Updated September 16, 2019

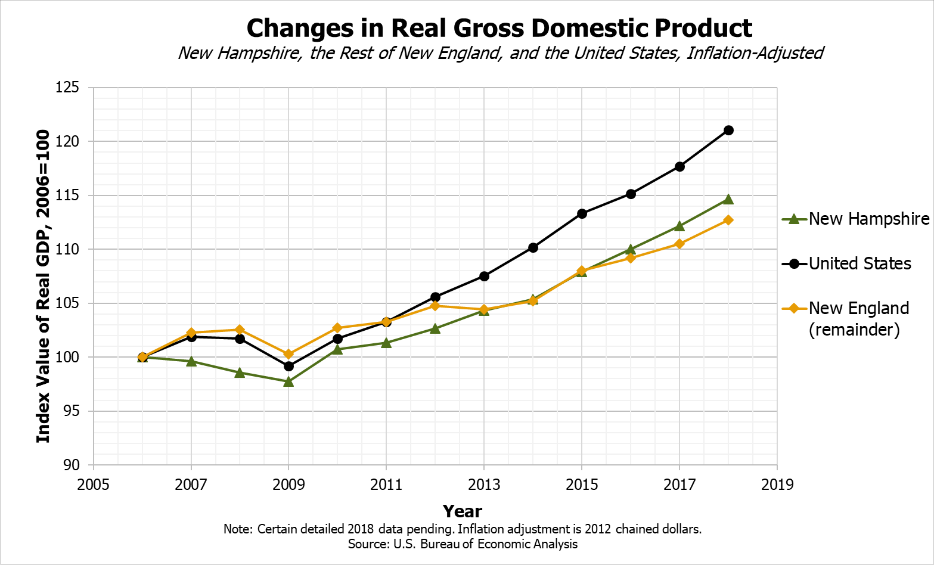

The essence of a labor market is the workers in it. When an economy improves, it is often assumed that conditions for workers, including wages and job opportunities, improve as well. In the decade since the Great Recession, which officially lasted from December 2007 to June 2009[1], New Hampshire’s economy has seen growth in its inflation-adjusted Gross State Product (GSP), increases in the number of available jobs and in the size of the labor force, and continued decreases in the unemployment rate. In recent years, GSP growth in New Hampshire has surpassed the average growth of the remaining New England states and is keeping

pace with national Gross Domestic Product growth levels.[2] The unemployment rate has been below 3 percent since December 2015, and nearly five thousand jobs were added to the state economy from 2017 to 2018. On the surface, it appears that this combination of factors would lead more workers to being better off than they were before the Great Recession.

However, the economic recovery and expansion that New Hampshire has experienced is complex. The diversity of New Hampshire’s distribution of jobs, wages, and other economic resources add more intricacies to understanding the well-being of workers in the state.[3] Differences in wages and job opportunities show disparities between different counties and industries. These disparities also exist when analyzing other indicators of the health of the economy. Increases to the costs of living in the state, in conjunction with decreases in purchasing power for many workers, lead to difficult economic realities for many Granite Staters. The adage suggests, a rising tide lifts all boats. The tide is rising, representing the expansion of New Hampshire’s economy since the Great Recession. However, analyses in this Issue Brief will show that since the Great Recession, some boats are stuck in the sand. Portions of New Hampshire’s workforce are coping with stagnant or shrinking wages and job opportunities in lower paying industries. As a result, the economic security of many New Hampshire workers is being jeopardized.

This Issue Brief explores the status of the labor market in New Hampshire, including the circumstances facing workers in the recovery and expansion period after the Great Recession through to the present. This analysis examines components of the state economy, including changes in the state’s labor force, employment opportunities, and wages and incomes. This Issue Brief also focuses on the uneven effects of the economic recovery on Granite Staters of differing incomes, and the challenges individuals face due to the changes in employment opportunities and increased living costs in the state.

The Labor Market

Labor Force

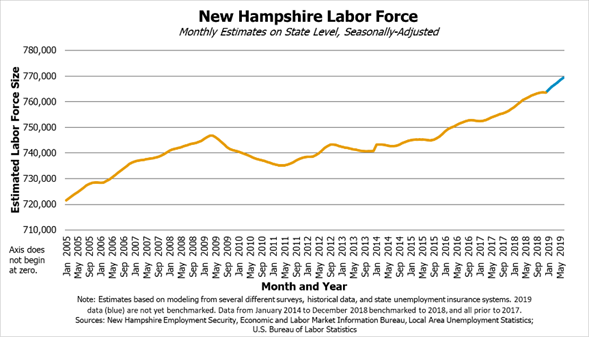

The labor force represents all individuals who are employed, plus all those who are unemployed but looking for work. When seasonally-adjusted, this indicator provides a relative representation of the number of those employed and searching for employment. In New Hampshire, steady increases to the seasonally-adjusted labor force have been a trend, aside from drops in the labor force size in the aftermath of the Great Recession and less even growth in the initial years of the recovery. A decrease in labor force size after the Recession may have been driven by an increase in discouraged workers who may have lost jobs and stopped actively seeking work, after an extended time, and were not accounted for in the labor force.[4]

The approximate size of New Hampshire’s labor force was nearly 764,000 individuals in December of 2018. Preliminary estimates of the first half of 2019 suggest the labor force has continued to grow. Increases in the size of a labor force can act as a catalyst for economic activity. The increases in GSP shows that overall economic activity has increased. As more individuals enter the labor force in New Hampshire, GSP is continuing along its post-Recession expansion.

