Investments in the operation, maintenance, and construction of transportation infrastructure in New Hampshire often draw from many different sources and funds. Decisions about financing mixes, timelines, projected interest costs, and the effects of deteriorating or enhanced transportation infrastructure at any level of government can all influence projects.

Any decisions made in the near-term will be in an environment where the number of structurally deficient, or “red list,” bridges are projected to increase, and 1,172 miles (28 percent) of New Hampshire’s State road mileage is in poor or very poor condition, according to the New Hampshire Department of Transportation (NHDOT). These indicators suggest investments are needed to adequately maintain the transportation system’s ability to support the state economy and ensure the smooth movement of goods and services throughout New Hampshire.

Funding for transportation infrastructure in New Hampshire at the State level comes from myriad sources and is held in several different funds. The primary source of funding for State road construction and repair activities is the State’s Highway Fund. The largest source of revenue for the Highway Fund is the Motor Fuels Tax, which is protected by the State Constitution to be used only for the construction, reconstruction, and maintenance of public highways, and may be used to pay for policing traffic on those highways. The Highway Fund itself is divided into two main construction accounts for highway construction projects, and an operating account, the repository for unrestricted Highway Fund revenues. The Motor Fuels Tax collected $182.6 million in State fiscal year (SFY) 2016, $123.6 million of which was unrestricted (but still limited in uses by the State Constitution). The total State Motor Fuels Tax is $0.222 per gallon for gasoline and diesel, with an additional $0.01625 per gallon combined for the Oil Pollution Control Fund and the Oil Discharge and Disposal Cleanup Fund. The restricted portion includes $0.0264 per gallon diverted to the Highway and Bridge Betterment Program and $0.042 per gallon, a temporary increase which first took effect in SFY 2015, for bridge rehabilitation work, municipal bridge and grant aid, and debt service for the Interstate 93 expansion project from Manchester to Salem. The Highway Fund is also supported by motor vehicle registration fees, certain fines and penalties, sales of certain goods and services, and grants from federal, private, and local sources.

Approximately 59 percent of the Highway Fund was appropriated to NHDOT in SFY 2016, while 26 percent was appropriated to other agencies, primarily the Department of Safety (DOS), and 15 percent to municipalities.

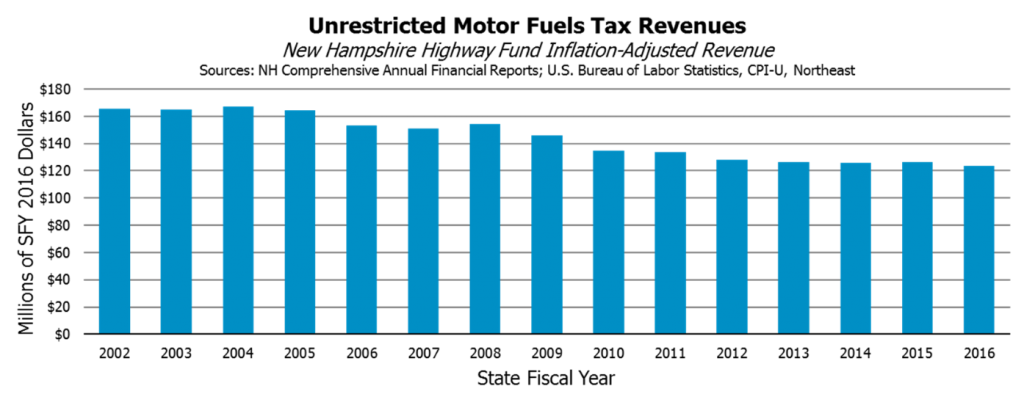

Adjusting for inflation shows the value of the unrestricted portion of the Highway Fund has declined, as the primary revenue source, the Motor Fuels Tax, has seen no change in its rate for the unrestricted portion. As such, inflation has eaten away at the real value of the fixed Motor Fuels Tax; specific construction costs may have also risen faster than inflation. Additionally, more fuel-efficient vehicles and alternative fuel vehicles have important benefits, but those increased efficiencies reduce Motor Fuels Tax revenue when all else is held equal. Although the estimated number of vehicle miles traveled has reached new highs, suggesting that people are driving more again after a lull during the Great Recession and the long recovery, gasoline sales have recovered somewhat more slowly. Despite adding $13.9 million in General Fund revenue surplus to the Highway Fund in SFY 2017 (which was then committed to DOS activities), the Highway Fund’s undesignated budgetary surplus was expected to drop from $60.3 million at the end of SFY 2016 to $54.9 million at the end of SFY 2017, $40.9 million at SFY 2018’s end, and $24.7 million at the end of SFY 2019. If revenues come in as planned, this rate of decline in the Highway Fund’s balance would not sustainably retain a budgetary surplus in future years.

