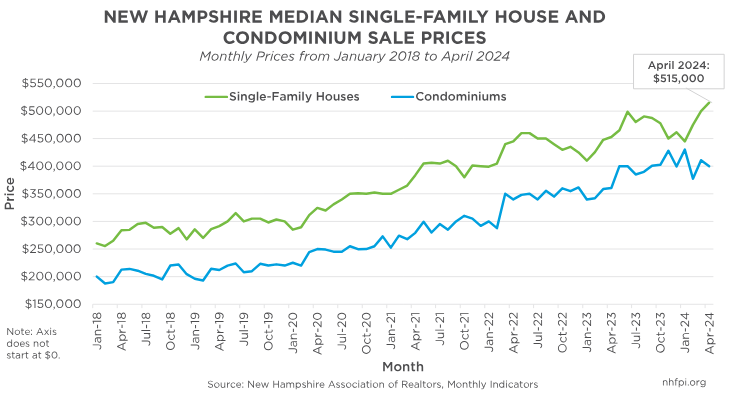

Rising housing costs, combined with diminished inventory, create barriers to adequate housing for both homeowners and renters across the Granite State. The median sale price for a single-family house reached a record $515,000 in preliminary data for April 2024, with prices for condominiums slightly decreasing to $400,000. These rising costs and declines of housing inventory contribute to the lack of affordable housing available for individuals and families across the state. Problems facing New Hampshire’s potential homeowners also have negative impacts for renters, particularly among renters with low incomes who are more likely to be cost-burdened by increased prices and less likely to be able to transition to the market for purchasing a home.

Increased Prices for Homebuyers

According to data from the New Hampshire Association of Realtors (NHAR), the median sale price of a single-family house rose to $515,000 in April 2024, a small increase from the revised median price of $499,950 for March 2024. Single-family house prices typically increase during the Spring and Summer months. However, prices have also increased rapidly on a long-term basis, rising by 80.3 percent between the median price of $269,000 for the first four months of 2018 and the median price of $485,000 for the first four months of 2024. The average 30-year fixed rate mortgage for April 2024 was 6.99 percent, and the average 2023 property tax rate across New Hampshire’s cities and towns would result in an annual property tax of $9,439, if it were taxed based on the April 2024 median sale price. Using these figures and a 5 percent down payment of $25,750, a homebuyer would need to pay a monthly mortgage of $4,039 to afford this median-priced house, not inclusive of homeowner’s insurance or private mortgage insurance. Based on the most recently available data from the U.S. Census Bureau, a household would need to spend nearly 54 percent of its monthly income ($7,499 was the median monthly household income estimate for 2022) in order to keep up with mortgage and property tax payments.

While monthly data can be more volatile, condominium prices are also higher thus far in 2024 compared to previous years. The median price of a condominium was $400,001 for the first four months of 2024, a 50.3 percent increase from the median price of $199,000 for the first four months of 2018; this was a larger percent increase than for single-family houses during that same time period (80.3 percent).

New Hampshire’s rising housing prices have surpassed those of neighboring New England states. According to the Maine Association of Realtors, Maine’s prices were lower than New Hampshire in March 2024, with a median price of $380,000 for a single-family house in Maine compared to New Hampshire’s $499,950 for that month. The median price of a single-family house in Vermont was $376,000 in March 2024, according to current data from the Vermont Association of Realtors lower than comparable prices in both Maine and New Hampshire. Although New Hampshire single-family house prices remain lower than Massachusetts, prices have grown slightly faster in the Granite State. In March 2023, the median price of a single-family house in New Hampshire was $447,900, and the price increased by 11.6 percent to $499,950 in March 2024; in Massachusetts, the median price increased by 8.9 percent, from $560,000 in March 2023 to the most recently reported median price of $610,000 in March 2024.

