Long-term care can take several forms, including nursing home care, assisted living, adult day care services, home care, and care coordination. Nursing homes are the most comprehensive form of long-term care, as they provide services to people who need 24-hour care or to people who require a higher level of nursing care. Nursing homes can be public or private facilities, and private facilities may be for-profit or non-profit organizations.

Nursing home care and long-term supports and services in New Hampshire are paid by public or private funds, with Medicaid as the major public health coverage program paying for these services. Medicaid costs are paid in part by the federal government, but county governments pay a significant portion of the non-federal costs for this care, increasing upward pressure on county property tax rates. The state’s aging population will likely increase the need for long-term care services and may require modifying the current system, particularly in counties with lower taxable property values or a greater proportion of low-income residents.

New Hampshire state and county governments have complementary and certain overlapping responsibilities for long-term care. State law identifies the New Hampshire Department of Health and Human Services (DHHS) as generally responsible for planning and ensuring administration of assistance to “needy aged, blind, permanently and totally disabled persons,” as well as for child welfare services and social services.[i] Law also requires the DHHS to develop and supervise a residential care facilities program.[ii] However, counties are responsible for caring for certain people who need support, including people who are residents of nursing homes or residential care facilities and receive certain types of public assistance, such as the home- and community-based services provided through the Choices for Independence Medicaid program.[iii]

County residents are eligible to receive county-supported nursing home services if clinical and financial eligibility criteria are met. Clinical eligibility is determined when a person must have 24-hours of medical monitoring, rehabilitative care, medication administration that requires medical or nursing intervention, or assistance with two or more activities of daily living. Financial eligibility is met if a resident is determined to be categorically or medically needy.[iv]

Multiple sources fund long-term care in New Hampshire. Nursing home care can be financed by personal assets, private insurance, certain components of Medicare, Medicaid (including federal, state, and county payments), or state funding through budget appropriations.[v] Funding for long-term nursing home services is primarily through private payments or through Medicaid, which is a partnership between the federal and state governments to provide healthcare coverage for specific populations with incomes below certain levels.[vi]

A single person will be eligible for Medicaid nursing facility care if his or her non-exempt monthly income in 2019 does not exceed $2,313, or if monthly income after certain expenses are removed is less than the Medicaid reimbursement rate assessed for the nursing facility; this second income threshold may permit significantly more individuals to be eligible, and certain other caveats and exemptions may also affect eligibility relative to both incomes and assets. Nursing facility residents also have a personal resource limitation of $2,500 in assets, with certain items, such as most homes serving as primary residences and certain vehicles, excluded from the calculations.[vii]

Under State law, counties are responsible for providing care to needy residents, but the State is responsible for administering long-term care programs, including those delivered through Medicaid, except for public county nursing homes. Therefore, counties are required to reimburse the State for expenditures on recipients for whom the county is liable under State law, such as recipients of in-state and out-of-state nursing home care or other alternative settings, including services provided through the Choices for Independence Medicaid program.[viii]

The amounts paid by the counties are capped in State law; in State Fiscal Year 2019, the cap for all counties together was set at $119,925,000. The State does not require counties pay more than the cap amount in total, and the cap is typically adjusted each State Budget cycle. The State is responsible for allocating $5 million among the counties based upon their relative proportions of residents age 65 or older who are Medicaid recipients.[ix] The State also contributes funds to nursing facilities that take Medicaid patients through the Medicaid Quality Incentive Program and through Proportionate Share Program, or ProShare, payments to public county nursing homes, and can provide State aid to counties in cases where counties find that it is impossible to pay the required amounts.[x]

A nursing home providing approved Medicaid services must be reimbursed for direct and indirect costs as determined by the bed-days of care provided and the prospective per diem rate.[xi] Certain nursing homes in New Hampshire have reported facing operating deficits between the cost of service provision and the Medicaid reimbursement rates. Private nursing homes may address these deficits by diversifying their portfolios. Counties must often address nursing homes deficits by increasing county property tax rates.[xii]

