This second edition of New Hampshire Policy Points provides an overview of the Granite State and the people who call New Hampshire home. It focuses in on some of the issues that are most important to supporting thriving lives and livelihoods for New Hampshire’s residents. Moreover, the book addresses areas of key policy investments that will help ensure greater well-being for all Granite Staters and a more equitable, inclusive, and prosperous New Hampshire.

New Hampshire Policy Points is intended to provide an informative and accessible resource to policymakers and the general public alike, highlighting areas of key concerns. Touching on some important points but by no means comprehensive, each section within New Hampshire Policy Points includes the most up-to-date information available on each topic area. The facts and figures included within this book provide useful information and references for anyone interested in learning about New Hampshire and contributing to making the Granite State a better place for everyone to call home.

To purchase a print copy or download a free digital PDF of New Hampshire Policy Points, visit nhfpi.org/nhpp

Building a Thriving New Hampshire Economy

Building a New Hampshire economy where everyone has the opportunity to thrive can improve the lives of New Hampshire residents across the state. As was the case before and after the COVID-19 pandemic, economic well-being and opportunity are not evenly distributed among Granite Staters. These barriers to economic success and financial stability hinder not only the people affected but also limit the growth of the state’s economy.

While expanded investments in public assistance programs and economic impact payments helped reduce the negative financial impacts of the pandemic for many families, the end of these programs has resulted in the return to financial instability for some Granite Staters. Data released by the U.S. Census Bureau indicated that targeted relief directed toward lower-income households in response to the COVID-19 pandemic cut New Hampshire’s child poverty rate, as measured after taxes and adjusting for certain costs, from 8.2 percent in 2019 to 4.0 percent in 2021. By 2022, however, the child poverty rate rebounded to 7.3 percent. Additionally, the rate among adults aged 65 and older increased by more than five percentage points from the previous year to over 14 percent in 2022.[1]

Median household income growth did not exceed inflation faced by Granite Staters in between 2021 and 2022. This drop in real purchasing power for the median household contrasts considerably with growth figures from 2021, in which the median household income was significantly higher than pre-pandemic 2019 incomes, even after adjusting for inflation.[2] This boost in household incomes seen in 2021, at a time when consumer spending was fueling economic growth, suggests that the families receiving assistance spent money in the local economy that they would not have been able to without the pandemic-related aid. As of 2023, New Hampshire’s median household income recovered to 2021 levels after adjusting for inflation, but did not exceed 2021’s purchasing power.[3]

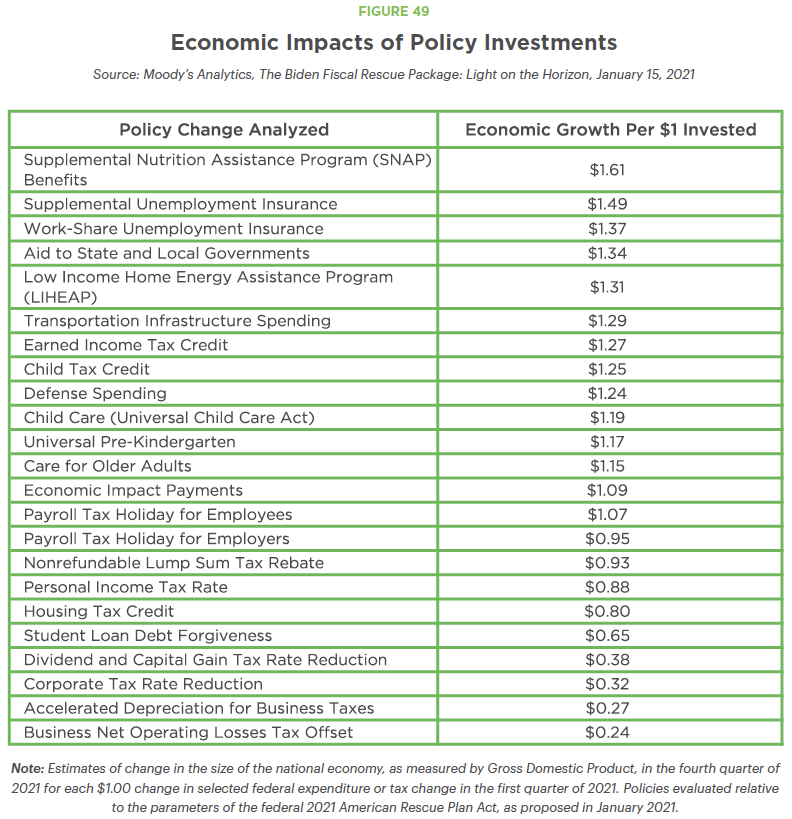

Research released by the Tax Policy Center in 2023 suggests that some policy investments directed toward children can have long-term returns on investment of up to $10 for every one dollar invested.[4] Additionally, Moody’s Analytics most recent findings underscored the importance of investments aimed at providing support to families and individuals with lower incomes. For every federal dollar invested in food assistance benefits, the economy was estimated to experience an estimated return of $1.61 by the end of the year, as well as $1.49 for supplemental unemployment insurance payments, $1.27 for each Earned Income Tax Credit dollar, and $1.25 per dollar invested in the Child Tax Credit. Meanwhile, tax reductions for corporations and their operating losses, as well as tax reductions for income from capital gains, showed little impact on economic growth.[5]

New Hampshire still faces many challenges to building an equitable economy, foremost among them the high cost of housing, limited access to affordable child care, and increased costs for everyday living expenses. Directing available resources to provide long-term support for struggling residents will be key to not only New Hampshire’s recovery, but its ongoing prosperity and success. Public policy can play an essential role in providing solutions to the challenges faced by Granite Staters, improving the well-being of all residents, and helping to ensure a thriving and prosperous state for all who call New Hampshire home today and the future generations to come.

• • •

This publication and its conclusions are based on independent research and analysis conducted by NHFPI. Please email us at info@nhfpi.org with any inquiries or when using or citing New Hampshire Policy Points in any forthcoming publications.

© New Hampshire Fiscal Policy Institute, 2024.

Endnotes

[1] Learn more in NHFPI’s June 2024 blog Poverty Among Older Adults Rose Significantly, and Rebounded for Children, in 2022.

[2] For more details, see NHFPI’s September 2023 blog Latest Census Bureau Data Show Median Household Income Fell Behind Inflation, Tax Credit Expirations Increased Poverty.

[3] See NHFPI’s September 2024 blog New Hampshire’s Median Household Income Increased in 2023, Poverty Remained Steady.

[4] See the Tax Policy Center’s September 2023 report The Return on Investing in Children: Helping Children Thrive.

[5] See Moody’s Analytics January 2021 analysis The Biden Fiscal Rescue Package: Light on the Horizon. See also NHFPI’s February 2021 issue brief Designing a State Budget to Meet New Hampshire’s Needs During and After the COVID-19 Crisis, NHFPI’s March 2023 blog Households with High Incomes Disproportionately Benefit from Interest and Dividends Tax Repeal, and the Center on Budget and Policy Priorities 2015 research report The Financial Crisis: Lessons for the Next One.