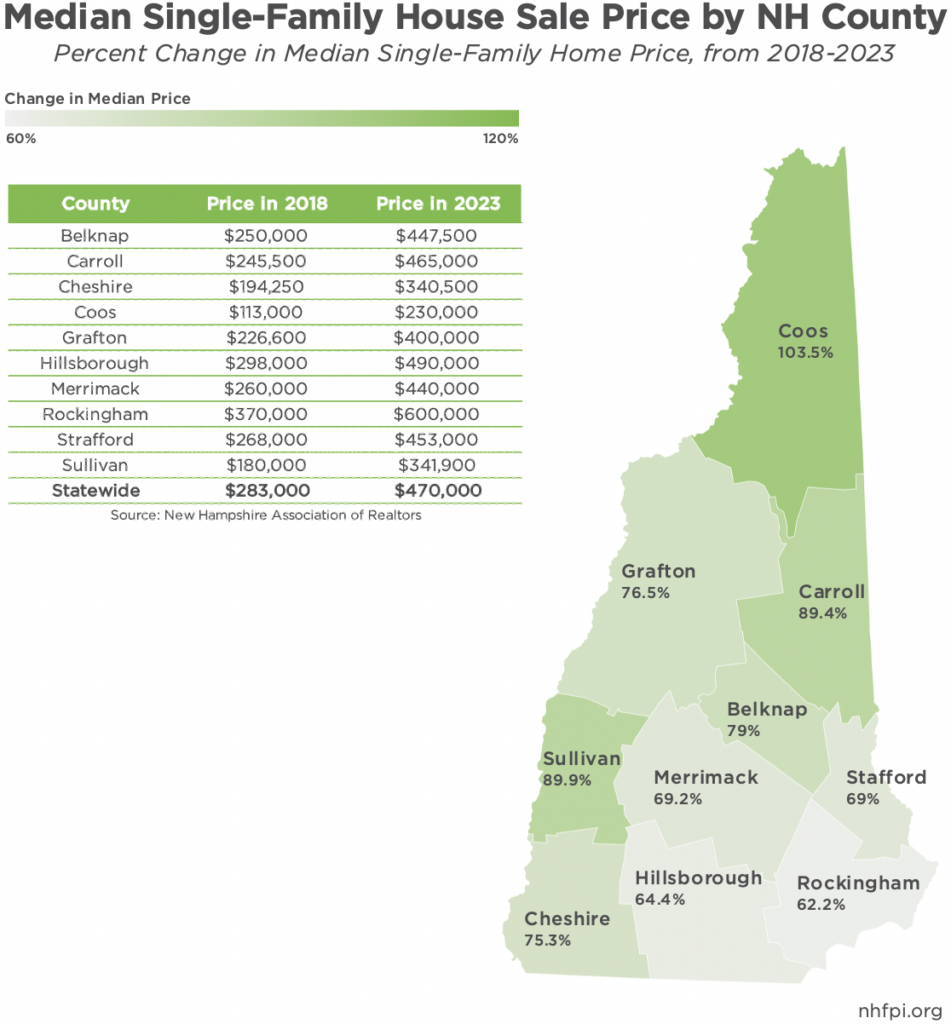

Housing prices differ greatly between New Hampshire counties. In 2023, the median sale prices for single-family houses were highest in Rockingham, Hillsborough, and Carroll Counties, reaching $600,000, $490,000, and $465,000, respectively. While only Coos, Sullivan, and Cheshire Counties experienced median prices under $400,000 in 2023, these counties also had some of the largest percent increases compared to 2018; Coos County median single-single family house prices rose from $113,000 to $230,000 (103.5 percent) between 2018 and 2023, while Sullivan County’s increased from $180,000 to $341,900 (89.9 percent) and the Cheshire County median price rose from $194,250 to $340,500 (75.3 percent). Rising housing prices in certain geographic areas impact where individuals and families are able to live, and can have implications for employment and educational opportunities, social supports, and other necessary resources.