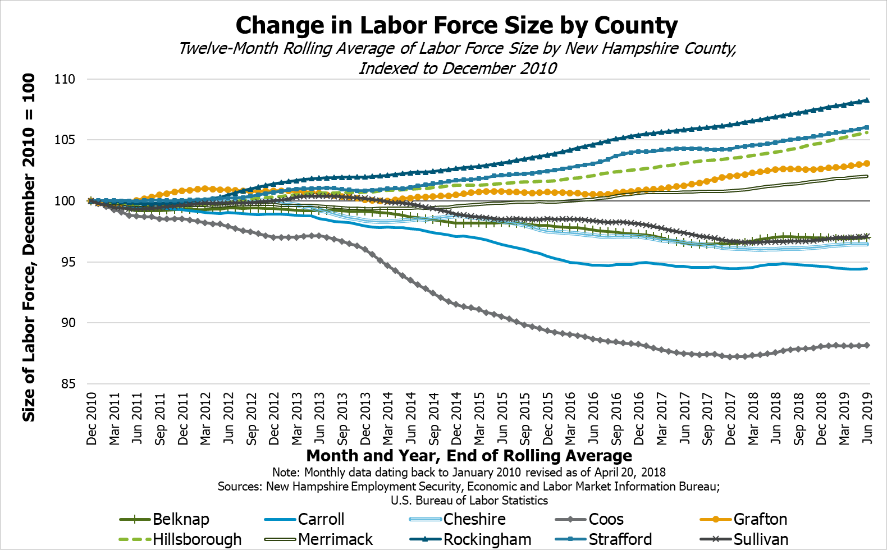

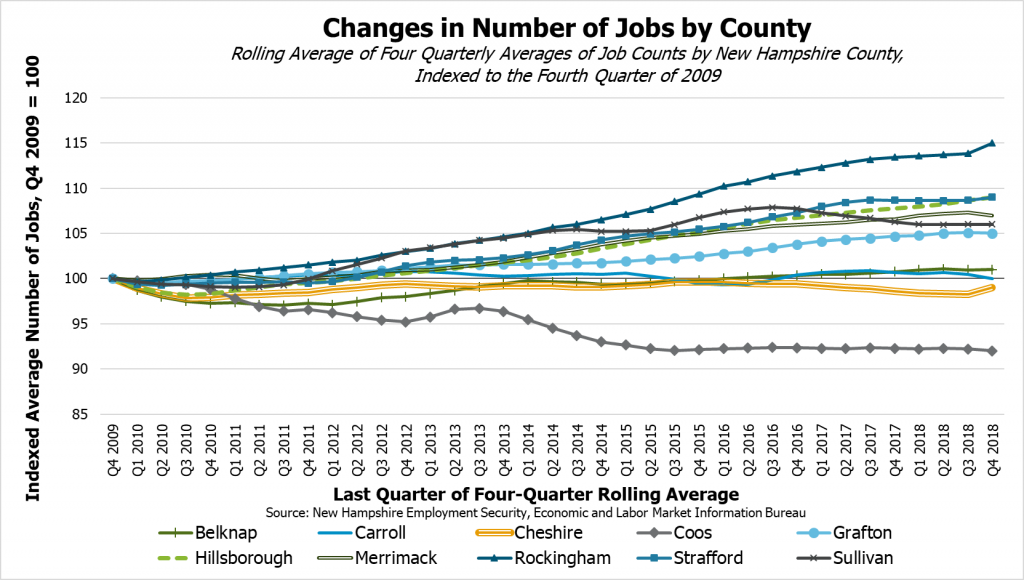

However, New Hampshire’s labor force has not been growing in all areas of the state. Regional differences between the ten counties of the state are profound. While the counties of Hillsborough, Grafton, Merrimack, Rockingham, and Strafford have seen increases in their average labor force sizes over time, the remaining counties have not. However, the declines in the workforce in these remaining counties of Belknap, Carroll, Cheshire, Coos, and Sullivan have begun to level off, and no longer appear to be decreasing as of the end of 2017. Most counties that have had increases in their labor forces are in the southeastern region of the state. Geography and demographic changes shape these trends. The proximity of the southeastern counties to the Greater Boston Metropolitan Area, and the inclusion of New Hampshire’s largest cities, likely contribute to these counties attracting and retaining more workers. This geographic favorability is in conjunction with the overall aging population of the state, where these effects are more pronounced in the northern and western counties.[5]

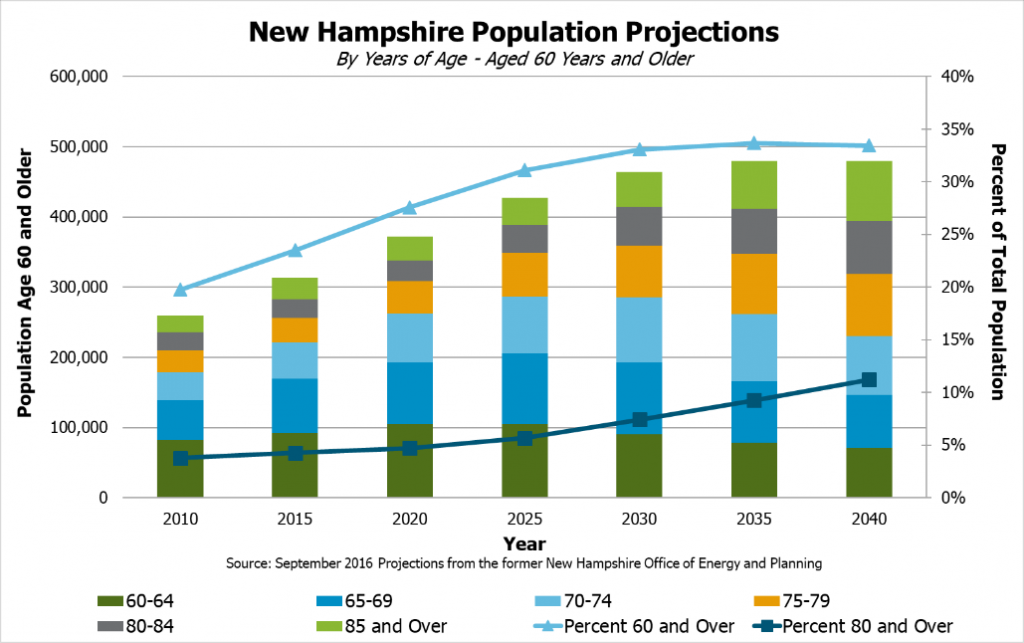

Demographic projections published in 2016 by the State of New Hampshire[6] estimated increases in the portion of the population age 60 and older. By 2025, this older portion of the population was expected to amount to about 31 percent of the state’s total population. By 2035, that number of older individuals in the state is estimated to reach about 34 percent. There is a notable projected increase in the percentage of the population over 60 in the northern and western counties of the state. With these projections and other trends suggesting proportional increases in the age of New Hampshire’s population, combined with decreases in the labor force size in certain regions of the state, labor shortages and shifts in job opportunities are possibilities, especially in northern and western counties.[7]

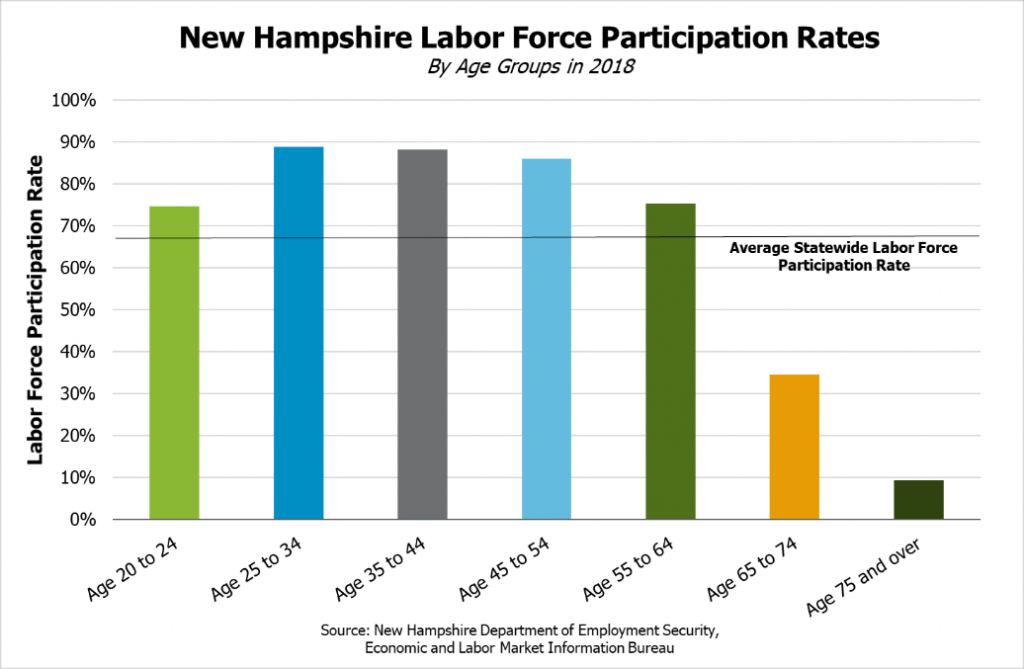

As the population ages, the labor force may contract, unless net inflows of migration outpace the rate at which the labor force potentially declines by size. Typically, the older age population is less likely to work. Estimates from 2018 show that over 70 percent of individuals aged 20 to 64, in their respective age categories, are in the labor force, while approximately one in three of those aged 65 to 74 years work, and about one in ten of those age 75 or older work. Although the rate at which individuals older than 64 work has been slowly rising over the past decade, this may not be enough to counter the effects at which the overall population in the state, especially in certain regions, is projected to age.[8]

A decrease in the supply of available workers can have short-run effects such as labor shortages. More damaging long-run effects that may result are decreases in the number of available jobs and economic contraction. Long-run decreases in the size of the labor force may cause industries to exit regional markets and move to regions where there is a greater supply of available workers. If this happens, contraction of the economy of a region or county may come to pass.

