This first edition of New Hampshire Policy Points provides an overview of the Granite State and the people who call New Hampshire home. It focuses on some of the issues that are most important to supporting thriving lives and livelihoods for New Hampshire’s residents.

New Hampshire Policy Points is intended to provide an informative and accessible resource to policymakers and the general public alike, highlighting areas of key concern. Touching on some important points but by no means comprehensive, each section within New Hampshire Policy Points includes the most up-to-date information available on each topic area as of October 2022.

The following section, Housing, is one of nine sections that frame this resource guide. Other sections cover Population and Demographics, Income and Economic Security, Economy and Jobs, Health, Education, Broadband Internet, Transportation, and How We Fund Public Services. The facts and figures included within this book provide useful information and references for anyone interested in learning about New Hampshire and contributing to making the Granite State a better place for everyone to call home.

To purchase a print copy or download a free digital PDF of New Hampshire Policy Points, visit nhfpi.org/policypoints

The high cost of housing in New Hampshire impacts all Granite Staters and the broader economy. While the lack of housing has been a significant concern in the state for some time, the challenges have become more acute in recent years

The Affordable Housing Shortage

The median sale price of a single-family house in New Hampshire increased 80 percent statewide between March 2017 and March 2022. The increase in median single-family house sale prices has accelerated since the COVID-19 pandemic began. In 2019, the median cost of a home in the state was $300,000, and rose to $395,000 in 2021. While housing constraints vary across regions, finding affordable housing is a struggle for residents statewide.

The lack of housing contributes substantially to the increase in housing costs. In 2022, the New Hampshire Housing Finance Authority indicated the state would need at least 20,000 new housing units to create a more balanced market. Factors such as local zoning or land use laws that restrict the building of more affordable housing units, as well as increased labor and construction costs, all may contribute to the shortage of housing in the state.

Rental Housing

The New Hampshire Housing Finance Authority identifies a vacancy rate for a balanced apartment rental market to be about 5 percent, which allows for a smoother transition of people into, out of, and between rental units. This vacancy rate also helps ensure there is a sufficient supply of rental units available at affordable prices. However, New Hampshire’s vacancy rate has been very low, indicating a severe shortage of rentable dwellings across the state. In 2019, the statewide vacancy rate for two-bedroom apartments was 0.8 percent, and it dropped to 0.3 percent by Spring 2022. By comparison, the overall national vacancy rate was approximately 5.6 percent for the second quarter of 2022, suggesting a more severe rental housing shortage in New Hampshire than on average nationwide.

Rents have been rising in New Hampshire. In 2019, the median rental rate for a two-bedroom apartment in the state was estimated at $1,347 per month, and had risen to an estimated $1,584 per month in Spring 2022. During most of the past decade, rental rates in the state have been rising faster than inflation and average wages.

In 2021, the median household income of renter households in New Hampshire was about $53,100, while the median household income of homeowners was about $103,700.

