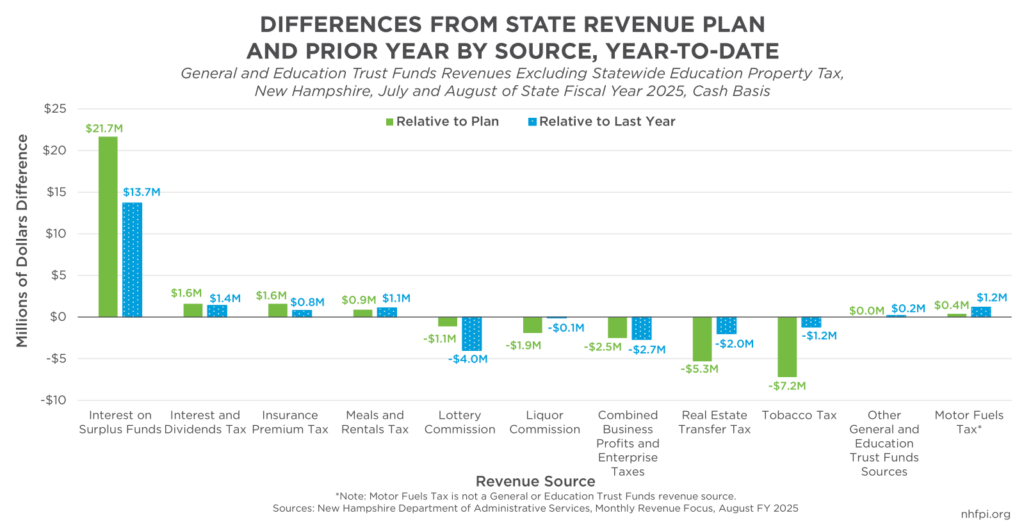

State revenues in August continued to rely on high interest rates and State cash holdings to generate a surplus relative to revenue targets planned for the State Budget. While some tax revenue sources, including the combined business taxes, matched or exceeded their revenue targets, others fell well behind expectations.

Interest on State cash holdings have generated $24.2 million so far in State Fiscal Year (SFY) 2025, which began on July 1, according to new State data. The State’s operating cash balance at the end of July was about $2.58 billion. Earned interest on the State’s cash holdings remained high due in part to elevated interest rates nationwide, which may start to decline depending in part on the actions of the U.S. Federal Reserve’s Federal Open Market Committee, which meets again on September 17.

Without this higher than anticipated return on State cash holdings, revenues would have fallen below the State Revenue Plan for the General and Education Trust Funds in August by about $10.4 million (7.4 percent), rather than adding $3.6 million (2.6 percent above planed amounts) to the surplus. Revenue to these two funds combined in August, including interest payments and all other reported revenue, was below last year’s August revenues by $1.4 million (1.0 percent).

Meals and Rentals Tax revenue, while higher than last year for SFY 2025 thus far due to favorable July receipts, fell below the State Revenue Plan by $1.7 million (4.7 percent) in August, reflecting lower taxable transactions than anticipated in July.

Real Estate Transfer Tax revenue was $3.1 million (6.2 percent) below August’s planned amount, although both the number of transactions and transaction values were up 8.8 percent and 11.2 percent from last year, respectively. Revenues from the Real Estate Transfer Tax are driven primarily by single-family house sales in New Hampshire, which have been constrained by the state’s housing shortage and resulted in declining revenues generated by this tax since 2022.

Of the State’s major tax revenue sources, revenue from the Tobacco Tax, a revenue source that has undergone a long-term decline and will likely continue to do so without adjustments, fell furthest behind its target amount for August. Receipts were $4.2 million (20.4 percent) below planned amounts, and $7.2 million (18.0 percent) below the State Revenue Plan for SFY 2025 thus far.

Combined business tax revenues from the Business Profits Tax and the Business Enterprise Tax were positive relative to the State Revenue Plan, despite falling behind expectations at the end of SFY 2024. While still below the State Revenue Plan targets for SFY 2025 so far, August receipts were $1.4 million (6.9 percent) above planned amounts. The combined business taxes were lower in SFY 2024 in part due to larger tax refunds paid to filers, which resulted from a State policy change limiting the dollars businesses can leave deposited with the State. Some of that refund-driven decline may be temporary, and if receipts continue to exceed plan rather than underperform after August, that might suggest refunds may decline again. Between December and July, business tax receipts subtracted from the revenue surplus every month except for April, a trend which suggests trouble ahead for State revenues overall. August is not a key month for business tax revenues, as the majority of revenue comes through quarterly estimates, and refunds remained higher this August than they did in August of last year; September receipts will provide key insights into the factors contributing to the behavior of the combined business taxes.

Collections continued to be higher from the Interest and Dividends Tax, as they were last year. This tax, which is scheduled to be repealed in 2025, collects revenue from income generated by wealth, such as dividends or distributions from stock or other business ownership, or interest earned on accumulated savings. Higher interest rates have helped increase Interest and Dividends Tax revenues, which generated the most revenue growth of any State tax revenue source last year. August is not a key month for revenues from this tax, but receipts were $1.2 million (109.1 percent) above plan in August and $1.6 million (88.9 percent) above the State Revenue Plan for SFY 2025 thus far.

A new analysis from Pew Charitable Trusts suggests that the majority of states have tax revenues below their 15-year growth trendlines, and inflation-adjusted tax collections were relatively stagnant for the first five months of calendar year 2024. While combined business tax receipts may show some potential recovery, New Hampshire State revenues face similar challenges, and remain in approximately the same condition as they did at the end of SFY 2024. Interest on State cash holdings generated the most revenue growth. This interest is likely a temporary revenue source, however, due to expected lower interest rates and reduced cash holdings in the future as one-time federal funds are spent. The Interest and Dividends Tax, the other source that generated higher than expected revenues for the state, will be repealed next year under current law. As these two revenue sources will likely be unable to sustain revenue growth into the next State Budget cycle, policymakers may face challenges funding the next State Budget if other revenue sources that had, up until recently, driven impressive revenue growth continue to fall behind expectations.

– Phil Sletten, Research Director