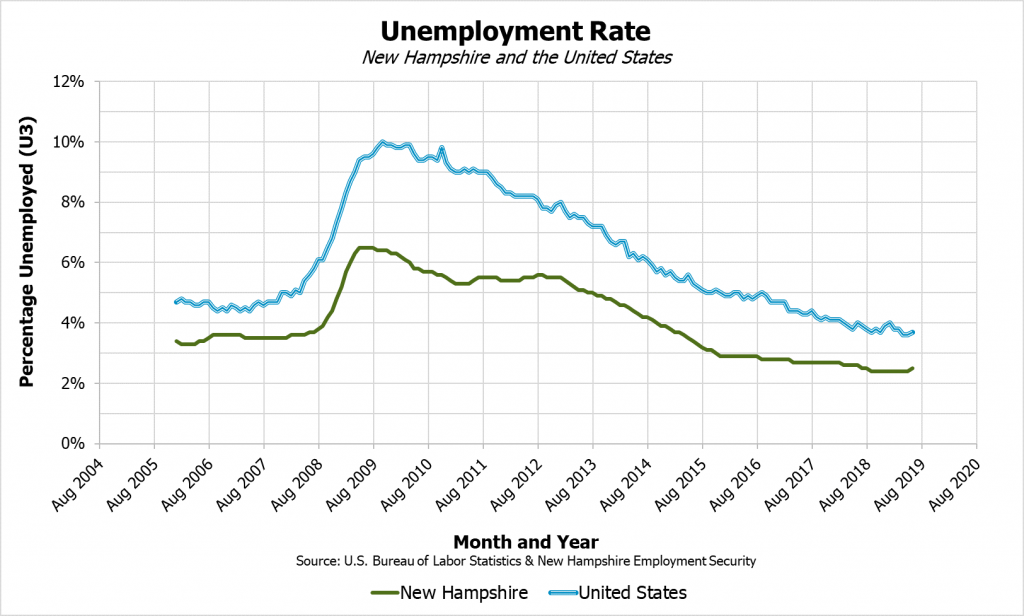

Unemployment

Even before the Great Recession, unemployment levels in New Hampshire have been below the overall rate for the United States. New Hampshire and the nation both experienced increases in the unemployment rate as a result of the Recession but have since seen improvements. Currently, these rates sit below levels seen in the years before the Recession. The official unemployment rate in the state was 2.4 percent at the end of 2018 and stood at 2.5 percent as of July 2019. This rate (referred to as “U3”) only counts individuals in the labor force who are actively (or recently were actively) looking for work but have not found employment. This more traditional unemployment rate fails to capture individuals who are working part time when they want to be working full time. It also does not capture those individuals who have stopped searching for work despite being of traditional working age, usually referred to as “discouraged workers.”[9]

Traditionally, most individuals believe that the lower an unemployment rate, the healthier a labor market is, and the better off workers are. This is true, but only to an extent. Unemployment is a complicated concept, and not all unemployment is undesirable. There are three main underlying types of unemployment: cyclical, structural, and frictional. Cyclical unemployment is when individuals lose jobs due to the ebbs and flows of business cycles but eventually return to work. Structural unemployment is when jobs are lost due to decreases in demand for workers (such as an industry or business leaving a region completely) and individuals struggle to re-enter the workforce. Lastly, frictional unemployment is temporary job loss when individuals move between jobs, typically to seek out new career paths, higher pay, or searching for a job after training or education.[10]

Of these types of unemployment, cyclical unemployment is an unavoidable, but recoverable, cost of economic booms and busts; structural unemployment is a severe problem that may leave individuals out of work for extended periods of time; and frictional unemployment is the temporary unemployment that is one of the drivers of increases in economic growth. As more individuals seek out new opportunities levels of frictional unemployment may increase. These individuals may be between jobs due to educational programs, geographic relocation, or other life events. Ergo, the Federal Reserve currently estimates a healthy, “natural” unemployment rate to be between 3.75 and 4.5 percent.[11] This rate allows for smoother transitions of people between different jobs and an unemployment rate between these bounds has historically been associated with economic growth. At 3.75 to 4.5 percent, the labor market is considered “fully employed”, with allowances for job transitions and growth.

The low unemployment rate in New Hampshire may be indicative of several things, including a shortage of employees willing to fill open positions in the state. This may be influenced by the aging population of the state. As mentioned previously, the Labor Force Participation Rates of individuals age 65 and older in the state are much lower than those age 64 or younger. As the divide between available workers and available jobs grows, a labor shortage worsens. Industries may relocate to different regions of the state to either attract more out-of-state workers or leave the state entirely.

Job Opportunities

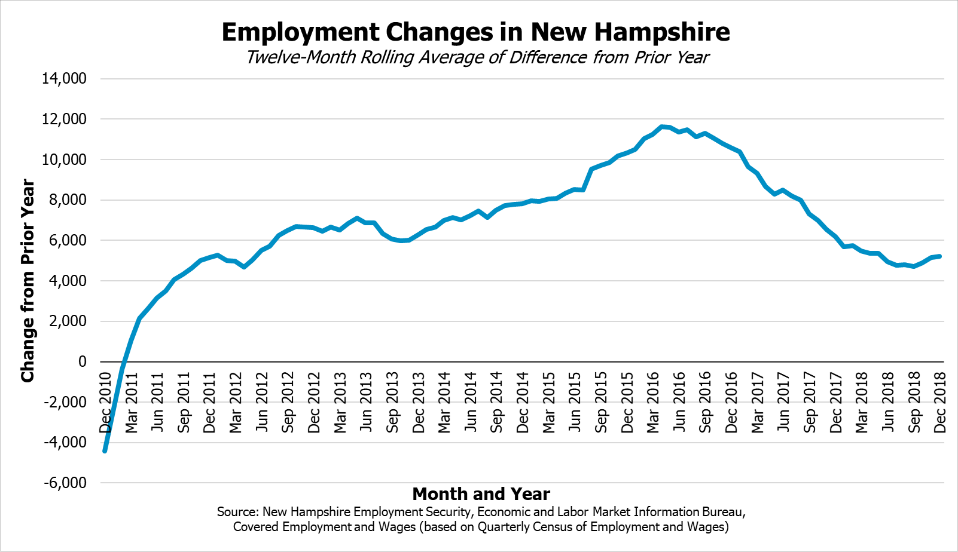

The Great Recession saw millions of jobs lost across the United States.[12] New Hampshire was not spared from this impact. In the initial recovery period after the Great Recession, average annual employment changes were negative until 2011. After 2011, the state’s overall employment has been increasing. New Hampshire’s labor market is experiencing growth as there have been continued increases in the number of jobs filled since 2011, although, since 2016, the rate of additional filled jobs appears to have slowed. Last year, about 5,000 jobs were filled in the state from December 2017 to December 2018.

However, this positive change in the number of filled jobs has not been uniform throughout the state. Moderate levels of job loss in certain counties continues to be offset by large gains in the number of jobs in the remaining counties. Coos and Cheshire counties have seen decreases in their yearly average numbers of jobs. From 2009 to 2018, Coos County has 1,011 fewer jobs in aggregate. In that same period, Cheshire County has 563 fewer jobs. The counties seeing the largest increase in jobs are in the southeastern portion of the state and in the northwest, surrounding population centers such as Lebanon and Hanover. Rockingham County has added a net of 18,194 jobs, and Hillsborough County has added 16,117 jobs over this period. Merrimack, Strafford, and Grafton Counties have added several thousand jobs as well. Belknap, Carroll, and Sullivan Counties have experienced more modest increases for employment over this period.[13]

The polarity between these two groups of counties, those with slow job growth and those with increasing levels of yearly job growth, is apparent. Trends of slower job growth are severe to the individuals who live in these counties. Stagnation in population growth, and lower levels of household income and wages are present in these affected counties. Uneven access to job opportunities throughout the state potentially accelerates the economic inequality among individuals and municipalities.

