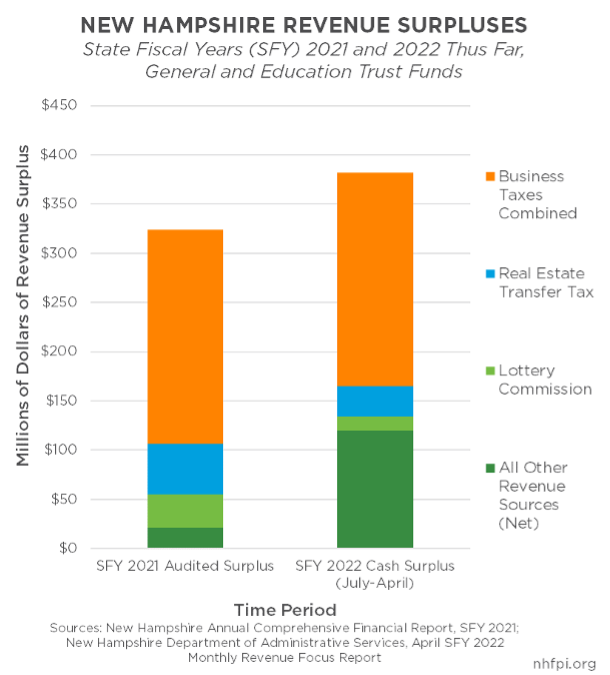

State revenues have grown substantially since the sharp decline associated with the early days of the pandemic. As of the end of April 2022, the unrestricted revenue surplus over the State Budget’s revenue plan was $382.2 million, 16.0 percent higher than planned. Revenue surpluses have been generated by higher-than-anticipated revenues from the State’s two primary business taxes, as well as higher receipts from restaurant meals, rental hotel rooms and cars, real estate sales, insurance premiums, lottery sales, and revenue generated from wealth and stock ownership. The substantial revenue surplus presents an opportunity to invest in long-term public needs and help support more equitable opportunity for Granite Staters at the greatest risk of being left behind by the economic recovery.

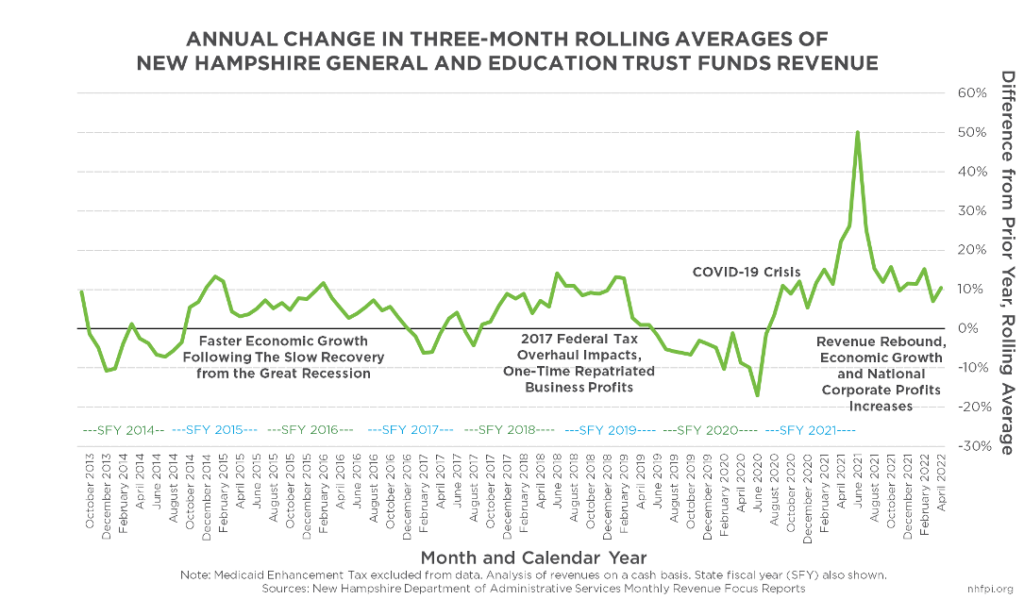

The rebound in State revenues to the General and Education Trust Funds was surprisingly swift. This was true in New Hampshire and in most other states, including in corporate tax revenue collected by other states. Some state tax deadlines were shifted, creating an artificial decline in April 2020 and higher tax revenues in June 2020, and comparatively large year-over-year increases in April 2021. Subsequently, revenues grew not only relative to State Fiscal Year (SFY) 2020 and the pandemic’s impacts in SFY 2021, but also began growing relative to pre-pandemic State revenues.

