Key New Hampshire State revenue collections in July relied on interest on State cash holdings to generate a small surplus and revenue growth from the same month last year. Several important tax revenue sources that the State has relied on for revenue growth in recent years remained behind both State Budget expectations and last year’s collections.

While it is the first month of State Fiscal Year (SFY) 2025, July revenue collections are only a small component of the overall monthly State Revenue Plan, which is based on the revenue projections in the State Budget. The State’s two primary taxes on businesses are paid quarterly, and most businesses have a tax year that coincides with the calendar year. As a result, the State projected that July revenues for the General Fund and the Education Trust Fund combined would be about one-third of collections in September during SFY 2025.

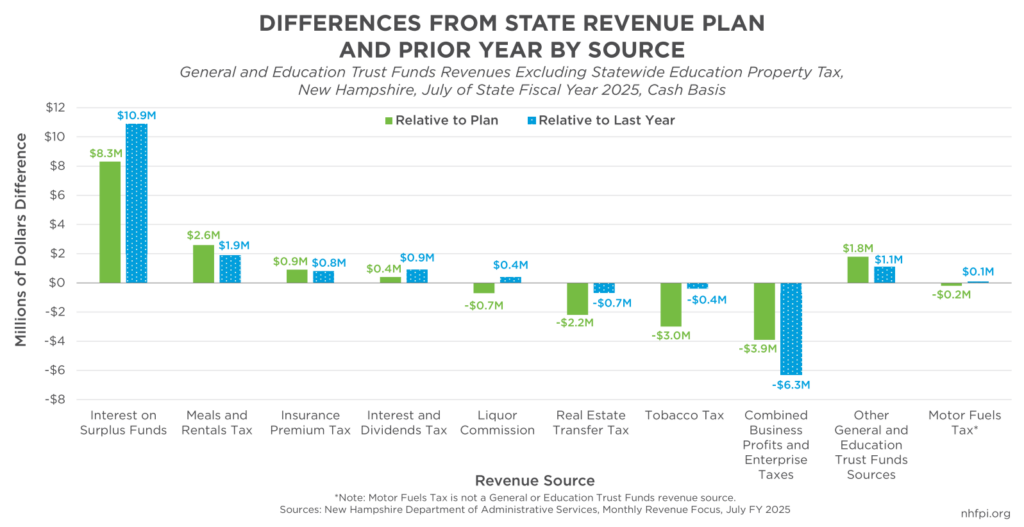

These early receipts, however, suggest SFY 2025 is starting substantially similarly to the end of SFY 2024. State revenues generated a modest surplus of $4.2 million (3.4 percent) relative to the State Revenue Plan, and were above the prior year’s July revenues by $8.6 million (7.3 percent). However, the State reported that interest on State cash holdings, which included about $2.56 billion in operating cash balances as of the end of June, totaled $10.9 million in July; this amount was 421.8 percent above the State Revenue Plan for the month and more than 1,200 times the amount the State reported in interest from last July in the most recent revenue report. This interest, which is likely going to be a temporary revenue source stemming from surpluses of past years and one-time federal funds, generated more revenue than either the total surplus or the revenue growth from the prior year. Without that additional interest revenue, July SFY 2025 would have resulted in a small revenue deficit and a revenue loss compared to July SFY 2024.

At the end of SFY 2024, the additional cash-basis revenue generated over expectations from interest on State cash holdings, as well as the soon-to-be-repealed Interest and Dividends Tax, accounted for about 87 percent of the cash revenue surplus in the General and Education Trust Funds. Key drivers of recent revenue surpluses, such as the combined receipts from the Business Profits Tax and the Business Enterprise Tax and Real Estate Transfer Tax revenues, are continuing to perform below the expectations of the State Revenue Plan. Business tax refunds were more than twice as high last month than they were in July SFY 2024, suggesting continued impacts of a policy change by the Legislature to limit tax filer holdings with the State.

Preliminary Numbers for Last Year Show Longer-Term Trends

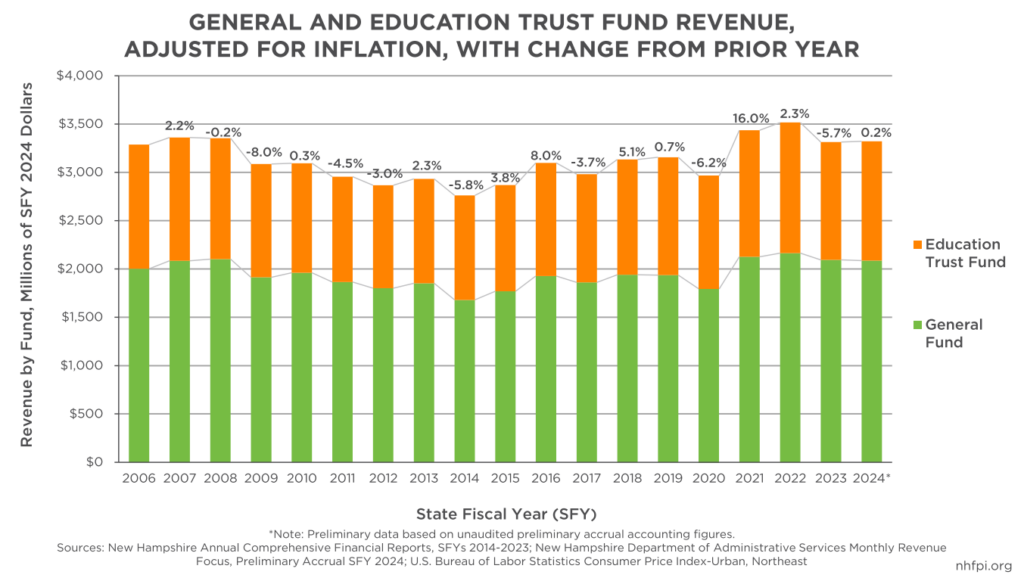

New data released by the State also provides insight into total General and Education Trust Funds revenues for SFY 2024 using the same method of accounting, rather than cash-basis figures, that will be used in the final audited numbers, which are due by the end of the year. Total collections for these two funds were estimated at an unaudited $3.32 billion, which would be up 3.2 percent from the audited $3.22 billion collected in SFY 2023 if the preliminary figures are not changed in the audit process. However, adjusting for inflation in the northeastern United States, revenue growth was 0.2 percent compared to final audited figures for SFY 2023.

These lower growth figures come after comparable revenues increased by 16.0 percent in SFY 2021, which was driven in large part by rising corporate profits providing a substantial boost to Business Profits Tax revenues. Higher corporate tax collections were part of a national trend, with revenue from these sources rising 172 percent nationwide between SFYs 2015 and 2022; New Hampshire’s increase was 118 percent. New Hampshire’s combined business tax receipts were $41.0 million (3.3 percent) lower in the preliminary figures than they were in SFY 2023. Revenues from the Tobacco Tax, the Real Estate Transfer Tax, and the Liquor Commission were all down by more than 10 percent from SFY 2023 to SFY 2024.

These new sets of figures continue to suggest the State may be in a challenging situation relative to revenues to the General Fund and the Education Trust Fund, which are key for the State Budget. The repeal of the Interest and Dividends Tax in 2025, which will disproportionately benefit wealthier households, and the eventual waning of interest revenue will remove or diminish the State’s two primary sources of revenue growth from last year. Other key revenue sources continue to underperform in the early days of the new fiscal year. Policymakers may face difficulties maintaining the services funded in the current State Budget as they build the next one in 2025.

– Phil Sletten, Research Director