Wages and Overall Incomes

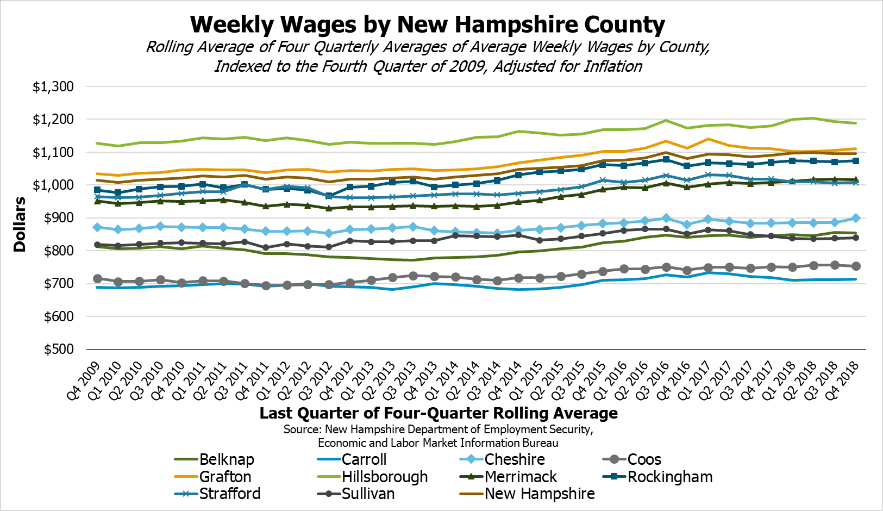

Much like the disparities seen between job opportunities in each county, average weekly wages in each county differ dramatically as well. At the end of 2017, the statewide four-quarter rolling average weekly wage was $1,055. This number is bounded by Carroll County’s rolling average weekly wage of $702 and Hillsborough County’s rolling average weekly wage of $1,143. The only relative commonality between the average wages on the county level is how little they have changed with respect to inflation. In all counties, weekly wages have stayed relatively flat during the time analyzed from 2009 through 2018.[14]

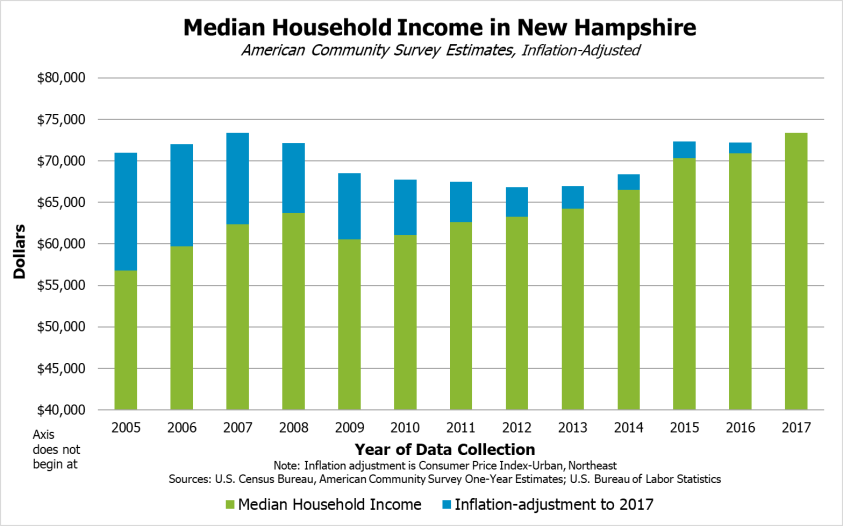

Median household income is another indicator that has not experienced net growth for over a decade, when adjusted for inflation. New Hampshire has a high median household income compared to that of the nation. In 2017, the U.S. median was estimated to be $60,336 per year, and New Hampshire’s median household income was estimated at $73,381 per year. Inflation-adjusted household income was affected negatively by the Great Recession, but only recently has returned to pre-Recession levels.

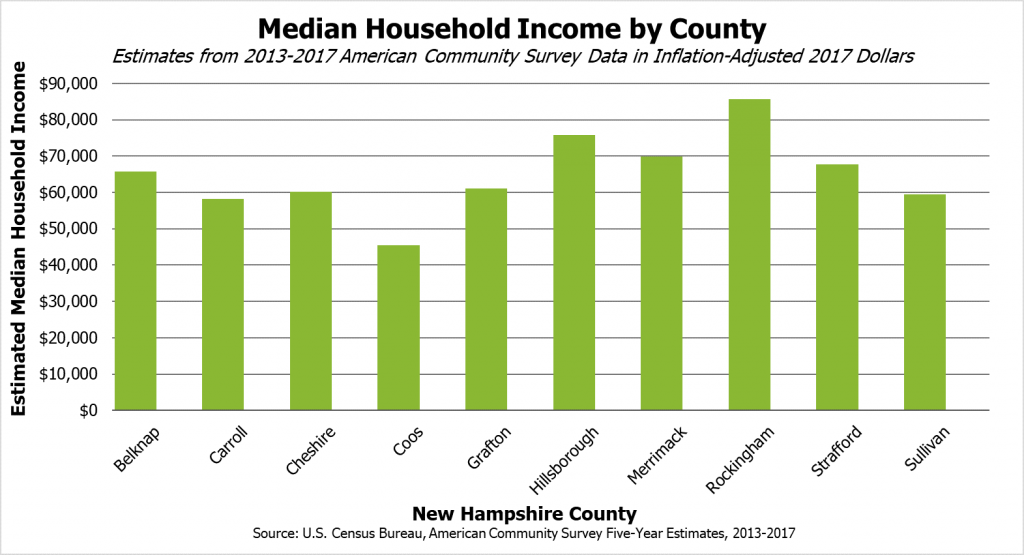

Despite New Hampshire collectively having a higher than average median household income when compared to the nation, large differences exist between the state’s ten counties. The range of median household incomes averaged over 2013 through 2017 and inflation-adjusted to 2017 dollars, vary from an estimated $45,386 in Coos County to $85,619 in Rockingham County. The remaining counties follow previous trends seen in average wages throughout the state. The southeastern portions of New Hampshire have relatively high median household incomes compared to most other areas of the state.[15]

Workers’ Challenges

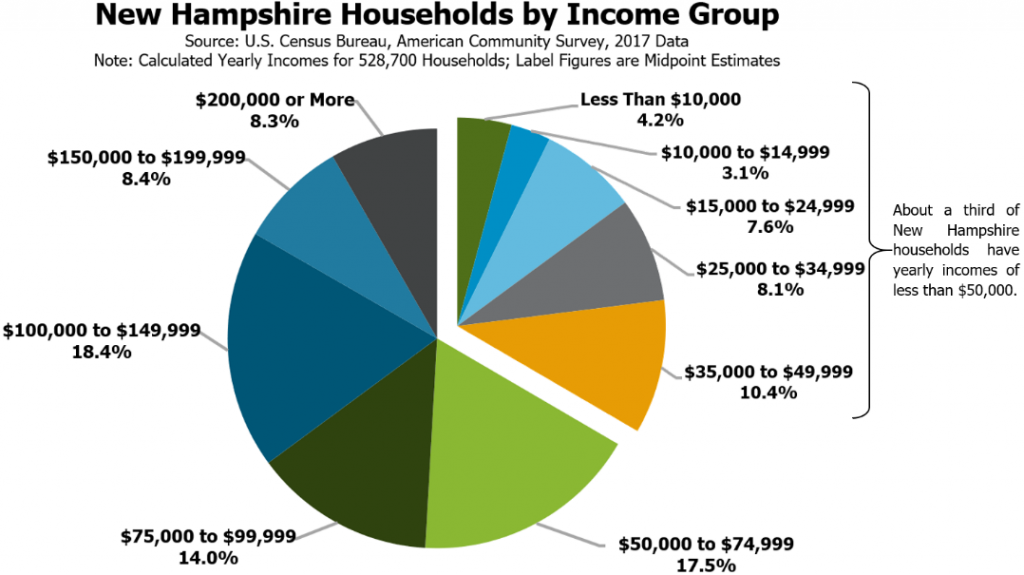

Overall, the economy in New Hampshire appears to be performing very well and to have recovered from most aspects of the Great Recession. Unemployment in the state is low and remains below national estimates; overall median household income is higher than the national median; New Hampshire’s Gross State Product is growing at rates that outpace its New England neighbors in aggregate; and there have been consistently positive increases in jobs added in the state year-over-year since 2011. Despite these positive indicators for the state overall, many Granite Staters may be financially struggling more now than even before the Great Recession. In 2017, about one in three households in the state had incomes of less than $50,000 per year. Approximately one in five households had incomes of less than $35,000 per year.[16] Despite being ranked the state with the lowest levels of poverty, in 2017, about 100,000 individuals were still impoverished in New Hampshire.[17]

As more households take home less pay, it raises the question of how job opportunities are changing. Trends of more employment opportunities in industries with lower average wages have taken hold in New Hampshire. Higher wage levels have seen growth relative to inflation, while lower wages have not been lifted beyond inflation-adjusted levels since the Great Recession, suggesting many of Granite Staters might be struggling more to make ends meet. While higher wage levels have seen growth relative to inflation, lower wages have not been lifted beyond inflation-adjusted levels since the Great Recession. With high costs of living and a very tight housing market, the state may be on a course of increased levels of economic insecurity.