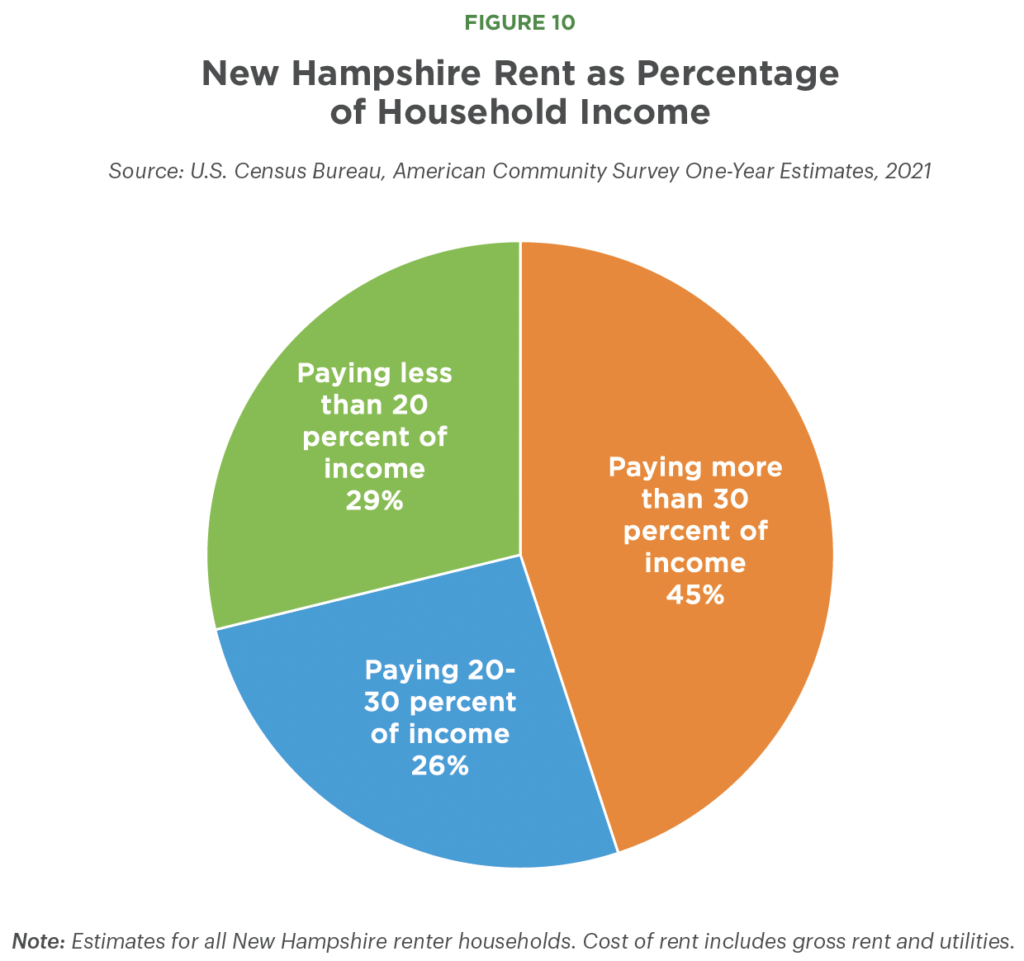

Renters who spend more than 30 percent of their income on total rental costs may be cost-burdened and have trouble affording other expenses. In 2021, an estimated 45 percent of renters in New Hampshire were paying more than 30 percent of their income on rental costs. During 2016 to 2020, about threequarters of renter households with incomes below $35,000 per year paid more than 30 percent of their incomes on rental costs.

Impacts of Lack of Affordable Housing

Granite Staters at all income levels are affected by rising housing costs, but those with lower incomes are disproportionately impacted, as they are more likely to be cost-burdened by housing expenses and rising prices. The disproportionate impacts on people with lower incomes means the lack of affordable housing is more likely to be a severe constraint for young individuals and families, households headed by a single parent, and individuals identifying as a member of certain racial or ethnic minority groups. The high costs of rental units and their associated cost burdens for lower-income households make achieving economic stability more challenging for many of these Granite Staters.

During June and July 2022, one-third of New Hampshire adults reported paying for usual household expenses during the last seven days had been somewhat or very difficult.

The lack of affordable housing has significant demographic and workforce impacts. The housing shortage limits New Hampshire’s ability to attract and retain a young and diverse population, which is essential to ensuring a robust and resilient economy. In 2022, the State of New Hampshire projected adults aged 60 years and older would exceed 30 percent of the state’s population by 2030. As older Granite Staters leave the workforce, the housing shortage will leave businesses struggling to hire a skilled, talented, and diverse workforce, as new potential workers may not be able to find affordable housing in New Hampshire. Older adults looking to downsize to smaller homes may also put more pressure on the housing market as they limit the number of more affordable homes available for younger residents.

Granite Staters facing increased housing costs, accelerated by the pandemic, are also at greater risk of homelessness. The U.S. Government Accountability Office estimated that a $100 increase in median rent was associated with a 9 percent increase in the homelessness rate. Children experiencing multiple moves are more likely to have adverse mental health, educational, and behavioral outcomes, and may experience long-term impacts on both their health and economic well-being.

A lack of stable, affordable housing puts families at risk for both temporary and chronic homelessness and this risk is especially pronounced among certain populations in New Hampshire. The New Hampshire Coalition to End Homelessness reported in 2021 that those identifying as Hispanic were more than twice as likely to experience homelessness, and Black or African American Granite Staters were four times as likely to experience homelessness than their white peers. Additionally, a survey conducted by ABLE NH suggested an elevated risk of housing insecurity for people with developmental or intellectual disabilities in New Hampshire. The New Hampshire Coalition to End Homelessness estimated 4,682 people experienced homelessness in New Hampshire during 2021.

Finding solutions to ensure a sufficient supply of available, affordable housing is essential for a vibrant and prosperous economy that lifts all Granite Staters.

• • •

This publication and its conclusions are based on independent research and analysis conducted by NHFPI. Please email us at info@nhfpi.org with any inquiries or when using or citing New Hampshire Policy Points in any forthcoming publications.

© New Hampshire Fiscal Policy Institute, 2022.