The challenges facing Granite Staters due to the COVID-19 crisis are unprecedented, and data continue to suggest the negative effects of this crisis are concentrated on those who are most vulnerable. New survey data indicate nearly half of New Hampshire households have lost employment income since March 13, and one in six have either missed or are likely to miss a monthly housing payment. Caseload data show that 198,905 new initial unemployment claims were generated in New Hampshire during the week ending March 15 through May 23. The preliminary seasonally-adjusted unemployment rate reached 16.3 percent in New Hampshire during April 2020, which is the second-highest among the New England states. Many Granite Staters appear to have lost employer-sponsored health insurance as well. These economic effects have led to increased needs for nutrition assistance and support from other aid programs. While the full effects of the crisis remain uncertain, key indicators provide valuable insights and comparisons between the current COVID-19 crisis, the period immediately before this crisis, and the Great Recession of 2007 to 2009.

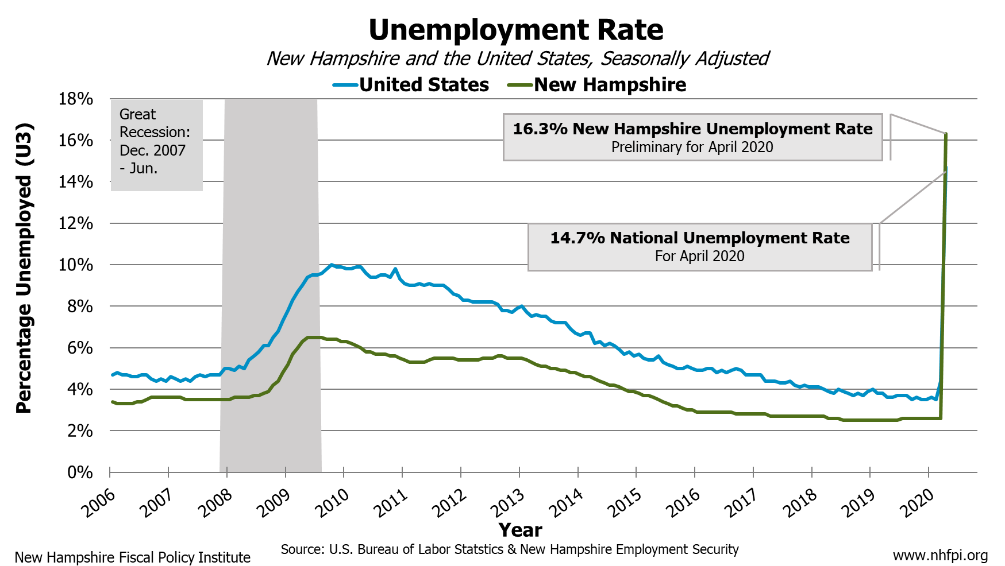

Prior to the beginning of the 2019 novel coronavirus pandemic, the national economy was experiencing the longest economic expansion on record after the end of the Great Recession. The peak level of unemployment in New Hampshire during the Great Recession was 6.5 percent. In New Hampshire, this economic expansion was slow to return the wages of Granite Staters consistently earning low and middle wages back to the inflation-adjusted levels from before the Great Recession. Only in recent years have inflation-adjusted wages for those earning up to the median income returned to pre-Recession levels. This wage growth followed an extended period of historically low levels of unemployment in New Hampshire, which had been below a seasonally-adjusted three percent rate since December 2015.