Changing Job Opportunities

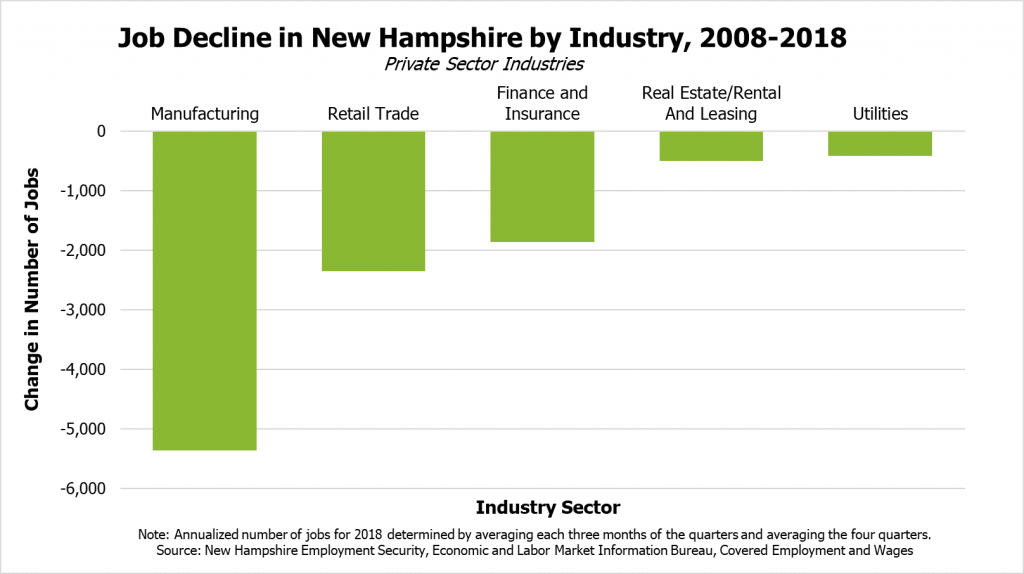

Thousands of jobs have been added to New Hampshire’s economy annually since 2011. Despite this, not all industries have seen equitable increases in jobs. Similar to the trend plaguing the nation, moderate- to higher-wage jobs in manufacturing have declined dramatically over the past decades. The jobs that replace these losses in manufacturing are typically in industries that have wages lower than the private sector average for the state.

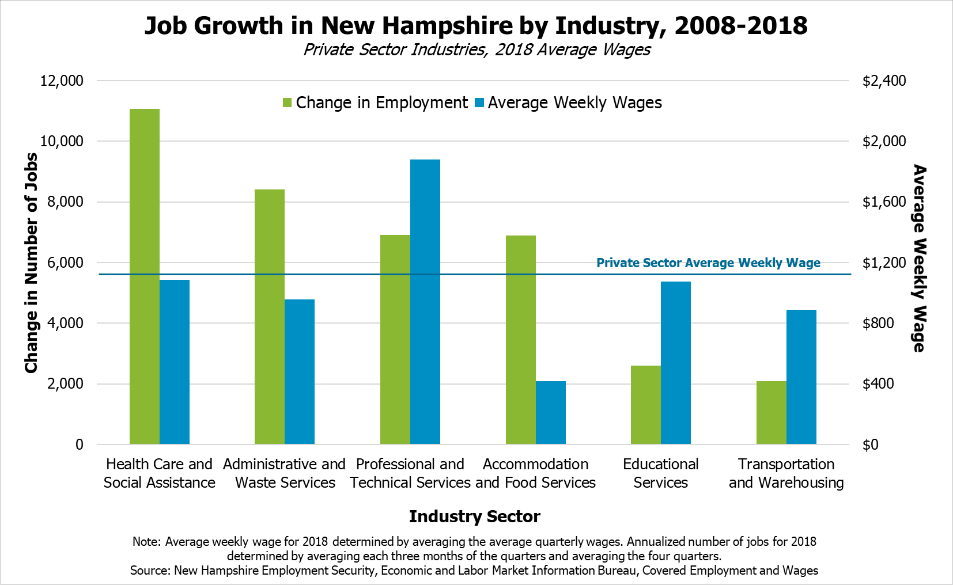

From 2008 to 2018, the net increase in number of jobs in the state was 27,519. Over this period, the industries with the largest job growth included Healthcare and Social Assistance with 11,079 jobs added; Administrative and Waste Services with 8,415 jobs added; Professional and Technical Services with 6,912 added; Accommodation and Food Services with 6,888 jobs added; Educational Services with 2,600 jobs added; and Transportation and Warehousing with 2,097 jobs added. Of these industries that were the largest drivers of job growth in the state, all but Professional and Technical Services have average weekly wages below the statewide private sector average of $1,107 per week.

While lower wage jobs have seen the largest increases in New Hampshire, jobs with wages higher than the state average have seen some of the largest declines from 2008 to 2018. Of industries with weekly wages higher than the private sector average, the Manufacturing industry lost 5,363 jobs; Finance and Insurance lost 2,347 jobs; and Utilities lost 410 jobs. The Retail Trade industry and Real Estate and Rental and Leasing industry also lost 2,347 and 497 jobs respectively over this period.[18]

Although the labor market has appeared to recover since the Great Recession, based on the growth experienced over the 2008 to 2018 period, this large increase of lower wage jobs is contemporaneous with decreases in higher wage jobs in the state. Industries with large job growth also have higher portions of part-time opportunities associated with them, including Healthcare and Social Assistance and Accommodation and Food Services. As a result, increasing portions of the jobs added to New Hampshire’s labor market are of lower average wage.

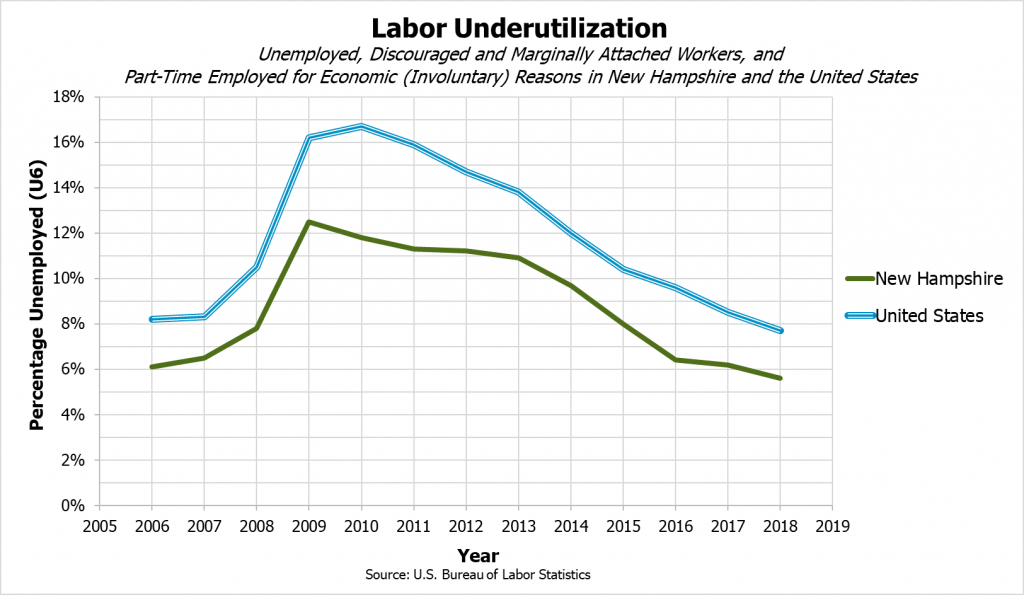

The traditional way unemployment is measured, as described in the preceding section of this Issue Brief, is called “U3.” This rate only counts individuals in the labor force who are actively, or were recently actively, looking for work, but have not found employment. It fails to capture underemployment in the economy, which may be a consequence of increases in lower-wage job opportunities. Underemployment happens when individuals are working jobs below their skillset or are working a part-time job when they would prefer to be working full time. With increases in lower wage opportunities and decreases in higher-wage ones, an individual in the state may be more likely to have a less stable source of income.

