the tax amnesty program referenced in the graphic, see the Department of Administrative Services, Monthly Revenue Focus June FY 2016. For more information on the one-time $30 million payment, see the Department of Administrative Services, Monthly Revenue Focus April FY 2016.

[12] For more information on all these revenue sources and their trends monthly, see NHFPI’s Common Cents blog posts, including October Revenues Above Plan Despite Sluggish Real Estate Transfer Tax from November 2, 2017.

[13] New Hampshire Department of Revenue Administration, 2017 Tax Expenditure Report, page 16.

[14] To learn more about Keno gaming revenues and payment for the full-day kindergarten subsidy, see NHFPI’s Common Cents blog posts, Elections Highlight Continuing Questions About Keno Revenue from November 8, 2017, and State Revenues on Target, But Concerns Linger from September 6, 2017.