State revenues slipped further behind expectations in November as key sources the State had been relying on for revenue growth fell behind the prior fiscal year’s receipts. Lower business tax receipts added to the year-to-date revenue deficit, with revenues thus far this fiscal year $76.4 million (20.9 percent) behind last year’s combined business tax collections.

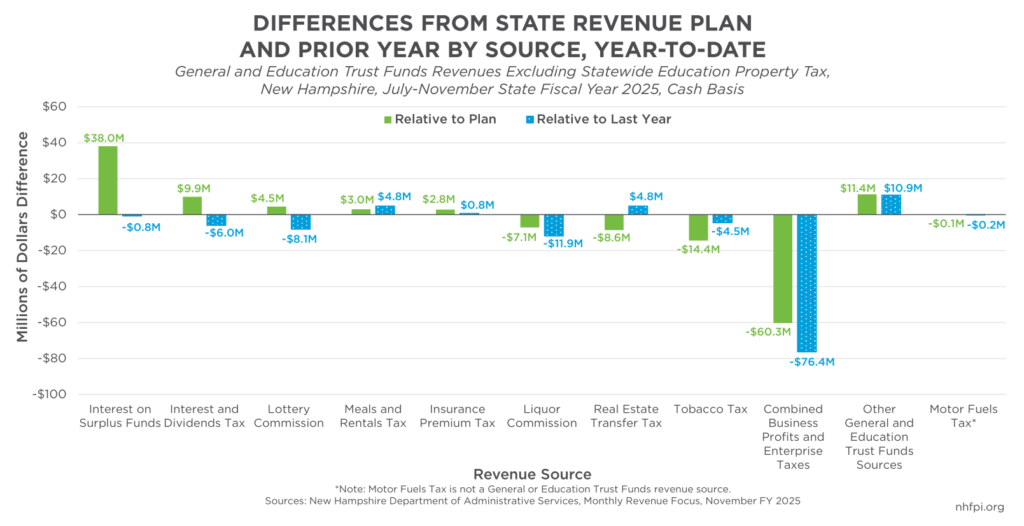

In total, State revenues were $20.8 million (2.3 percent) behind the combined State Revenue Plan for the General Fund and the Education Trust Fund for State Fiscal Year (SFY) 2025, which began in July. Revenue to these two key funds ended November at $86.4 million (8.9 percent) below amounts collected by the end of November SFY 2024.

