New Hampshire’s Low and Moderate Income Homeowners Property Tax Relief Program provides tax refunds for individual homeowners who earn less than $37,000 annually or a married couple or head of household who earns less than $47,000. These thresholds were raised in 2021 after two decades without adjustments since the program’s inception in 2001. Based on the most recent data available, about a quarter of New Hampshire households had less than $50,000 in income during 2022. This program assists Granite State homeowners with low and moderate incomes who typically pay more in state and local property taxes as a share of their incomes relative to households with higher incomes. Applications are currently open until June 30, 2024 and can be submitted to the New Hampshire Department of Revenue Administration.

Rising Program Participation

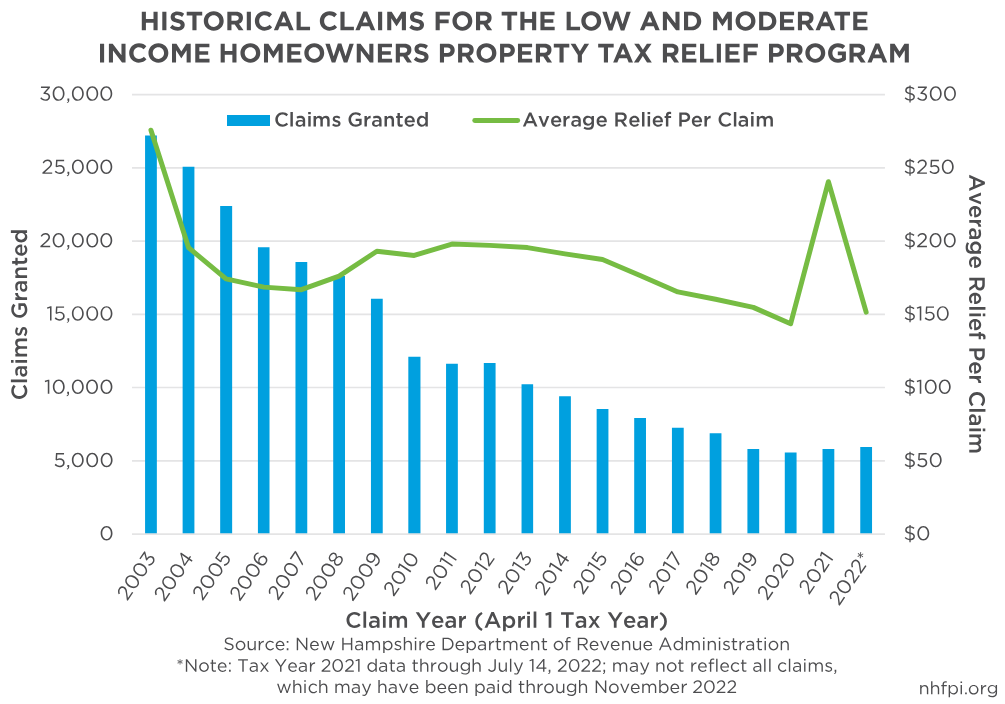

Although there has been an increase in program participation over the last few years, the number of claims granted had been on a steady decline from its peak of 27,208 in 2003, the first year of its implementation. A total of 5,943 claims were granted for 2022 as of July 2023 data, which is a slight increase from the total number of 5,821 claims in 2021. Despite this increase, the total amount of relief paid has declined to about $900,000 in 2022 after spiking to approximately $1.4 million the prior year. In 2021, the average relief amount per claim was $240.51, which is the highest it has been since the average relief amount was $275.65 in 2003, unadjusted for inflation. Thus far, the average relief amount was $151.44 in 2022, which may fluctuate as claims continue to be processed and paid in 2023. While homeowners with low and moderate incomes have benefitted from the program, renters, who have substantially lower median incomes, are not eligible for relief. As of 2022, the median household income for renters was about $56,000 while homeowner median income was approximately $108,000.

