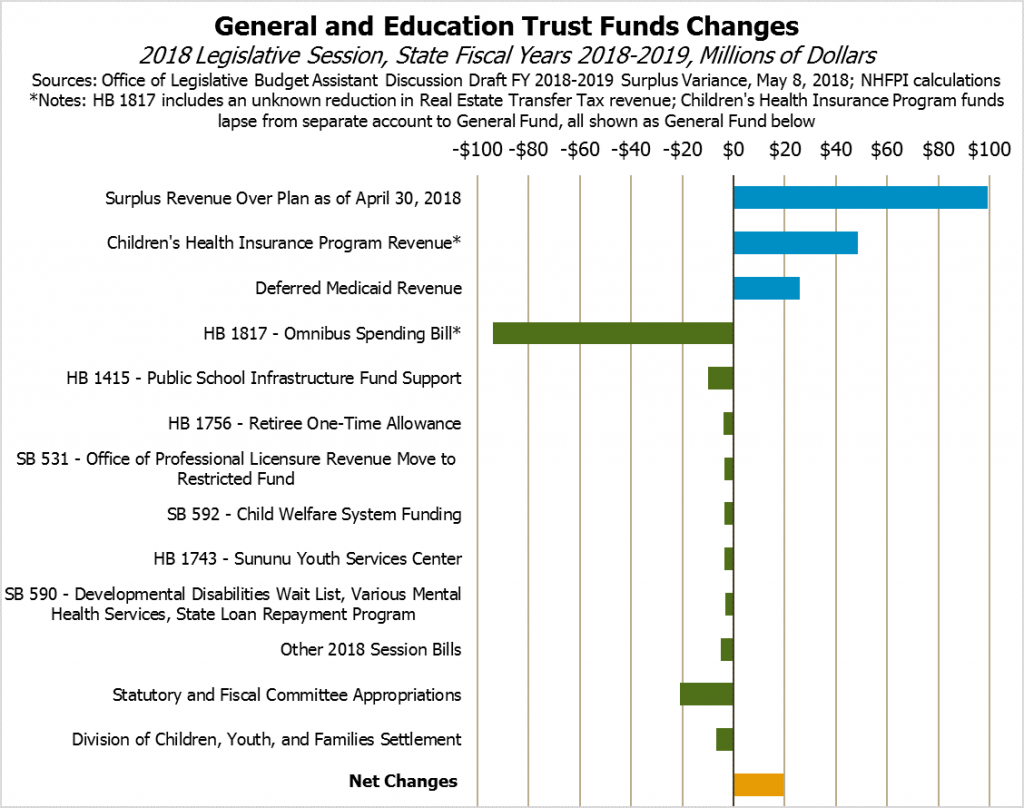

Following a flurry of amendments to existing bills, the Legislature now faces major spending decisions in a non-budget year that would make use of the current unrestricted revenue surplus. Bills to authorize new State expenditures totaling approximately $130.4 million, which is in addition to the current State operating budget, propose major changes, including a new agreement with hospitals over reimbursements, education and transportation infrastructure funding, State employee salary increases, and reductions in state revenue. The Legislature is convening a Committee of Conference on the largest bill on May 15, and plans to wrap up all its business by May 24.

The largest expenditures are included in House Bill 1817, an omnibus bill which accounts for about $103.7 million of the new State spending in State fiscal years (SFY) 2018 and 2019, with some additional expenditures and revenue reductions with an undetermined price tag. This bill was formerly focused on establishing the position of a State demographer, but now includes a wide variety of provisions and appears to behave as a miniature budget bill. The bill, as amended by the Senate, would:

- Alter and extend the disproportionate share payment agreement with hospitals. These payments are designed to compensate hospitals for taking care of patients on Medicaid, which has a lower reimbursement rate for services rendered than most other health coverage programs or private health insurance, and patients without health coverage. The previous agreement framed future payment amounts for uncompensated care with certain dollar amounts, while this one would establish a percentage of revenue collected through the Medicaid Enhancement Tax (MET) as the reimbursement amount. The agreement would also hold the MET at 5.4 percent, rather than permit it to drop to 5.25 percent as the previous agreement would have, and increase hospital service provider reimbursement rates by an amount equal to 5 percent of MET revenue starting in SFY 2020. This new preliminary agreement between the State and the hospitals is expected to cost $21.9 million in SFY 2018 and $22.3 million in SFY 2019, according to the Office of Legislative Budget Assistant.

- Appropriate $20 million in State funds to address State bridges that are identified as structurally deficient and on the State Red List. Last year’s appropriation of $36.8 million from the SFY 2017 surplus was applied to local highway and bridge projects, while this appropriation would be for State bridges. Transportation projects often have very favorable federal funds matching rates if they qualify for one of many transportation aid programs; however, it is not clear that these dollars would be used to leverage those federal matches as currently appropriated.

- Increase pay for State employees by 1.5 percent starting in June 2018 and another 1.5 percent in January 2019. This pay increase would add to total State expenditures by $27.0 million, with $12.7 million coming from the General Fund unrestricted surplus in SFY 2019.