In order to measure underemployment, a different unemployment metric, called “U6”, provides additional insight. U6 includes those actively, or who were recently actively, searching for a job; “discouraged workers” and those marginally attached to the labor force; and those working part time when they would rather be working full time.[19] When including these individuals, the labor underutilization rate of 5.5 percent in 2018 is above the traditional unemployment rate for the state. This means that there are Granite Staters who are unable to find a job, and are “discouraged”, and a portion who are working part-time while they would rather be working full time. While the U6 rate is trending downward and is at approximately pre-Recession levels, the noteworthy gap between U6 and U3 suggests some workers are still having difficulty securing the level of employment they seek.

Uneven Changes in Real Wages and Purchasing Power

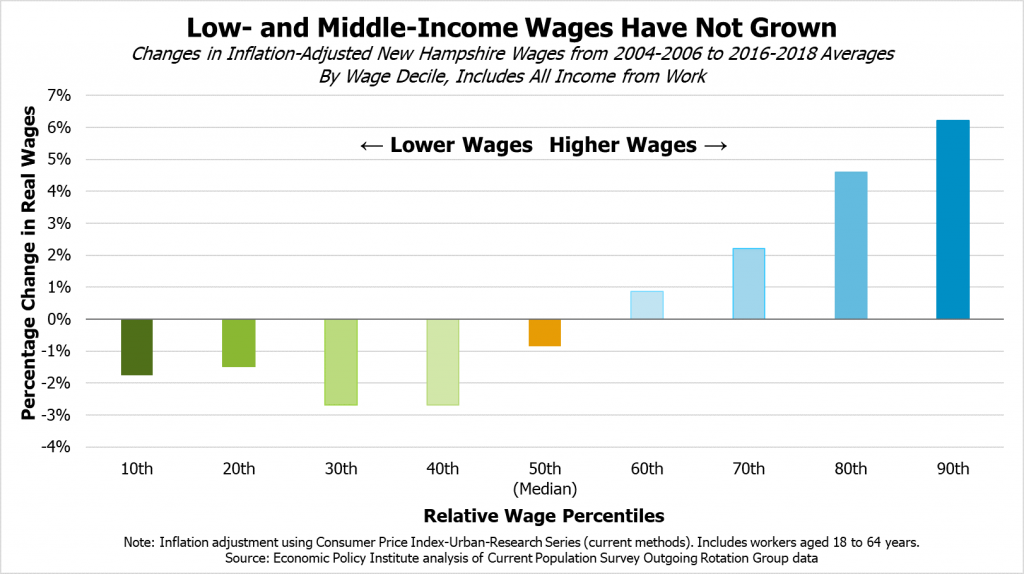

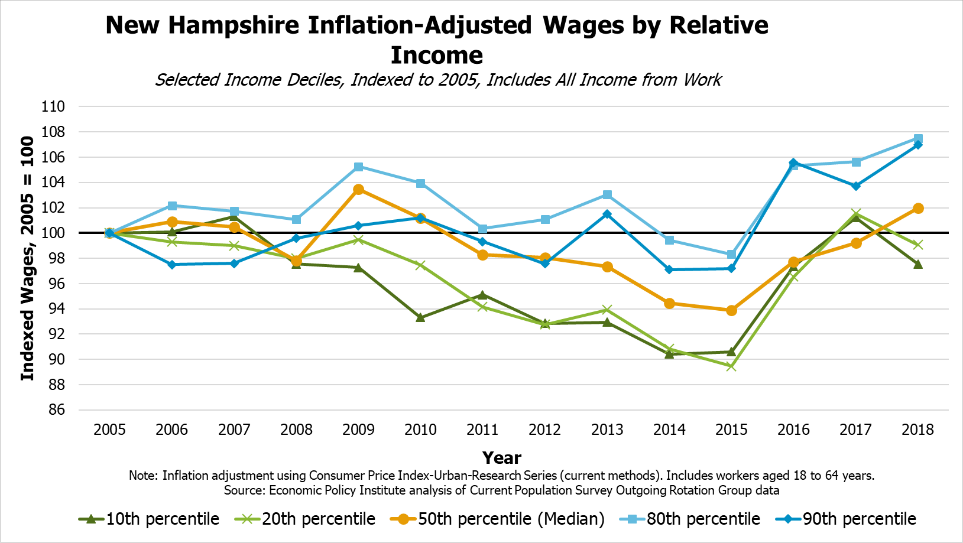

The trend of increasing lower wage work in New Hampshire has occurred in tandem with changes in the distribution of wage increases. While increases in lower-wage job opportunities have occurred, inflation-adjusted wages averaged over the period of 2016 to 2018, compared to pre-Recession wages from 2004 to 2006, have changed significantly for different income deciles of Granite Staters. Over this period, inflation-adjusted wages have decreased for up to the 50th percentile, or median, of New Hampshire workers. The 50th percentile represents the amount that is in the center of New Hampshire’s distribution of wages. This means that half of the states’ workers make below this wage and half make above it. Only those individuals that made consistently more than the median income in the state have seen their wages increase to levels greater than before the Great Recession. Individuals who have consistently earned a median wage or less over this period have seen no real wage growth when adjusted for inflation. In straightforward terms, those individuals in the state making the median wage or less actually have less purchasing power than individuals in the same situation did before the Great Recession.

Detailed annual data from 2005 to 2018 provide additional evidence that lower wages fell behind during the long, slow economic recovery. Despite following similar ebbs and flows in inflation-adjusted wages, the top earners in the 80th and 90th percentiles have seen real wages sustained and increased from 2005, while those with incomes consistently below the median have seen their real wages, and purchasing power, decrease. This decrease in real purchasing power shows that individuals consistently making less than the median wage of $20.95 per hour in 2018 have experienced what feels like a pay cut compared to the past. From 2010 to 2016, those workers earning at the 20th percentile or lower experienced what felt like a very drastic pay cut. As of 2018, real wages for the 50th percentile and lower earners appears to be equivalent to the wages these workers made in 2005. These portions of New Hampshire’s workforce, who make less than this median, are at risk of decreased economic security. The tight labor market in New Hampshire has helped push lower wages higher, as seen in the increase in their real wages beginning in 2016. However, individuals earning incomes lower than the median of $20.95 have barely had their purchasing power restored to pre-Recession levels.[20]