Two Key Sources of Recent Revenue Growth Stall

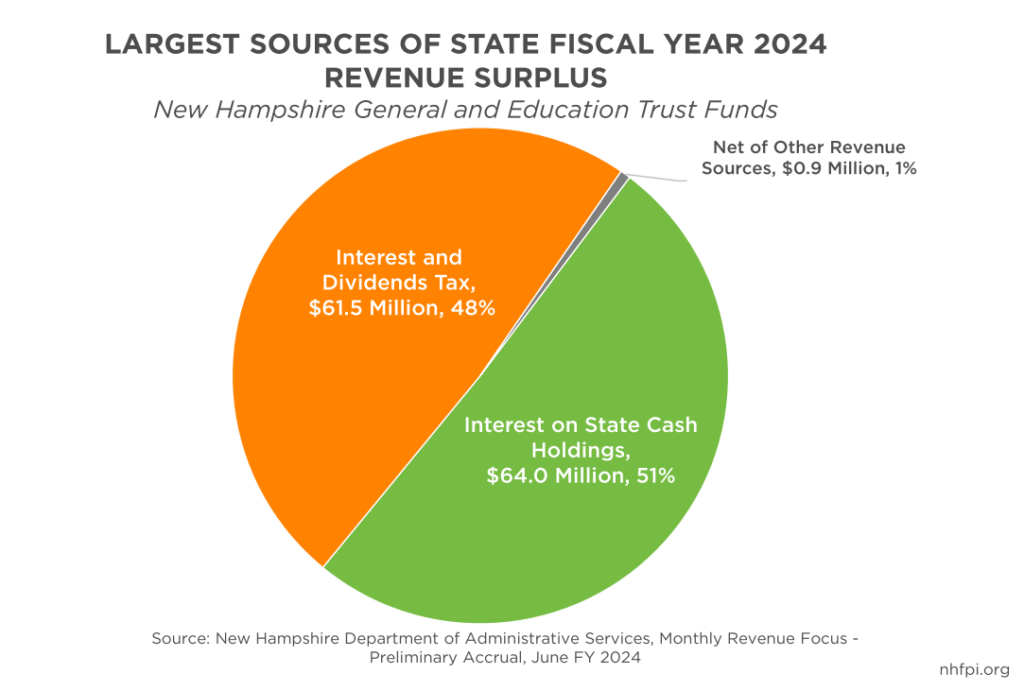

Since partway through last fiscal year, the State has been relying on two temporary sources of revenue for growth: the Interest and Dividends Tax and interest earned on State cash holdings. The Interest and Dividends Tax, which taxes income derived from wealth, will be repealed on January 1, 2025. State cash holdings include temporary, one-time federal funds and totaled about $2.1 billion at the end of November, which was a decline from $2.5 billion in September. Interest rates that have been generally higher since 2022 than in the decade prior, which has temporarily boosted both of these revenue sources; however, the federal funds effective interest rate has been declining since August, pushing interest rates down throughout the economy. Surplus revenue generated by the Interest and Dividends Tax and by interest on the State’s cash holdings accounted for 99 percent of the entire revenue surplus at the end of SFY 2024, based on preliminary accrual revenue estimates from the State.

