New Hampshire State revenues ended State Fiscal Year (SFY) 2024 in June with receipts slightly above expectations, but below the prior year, for the month. Overall, the State’s combined General and Education Trust Funds surplus for the total of SFY 2024 held at $146.5 million, or 4.6 percent, above the State Revenue Plan on a cash basis. However, about 87 percent of that total surplus amount was generated by two revenue sources that are likely to disappear in future years.

The revenue figures for June, published on July 8, have not yet been audited and only provide initial insight into revenues for the entirety of SFY 2024. However, June is an important month for revenue, as it reflects the quarterly estimate payments for business taxpayers that use a calendar year as the tax year, which includes about 90 percent of tax filers. In SFY 2023, June receipts increased the combined total General Fund and Education Trust Fund surplus by $51.9 million.

In SFY 2024, however, revenues only added $3.6 million to the surplus, and were 1.1 percent above the State Revenue Plan for the month. The Lottery Commission’s contributions to the Education Trust Fund were $7.7 million (29.8 percent) above planned amounts, due in part to increased internet-based lottery activity, historic horse racing, and sports betting. The next largest contributor to the surplus in June SFY 2024 was the Interest and Dividends Tax, which was $3.5 million (22.2 percent) above the State Revenue Plan for the month. The Interest and Dividends Tax is scheduled to be eliminated starting in calendar year 2025.

Combined revenues from the two primary business taxes were $4.9 million (2.8 percent) below the State Revenue Plan for June, and $4.1 million (2.3 percent) below the June SFY 2023 collections. The Tobacco Tax was $4.3 million (21.2 percent) behind planned amounts for the month, and $2.7 million (14.4 percent) behind last year, continuing a likely long-term decline. Real Estate Transfer Tax revenues were below planned amounts by $0.4 million (2.1 percent), reflecting the very constrained housing market; however, Real Estate Transfer Tax revenue matched the amount collected in June SFY 2022 and was $3.0 million (19.1 percent) above June SFY 2023 amounts, suggesting that rising prices of single family houses may be outpacing the very limited inventory and sales volume.

