The average price of child care in the Granite State for an infant in center-based care was over $15,000 in 2022. To help make child care more affordable, the State Fiscal Years (SFYs) 2024-2025 biennium budget, enacted July 1, 2023, expanded family income eligibility for New Hampshire Child Care Scholarship recipients, reduced family cost share contributions toward child care tuition to no more than seven percent of household income for eligible families, and increased reimbursement rates for providers accepting scholarships. The program is anticipated to be ready for implementation in 2024.

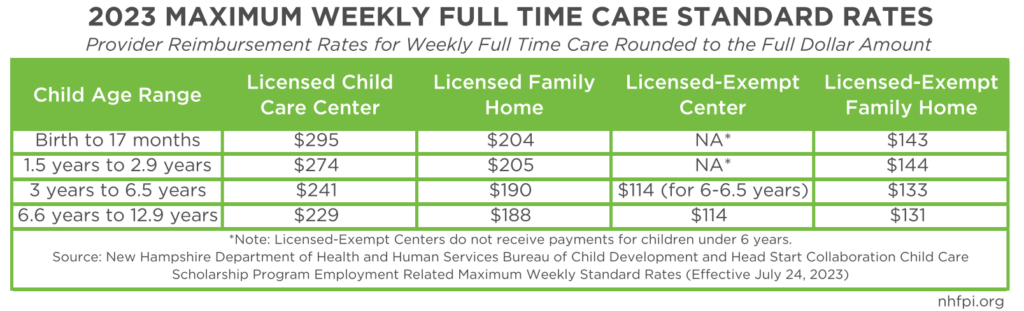

This expansion means, for example, that a family of three making less than about $89,200 yearly may be eligible for the NH Child Care Scholarship program, and only need to spend approximately $6,200 (7 percent) of their annual income on child care tuition. Depending on the age and enrollment of a child, providers that accept scholarships can currently receive a maximum reimbursement of between $228 and $295 per week for children enrolled full-time if they are a licensed child care center, or $188 and $204 if they are a licensed family home provider.

Once the expanded eligibility provisions are finalized, families will be able to apply to determine eligibility in the Child Care Scholarship program through the NHEasy website. Providers can enroll to accept Child Care Scholarships on the NH Connections website.

Scholarship Eligibility Expansions for Families

New Hampshire’s Child Care Scholarship is a state and federal partnership subsidy program that makes child care more accessible to families with low and moderate incomes so parents or caregivers can look for employment, attend school, participate in a mental health or substance misuse treatment program, or engage in the workforce. Children are eligible to receive child care scholarships if they are, 1) residents of New Hampshire, 2) residing with a parent, caretaker relative, or legal guardian, 3) under thirteen years of age, or seventeen years of age if the child experiences a disability or special need, 4) a U.S. citizen and certain eligible non-citizens and, 5) part of a household that meets income eligibility requirements.

