May is not a critical month for State revenue collections, but policymakers in the State Budget’s Committee of Conference have been seeking any additional information they can find that could help inform final revenue projection negotiations for the budget. As a result, revenues in May have received more scrutiny than usual as policymakers look for hints about the future.

Topline Numbers Show No Significant Shift

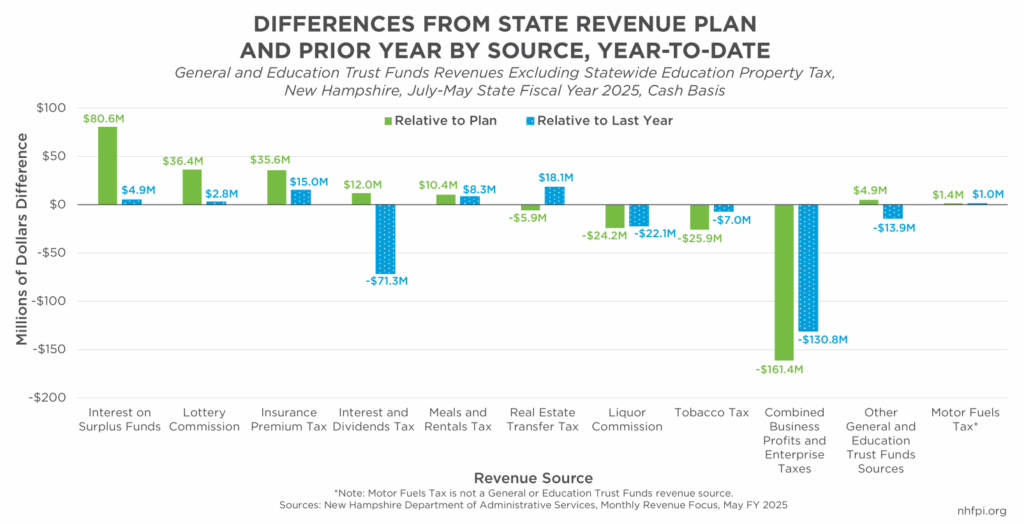

Combined revenue to the General and Education Trust Funds collected in May totaled $141.1 million. That amount was $5.4 million (4.0 percent) above the State Revenue Plan for the month, while it fell just short, by $0.6 million (0.4 percent), of collections from last May.

Revenues would have been below planned amounts, and been in deficit for the month, if there had not been higher than expected interest earned on the State’s cash holdings. These interest earnings have recently been a key source of State funding. They comprised the equivalent of about half the surplus last fiscal year, and the State would have a State Fiscal Year (SFY) 2026 revenue deficit of about $116.8 million, rather than the current $36.2 million, if surplus funds had not been generated from higher-than-expected interest earnings.

May revenues from the Lottery Commission were also above planned amounts by $3.2 million (24.2 percent) due to higher revenues from sports betting and Historic Horse Racing. Revenues from most other major sources were underperforming or, even if above the prior year’s collections, were below the State’s targeted amounts of revenue for the month.

For example, Real Estate Transfer Tax revenues were ahead of last May’s collections by $1.3 million (9.8 percent), but fell short of the State Revenue plan for the month by $1.8 million (11.0 percent).

Business Tax Declines Slow…or Stop?

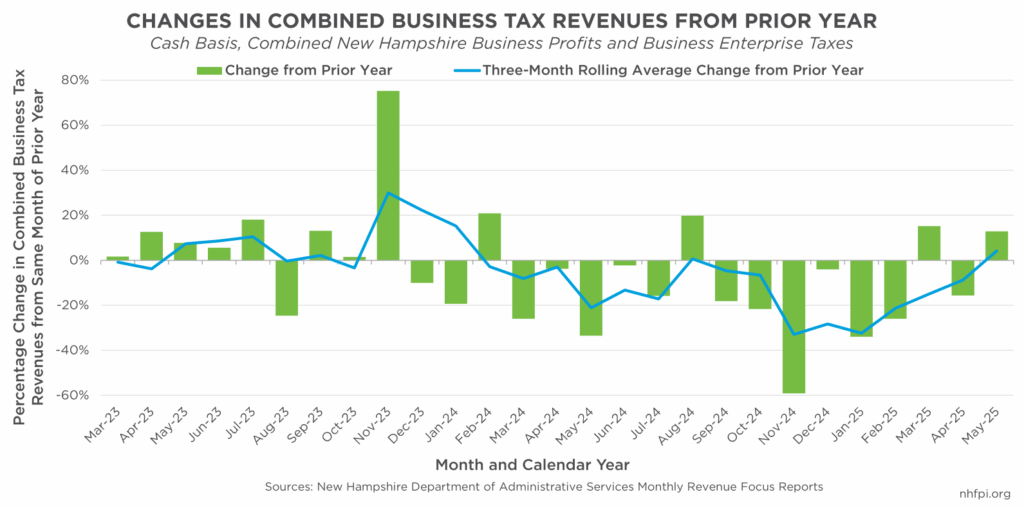

The combined business taxes also showed incremental improvements that fell between original expectations for this budget cycle and the declines in revenue experienced last year.

While revenues for the State’s two combined business taxes were $3.7 million (12.9 percent) above last year, they were $5.1 million (13.6 percent) below planned amounts. May’s business tax revenues running ahead of last year’s receipts is more favorable for State coffers than much of SFY 2025 has been so far, as business tax revenues were still $130.8 million (12.4 percent) lower in the first eleven months of SFY 2024 than during the same period in SFY 2025. Combined business tax revenues are $161.4 million (14.9 percent) below planned amounts for SFY 2025, with one month remaining in the fiscal year.

With both March and May suggesting the slide in business tax revenues is slowing, and may even have stopped, policymakers may have reason to be more optimistic about the future trajectory of business tax revenues. However, May only offers limited information; accurately projecting State revenues for the next two years based on early suggestions of a pattern change is a challenging task.