Following a substantial growth in revenue in State fiscal year (SFY) 2016, the preliminary accrual figures for SFY 2017 have been tabulated and show essentially no change in tax and transfer revenues from SFY 2016 preliminary numbers, and a drop in overall revenues, for the General and Education Trust Funds. These unaudited numbers are subject to change, and the State’s final numbers will not be known until the Comprehensive Annual Financial Report is completed at the end of the year. Last year, an additional $20.4 million in revenue was identified in the review process between the preliminary accrual and September 2016, so these 2017 figures are likely to vary in the coming months. However, the figures are not promising relative to the preliminary accrual figures for SFY 2016, suggesting revenue growth may have stalled.

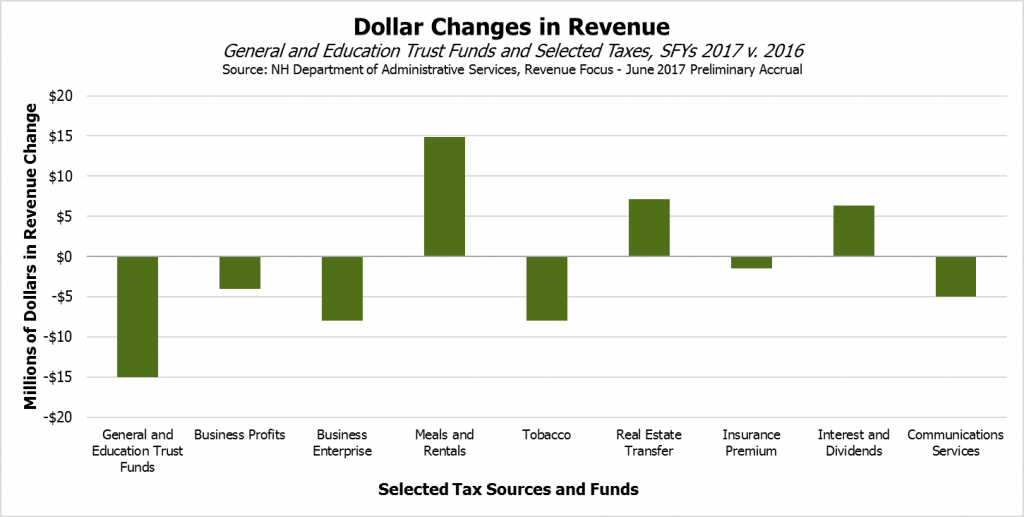

The total decline in General Fund and Education Trust Fund revenue, which are the two primary repositories for State tax revenue collections, was $15.0 million. Removing one-time revenues associated with the $19.0 million in SFY 2016 revenue attributable to the State’s tax amnesty program as well as the $4.5 million in received payments due to legal settlements in SFY 2017, receipts were approximately $0.5 million lower than the SFY 2016 preliminary receipts. Although the SFY 2017 figures may be revised upward in the audit process, these comparisons to the SFY 2016 preliminary numbers indicate revenue growth was far from robust between the two years, and revenues may have declined overall.

This decline compares to a final audited $191.0 million (8.4 percent) increase from SFYs 2015 to 2016, and a $93.5 million (4.3 percent) increase from SFYs 2014 to 2015, for the General and Education Trust Funds. SFY 2014 revenue dropped relative to the prior year in part due to Medicaid Enhancement Tax revenues being diverted away from the General Fund after SFY 2013.

While the preliminary accrual revenues for SFY 2017 show no growth over SFY 2016’s preliminary accrual numbers, the figures do show substantially more revenue than was planned under the SFYs 2016-2017 State Budget. SFY 2017 revenue for the General and Education Trust Funds was $93.5 million (4.0 percent) over plan, when one-time sources are included. The State appears to have ended SFY 2017 with a significant surplus, despite a slight decline in revenues from SFY 2016’s preliminary accrual figures.

