September was the first big month for revenue collection of State fiscal year (SFY) 2018, and while the total cash collected should not yet ring alarm bells, overall receipts were nothing to boast about. This trend continues observations from SFY 2017, which ended June 30, 2017, and the first two months of the current fiscal year.

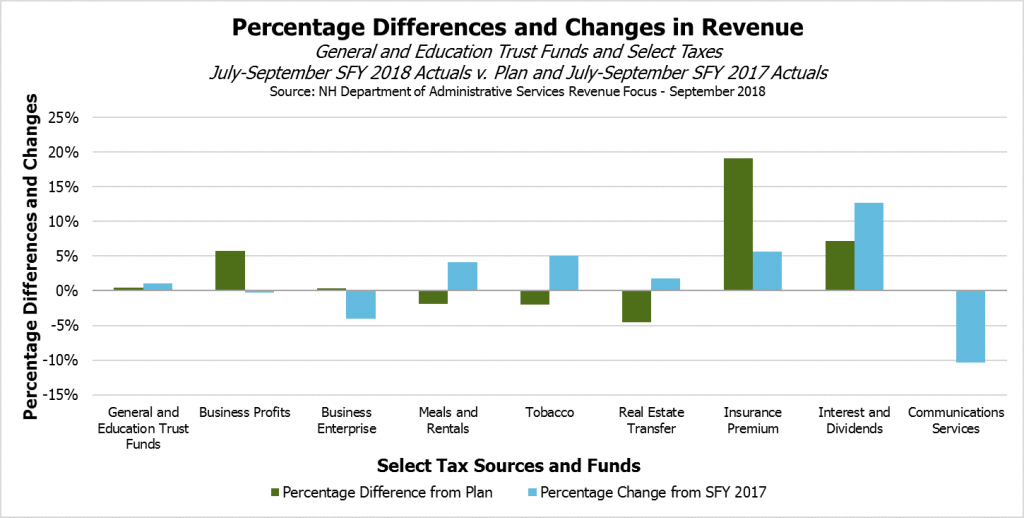

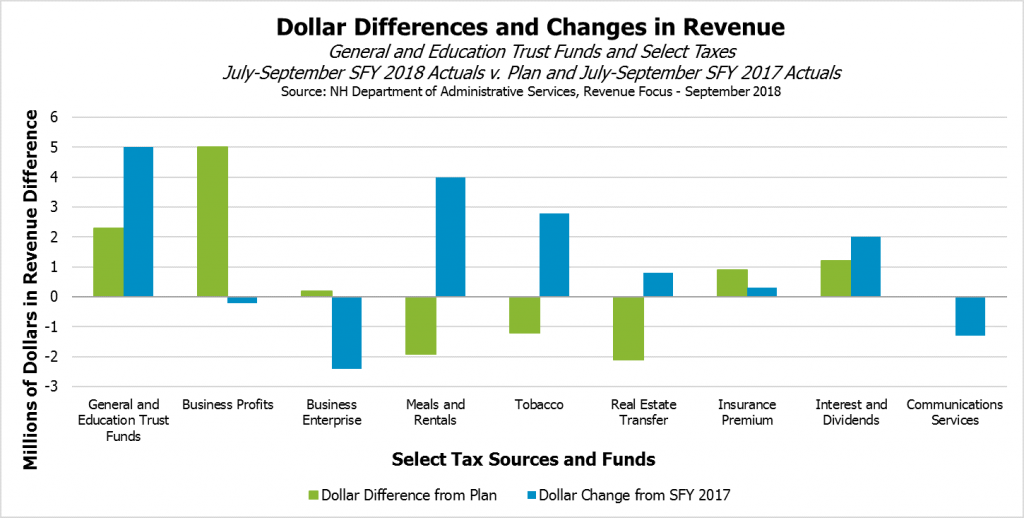

The General and Education Trust Funds, the primary repositories for the least restricted revenue streams from State taxation, were $2.3 million (0.5 percent) above plan for the year after September’s receipts, but that was down from $4.6 million at the end of August, with September’s shortfall relative to the revenue plan cutting the unrestricted cash revenue surplus in half.