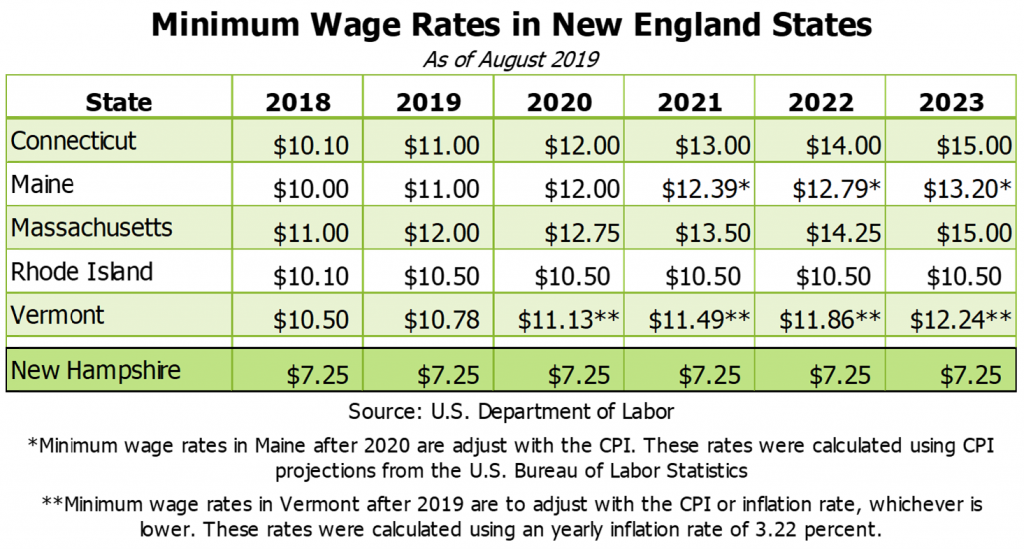

New Hampshire is the only state in New England that follows the federal minimum wage of $7.25 per hour, where the wage has stood since 2008. The remaining New England states have raised their minimum wages in recent years and provided guidelines on mandatory increases that will occur in subsequent years. Examples include Maine’s minimum wage increase to $12.00 an hour in 2020 and Massachusetts’ increase to $15.00 an hour by 2023. States across the region have also implemented minimum wage increases that will be tied to the Consumer Price Index, otherwise known as CPI, so that wages continue to keep pace with inflation on their own.[21] The minimum wage in New Hampshire is mostly associated with industries such as Healthcare and Social Services, Accommodation and Food Services, and Retail Trade. Due to the tight labor market, only about 8,000 workers in New Hampshire make this wage. The competitive nature of the labor market in the state results in more workers making more than $7.25 per hour. However, normal yearly inflation still outpaces the competitive wages created by this labor market.[22] As surrounding New England states are implementing minimum wages that adjust with the CPI, New Hampshire workers earning at or near the minimum wage may face greater future challenges if their real purchasing power continues to decline.

Household Expenses

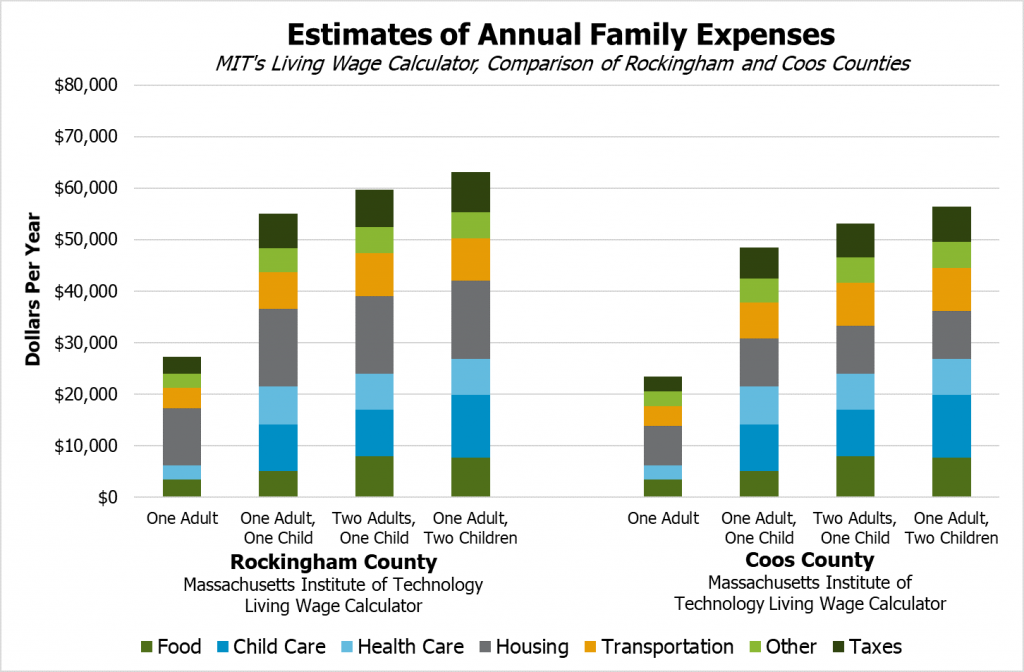

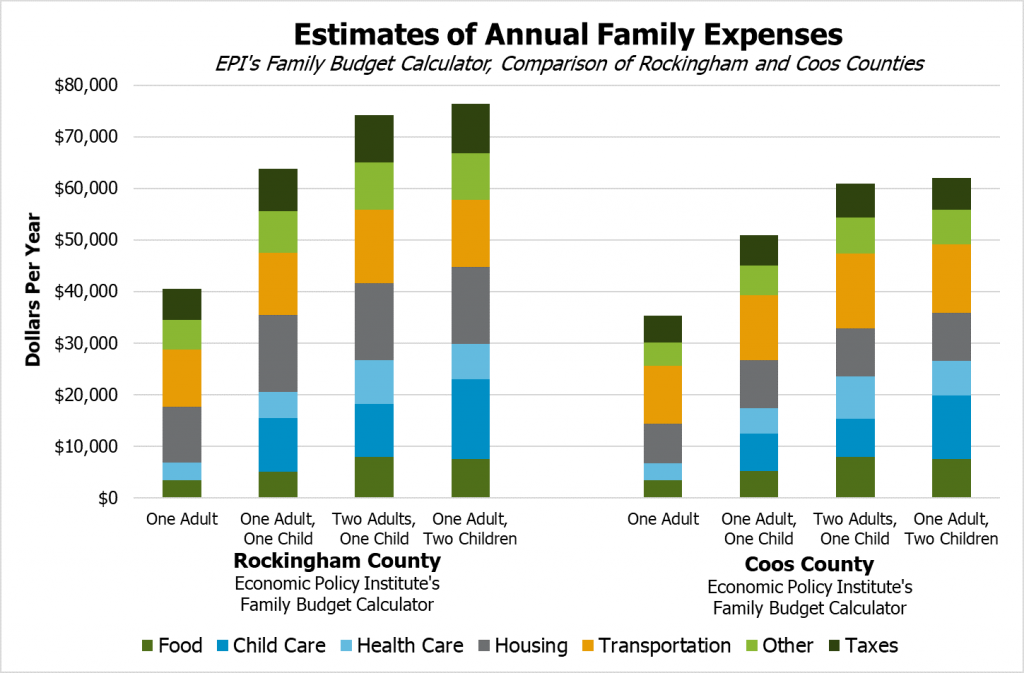

New Hampshire’s overall cost of living falls near the middle of state rankings. However, increases in recent years for certain expenses, including housing and transportation, continue to pressure low- and moderate-income Granite Staters. Both the Massachusetts Institute of Technology (MIT) and the Economic Policy Institute (EPI) have created indexes that estimate costs of living for New Hampshire. There is a large range of expected costs for Granite Staters, dependent on the size and location of their household. The range of living expenses in the state are bounded on the high end by Rockingham County and the low end by Coos County.

In Rockingham County, MIT’s Living Wage Calculator estimates the following annual budgets: a household of one adult would need $27,316; one adult and one child would need $55,002; two working adults and one child would need $59,686; and a household of one adult and two children would need $63,060.[23] In Coos County, one adult would need to budget $23,377; one adult and one child would need $48,408; two working adults and one child would need $53,091; and a household of one adult and two children would need $56,466 per year.[24]

EPI uses a different methodology that produces generally higher estimates for the cost of living budgets. In Rockingham County, EPI’s Family Budget Calculator estimates the following annual budgets: one adult would need $40,576; one adult and one child would need $63,845; two working adults and one child would need $74,223; and a household of one adult and two children would need $76,431 per year. In Coos County, EPI estimates that one adult would need to budget $35,274; one adult and one child would need $50,893; two working adults and one child would need $60,957; and a household of one adult and two children would need $62,030 per year.[25]

Housing Costs and Availability

Housing costs make up a significant portion of expenses for residents in New Hampshire. Compared to renting, owning a home can create a substantial source of equity for individuals and families over time. However, there is a large divide between the incomes of individuals who own and rent in the state. Estimates show the median household income of homeowners in the state in 2017 was over $90,000 per year while for renter households it was just over $40,000 per year. This difference between the median household incomes of renters and owners has been consistent over the past decade.[26] This divide between the median household incomes of those who own and rent results in lower-income individuals and families being more susceptible to increases in rental housing costs.

