With revenues collected for the first two months of State fiscal year (SFY) 2018, certain revenue sources appear to be matching the State’s revenue plan while others, including key revenue generators, appear to be flagging.

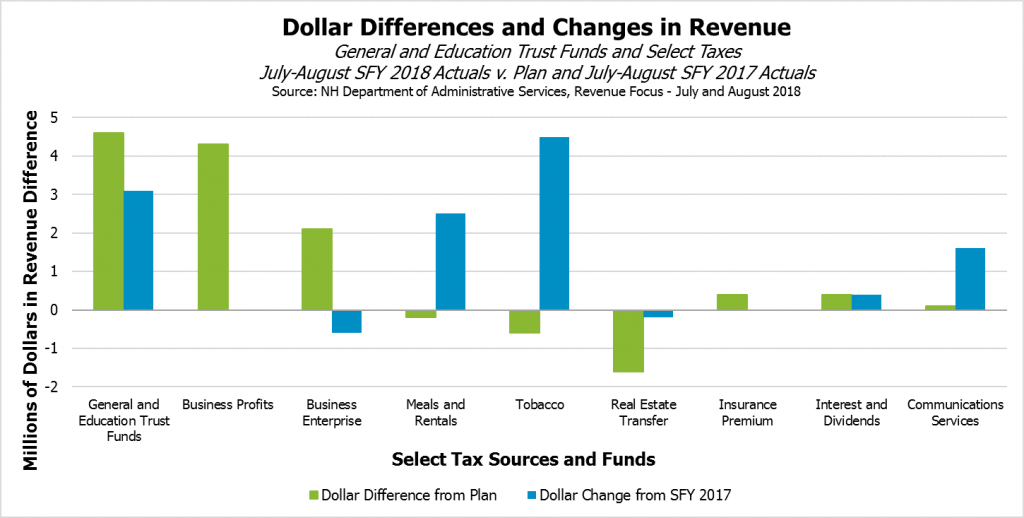

On a cash basis, revenue for the General and Education Trust Funds was $1.4 million below plan during the month of August. The Real Estate Transfer Tax, which has been robust in recent years, fell short of plan by the largest dollar amount of any other source at $1.9 million. Tobacco Tax revenues fell short by $1.4 million, but earlier than anticipated receipts from the Utility Property Tax bolstered revenues by $1.2 million in August. The Meals and Rentals Tax, which has been a reliable source of revenue growth in recent years, matched its planned amount. This follows July revenues in which Meals and Rentals Tax and Real Estate Transfer Tax revenues did not deviate significantly from plan, and Tobacco Tax revenues were $0.8 million higher than planned.

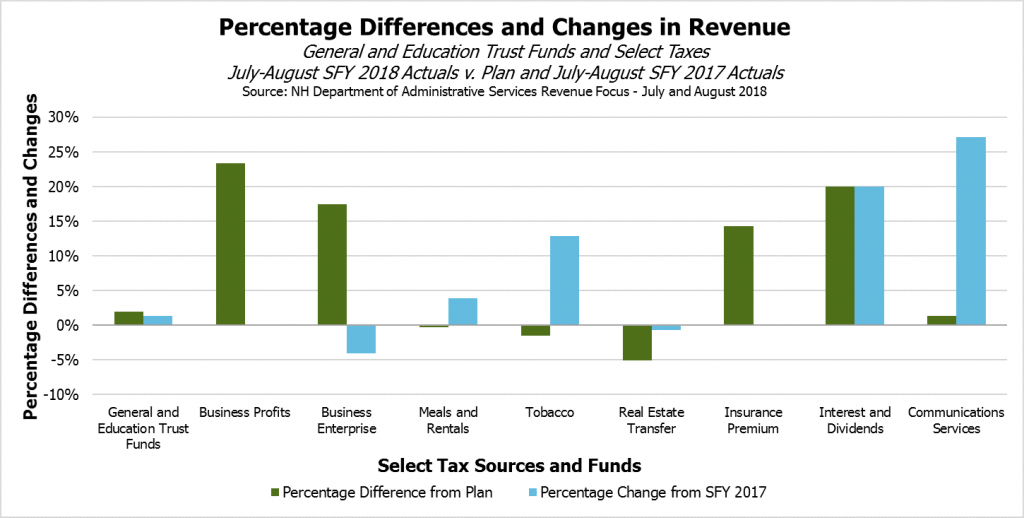

July and August are not major months for New Hampshire’s two primary business taxes, the Business Profits Tax and the Business Enterprise Tax, but the $6.0 million surplus in July revenues over plan was driven in part by anomalies in these two business taxes, which were a combined $6.2 million over plan. August business tax receipts were $0.2 million above plan, and the combined July and August surplus above plan for all General and Education Trust Fund revenue fell to $4.6 million.

Relative to the revenues during July and August of SFY 2017, total growth for the first two months combined of SFY 2018 was 1.3 percent, or $3.1 million higher. The two primary business taxes were $0.6 million (1.6 percent) below the same period in SFY 2017, while Meals and Rental Tax revenue was $2.5 million (3.9 percent) higher. Real Estate Transfer Tax revenue was down $0.2 million (0.7 percent), suggesting weaker home sales during this summer than last.

The SFY 2018 revenues were pushed above SFY 2017 by some surprising sources; the Tobacco Tax, which is likely to be a declining source of revenue in the long term, added $4.5 million (12.9 percent) over last year, while the Communication Services Tax, which has been on a precipitous decline since a SFY 2012 change to its tax base, was $1.6 million (27.1 percent) higher than last year. While the State is fortunate to have collected these additional revenues from these sources, legislators should not rely on these sources for continued overall revenue growth.

These mixed revenue figures match the trend visible in the preliminary accrual for SFY 2017, which showed essentially no growth in General and Education Trust Fund tax and transfer revenues between SFY 2016 and SFY 2017. While revenues were still above plan for SFY 2017, projecting forward with no growth between the two fiscal years does not inspire confidence when the costs of providing key State services are likely to continue to rise.

If revenue holds to the State plan, however, that still may not be enough to cover costs. The Legislature committed the State to paying for $1,100 in additional adequacy grant aid per full-day kindergarten pupil in school districts and chartered public schools starting in SFY 2019, paid for from the Education Trust Fund. The Legislature planned this additional aid to be funded with Keno gaming legalization revenue, but did not leave substantial additional planned revenue in the Education Trust Fund during the State Budget process to provide support if Keno revenues are insufficient. Additionally, any legislation during the 2018 Legislative Session that has a financial impact and does not have a new, amended, or dedicated funding source would need surplus revenues to be financed.

September’s revenue numbers will provide additional insights, particularly regarding the two primary business taxes. July and August revenue collections for the General and Education Trust Funds were projected to bring in $230.3 million according to the State’s plan, while September’s plan alone is $241.7 million. The quarterly payments for the two business taxes are projected to contribute $113.1 million in September, compared to the combined July and August collections of $30.4 million; as such, September’s number will provide the best early indicator of the performance of these two key revenue sources during the SFYs 2018-2019 State Budget.

For more information on the State’s revenue sources, see NHFPI’s Revenue in Review resource.