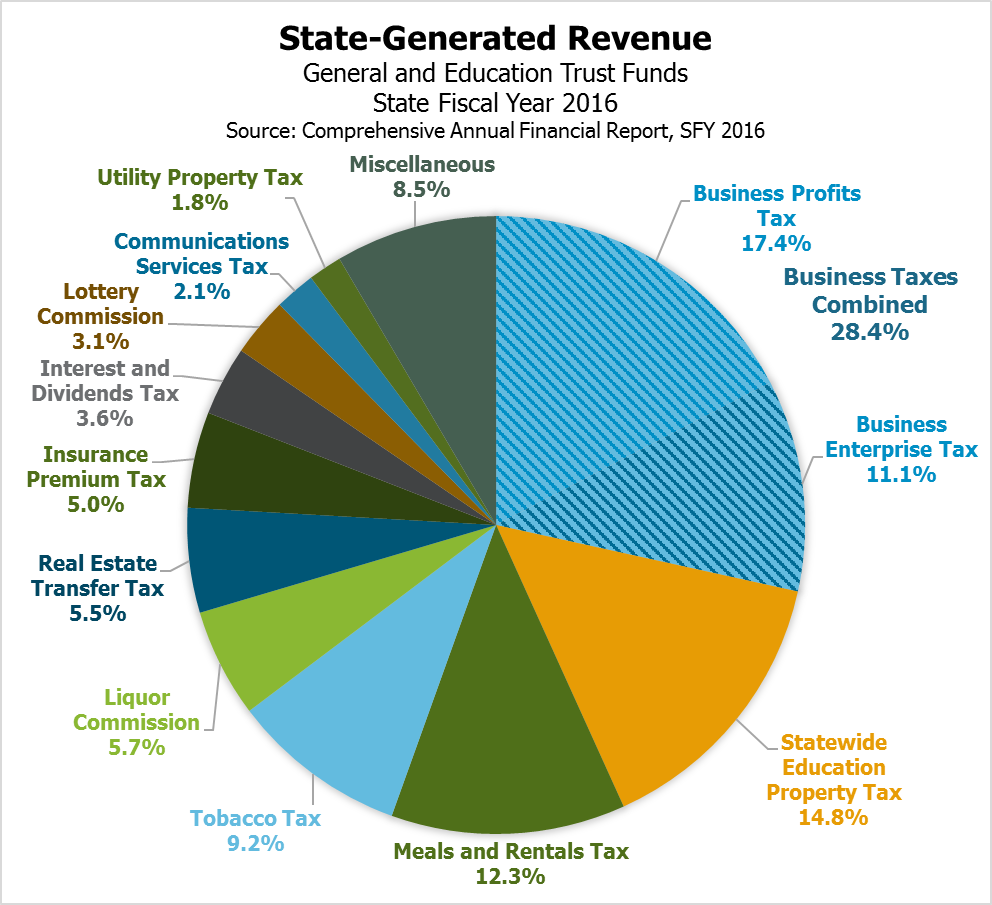

New Hampshire’s revenue system is relatively unique in the United States, as it lacks broad-based income and sales taxes and instead relies on a diversity of more narrowly-based taxes, fees, and other revenue sources to fund public services. This system presents both advantages and disadvantages to stable, adequate, and sustainable revenue generation.

The New Hampshire revenue system draws primarily from federal transfers, State taxation, enterprise funds, and fees for services. Federal transfers account for just over 30 percent of the State Budget, and remain similarly important when considering the broader universe of revenues beyond State Budget funding.

Revenue streams have varying levels of limitation on their uses. Federal fund use is often dictated by the program through which the funds were transferred to the State. Fees often have dedicated purposes, and certain taxes are set aside in whole or part for specific purposes, such as education funding or transportation.

This wide variety of funding streams, and the limitations on the uses of some sources, strengthens New Hampshire’s State revenue system through diversification and a lack of over-reliance on a few large sources. However, the system also may limit policymaker flexibility when faced with substantial revenue shortfalls, such as from recessions or changes to federal grant programs.

“Revenue in Review: An Overview of New Hampshire’s Tax System and Major Revenue Sources” features a comprehensive review of the State’s primary tax and revenue sources and examines past performance and current collection trends.

The publication reviews the following State revenue sources:

Tax Revenue Sources

Business Profits Tax

Business Enterprise Tax

Statewide Education Property Tax

Meals and Rentals Tax

Tobacco Tax

Real Estate Transfer Tax

Insurance Premium Tax

Interest and Dividends Tax

Motor Fuels Tax

Medicaid Enhancement Tax

Communications Services Tax

Utility Property Tax

Enterprise Revenue Sources

Liquor Commission

Lottery Commission

Turnpike System

Additionally, “Revenue in Review” highlights the role of federal funding sources, which contribute to a wide range of public services in New Hampshire.