Widespread Income Reductions and Impacts

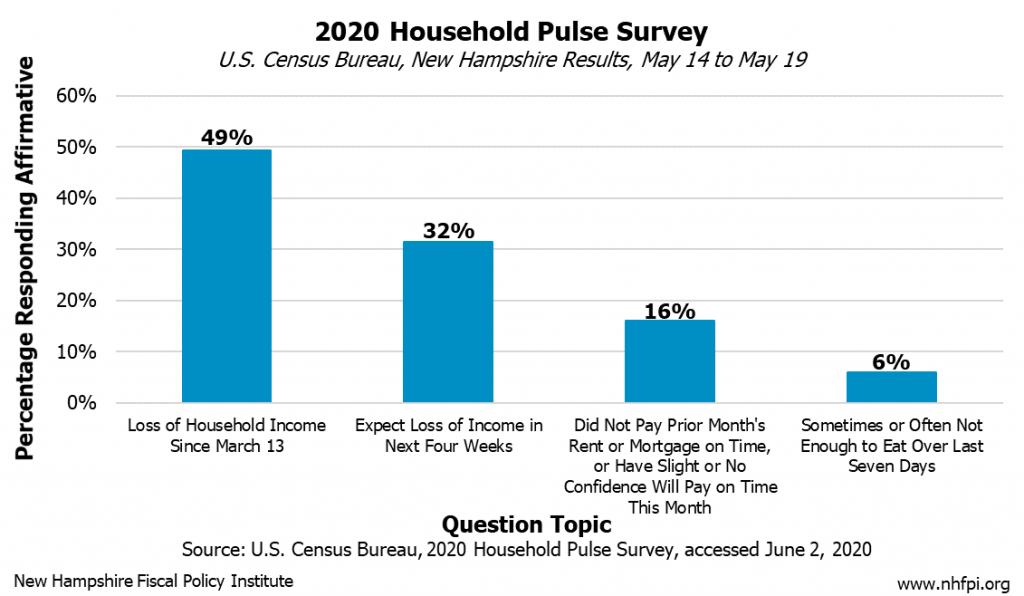

In an effort to understand how the COVID-19 crisis is affecting households, the U.S. Census Bureau is collecting new weekly survey data online targeted at understanding the effects of the crisis. This weekly Household Pulse Survey, an experimental data product designed and conducted in partnership with five other federal agencies, collected responses from 2,225 people in New Hampshire during the week of May 14 to May 19.

Based on those responses, the U.S. Census Bureau has estimated widespread income losses among Granite Staters since the pandemic began, with a resulting decrease in housing security. According to the May 14 to May 19 survey data, nearly half (49.4 percent) of New Hampshire respondents reported a reduction in household income from employment since March 13, 2020. Nearly one in three (31.5 percent) expected a decline in incomes during the next four weeks because of the pandemic. In the survey, 16 percent of Granite Staters responding indicated they did not pay their rent or mortgage on time last month or “have little or no confidence that their household can pay next month’s rent or mortgage on time.”

Declines in Economic Activity and Increases in Unemployment

Necessary actions to reduce the public health impacts of the COVID-19 pandemic have resulted in a sharp decline in employment. As consumer spending drops and social distancing efforts have increased, economic impacts are most direct on industries that cannot reduce physical interactions among employees or the public; these industries include key employers that pay lower than average wages, such as food services, accommodations, and retail trade. This economic contraction has resulted in a projected decline in inflation-adjusted Gross Domestic Product (GDP) by an annualized 37.7 percent in during the second quarter of 2020, with a decline in real GDP for all of 2020 estimated at 5.6 percent. By contrast, the average annual decline in real GDP during the years of the Great Recession was 3.5 percent, with a cumulative decline during the 2007 to 2009 period of 5.1 percent.

With certain industries experiencing greater economic impacts from the COVID-19 crisis and overall declines in economic activity, historic levels of job loss have occurred, which have been most concentrated among industries employing those earning lower-than-average wages. The financial hardships of the COVID-19 crisis appear to be most concentrated among those with the fewest resources, including those workers identifying as either Hispanic or Latino, or as Black or African American.