Specific Sources

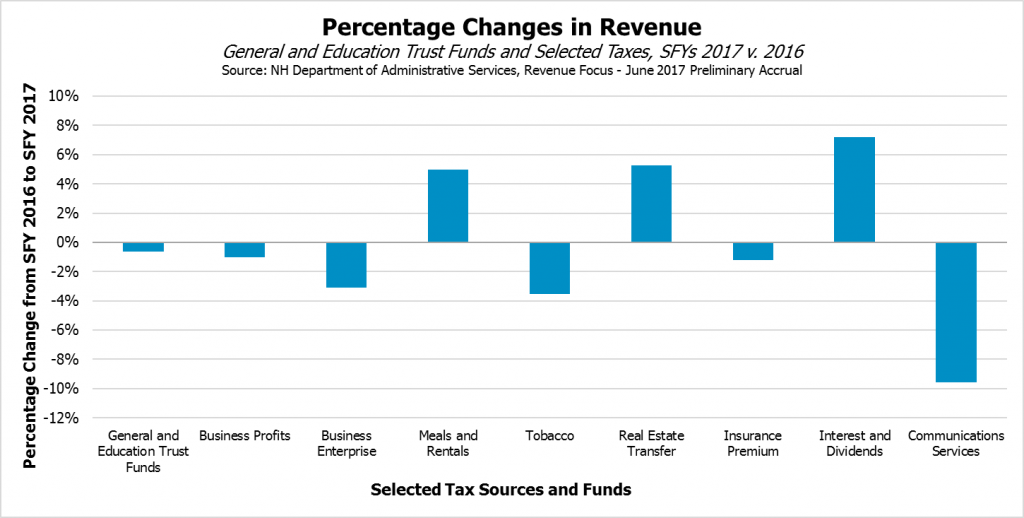

The State’s two primary business taxes, the Business Profits Tax (BPT) and the Business Enterprise Tax (BET), together brought in $634.3 million during SFY 2017, a 1.9 percent decrease from SFY 2016’s preliminary accrual total. BPT and BET revenue accounted for 28.4 percent of all revenue to the General and Education Trust Funds in SFY 2016, and the BPT alone was the State’s largest tax revenue source. Both the BPT and the BET were ahead of plan for SFY 2017, with the combined total $69.2 million (12.2 percent) higher than budgeted, based on the preliminary accrual.

Disaggregated into the separate taxes, BPT revenue fell by approximately $4.0 million (1.0 percent) between SFY 2016’s and SFY 2017’s preliminary accrual figures. This change compares to final audited BPT growth of $83.5 million (24.3 percent) from SFYs 2015 to 2016, and $13.3 million (4.0 percent) from SFYs 2014 to 2015.

The BET generated $8.0 million (3.1 percent) less revenue in SFY 2017 than in SFY 2016. This decline compares to final audited BET growth of $54.1 million (24.8 percent) from SFYs 2015 to 2016, and a $1.2 million (0.6 percent) decline between SFYs 2014 and 2015.

A few key taxes kept the revenue decline small between the SFY 2017 preliminary accrual and the SFY 2016 figures. The Meals and Rentals Tax continued to be a strong performer, coming in $14.9 million (5.0 percent) ahead of SFY 2016’s preliminary accrual. The Real Estate Transfer Tax brought in $7.1 million (5.3 percent) more than the prior year, and while the Interest and Dividends Tax was below the plan for SFY 2017, it was $6.3 million (7.2 percent) higher than SFY 2016’s revenue figures.

Certain other taxes reduced the SFY 2017 total relative to the prior year. The Tobacco Tax was down $8.0 million (3.5 percent). The Communications Services Tax continues to underperform, bringing in $5.0 million (9.6 percent) less than in SFY 2016.

Notably, the July revenue figures for SFY 2018 show the Tobacco Tax and Meals and Rentals Taxes lifting total receipts to $5.3 million above July of SFY 2017, but BPT and the BET were mixed relative to the prior year, with a net drop of $0.2 million, or 0.9 percent. The Department of Revenue Administration reported some anomalies led to higher revenue from the business taxes than expected.