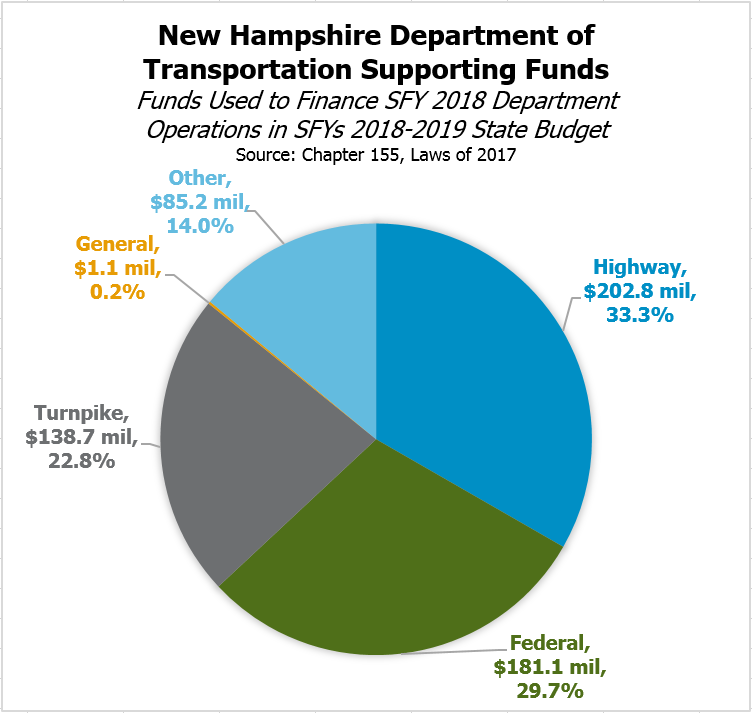

Federal aid is also quite important to the State’s ability to maintain its transportation infrastructure. Federal aid, however, also has funding limitations, as the federal gasoline tax has remained at $0.184 cents per gallon since 1993, and alternative funding has been somewhat inconsistent. There are a plethora of federal aid programs through the Federal Highway Administration, and the NHDOT reported receiving a total of approximately $183 million from the Federal Highway Administration (at $165 million), the Federal Transit Administration, the Federal Aviation Administration, and the Federal Railroad Administration combined in SFY 2016. In the SFYs 2018-2019 State Budget, federal funds account for $181.1 million (29.7 percent) of the total SFY 2018 NHDOT operating budget, while Highway Funds budgeted accounted for $202.8 million (33.3 percent). Notably, not all transportation-related spending plans, particularly bonded expenses, are included in the State Budget, as the State Budget is only an operating budget for two years and does not include borrowing. Transportation spending plans are also included and approved separately in the State’s Ten Year Transportation Improvement Plan, which is revisited every two years and will be again during the 2018 legislative session, and may be included in the Capital Budget, typically called House Bill 25.

Revenue from the State’s Turnpike System Fund accounts for about $138.7 million (22.8 percent) of the NHDOT’s budget, with an additional $8.7 million in funding from the Turnpike System Fund going to the DOS for patrols on the 89-mile Turnpike System. The System’s mileage is not fixed permanently, however; the NHDOT was authorized to sell the Bureau of Turnpikes (the Bureau within the NHDOT that operates the Turnpike System) a 1.6-mile section of Interstate 95 in exchange for $120 million and other terms and conditions following law passed in 2009. Most funding for the Turnpike System Fund comes from tolling, paid by the users of the turnpikes at toll booths and plazas. In SFY 2016, $130.7 million came through tolling operations. Other revenue stems from toll violation fees, transponder sales, interest on investments, and federal transfers. State law requires toll collections be used exclusively for the operation, construction, reconstruction, and maintenance of the Turnpike System, with a provision permitting the State Police to draw from these funds for patrols. This Fund supports both operating and interest and principal on bonds drawn to finance the System.

Policymakers recently invested one-time State revenue surplus funds for repairs. Local governments received $36.8 million during 2017 in State General Fund surplus revenue from SFY 2017 to fund local highway and municipal bridge aid. Municipalities make decisions about funding their transportation infrastructure based in part on State Budget and Ten Year Transportation Improvement Plan decisions as well as the willingness of local property tax payers to make expenditures on local highways. The State’s decisions are, in turn, informed by federal decisions that may potentially affect tens of millions of dollars in funding.

The ongoing benefits of long-term investments should be considered in short-term decisions. The cost-savings associated with routine, preservation-oriented investments in infrastructure, as well as determinations as to which upgrades best serve the state’s population, should drive conversations around which investments should be made in New Hampshire’s roads, bridges, and transit systems.

For more information on State revenue sources, see NHFPI’s Revenue in Review resource.