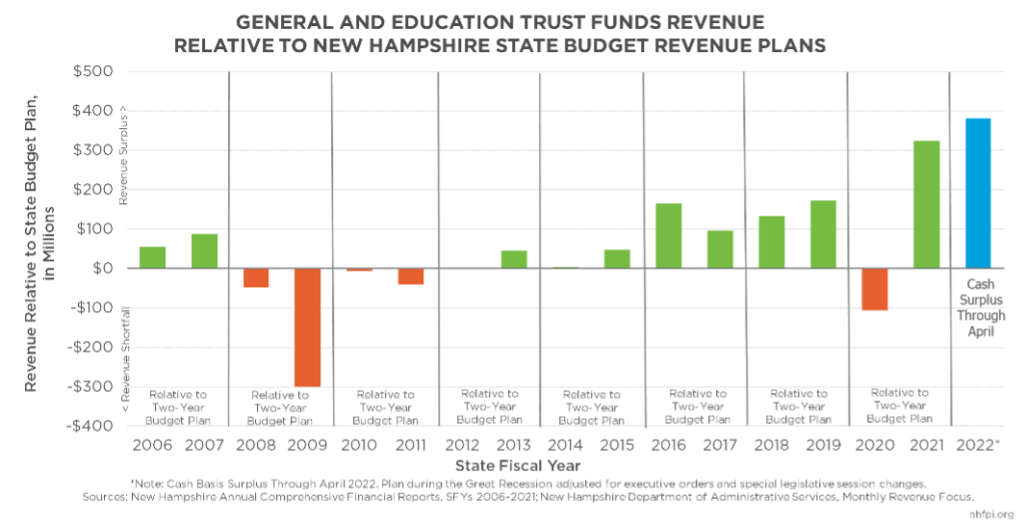

By April 2022, the New Hampshire Department of Administrative Services reported a cash surplus of $382.2 million (16.0 percent) for the combined General and Education Trust Funds relative to the State Revenue Plan associated with the State Budget. This figure was also $266.7 million (10.7 percent) above the prior year’s revenue collections and $457.4 million (19.8 percent) above the revenues collected by these same two funds in SFY 2019 through the month of April. The current cash revenue surplus for the General and Education Trust Funds is larger, in dollar terms, than the deficit was during the worst fiscal year for the State during the Great Recession of 2007-2009, and is larger than the surplus at the end of the last State Budget cycle in 2021.

This surplus has been primarily generated by the State’s two primary business taxes, the Business Profits Tax and the Business Enterprise Tax. These two taxes are typically filed together, so differentiating the revenue generated between the two tax revenue sources on a monthly basis can be difficult. However, the Business Profits Tax is the largest State tax revenue source, and has been growing faster than the Business Enterprise Tax in recent years. The combined business tax revenues were $217.2 million (27.5 percent) above the State Revenue Plan for SFY 2022 through April’s end.

The surplus was also boosted by the Meals and Rentals Tax, which has been recovering from the pandemic and is generating substantially more revenue than the State Revenue Plan envisioned thus far. This tax, which primarily generates revenue from restaurant meals but also taxes rented hotel rooms and rental cars, ended the month $54.6 million (26.9 percent) ahead of planned amounts. Pent up demand for restaurant dining and travel are likely contributing, as may be higher food and car rental prices and a growing economy overall.

Higher revenues than expected continued to be generated by the Real Estate Transfer Tax, which primarily generates revenue from single family home sales. A very constrained housing market with limited supply has generated much higher prices, but a smaller number of transactions may not be sufficient to maintain continual surpluses from this tax in the future. Lottery Commission revenues also continue to perform above planned amounts, but less substantially so than in SFY 2021. Additionally, the Insurance Premium Tax continues to collect significantly more revenue than planned, as does the Interest and Dividends Tax, which primarily collects revenue from wealthy people with higher incomes and is due to be eliminated entirely under current law in the next five years.

During SFY 2022 thus far, revenues from the Liquor Commission, the Tobacco Tax, and the Communications Services Tax have been below expectations. These shortfalls were offset, however, by a significant amount of unplanned General Fund unrestricted revenues in the form of about $28.3 million from legal settlements.

With the majority of the State’s large revenue surplus generated by the combined business taxes, understanding the potential causes of the revenue increases is critical to projecting the durability of these relatively high tax receipts. Underlying economic activity in New Hampshire has rebounded from the pandemic, as it has in other states, likely contributing to substantial revenue growth and much more business activity than would have been the case without federal investments to support the recovery. Federal stimulus efforts for the economy have been key to helping spur this growth and support incomes since the beginning of the COVID-19 crisis.

Much of the revenue growth through the Business Profits Tax specifically has likely occurred due to rising national profits. Multi-state and multi-national businesses are a key part of the New Hampshire Business Profits Tax base. The New Hampshire Department of Revenue Administration does not definitively determine where a company is “based” with the information provided in a tax return. However, taxed businesses identify their organization’s structure by filing as a certain type of business. “Water’s Edge” filers, which have a significant international component, accounted for 60.2 percent of all revenue collected by the Business Profits Tax in Tax Year 2019, despite only accounting for 5.7 percent of filers. These filers do not constitute all multi-state or multi-national businesses, which could file as other entity types, depending on their organizational or ownership structures.

The profitability of the largest business entities with sales or operations in New Hampshire can have a substantial impact on State revenues. In Tax Year 2019, less than 0.9 percent of filers paid about 77.0 percent of the State’s Business Profits Tax revenue.

If national corporate profits continue their strong pace, growth in New Hampshire’s key revenue sources may continue. However, if the economy slows with declining federal stimulus, supply chain challenges, and inflation, these high revenues may not continue into the next biennium. The economic risks could substantially impact the well-being of Granite Staters with low and moderate incomes, and key investments in their financial security with these surplus dollars could help reduce economic hardship and support a more equitable recovery.

– Phil Sletten, Senior Policy Analyst