Declining Inventory of Single-Family Houses

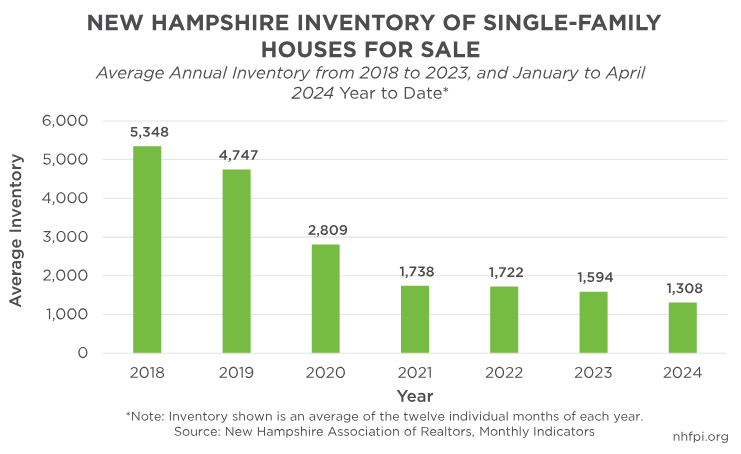

Rapidly increasing housing prices across the Granite State reflect the drastic decline in inventory for single-family houses on the market. According to NHAR, there were a total of 1,435 single-family houses on the market across the entire state in April 2024. While the monthly average of 1,308 houses for sale per month thus far this year is a small increase from the same period in 2023, the 2024 average to date is a 69.9 percent decline from the monthly average of 4,346 houses for the first four months of 2018. Overall, inventory has been on a steady decline on an annual basis since 2018, with the most substantial recent drop occurring between 2019 and 2020.

While inventory has steadily declined since 2018, the number of closed sales for single-family houses across the state rose slightly in 2019 and 2020 before declining again. According to NHAR, there were a total of 11,620 units sold in 2023, a 33.8 percent decline from a total of 17,555 units five years earlier. Rising mortgage interest rates have likely deterred individuals and families from selling their homes, and in turn, have led to declines in housing inventory and increases in prices. The construction of new homes also affects the amount of available inventory. The total number of housing permits issued has increased every year except two between 2011 and 2022, according to the most recent available data from the New Hampshire Department of Business and Economic Affairs. Permits for single-family houses slightly declined from 2,536 in 2021 to 2,495 in 2022, but the total number of units permitted, including multi-family housing construction, increased by an estimated 5,726 in 2022.

Rising Costs for Renters

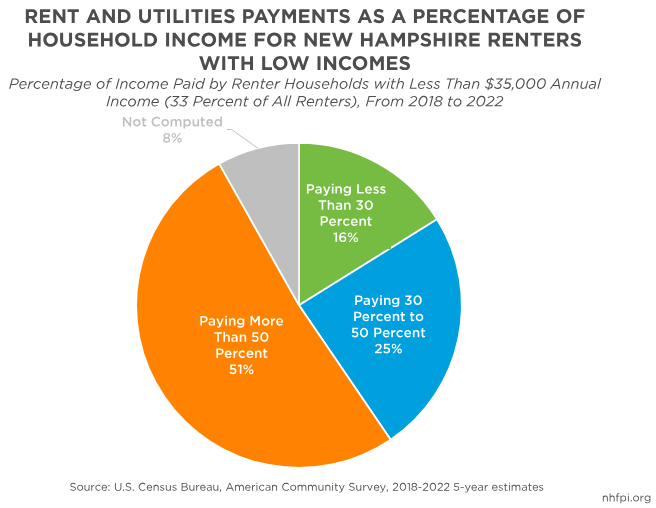

The rise in housing prices has increased costs for Granite State families who rent their homes. As of 2023, the median monthly rent and utilities cost for a two-bedroom apartment was $1,764. Using a simple but reliable measure, the U.S. Department of Housing and Urban Development has historically defined families paying more than 30 percent of their income for housing as “cost burdened.” Renters with incomes less than $35,000, or 33 percent of total renters across the state, are more likely to be cost burdened than renters overall in New Hampshire. According to U.S. Census Bureau data collected from 2018 to 2022, nearly half of New Hampshire renters are cost burdened, paying more than 30 percent of their income towards rent and utilities. Among Granite State renters who make less than $35,000 a year, slightly more than a half (51 percent) put more than 50 percent of their income towards rent and utilities. A quarter (25 percent) paid between 30 to 50 percent of their income towards housing costs, while only 16 percent paid less than 30 percent of their household income. Furthermore, eight percent of renters did not have calculated cost burdens due to there being an insufficient number of sample estimates. Increased rental costs leave diminished income for other necessary expenses, such as child care and health care services, and can negatively impact New Hampshire’s economy.