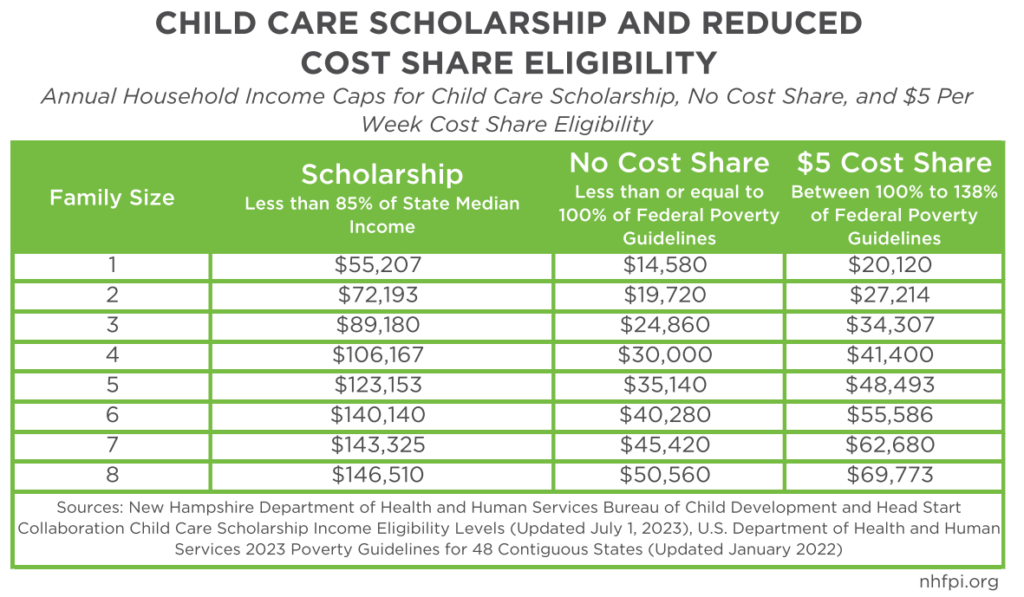

The SFYs 2024-2025 State Budget raised the family income eligibility cap to 85 percent of the State Median Income. This means, for example, a family of two is eligible for a child care scholarship if it makes less than $72,193, or $89,180 for a family of three, based on income thresholds published by the State in July 2023. Family cost share rates have also been lowered for scholarship recipients. The family cost share is the household’s financial contribution toward care set by New Hampshire’s Department of Health and Human Services based on household income.

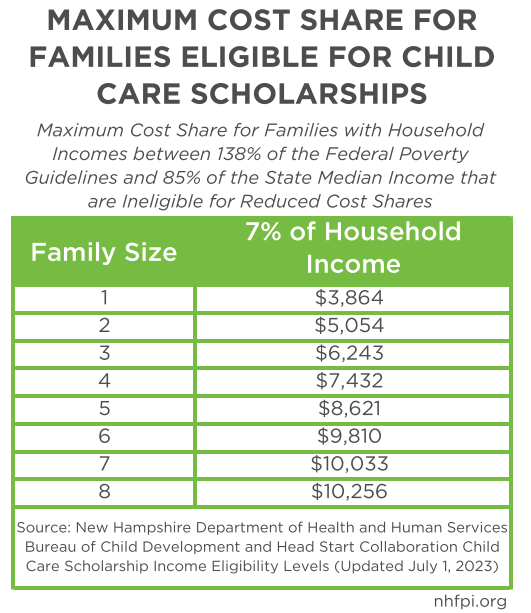

Under the new State Budget, families making 100 percent of the Federal Poverty Guidelines income levels or less (based on State figures from July 2023, $19,720 for a family of two, $24,860 for a family of three) will not have a cost share. Families earning between 100 percent and 138 percent of the Federal Poverty Guideline (for example, $27,214 for a family of two, or $34,307 for a family of three, in July 2023) will have a weekly cost share of $5. Families with incomes between 138 percent of the Federal Poverty Guidelines and 85 percent of the State Median Income will pay seven percent of their family income toward child care, the percentage of household income defined as affordable by the U.S. Department of Health and Human Services. If a household has multiple children in care, the cost share is divided among all children receiving care.

Families must pay their cost share contribution before the scholarship subsidy is applied. Additionally, copayments, or the difference between a provider’s tuition rate and the Weekly Standard Rate set by the State, may be collected from families by providers if tuition exceeds the Weekly Standard Rate. For example, if a family of three with an infant who attends a licensed center-based provider that charges $420 per week for full time care, and the family’s household income is $80,000, the family’s cost share of $108 per week (7 percent of the household income, $5,600, divided by 52 weeks in a year) would be applied to the tuition price first and paid directly to the provider. Next, the Weekly Standard Rate for an infant in licensed center-based care ($295) would be compared to the provider’s weekly rate for full-time infant care ($420). The amount paid by DHHS would be calculated using the lesser amount ($295) and subtracting from it the family cost share ($108). In this example, DHHS would pay $187 per week. This would leave an outstanding $125 per week that a provider could choose to charge to the family as a copayment. If the family is responsible for the copayment, they would pay $233 per week instead of the full cost of $420 per week. However, if the same family attends a similar provider that only charged $275 a week, the family would pay their $108 cost share, the scholarship program would pay $167, and the family would not have a co-pay.

Families can work with a provider to determine eligibility, cost share, and copayment (if applicable) prior to enrollment if the family has an anticipated enrollment date with the provider. This early discussion can help families plan for budgeting purposes and to determine if there may be potential barriers that need to be addressed prior to the child’s start date.