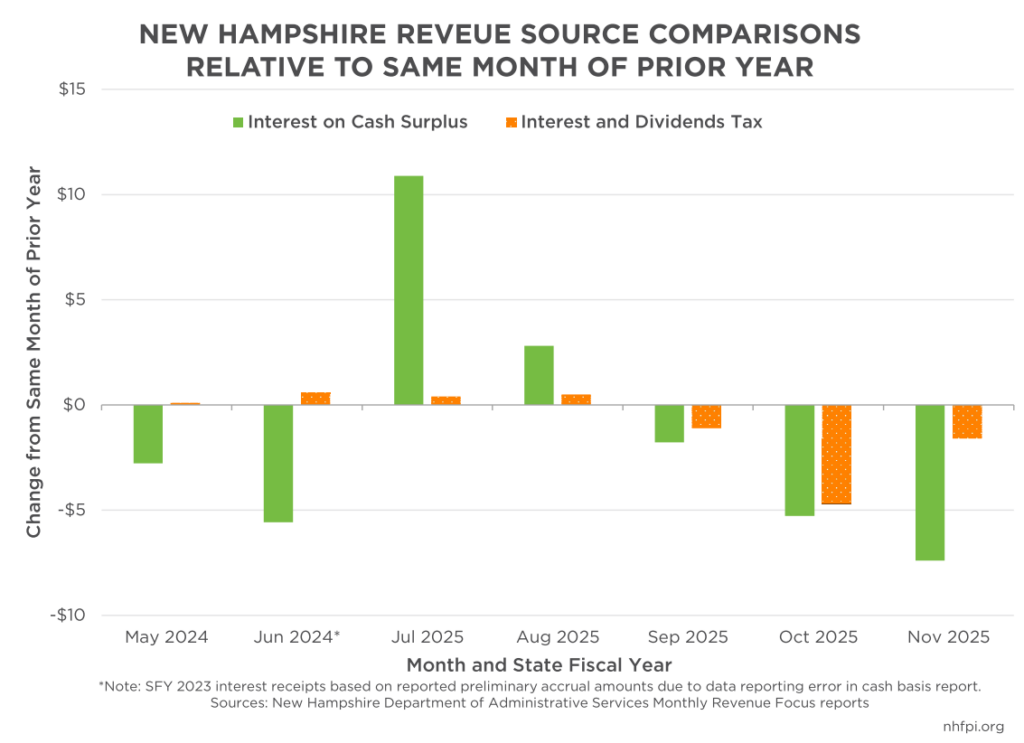

In November, receipts from these two sources both fell behind prior year receipts. The New Hampshire Department of Revenue Administration identified the Interest and Dividend Tax receipts coming in $0.6 million behind the month’s plan, and $1.6 million below last November, was primarily due to the lower tax rate in the phase out of the tax. Lower overall interest rates and smaller cash holdings by the State in November likely contributed to less interest income generated in November. Year-to-date interest income was still $38.0 million above planned amounts, but about $758,000 behind last year’s collections through the end of November. Monthly interest collections reported by the State totaled $12.5 million in November of SFY 2024, while they slowed to $5.1 million in November SFY 2025. While both Interest and Dividends Tax revenues and interest earned can be erratic from month-to-month, the last three months of data suggest these revenue sources may not provide revenue growth through the end of SFY 2025.

Business Tax Revenues Fall from Both Refunds and Lower Payments

The State’s two primary business taxes, the Business Profits Tax and the Business Enterprise Tax, were the largest and fifth-largest tax revenue sources in SFY 2024, respectively, and have driven significant revenue growth in the last four biennial State Budget cycles. November is not a key month for combined business tax revenues, as most taxpaying businesses do not have quarterly estimate payments due. However, businesses that filed for extensions in March or April finished their tax returns in October and November, which increases the chance of higher refunds after calculations and the details of tax returns have been completed. Returns totaled $12.2 million in November SFY 2025, up from $8.2 million last year. Some of these higher refunds may be due to a relatively new State policy that caps the amount businesses can keep with the State in overpaid taxes. In total, business taxes were $23.2 million (58.4 percent) behind the State Revenue Plan for the month, and were $60.3 million (17.2 percent) for the year.

Other revenue sources were unable to fill the revenue shortfall left by the business taxes in the General and Education Trust Funds for November. Tobacco Tax revenues were $4.2 million (23.0 percent) lower than planned for the month, while Liquor Commission revenues were $2.2 million (66.7 percent) behind. Meals and Rentals Tax revenues were $1.5 million (5.2 percent) above the State Revenue Plan, due to a 5.8 percent increase in taxable meals and an 8.5 percent increase in hotel activity in October, the month upon which economic activity for November collections are based. Real Estate Transfer Tax revenues continued to hold steady near expected amounts, halting the slide in revenues associated with the housing shortage during the last two years. Lottery Commission revenues were also nearly on target, generating a $0.1 million (0.1 percent) surplus.

Looking Ahead to December and June

While November offers some insight into revenue trends for the year, December’s receipts will be more significant for understanding the amount of revenue policymakers may have ahead of the next State Budget. December revenues will include quarterly estimate payments for most business tax filers and the last quarterly estimate payments for the Interest and Dividends Tax before it is repealed. All three of these taxes will have final filings or extension payments for this tax year due in March or April, depending on filer type, and the business taxes have two more quarterly estimate payments before the new fiscal year begins on July 1.

Policymakers likely will become increasing reliant on shifts in business tax revenues, which comprised about 39 percent of combined General and Education Trust Funds revenue in SFY 2023, to fund the State Budget. The two primary drivers of recent revenue growth, the Interest and Dividends Tax and interest on State cash holdings, appear to be waning considerably. The repeal of the interest and Dividends Tax, which was about 4.6 percent of combined General and Education Trust Funds revenue in SFY 2023 and rose to an estimated 5.6 percent in preliminary SFY 2024 revenues, or about one in every eighteen dollars collected, shifts reliance for funding services to other revenue sources and reduces available resources. If overall revenues continue to decline, policymakers will find supporting current State Budget expenditures difficult unless revenue forecasts shift to a more positive outlook by final legislative budget negotiations in June.

– Phil Sletten, Research Director