This second edition of New Hampshire Policy Points provides an overview of the Granite State and the people who call New Hampshire home. It focuses in on some of the issues that are most important to supporting thriving lives and livelihoods for New Hampshire’s residents. Moreover, the book addresses areas of key policy investments that will help ensure greater well-being for all Granite Staters and a more equitable, inclusive, and prosperous New Hampshire.

New Hampshire Policy Points is intended to provide an informative and accessible resource to policymakers and the general public alike, highlighting areas of key concerns. Touching on some important points but by no means comprehensive, each section within New Hampshire Policy Points includes the most up-to-date information available on each topic area. The facts and figures included within this book provide useful information and references for anyone interested in learning about New Hampshire and contributing to making the Granite State a better place for everyone to call home.

To purchase a print copy or download a free digital PDF of New Hampshire Policy Points, visit nhfpi.org/nhpp

The high cost of housing in New Hampshire impacts all residents and is a key cause of the workforce constraint affecting the state economy. While the lack of housing has been a significant concern in the state for some time, the challenges have become more acute in recent years, particularly since the start of the COVID-19 pandemic.

Market for Purchasing Homes

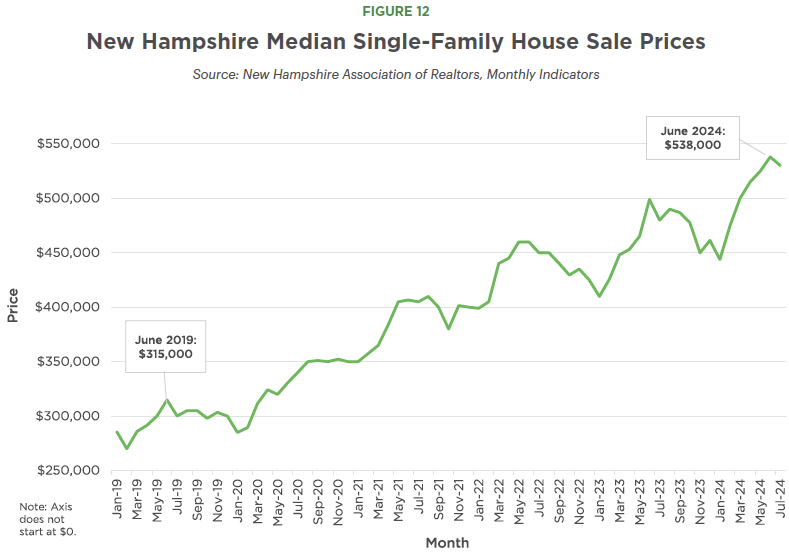

The median sale prices of a single-family house increased about 76 percent statewide between the first halves of 2019 and 2024, with a considerable acceleration following the start of the COVID-19 pandemic. The median single-family house sale price in 2014 was $227,500. By 2019, the median cost of a house in the state had risen to $300,000. In 2021, the median price increased to $395,000. As of the first nine months of 2024, the median single-family house price was $515,900.[1] While housing constraints vary across different regions of the state, finding affordable housing is a struggle for residents statewide.

The lack of housing contributes substantially to the increase in housing costs. In 2023, the New Hampshire Housing Finance Authority estimated the state had a shortage of 23,500 housing units relative to the number needed to stabilize the housing supply.[2] Factors such as zoning or land use laws that restrict the building of housing units, as well as increased labor and construction costs, may all contribute to the shortage of housing in the state.

Rental Housing

New Hampshire’s rental vacancy rate is substantially below comparable national figures. The New Hampshire Housing Finance Authority identifies that a vacancy rate of about 5 percent reflects a balanced apartment rental market, which allows for a smoother transition of people into, out of, and between rental units. This vacancy rate also helps ensure there is a sufficient supply of affordable rental units. However, New Hampshire’s vacancy rate has been very low, indicating a severe shortage of rentable dwellings across the state. In 2019, the statewide vacancy rate for two-bedroom apartments was 0.8 percent, and it dropped to 0.6 percent by mid-2023.[3] By comparison, the overall national vacancy rate was approximately 6.6 percent for the second quarter of 2024, suggesting New Hampshire’s rental housing market was experiencing a more severe shortage than the shortage being experienced nationwide.[4]

Due to limited available rental units, the cost of rent has been rising. In 2019, the median rental rate for a two-bedroom apartment in the state, including utilities, was estimated at $1,347 per month. Data collected during 2024 showed the median rental price for two-bedroom apartments statewide had risen to an estimated $1,833 per month.[5] During most of the past decade, rental rates in the state have been rising faster than inflation and average wages.