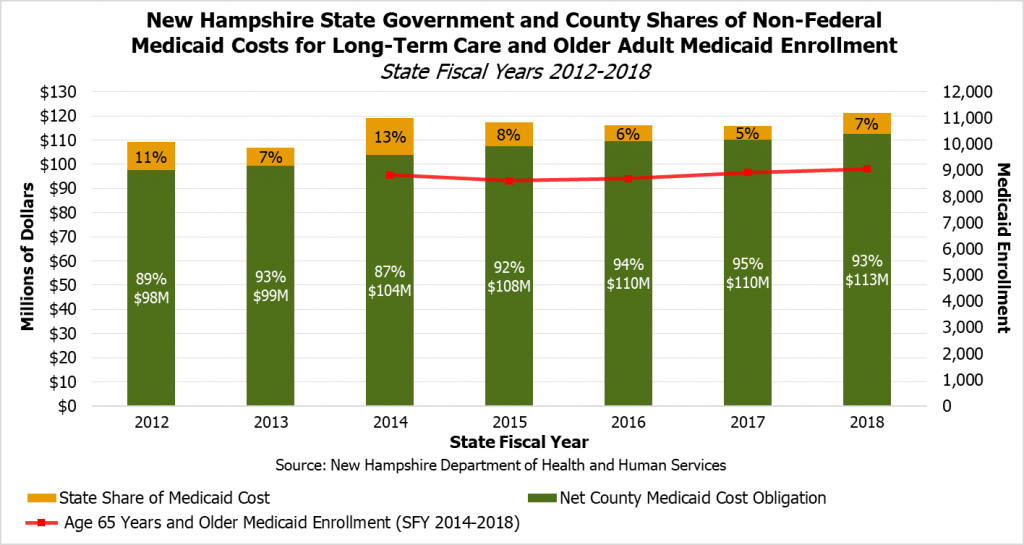

While the federal government pays for half of Medicaid expenditures at county nursing homes and in certain other long-term home- and community-based settings, the State and county governments split the other half of incurred costs.[xiii] However, the non-federal payments for long-term care have been disproportionately made by the counties, which have been paying more than 85 percent of the non-federal share since at least State Fiscal Year 2012.

In recent years, the State government’s share of Medicaid long-term care expenditures have varied as a portion of the total non-federal Medicaid obligations. However, county long-term care spending has increased steadily, which is likely related to the increase in Medicaid enrollment among those age 65 and older. While State law caps county obligations, the cap has been raised in each successive State Budget since State Fiscal Year 2013, while the State allocation to counties based on proportions of older Medicaid residents has remained at $5 million annually since State Fiscal Year 2011.[xiv]

The upward trend of county spending in long-term care can have financial impacts on all New Hampshire residents, as counties rely on the property tax for revenue. Such financial impact may be greater and more difficult to absorb in counties that have both larger shares of low-income households and older adults, as well as in counties in which the rate of household income growth is less than the growth rate of county long-term care obligation costs. Counties and their residents, particularly counties with relatively low property wealth and residents with relatively low or fixed incomes, will likely face greater difficulty paying for these services over time, especially rural counties with older populations that may be in greater need of these services.

Sources

[ii] RSA 161:2, IV-a and XII-a.

[iii] RSA 28:9; RSA 167:18-a; RSA 166:8. For more information on the Choices for Independence Medicaid waiver program, see NHFPI’s Issue Brief, Medicaid Home- and Community-Based Care Service Delivery Limited by Workforce Challenges, March 15, 2019.

[v] For more on Medicare and services related to nursing homes that are covered, see Medicare Part A coverage—nursing home care on Medicare.gov.

[vi] For more information regarding Medicaid, see NHFPI’s Issue Brief, Medicaid Expansion in New Hampshire and the State Senate’s Proposed Changes, March 30, 2018.

[vii] For more information, see the New Hampshire Department of Health and Human Services Medical Assistance Manual. See also the New Hampshire Bar Association and New Hampshire Legal Assistance guide Medicaid Income and Asset Rules for Nursing Home Residents.

[viii] RSA 167:18-a; He-E 806.37; RSA 166:8.

[ix] RSA 167:18-a, II; RSA 167:18-a, III, (a)(3).

[x] For more information regarding those programs, see DHHS NH Nursing Facility Medicaid Rates and Payments and RSA 167:18-h; see also RSA 167:21.

[xii] For the importance of property tax revenues in New Hampshire local government finances, see NHFPI’s presentation How We Fund Public Services in New Hampshire, June 24, 2019.

[xiii] University of New Hampshire, Health Law and Policy Programs at UNH School of Law, NH Medicaid Today and Tomorrow: Focusing On Value Symposium, May 31, 2017, p. 6.

[xiv] RSA 167:18-a; Chapter 156:84, Laws of 2017; Chapter 276:153, Laws of 2015; Chapter 144:8, Laws of 2013; RSA 167:18-a, III, (a)(3).