Increased Reimbursement Rates and Enrollment-Based Payments for Providers

Providers enrolled to accept scholarships receive funding for each scholarship child in their care. Payment rates depend on the current child care market rate survey, type of child care provider, child age, and hours the child spends in care each week. Providers also receive additional reimbursements per week ($100 for full-time care) for any children receiving a child care scholarship with documented “significant special needs.”

Previously, child care providers received reimbursement payments for children receiving scholarships at the 60th percentile for infants and 55th percentile for all other children, with reimbursement levels based on the most recent 2021 Market Rate Survey (MRS). The SFYs 2024-2025 State Budget changed the maximum provider reimbursement rates for scholarship students to the 75th percentile of 2021 MRS rates for all age groups.

The SFYs 2024-2025 budget also changed provider reimbursements to encompass a child’s enrollment in their care as opposed to attendance-based reimbursements which only provided payments to providers for days a child attended care. This created budgeting challenges for providers when a child was sick. Providers would have reduced income for the days that a scholarship child was absent due to illness, or they could charge a family tuition even though the child was absent and could not be at day care due to health and safety policies.

Eligible Families are Unaware of the Child Care Scholarship Program

The New Hampshire Child Care Scholarship program has been historically underutilized, with nearly half of families surveyed reporting they never heard of the program. In SFY 2022, an average of 3,179 children participated in the scholarship program each month. The U.S. Census’ American Community Survey 2022 five-year estimates reveal that approximately 4,382 Granite State families with one or more children under the age of 5 had household incomes under 185 percent of the 2022 Federal Poverty Level (FPL; $33,874 for a family of two, $42,606 for a family of three). If all these families met the caregiver requirements for the program, there would be at least 4,382 children utilizing scholarships, 1,203 more children than were enrolled on average during 2023; while not all families are likely to meet the caregiver requirements, this estimate undercounts the number of children served who live in families in this income group that had more than one child under five, and does not include all family incomes triggering eligibility for the program in 2022.

The above figures assume all families who are eligible for the scholarship program have parents or caregivers in the labor force. In 2021, labor force participation in New Hampshire for men and women with children birth to five years old was approximately 95 percent and 74 percent, respectively. The labor force participation rates, however, may not capture families whose children are eligible to participate in the scholarship program because parents or caregivers are not in the labor force but are engaging in education or career training, or receiving mental health and substance misuse treatment. The estimate also does not include family households with multiple children between the ages of birth and 13 years old, or families between 185 percent and 220 percent of FPL, which is the income eligibility range used for the scholarship program prior to the implementation of the income eligibility expansion. Under that expanded eligibility, all these families would be eligible to participate in the program, as will any families making below 85 percent of the State Median Income, which the State identified as $72,193 for a family of two and $89,180 for a family of three in July 2023.

Expanded Access Helps Traditionally Underserved Families

In 2022, the price of child care for a New Hampshire family with an infant and a four year old in center-based care was $28,340. Without a child care subsidy, families with lower incomes pay larger percentages of their household incomes toward child care. The Child Care Scholarship program helps families with low incomes and underserved groups who are disproportionately more likely to experience poverty in the Granite State including Black, Hispanic, and Native American individuals as well as individuals who identify as two or more races.

The price of child care may be forcing some parents to leave the workforce to care for children. During 2023, an average of 16,000 Granite Staters per month were not working because they were caring for children who were not in school or daycare. For New England families, particularly those with low incomes, caring for children at home or relying on a mix of child care arrangements are often the best options financially. As a result, household incomes for Granite Staters with children may be lower, and the number of available workers for the New Hampshire labor force is reduced, potentially hurting the overall state economy.

Accessing Child Care Scholarship Information

Policies that provide assistance to families and individuals with low and moderate incomes, like the Child Care Scholarship program, have been found to be some of the most effective forms of economic stimuli. Connecting eligible households with assistance programs can help stimulate the New Hampshire economy and support the abilities of individuals of all backgrounds to thrive in the Granite State.

To learn more about the NH Child Care Scholarship program, families can visit the NH Connections Child Care Scholarship webpage. Providers can access more information to enroll in the Child Care Scholarship program on the NH Connections website.

– Nicole Heller, Senior Policy Analyst

Note: This blog was corrected on September 26, 2024 to adjust the calculation of the Child Care Scholarship’s subsidy for the family in the example. The Weekly Standard Rate was characterized as a payment to a provider, when it is the basis for calculating the payment to the provider.