On Thursday, February 13, 2025 the Governor released her Operating Budget Proposal and associated documents for the next two State Fiscal Years (SFYs), 2026 and 2027. This step kicks off the start of the most public phase of the State Budget process, as the House Finance Committee will begin to examine, and propose changes to, the Governor’s proposal. Not all documents have yet been made public in final form. Specifically, the Trailer Bill, which is the companion policy bill that moves through the State Budget process with the Operating Budget Bill, has only been published in draft form and may be incomplete.

Here are some key facts about the Governor’s budget proposal:

1. Increases in Total Budget Appropriations

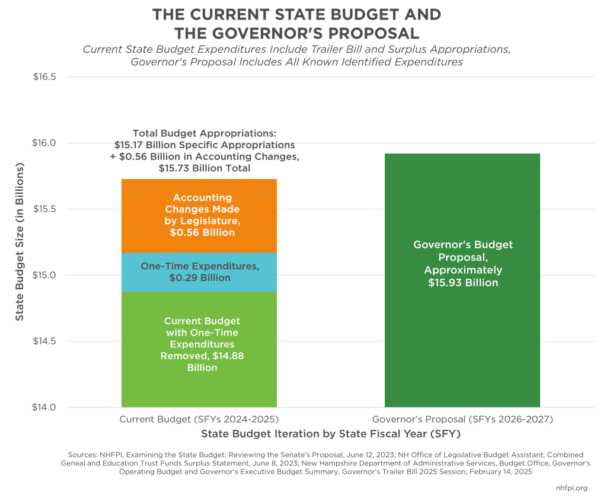

The Governor’s budget proposal would grow expenditures relative to the current State Budget. The State Budget approved by the Legislature and the Governor in June 2023 appropriated $15.17 billion to fund most State operations for the subsequent two years. The Governor’s budget proposal totals about $15.93 billion, based on all known and identifiable expenses and including expenses from all funds.

The comparison of these two-year budget totals is complicated by the inclusion or exclusion of specific funds in the accounting of the State Budget. The two bottom-line numbers grow by five percent, but the Legislature typically removes funds the Governor includes in the budget proposal, particularly federal funds that can be accepted during the budget biennium. Adjusting for funds moved off-budget by the Legislature in the current State Budget, the increase drops to 1.2 percent.

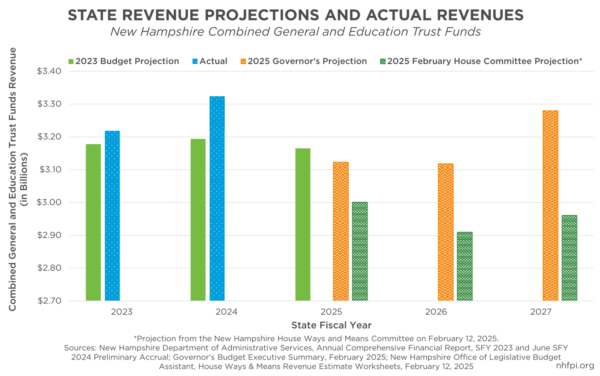

2. Revenue Projections and A New Revenue Source

The Governor proposed funding this increase in appropriations with a relatively optimistic revenue forecast and by adding a new revenue source for the State. The Governor projected that revenues to the combined General and Education Trust Funds in SFY 2026 would be about the same (0.2 percent lower) as revenues in SFY 2025, but that revenues would grow 5.2 percent in SFY 2027. Preliminary estimates from the House Ways and Means Committee are less optimistic, sliding 3.0 percent in the first year and growing 1.7 percent in SFY 2027. Revenue growth averaged 4.5 percent annually from SFYs 2015 to 2024, and averaged 2.5 percent annually from SFYs 2007 to 2024.