National Context

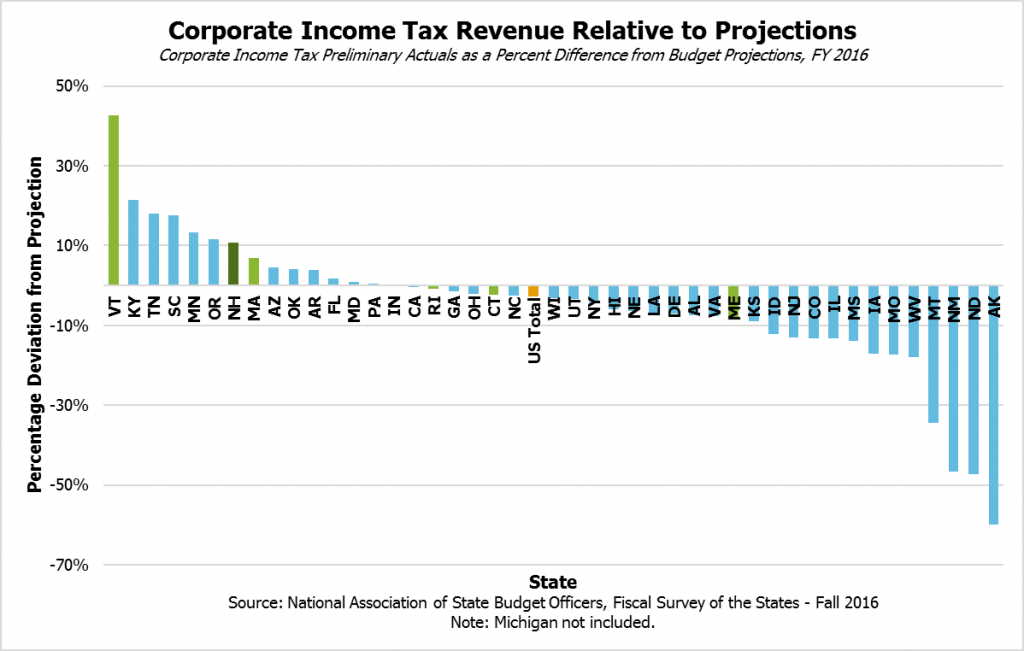

New Hampshire’s potential revenue difficulties appear to follow, with some delay, the experiences of other states, which have been undergoing revenue challenges recently. The National Association of State Budget Officers found that states faced relatively weak revenue collections overall during fiscal year 2017; corporate income tax collections were estimated to have been below forecast and declined overall relative to the prior year. New Hampshire was also one of only fourteen states that met or exceeded projections for preliminary corporate income tax revenue for fiscal year 2016.

The Urban Institute calculated that, in the first quarter of 2017 compared to the previous year, inflation-adjusted total tax revenue was down 0.9 percent, and corporate income tax revenue was down 13.8 percent over the same period.

A July 2017 report from the Rockefeller Institute of Government examining state income taxes found that not only were April collections down a total of 4.0 percent relative to last year, but the declines were largest in the New England states at 9.9 percent. While studying state income tax revenue has limited applicability in New Hampshire, it can provide insight into how both certain New Hampshire taxes and the economy as a whole could be performing.

While the explanations for New Hampshire’s recent revenue increase vary considerably, the State may not be able to depend on continued robust revenue growth. Tax collections may have plateaued after a boost last year, mirroring the experiences of other states, particularly relative to corporate income taxes. Speculation about the causes of the national slowdown in revenue collections identify potential federal policy changes prompting shifts in individual and business tax-related decisions, or the economy showing weaknesses not collected in other data. New Hampshire policymakers will learn more when revenue is collected in the initial months of the new State Budget.

For more information on how the New Hampshire State government collects revenue and an explanation of the different State government funds, see NHFPI’s Revenue in Review and Building the Budget resources.