The increase in claims, but decrease in the relief amount paid, may be due to changes in income that reflect rising inflation and people returning to work after unemployment associated with the COVID-19 pandemic. Refund amounts are determined based on specific income brackets, with households making lower incomes receiving higher refunds. Higher median incomes and wage increases may have pushed more households into other income brackets, thus decreasing the total amount refunded. While incomes may continue to increase as inflation persists, more people may become ineligible for assistance through the program due to the fixed income thresholds in State law. In addition, substantial and rapid increases in assessed property values may have affected the equalization ratios that are used by the State to determine the percentage of each house’s value that is eligible for the program, which could have limited refunds in some cases. The one-time reduction for State Fiscal Year 2023 in the Statewide Education Property Tax may also have had an influence on the decline in the total relief amount, as the refund is a tax credit against the Statewide Education Property Tax, rather than local property taxes, and a lower liability could reduce the available credit amount.

The Impact of Relief for Homeowners

While raising the income threshold has helped provide assistance to an increasing number of applicants since 2020, the decline in claims over the previous twenty years may be due to the limited relief provided when compared to the amount of property tax that is paid by homeowners. For a married couple with a total adjusted gross income of $30,000 and a home assessed at $310,000 in 2023, the total refund provided would be $190.08, assuming that the State’s estimated equalization ratio does not impact the home value. According to the State’s tax credit form for the program, this refund is calculated by dividing the capped eligible assessed home value of $220,000 by 1,000, and then multiplying that figure by the Statewide Education Property Tax rate, which averaged $1.44 per $1,000 statewide in 2023. That total, $316.80, is adjusted by a sliding scale of the subsidy amount based on household income (0.60 for a married couple with at least $29,400 and less than $35,300 in annual income, based on federal tax calculations). Households with lower incomes receive higher refunds; a married couple with a total adjusted gross income under $23,100 would receive a full refund of $316.80 in this scenario. While the refund amount is lower for 2022 compared to 2021, both income eligibility limits and the value-based credit cap are not adjusted for inflation.

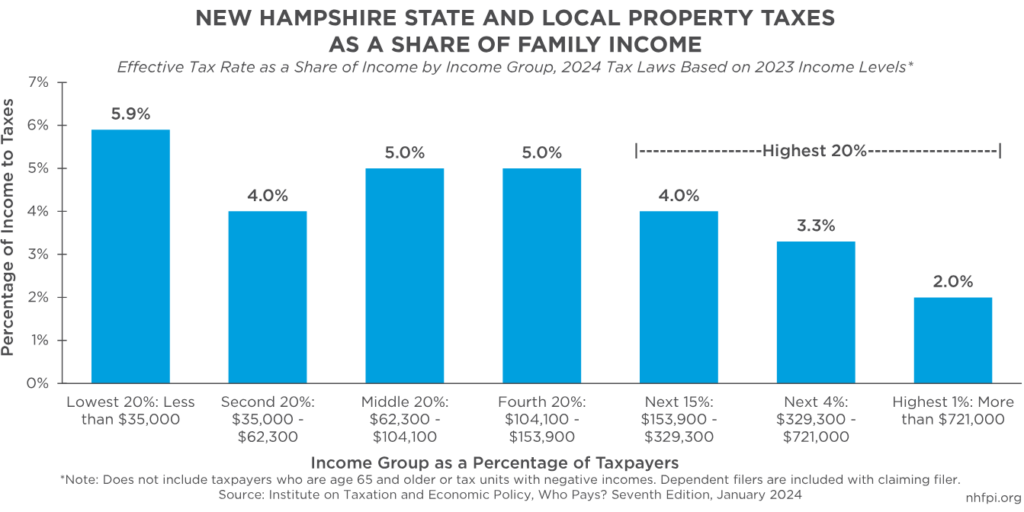

While refund rates are low in comparison to the amount paid in property tax, the program helps offset costs for homeowners with low and moderate incomes who typically pay a greater percentage of their income in property taxes relative to homeowners with higher incomes. According to the Institute on Taxation and Economic Policy, Granite Staters under 65 years old with incomes between $62,300 and $153,900 paid about 5.0 percent of their income in state and local property taxes in 2023. This percentage was higher among those with incomes below $35,000, who paid approximately 5.9 percent. The highest one percent of households by income, with more than $721,000 annually, paid about 2.0 percent of their incomes in property taxes.

How To Apply

Eligible homeowners are invited to apply for relief by June 30, 2024. Applications can be submitted online through the State’s Granite Tax Connect portal, as well as via mail by submitting a paper form. The State encourages applicants to view the program’s website to learn answers to frequently asked questions, check online claim status, and contact the New Hampshire Department of Revenue Administration with any additional questions.

– Jessica Williams, Policy Analyst