State revenues in the upcoming budget biennium have been reduced by the elimination of the Interest and Dividends Tax, which taxed income generated from wealth ownership, and recent revenues have fallen below expectations due to lower business tax receipts. The Governor projected this would be offset by rebounding business tax revenues, estimated growth of 8.0 percent in SFY 2026 and another 3.0 percent in SFY 2027. Other revenue sources would contribute to the Governor’s projected totals as well, including a 10.3 percent rise in Meals and Rentals Tax revenues between SFYs 2025 and 2027, a 16.6 percent increase in Real Estate Transfer Tax revenues, and a 24.1 percent increase in profits from the Liquor Commission flowing to the General Fund.

The Governor is also proposing the adoption of video lottery terminals to provide new funding to the General Fund and to the Education Trust Fund. The Legislature is currently considering two different bills that would legalize video lottery terminal gaming, and the Governor estimates it would generate $117 million in State revenue during SFY 2027.

3. Changes in Appropriations for State Agencies

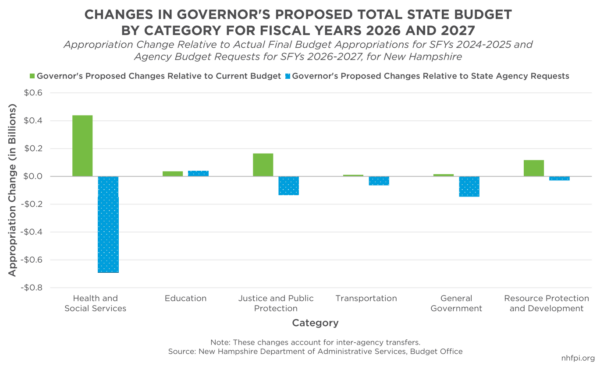

All State Budget appropriations are assigned to one of six expenditure categories.

The Health and Social Services category saw a proposed budget increase of about $440 million (6.7 percent) from the prior Budget biennium. Despite this increase, the Governor’s proposed budget fell $690 million below the amount requested by agencies in this category. Within the State’s Department of Health and Human Services, which comprises almost all of this category, the largest proposed increases between the adjusted authorized amount for SFY 2025 and the proposed amount for SFY 2026 included the Sununu Youth Service Center (47.8 percent), the Bureau of Informatics (35.8 percent), and the Bureau for Homeless Services (30.0 percent). The largest decreases between SFYs 2025 and 2026 were among the Bureaus for Children’s Behavioral Health (30.1 percent), Child Development (26.6 percent), and Public Health Protection (23.2 percent). The Veterans Home, separate from the Department of Health and Human Services, saw an increase of about $18.0 million (21.0 percent) from the prior biennium.

The Education category saw an overall proposed increase of around $40 million (1.0 percent), although not all agencies under this category experienced a proposed increase to their budgets from the previous biennium. The state’s Community College System saw proposed increases, while the University System experienced a decline. Among the state’s Department of Education, which funds public K-12 education, the Governor’s budget proposed a $48.1 million (1.6 percent) increase in total across both fiscal years of the biennium.

Among the category of Justice and Public Protection, the Governor proposed an increase of approximately $160 million (9.5 percent) from the prior State Budget biennium, which was the second largest monetary increase among the six categories. Among the proposed increases included the largest inclines for the Liquor Commission ($54.3 million, 30.2 percent) and the Department of Justice ($18.6 million, 19.1 percent). While the budgets for other departments under this category saw smaller increases or remained relatively flat, the only decrease was proposed for the Judicial Council ($6.7 million, 8.1 percent).

The smallest proposed increase among the categories was $10 million (0.7 percent) from the prior biennium for the Transportation category, which is comprised entirely of the Department of Transportation.

The Resource Protection and Development category experienced a proposed total increase of $120 million (13.5 percent), with the largest monetary increase reserved for the Department of Environmental Services ($99.1 million, 16.0 percent). Although the budgets for most departments under this category saw smaller increases, the largest decrease was among the state’s Department of Natural and Cultural Resources ($22 million, 14.4 percent).