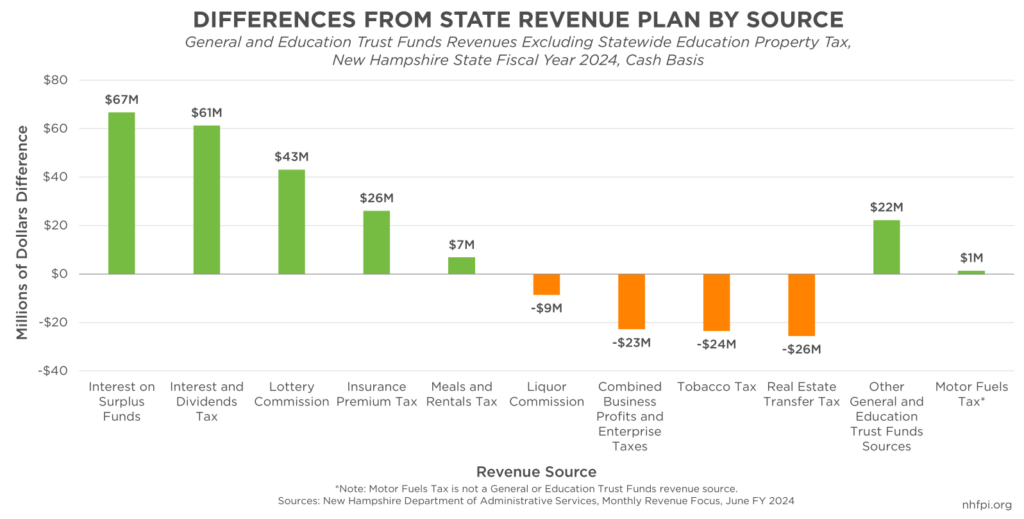

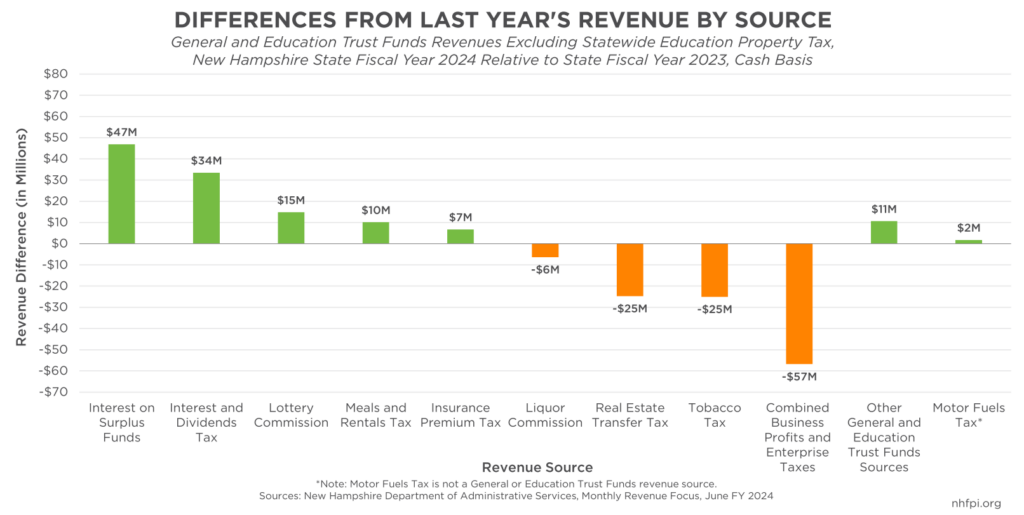

June revenues largely continued trends from the second half of SFY 2024. About $128.1 million (87 percent) of the $146.5 million combined General and Education Trust Funds cash basis revenue surplus stems from two sources that are likely to be temporary: the Interest and Dividends Tax, which is due to be eliminated in 2025, and interest payments made to the State based on State cash holdings, which has benefitted from both high interest rates and one-time federal funds.

Without these revenue sources, revenue growth in the last year would have been dependent on the somewhat higher lottery, Meals and Rentals Tax, and Insurance Premium Tax revenues. These revenues would not have fully offset declines in Tobacco Tax, Real Estate Transfer Tax, and combined business tax revenues. Some of the drop in business tax receipts is likely temporary and associated with policy changes prompting more refunds, but other indicators also suggest longer-term slowing growth in taxable business profits.

For the year, combined business tax revenues were $22.8 million (1.8 percent) below planned amounts, and $56.8 million (4.4 percent) below SFY 2023 collections. Tobacco Tax revenues were $23.5 million (11.0 percent) below planned amounts, and declined $25.1 million (11.6 percent) relative to last year. Real Estate Transfer Tax revenues were $25.6 million (12.2 percent) below the expectations of the State Revenue Plan, and were $24.7 million (11.8 percent) below SFY 2023 collections.

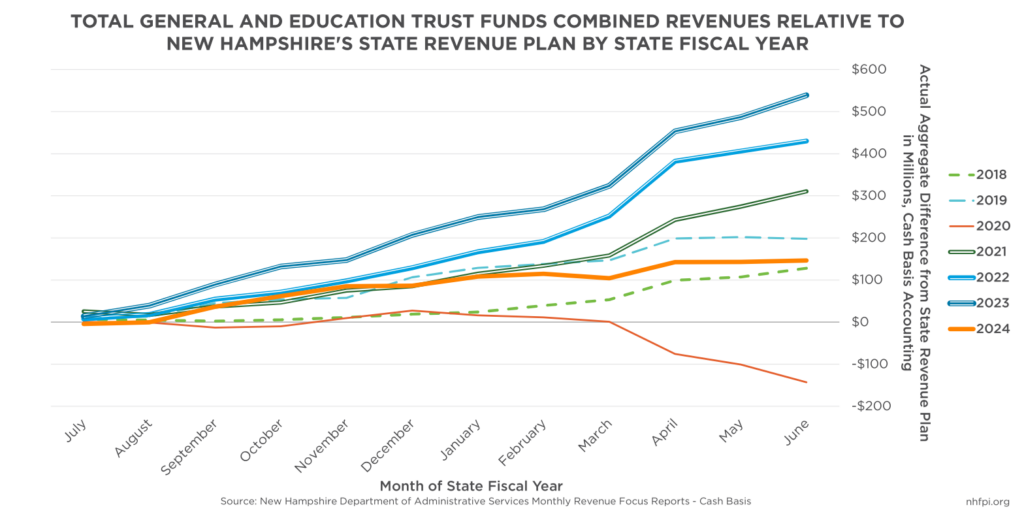

These SFY 2024 State revenue figures are likely to undergo revision in the year-end auditing process. The $146.5 million revenue surplus is a healthy amount, but is smaller than the year-end cash General and Education Trust Funds surpluses from SFYs 2019, 2021, 2022, and 2023. Combined revenues to the General Fund and the Education Trust Fund were $110.3 million (3.4 percent) above SFY 2023, while consumer price inflation in New England was 3.8 percent from May 2023 to May 2024. States around the country are experiencing slowing revenue growth, and policymakers in New Hampshire and elsewhere may face difficult budget and revenue policy choices to maintain key public services in the coming years.

– Phil Sletten, Research Director