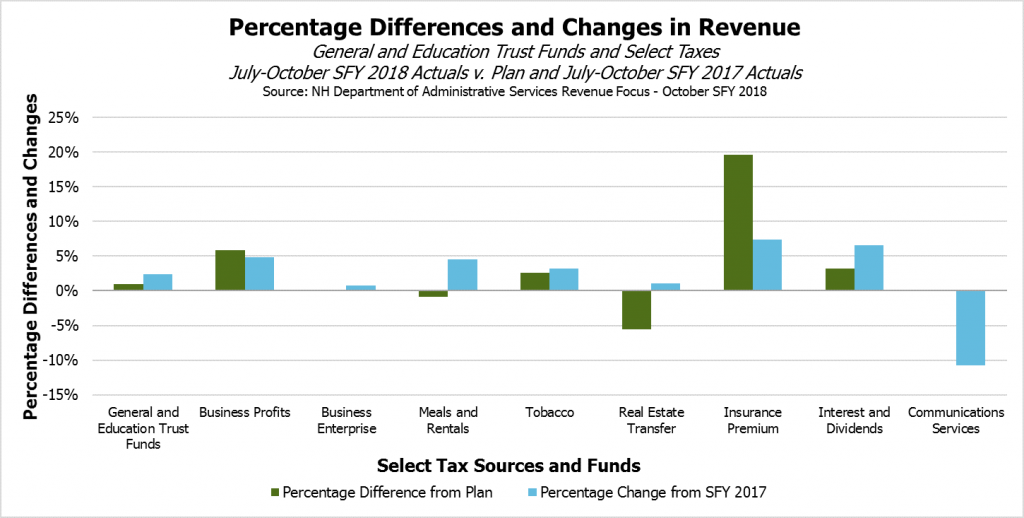

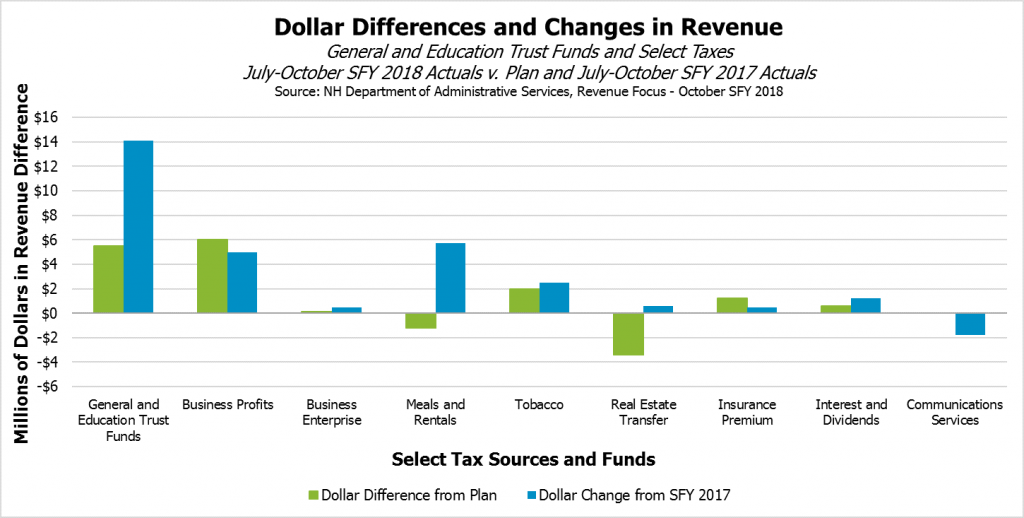

October revenues for the General and Education Trust Funds met the State’s anticipated revenue plan based on State Budget expenditures, but the relative strengths and weaknesses of certain revenue sources and comparatively small revenue surpluses may limit the Legislature’s flexibility in future deliberations. As with earlier revenues thus far this fiscal year, the receipts did not show robust growth over the prior year or a significant revenue surplus above plan. October cash revenues for the General and Education Trust Funds were $3.2 million (2.6 percent) above plan, boosting the revenue surplus for State fiscal year (SFY) 2018, which began on July 1, to $5.5 million (0.9 percent) thus far.