The Budget’s smallest category, General Government, experienced a slight increase of $20 million (1.6 percent) from the prior biennium. The largest increased allocation was seen among the Retirement System ($38.0 million, 112.7 percent), with the largest decrease among the Department of Administrative Services ($46 million, 13.0 percent).

4. Targeted Investments Not Repeated from Prior Budget

As enacted, the current State Budget included about $292.9 million in expenditures that could be considered one-time appropriations. These appropriations included funding for planning a new State prison for men, water infrastructure grants to municipalities, information technology appropriations, and bridge and highway aid for local governments. Based on available information, most of these appropriations were not repeated in the Governor’s proposal, including any of the next steps in funding the new State prison or covering costs associated with Youth Development Center-related lawsuits and settlement costs facing the State.

Relative to the primary constraints on the state’s economy, the current State Budget included several one-time investments for housing initiatives, including $25 million towards the Affordable Housing Fund, $10 million for the InvestNH Fund, $10 million for homelessness and housing shelter programs, and $5.25 million for the Housing Champion Designation and Grant Program. The current State Budget also had a $15 million appropriation to support early child care and education professionals and providers, which also required the Department of Health and Human Services to request an ongoing appropriation.

One of the four previous housing investments has been repeated in the proposed 2026-2027 biennium, encompassing an additional $10 million for homelessness services to support increases in rates paid to shelter programs. While allocations have not been repeated, extensions were proposed for lapsing funds among the Housing Champions Program until June 30, 2026. Outside of these changes, other specific allocations for housing and early care and education do not appear to be repeated in the current Budget as proposed by the Governor.

While most housing investments in the current State Budget have not been repeated, the Governor proposed changes to the housing permitting process, requiring the State processes for new permit determinations to concluded within 60 days.

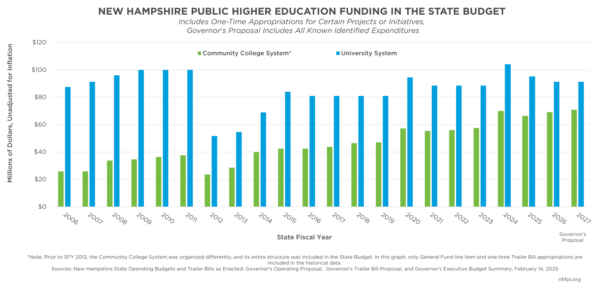

5. Funding Changes for Higher Education and Workforce Investments

New Hampshire’s labor force has not returned to its pre-pandemic size, and as of October 2024, there were approximately two jobs available for every one unemployed Granite Stater who was seeking work. The Governor’s proposed appropriations to New Hampshire’s public higher educational institutions may help address New Hampshire’s labor force shortage in some sectors.

The Governor’s proposed operating budget allocates approximately $140 million to the Community College System of New Hampshire (CCSNH) and $182.5 million to the University System of New Hampshire (USNH) over the biennium. The $140 million for CCSNH includes $6 million in funding allocated from the Education Trust Fund for continued investment in dual and concurrent enrollment programs for New Hampshire’s high school students in grades 10-12. The State Budget proposal would also provide funding for continued tuition freezes at New Hampshire’s seven community colleges and an expansion of career and technical training as well as workforce credentialing programing for in-demand jobs, according to the Governor’s Executive Budget Summary.

When compared to SFYs 2024-2025 appropriations, including one-time allocations, these changes represent a $4 million (2.9 percent) funding increase for CCSNH and a $16.5 million (8.3 percent) decrease for USNH across the budget biennium.

Stay Tuned

As more information becomes available, NHFPI will continue to unpack and update information about the Governor’s budget proposal and changes made by the Legislature. To learn more about the Governor’s budget proposal. Sign up for NHFPI’s Friday, February 21 webinar on the proposal at https://nhfpi.org/events/ and sign up for NHFPI’s email list at www.nhfpi.org/subscribe to get the latest research and analysis.

– Jess Williams, Nicole Heller, and Phil Sletten