- Direct an additional $10 million to the Revenue Stabilization Reserve Account, also known as the Rainy Day Fund. This fund was increased to $100 million in the State Budget last year. If no other use of unrestricted revenue surplus dollars is identified in law, all surplus dollars would be transferred to this fund at the end of a biennium until it reaches its cap, after which time unrestricted revenue surplus figures lapse to the General Fund.

- Appropriate $5 million to the New Hampshire Housing Finance Authority for use to provide affordable transitional housing opportunities for those leaving mental health and substance use disorder treatment facilities. New Hampshire Housing would be required to report annually on the use of these funds.

- Permit the New Hampshire Community Development Finance Authority’s 75 percent tax credit for businesses limit to rise from an aggregate of $5 million to $6 million, and permitting $1 million to flow to programs that seek to educate employers on reducing substance misuse in the workplace and programs providing public information and awareness for employee health, safety, and community engagement. This credit may reduce business tax revenues by up to $1 million. The House decided to send a Senate bill establishing this tax credit to Interim Study on a voice vote after the House Ways and Means Committee voted unanimously to recommend additional study.

- Temporarily reduce the Real Estate Transfer Tax (RETT) rate for first-time homebuyers from $0.75 per $100 transferred to $0.50 per $100. The reduced rate would only apply to residential real estate with a price of $300,000 or less, which means the most any individual buyer would save due to this reduced tax rate would be $750. This change would be reversed in January 2020 without other legislative action, and the Department of Revenue Administration would be required to report on whether the number of first-time homebuyers increased or decreased as a result of the reduced tax rate. The fiscal impact of this change is indeterminable, although it would very likely reduce State revenue. The House decided to send a Senate bill reducing the RETT rate in the same manner to Interim Study on a voice vote after the House Ways and Means Committee voted 22 to one to recommend additional study.

- Allocate an additional $1 million to the State Loan Repayment Program, which supports health care professionals willing to work in areas identified as underserved and contract with the State for a minimum of three years, or two if part-time. Notably, Senate Bill 590 also adds $410,000 to this program.

- Re-establish the foster grandparent and congregate housing programs with an appropriation of $850,000. These programs have been suspended through the State Budget.

- Authorize $100,000 to support education and acceleration programs in nonprofit business technology incubators.

House Bill 1817 as passed by the Senate would also boost kindergarten adequacy payments to be the same amount as students in grades one through 12 for children enrolled in full-day kindergarten programs at their school districts. The bill would also, for SFY 2019, permit private payments to be used for certain kindergarten students who would count toward the district’s total student count for adequacy payments. However, the Office of Legislative Budget Assistant reports the Senate’s intent was to enable districts to charge a fee for full-day kindergarten without limiting their abilities to collect Keno revenue from the State. This section will likely be rewritten.

Outside of the House Bill 1817 omnibus miniature budget bill, other bills appropriate significant amounts of money for new expenditures. These bills include:

- House Bill 1415, which the Senate amended to appropriate $10 million to the Public School Infrastructure Fund established by the State Budget and specified as for the purpose of improving school emergency readiness.

- House Bill 1756, which appropriates $4.0 million in General Funds to pay for a one-time payment of $500 to members of the New Hampshire Retirement System who are retired with at least 20 years of service, have been receiving an allowance for at least five years, and do not have allowances greater than $30,000 annually.

- Senate Bill 592, which appropriates approximately $4.5 million, the majority of which is State funds, to increase foster care funding rates and adoption programs, hire child protective workers, and fund voluntary services to children, youth, and families.

- House Bill 1743, which appropriates $3.6 million to the Sununu Youth Services Center and removes a provision of the State Budget that would have permitted certain services at the Sununu Youth Services Center to be funded with money from the Alcohol Abuse Prevention and Treatment Fund.

- Senate Bill 590, which would appropriate $5.4 million, split evenly between federal funds and lapsed General Funds, to support services for those individuals on the developmental disabilities wait list. The bill would also appropriates $410,000 for the State Loan Repayment Program, approximately $3.4 million (including $1.1 million in federal funds) to support a behavioral health crisis treatment center or mobile crisis team, $500,000 to assist in finding housing for those with serious mental illnesses, and alter processes around involuntary admissions.

Other bills make smaller appropriations, and additional expenditures have already been approved. These expenditures are planned to be paid for from the unrestricted revenue surplus, with is $99.3 million as of the end of April, and $74.7 million in dollars related to Medicaid that were either deferred revenues or made available for SFYs 2018 and 2019 by the federal government’s decision to reauthorize the Children’s Health Insurance Program.

While these expenditures appear to be paid for with funds currently available, legislators should be cautious about assuming revenues will continue to remain elevated or reducing revenues through changes to statute. Tax receipts are abnormally high, likely due to temporary effects associated with the federal tax overhaul, and most of the current surplus has been accrued only over the last three months, almost entirely from business tax receipts. Legislators should be prudent about using surplus revenues in an environment with uncertain revenue sustainability.