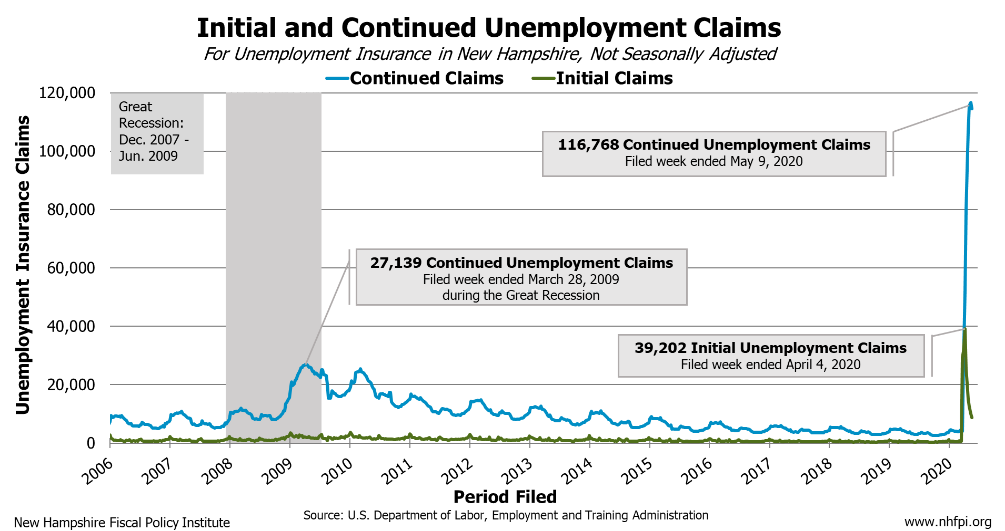

In New Hampshire, initial unemployment claims first spiked for the filed week ending March 21, 2020, during which 29,379 new initial claims were filed. This level was a 4,476 percent increase over the preceding week’s 642 initial claims. Initial claims for the following weeks continued to rise until the filed week ending April 4, 2020, where 39,202 new initial unemployment claims were filed. Initial unemployment claims levels, while lower in more recent weeks, are still extremely elevated, especially when compared to the Great Recession and subsequent recovery; the worst week for initial unemployment claims following the Recession was the filed week ending January 2, 2010, with 3,628 initial claims filed.

Breakdowns of initial claims by industry show that from March 15, 2020 to May 9, 2020 the largest number of claims came from Granite Staters who worked in the food services, accommodation and leisure, retail, medical, and child care industries; most of these industries paid less than average weekly wages in New Hampshire during 2018, and some may be subject to higher than average levels of employment instability. Continued weekly claims for unemployment have also increased to numbers much higher than those seen during the Great Recession. For the week ending May 9, 2020, an unprecedented 116,768 unemployed workers in New Hampshire had filed continued claims for benefits, a 2,857 percent increase in continued claims compared to the those filed during the week ending March 14, 2020. For the week ending May 16, 2020, continued claims had dropped slightly to 114,450, but were still over 422 percent higher than the peak number of continued claims filed during any week of the Great Recession, which was 27,139 continued claims for the week of March 28, 2009.

National and state level unemployment rates for the month of March 2020 did not fully capture the true number of people experiencing job loss throughout the month, due to the data collection methods and timing of the COVID-19 crisis. For April, the estimated national unemployment rate was 14.7 percent, and this figure also likely underrepresents the number of people out of work. Current national unemployment levels are nearly five percentage points higher than the peak level associated with the Great Recession. State-level preliminary estimates of unemployment for April 2020 reveal an unemployment rate in New Hampshire of 16.3 percent, over six times higher than unemployment rate in March. While the figures are subject to change, New Hampshire has the second highest preliminary unemployment rate in the New England for April 2020.

Increased Need for Nutritional Aid

National surveys measuring the overall impacts of the COVID-19 crisis, and analyses focusing on a household’s ability to afford basic necessities such as food and housing during these times, help quantify how many individuals and families may be in need of assistance. Rates of food insecurity, which is when a household does not have enough resources to provide members with sufficient food, are estimated to be significantly higher now than any other point during the last recession, despite large investments in expanded unemployment benefits.

National survey data collected from March 25, 2020 through April 10, 2020 reveal that 21.9 percent of households with adults under age 65 were experiencing some form of food insecurity, as measured by not being able to afford sufficient levels food during COVID-19 crisis. The largest increases in food insecurity have occurred among households with children. An estimated 40.9 percent of these households reported food insecurity, with 17.4 percent reporting specifically that the children in the household were not eating enough because the household could not afford sufficient food at some point since the pandemic began.