While the Business Profits Tax has performed above plan and above the prior year thanks in part to stronger than anticipated October receipts, the Business Enterprise Tax shows little growth over the prior year and is only $0.1 million (0.1 percent) above plan.

The Meals and Rentals Tax, which has been a key driver of recent revenue growth, exceeded plan in October by $0.7 million (2.4 percent), but remained $1.2 million (0.9 percent) below plan for the year thus far. However, Meals and Rentals Tax revenue is still above the prior year by $5.7 million (4.5 percent). The New Hampshire Department of Revenue Administration noted that October collections, based on September activity, from full service restaurants and hotels were both up five percent as compared to October SFY 2017; weather conditions may have prompted more eating outside of homes or tourism relative to last year’s September.

The entire General and Education Trust Fund revenue surplus for October can be attributed to the Tobacco Tax, which delivered an additional $3.2 million (17.5 percent) above plan while being $0.3 million (1.4 percent) below the prior year. Despite this revenue surplus, the Tobacco Tax is likely to be a declining source of revenue in the long-term barring changes to the tax, and expecting the Tobacco Tax to generate a surplus for other priorities or potential spending needs, such as the full-day kindergarten subsidy should Keno gaming revenue come in below expectations, may not be wise.

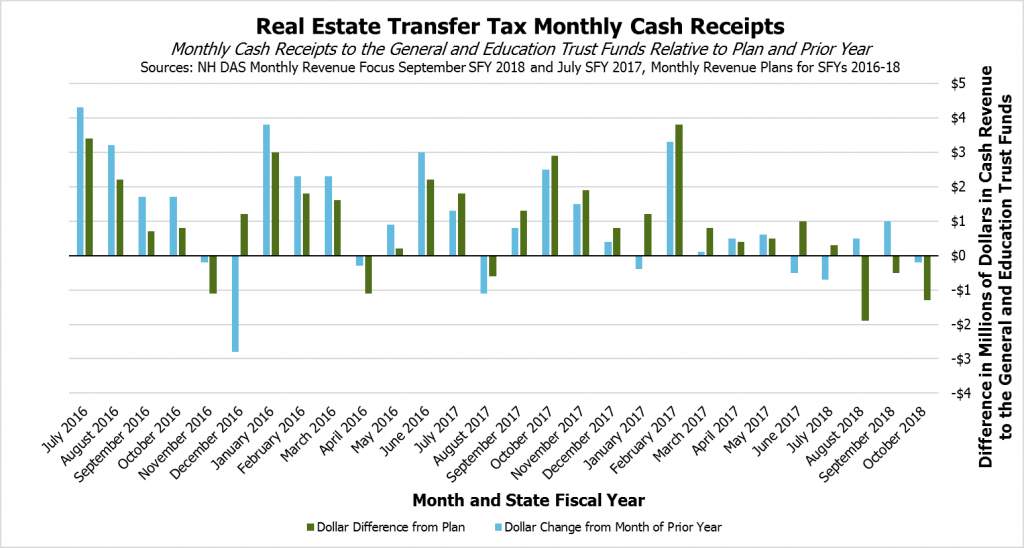

The Real Estate Transfer Tax was the single source that ran the most behind the revenue plan in the month of October; receipts were down $1.3 million (8.7 percent) relative to plan and $0.2 million (1.4 percent) relative to last year. Revenues from this source for the year are up $0.6 million (1.0 percent) over SFY 2017’s first four months, but receipts are $3.4 million (5.5 percent) below plan. For the second month in a row, the Department of Revenue Administration noted a decline in transactions but a rise in prices. The number of transactions from September (October revenue is based on September activity) was down 3.5 percent, but transaction values were up one percent, compared to the same month last year. The tight housing market is likely constraining the number of sales, but apparently continues to be putting upward pressure on prices. However, the low sales numbers may be limiting Real Estate Transfer Tax revenue growth more than higher prices are boosting it. Growth over prior years has slowed significantly in the Real Estate Transfer Tax, and it has brought in less revenue than planned for three months in a row.