In 2023, the median household income of renter households in New Hampshire was about $53,816, while the median household income of homeowners was about $114,853.[6]

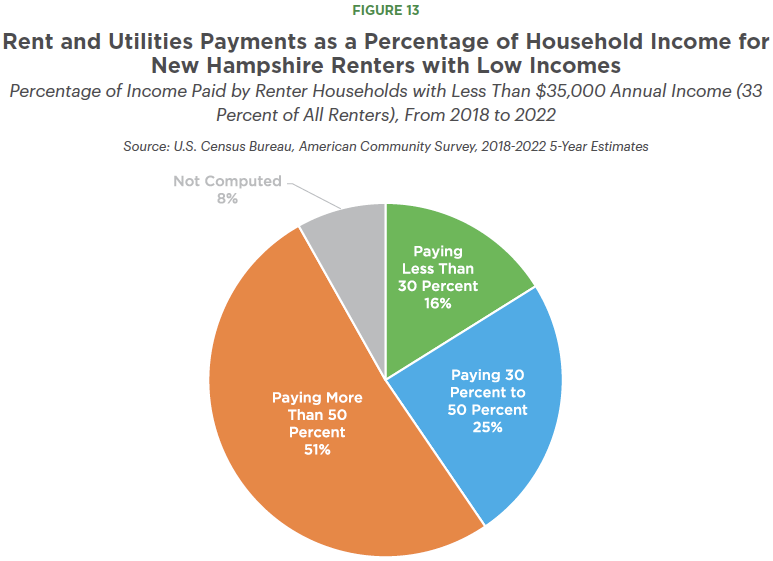

Renters who spend more than 30 percent of their income on total rental costs may be cost-burdened and have trouble affording other expenses. In 2023, an estimated 51 percent of renters in New Hampshire were paying more than 30 percent of their income on rental costs.[7] During the 2018 to 2022 period, about three-quarters of renter households with incomes below $35,000 per year paid more than 30 percent of their incomes on rental costs.[8]

Unhoused Granite Staters

Granite Staters facing increased housing costs, accelerated by the pandemic, are also at greater risk of becoming unhoused. The U.S. Government Accountability Office estimated that a $100 increase in median rent was associated with a 9 percent increase in the unhoused rate.[9] Point in time estimates of the unhoused population are taken once per year nationwide, typically in January, through the Continuum of Care Program.[10] These estimates are an official count of the number of people experiencing homelessness, and include those who are both sheltered and unsheltered. According to the most recent point-in-time count, the number of people experiencing homelessness in New Hampshire increased by about 52 percent between 2022 and 2023, a much faster rise than the about 8 percent increase from 2021 to 2022.[11]

Due to increased rental costs, families may have to relocate to afford their homes. Frequent moving may have long-term effects for children including increased likelihood of poor mental health, educational, and behavioral outcomes, which may have adverse, life-long impacts on both the health and financial well-being of families as well as the state economy.[12] Higher rental costs may have also contributed to the increase in the number of evictions since the COVID-19 pandemic. The total number of landlord-tenant eviction writ filings in New Hampshire increased by about 66 percent from 2020 to 2023, encompassing a temporary eviction moratorium in New Hampshire followed by federally-funded rental assistance. The number of eviction writ filings in 2023 was similar to 2019 pre-pandemic numbers.[13] According to Princeton University’s Eviction Lab, the number of evictions in New Hampshire per 100 renters was double that of neighboring Vermont in 2018, and a higher rate than any New England state except for Rhode Island.[14]

A lack of stable, affordable housing puts families at risk for both temporary and chronic homelessness. This risk is especially pronounced among certain populations in New Hampshire. The New Hampshire Coalition to End Homelessness reported in 2023 that people identifying as Hispanic were more than twice as likely to experience homelessness, and Black or African American Granite Staters were four times as likely to experience homelessness, as white residents.[15] Additionally, a survey conducted by ABLE NH suggested an elevated risk of housing insecurity for people with developmental or intellectual disabilities.[16]