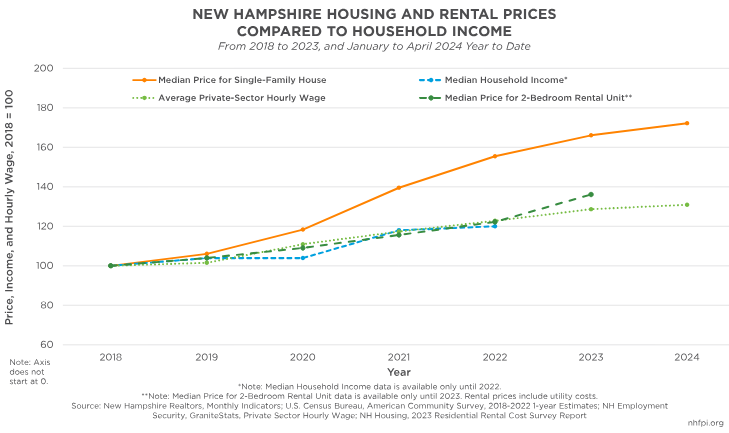

New Hampshire’s median household income and average wages have not kept up with rising housing costs across the state. According to the most recent data, the median household income in New Hampshire was about $90,000 in 2022, which was an increase of 20 percent from the median household income of about $75,000 in 2018. The median price of a single family house grew faster during this time period, from $283,000 in 2018 to $440,000 in 2022, a 55.5 percent increase. Wages have also not grown as quickly as housing prices have, likely making homeownership less achievable for individuals and families, particularly those with low and moderate incomes. From 2018 to 2023, the average private-sector hourly wage in New Hampshire grew by 28.7 percent, while the median monthly cost of rent and utilities for a two-bedroom apartment increased 36.1 percent. Although benchmark rental prices did not substantially outpace median household income or average wage growth between 2018 and 2022, individuals and families who rent their homes typically earn significantly lower incomes compared to homeowners in the state. As of 2022, the median household income for renters was about $56,000 while homeowner median income was approximately $108,000. Although rental prices may be affordable for households with higher-incomes making statewide median household income or more, nearly half of renter-households are cost burdened by rent and utilities.

Rising rental prices may have some association with increases in homelessness. According to the U.S. Government Accountability Office, a $100 per month increase in median rent was associated with a nine percent increase in the estimated rate of homelessness nationally during the 2012 to 2018 period. Point-in-time estimates, which are typically the most reliable measures for counting the number of individuals experiencing homelessness who are both sheltered and unsheltered, suggest that the number in the state increased from 1,605 to 2,441, or by about 52 percent, between 2022 and 2023; this increase is much larger than the 7.6 percent increase between 2021 and 2022.

Policy Actions and Implications

Recent COVID-19-related federal and State investments in housing have provided economic and financial relief for the thousands of Granite Staters who have been impacted by rising housing costs. As of December 2023, the State’s federally-funded Emergency Rental Assistance Program supported a total of 31,464 renters, providing an average of $10,542 to each approved applicant for rent, utilities, and other eligible household expenses. As of April 2024, the companion Homeowner Assistance Fund has provided $39.2 million to 3,212 homeowners to assist with mortgage, insurance, and property tax payments. In addition, the State’s InvestNH initiative, funded with $100 million of the flexible funds provided to the State from the federal American Rescue Plan Act and another $10 million in State funds, has provided capital grants to developers building multi-family residential units, support for the State’s Affordable Housing Fund, and grants to municipalities to incentivize the permitting of multifamily rental units, help update zoning rules, and aid in demolition of vacant or dilapidated buildings. The current State Budget also provided $25 million directly to the Affordable Housing Fund, $10 million for homelessness and housing shelter programs, and about $5 million for the Housing Champions Program to incentivize municipalities to make infrastructure upgrades to support workforce housing.

Despite these programs’ beneficial impacts, most of the federal funding associated with COVID-19 response legislation has already expired or will have to be committed to its final purpose soon. Further investments, such as increasing the construction of multi-unit houses and continuing to consider reforms to zoning laws to allow more housing density, could help boost the supply of housing. Moreover, increasing access into the Housing Choice Voucher (HCV) and HCV Homeownership Programs may help lessen the burden of housing costs for New Hampshire renters with low incomes. Such efforts to expand access to affordable housing across the state support Granite State families, workers, and the overall economy.

– Jessica Williams, Policy Analyst