Owning a home has higher associated upfront costs, so many individuals with lower incomes are unable to afford to own their home. Lower rental costs would allow individuals to save greater portions of their incomes and possibly allow them to invest in a home to own. However, rental costs are likely to continue to increase, as they have over the past decade. Increasing rents may contribute to the inability of lower income individuals to build equity.

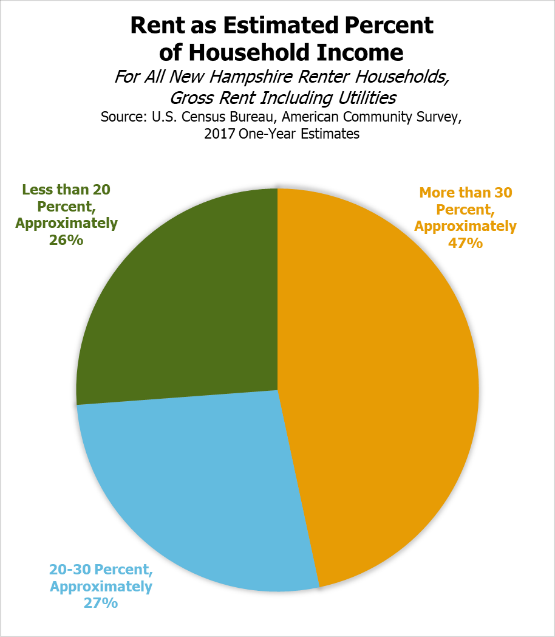

The overall increase of New Hampshire’s median rent and utility costs over the past decade continues into 2019, with total rental costs for residential units trending upward to the 2019 median level of $1,347 for a two-bedroom apartment. In the past five years, rental costs in the state have increased by nearly 22 percent on average for a two-bedroom apartment. Along with the continued increase for the cost of renting, the vacancy rate of units across the state has continued to drop and currently sits below 1 percent.[27] With demand for housing high and the supply of affordable dwellings low, renters are spending larger portions of their paychecks on housing. The U.S. Department of Housing and Urban Development states that, “Families who pay more than 30 percent of their income for housing are considered cost burdened and may have difficulty affording necessities such as food, clothing, transportation and medical care.” Based on the most recent estimates from 2017, approximately 47 percent of New Hampshire’s renters were spending greater than 30 percent of their income on rental costs.[28]

Conclusion

In the decade since the Great Recession, New Hampshire’s economy has improved by many measures, yet uneven wage growth, decreases in access to economic opportunity, and increasing expenses have left many Granite Staters behind. New Hampshire’s median wage in 2018 was $20.95 per hour or about $43,000 per year when working full time.[29] Half of workers in New Hampshire earn less than this amount. Incomes for workers earning below median wages have not kept pace with inflation, while housing costs have outpaced inflation in recent years. At the same time, individuals earning more than the median have historically seen their inflation-adjusted wages increase.

Contributing to the decline in the real wages and purchasing power of lower- and middle- income individuals are the changes in the industries and job opportunities in New Hampshire. Compared to a decade ago, increases in jobs in sectors with lower average wages, combined with decreases in certain jobs with higher average wages, leave workers with fewer available opportunities to increase income and economic stability.

The economic recovery has not reached all Granite Staters equally. The tide has risen, and many boats are rising with it. However, many boats are stuck in the sand and many Granite Staters, in terms of their wages and job opportunities, are not better off than they were before the Great Recession. As New Hampshire strives to sustain a strong economy, greater growth in lower- and middle-income wages would help to ensure more Granite Staters have the opportunity to achieve economic prosperity.

Updates and revisions, September 16, 2019:

The graph titled “Change in Labor Force Size by County” and accompanying text at the end of page two have been updated to reflect remediation of a previous error related to Grafton County’s estimated labor force data. Grafton County has seen growth in estimated labor force size over the 2010 to 2019 period.

The “New Hampshire Population Projections” graph on page three has been reformatted to display percentage values on the right vertical axis; the prior version displayed decimal values.

Endnotes

[1] The National Bureau of Economic Research Business Cycle Dating Committee’s report officially recognizes the Great Recession as lasting from December 2007 through June 2009.

[2] These trends were calculated using data compiled by the Bureau of Economic Analysis’s datasets for national GDP and regional GDP.

[3] For detailed information on the fiscal capacities and distribution of economic resources throughout the state, see NHFPI’s publication Measuring New Hampshire’s Municipalities: Economic Disparities and Fiscal Capacities.

[4] For more information on labor force definitions and explanations, see the U.S. Bureau of Labor Statistics’ Labor Force Statistics from the Current Population Survey.

[5] These figures and trends were compiled using data published by New Hampshire Employment Security through the Economic and Labor Market Information Bureau and NHetwork.

[6] Published in 2016 by the New Hampshire Office of Energy and Planning, current responsibility for this data falls under the New Hampshire Office of Strategic Initiatives.

[7] County and statewide demographic projections were most recently updated in 2016, see the State of New Hampshire State and County Population Projections publication.

[8] Labor Force Participation Rates by age group have been provided by New Hampshire Employment Security through the Economic and Labor Market Information Bureau. For more information, see New Hampshire 2018 Workforce Analysis In Review.

[9] The Bureau of Labor Statistics defines “recently actively looking for work” as looking for work in the past 4 weeks; full definitions of unemployment and measurement methodologies can be seen on the Local Area Unemployment Statistics publication.

[10] An in-depth explanation on the three main types of unemployment have been published by the St. Louis Federal Reserve. See the publication titled Making Sense of Unemployment Data.

[11] Information on the sustainability of low unemployment rates has been published by the Board of Governors of the Federal Reserve System. More historical insights on the “natural” rate of unemployment have been published by the Federal Reserve Bank of San Francisco.

[12] The Bureau of Labor Statistics released a publication stating the U.S. saw an 8.8 million job decrease initially after the Great Recession; see the full publication titled Employment loss and the 2007-09 recession: an overview.

[13] These figures and trends were compiled using Covered Employment and Wages data from published by New Hampshire Employment Security through the Economic and Labor Market Information Bureau and NHetwork.

[14] Quarterly Covered Employment and Wages data and trends on weekly county-level wages were compiled from New Hampshire Employment Security through the Economic and Labor Market Information Bureau and NHetwork.

[15] Median household incomes are estimates from the American Community Survey; see full estimates on the American FactFinder website.

[16] Household income estimates are available via the American Community Survey.

[17] In 2017, the federal poverty line for a family of three with one child was $19,730. More information on poverty and poverty thresholds have been published in NHFPI’s September 2018 Fact Sheet New Hampshire’s Numbers: 2017 Census Bureau Estimates for Income, Poverty, Housing Costs, and Health Coverage.

[18] For more information on the composition of jobs included in these sectors, see the U.S. Bureau of Labor Statistics, Industries at a Glance web page. These figures, as well as other figures citing specific job numbers in this Issue Brief, are from the Quarterly Census of Employment and Wages.

[19] Definitions of Alternative Measures of Labor Underutilization have been published by the U.S. Bureau of Labor Statistics.

[20] Data and trends used to compile these figures have been published by the Economic Policy Institute.

[21] The Economic Policy Institute tracks the minimum wages, and anticipated future minimum wages as prescribed in current state laws, via an online guide.

[22] Detailed data on the average wages made in different occupations across New Hampshire has been published by New Hampshire Employment Security.

[23] The Massachusetts Institute of Technology’s Living Wage Calculator for Rockingham County has detailed breakdowns of expenses and methodologies employed.

[24] The Massachusetts Institute of Technology’s Living Wage Calculator for Coos County has detailed breakdowns of expenses and methodologies employed.

[25] See the Economic Policy Institute’s Family Budget Calculator has detailed breakdowns of expenses and methodologies used.

[26] See the American Community Survey 2017 One-Year Estimates on incomes of renter households and homeowner households.

[27] See the New Hampshire Housing Finance Authority 2019 Rental Housing Survey.

[28] See the U.S. Department of Housing and Urban Development’s guidelines to affordable housing.

[29] Assuming an individual works 40 hours per week and 52 weeks per year.