The State’s two primary business taxes, the Business Profits Tax and the Business Enterprise Tax, underperformed slightly in September relative to plan and were down more substantially relative to the prior year. Combined, the two taxes were under September’s plan by $1.2 million and below September of SFY 2017 receipts by $2.0 million, ending down $2.6 million (1.7 percent) for the first quarter of SFY 2018 relative to the first three months of SFY 2017. September is the first quarterly estimate payment for the two business taxes of the new fiscal year, so it provides the best early indicator as to how these important sources of State revenue may perform over the year. The Business Profits Tax was down $0.2 million (0.2 percent) relative to the first quarter of SFY 2017, but was $5.0 million (5.8 percent) above planned revenue for SFY 2018’s first quarter, lifting both funds while Business Enterprise Tax receipts were up a much smaller $0.2 million (0.4 percent) from plan and down $2.4 million (4.0 percent) from last year.

Receipts from the two primary business taxes were down in part because of larger requests for refunds. In the first quarter of SFY 2017, about $4.3 million in refunds had been requested, while refunds are at $11.1 million through September of this year. While these refunds were higher than last year at this point and affect the comparisons, October and November of SFY 2017 had substantial refunds, totaling about $22.3 million across the two months. Whether businesses will ask for another significant round of refunds is difficult to predict, but these refunds do affect cash basis revenues, and businesses likely have plenty of refunds from tax credits available and unused. As of the end of June 2016, the Department of Revenue Administration reported that 17,349 businesses had requested their overpayment of taxes be credited and carried forward to the next tax year, and total refund credits available grew to nearly $173.4 million. While it is unlikely all these businesses will request refunds at the same time, these overpayments could either be returned as refunds when requested or reduce future business tax receipts, potentially limiting future net revenue.

September revenues also showed that, relative to last year, certain other key taxes performed slightly better, but remained below planned revenue targets. The Meals and Rentals Tax, a key driver of recent revenue growth, was up $4.0 million (4.1. percent) in the first quarter of SFY 2018 relative to the same period last year, but was $1.9 million (2.0 percent) short of plan in aggregate. The Real Estate Transfer Tax eked out about $0.8 million (1.8 percent) more in the first three months of this year than last’s year’s first quarter, but was below plan by $2.1 million (4.0 percent). Revenues from this tax have likely been constrained by a housing market with a low and falling supply of homes on the market, even though rising prices likely benefitted revenues. Transactions associated with the Real Estate Transfer Tax for September’s report, which were based on August collections, dropped 3.0 percent from last year, while transaction values were 7.1 percent higher. The first quarter’s revenues from the Tobacco Tax, which is likely to be a declining revenue source in the long term, were $2.8 million (5.0 percent) higher than those from the first quarter of last year, but were $1.2 million (2.0 percent) below plan. After a surprisingly robust first two months of receipts, the Communications Services Tax fell to levels below last year’s receipts and matched plan for the first quarter. The Insurance Premium Tax and the Interest and Dividend Tax performed above plan and last year’s receipts overall, and transfers from the Liquor Commission were above last year’s revenue-to-date but below plan for the first three months of SFY 2018.

The Education Trust Fund received a boost from Lottery Commission revenues, which were $3.4 million (27.9 percent) above plan and $2.6 million (20.0 percent) above last year for the first quarter due to a large jackpot prize in August driving ticket sales. However, the higher-than-anticipated revenue in August from increased Utility Property Tax receipts resulted in lower September receipts, leaving revenues just $0.1 million (1.0 percent) above plan for this source in the first quarter.

As legislators craft bills for the next legislative session, the revenue surplus amount will be a key figure in determining which new initiatives, if any, can be paid for without finding additional revenue or diverting revenue from other programs. Other revenue uncertainties, such as those associated with Keno gaming legalization, also potentially limit the use of surplus dollars for new initiatives. For more information on the State’s revenue sources, see NHFPI’s Revenue in Review resource.