In New Hampshire, an increasing proportion of adults reported in the Household Pulse Survey that there was either sometimes or often not enough to eat within the last seven days, according to survey data collected weekly from April 23 to May 19. The May 14 to May 19 Census Bureau data suggest that, compared to levels prior to March 13, about 60 percent more New Hampshire adults sometimes or often did not have enough to eat within their households in the prior seven days.

Official estimates show that about 11.7 percent of households nationally were food insecure during the period averaged over 2016 to 2018, as calculated by the U.S. Department of Agriculture based on a survey that asks about food availability during the year prior to survey responses. In New Hampshire, the official food insecurity rate was about 7.8 percent, or approximately 42,000 households, during the same period and before the onset of the COVID-19 crisis. Estimates from the Household Pulse Survey from May 14 to May 19 suggest about 64,000 New Hampshire adults sometimes or often did not have enough to eat within their households in the last seven days alone, not including the year-long time period measured by the traditional food insecurity metric.

In New Hampshire, participation in a key nutrition assistance program, the New Hampshire Food Stamp Program (nationally known as the Supplemental Nutrition Assistance Program, or SNAP) increased from March 2020 to April 2020. Between the end of March and the end of April, 5,316 more individuals enrolled in the program, interrupting a trend of declining enrollment since about 2013. April 2020 enrollment in SNAP totaled 77,455 Granite Staters and represents an increase of 1,258 more individuals receiving benefits relative to April 2019. Expanding eligibility and increasing benefits for nutrition assistance programs like SNAP will both assist those struggling with food insecurity throughout the crisis and support the economy overall.

Potential Health Coverage Losses

New Hampshire residents losing their jobs may also be at risk of losing employer-sponsored health insurance, if they received coverage through their employment. Analysis from the Kaiser Family Foundation estimated that nearly 78 million Americans lived with someone who lost their job from March 1, 2020 through May 2, 2020, and about 27 million who were covered by employer-sponsored health insurance, including employees and family members, may lose their coverage and become uninsured. This analysis estimated that up to 144,000 individuals in New Hampshire may potentially lose employer-sponsored coverage and 29,000 of these Granite Staters may not be eligible for Medicaid or health insurance marketplace coverage subsidies with current eligibility guidelines in place. A separate analysis from the Economic Policy Institute estimates that over 82,000 Granite Staters may have lost employer-sponsored health insurance between March 15 and May 9.

Enrollment data for New Hampshire’s Medicaid program show that 187,079 Granite Staters were enrolled at the end of April 2020. This enrollment was an increase of 5,283 relative to March 2020, and an increase of 9,067 individuals relative to April 2019.

Additional enrollment in public assistance programs like Medicaid may require more investments to support those in need. Additionally, expansions of eligibility may be needed to help ensure that individuals do not fall between the maximum eligibility guidelines for programs like Medicaid or marketplace insurance subsidies and the ability to afford private health insurance.

More Support Needed for Equitable Recovery

The impacts of the COVID-19 crisis on individuals, families, certain industries, and local, state and national economies overall have been rapid and significant. Compared to the Great Recession, declines in GDP may be more significant, job losses have occurred more rapidly, and portions of the economic progress made by lower- and middle-income Granite Staters during the most recent recovery may be wiped out. Needs for food and other assistance have increased in New Hampshire since the current crisis began, and investments made in aid programs, such as expanded unemployment, may not be sufficient to effectively quell the negative economic impacts of the crisis on vulnerable Granite Staters. Increased investments and expanded eligibility in programs that provide support and assistance throughout and after the COVID-19 crisis may be required to aid those affected and equitably lift all Granite Staters.

– Michael Polizzotti, Policy Analyst

Revision, June 29, 2020: The U.S. Census Bureau indicated an error in their data tables related to food insufficiency and security had occurred. Subsequently, this post was revised to identify the amount of respondents lacking food in the prior seven days relative to before the crisis from households to adult individuals. Similarly, in this post’s comparison to prior food insecurity data from the U.S. Department of Agriculture survey, the Household Pulse Survey unit of measurement described in the post was changed from households to adults.