Housing and the Economy

Granite Staters at all income levels are affected by rising housing costs, but those with lower incomes are disproportionately impacted, as they are more likely to be cost-burdened by housing expenses and rising prices. The disproportionate impacts on people with lower incomes means the lack of affordable housing is more likely to be a severe constraint for young individuals and families, households headed by a single parent, and those identifying as a member of certain racial or ethnic minority groups. The high costs of rental units and their associated cost burdens for lower-income households make achieving economic stability more challenging for many of these Granite Staters.

The lack of affordable housing has significant demographic and workforce impacts. The housing shortage limits New Hampshire’s ability to attract and retain a younger and more diverse population. As older Granite Staters leave the workforce, the housing shortage will leave businesses struggling to hire a skilled, talented, and diverse workforce, if new potential workers cannot find affordable housing.

Finding solutions to help ensure a sufficient supply of available, affordable housing is key to supporting a vibrant and prosperous economy that serves all Granite Staters.

• • •

This publication and its conclusions are based on independent research and analysis conducted by NHFPI. Please email us at info@nhfpi.org with any inquiries or when using or citing New Hampshire Policy Points in any forthcoming publications.

© New Hampshire Fiscal Policy Institute, 2024.

Endnotes

[1] Price data collected and published by the New Hampshire Association of Realtors.

[2] See the New Hampshire Housing’s March 2023 report, New Hampshire Statewide Housing Needs Assessment.

[3] See the New Hampshire Housing’s August 2023 report, New Hampshire 2023 Residential Rental Cost Survey Report.

[4] See the U.S. Census Bureau’s July 30, 2024 press release, Quarterly Residential Vacancies and Homeownership, Second Quarter 2024.

[5] See the New Hampshire Housing’s August 2024 report, New Hampshire 2024 Residential Rental Cost Survey Report.

[6] See the U.S. Census Bureau, American Community Survey, 1-Year Estimates for 2023, B25119.

[7] See the U.S. Census Bureau, American Community Survey, 1-Year Estimates for 2023, B25074.

[8] See the U.S. Census Bureau, American Community Survey, 5-Year Estimates for 2018-2022, B25074.

[9] See the U.S. Government Accountability Office’s July 2020 report, Better HUD Oversight of Data Collection Could Improve Estimates of Homeless Population.

[10] For more information on the point-in-time counts, see the United States Interagency Council on Homelessness January 2024 publication USICH Leaders and Staff Participate in 2024 Homelessness Count, the U.S. Department of Housing and Urban Development’s December 2023 HUD No. 23-278 information release HUD Releases January 2023 Point-in-Time Count Report, and the New Hampshire Department of Health and Human Services webpage Balance of State Continuum of Care, accessed August 2024.

[11] See the U.S. Department of Housing and Urban Development, Point in Time Counts.

[12] For more information on the health impacts of varying housing quality and multiple or frequent moves, see the Urban Institute, How Housing Affects Children’s Outcomes, January 2, 2019; the Urban Institute, The Negative Effects of Instability on Child Development: A Research Synthesis, September 2013; the American Journal of Pediatrics, Unstable Housing and Caregiver and Child Health in Renter Families, February 2018; the American Journal of Pediatrics, Eviction and Household Health and Hardships in Families With Very Young Children, October 2022; and the American Journal of Public Health, U.S. Housing Insecurity and the Health of Very Young Children, August 2011.

[13] See the NH Judicial Branch, Data and Reports, Landlord Tenant Writ Filings by month and court, 2019-2023. See NHFPI’s June 18, 2020 blog, Eviction Moratorium to End July 1 as the State Establishes New Housing Assistance Program.

[14] See Princeton University, Eviction Lab, accessed August 2024.

[15] See the NH Coalition to End Homelessness’s 2023 report, The State of Homelessness in New Hampshire.

[16] See the Advocates Building Lasting Equality in New Hampshire’s survey of caregivers, 2021 Disability Housing Survey Report: A Severe Crisis is Upon Us.