There are many things not yet known about Governor Sununu’s proposed budget. Although the Governor released his specific spending plan ahead of the February 15 deadline set in State law, he is not required to release the companion bill, commonly called House Bill 2 or the “Trailer Bill,” by the same deadline. This bill also requires the time and attention of the Office of Legislative Services, which transforms policy proposals into formal legislation. House Bill 2 will likely include more details regarding Governor Sununu’s proposed restructuring of two State agencies, targeted State aid for full-day kindergarten, and other policy initiatives not solely related to adding and subtracting funding from budget lines. The Governor’s line-by-line budget proposal, likely soon to be introduced into the Legislature as House Bill 1, reveals some key choices regarding the budget and sets up much of the coming discussion. (To learn more about the budget and the process of creating it, read our Building the Budget resource.)

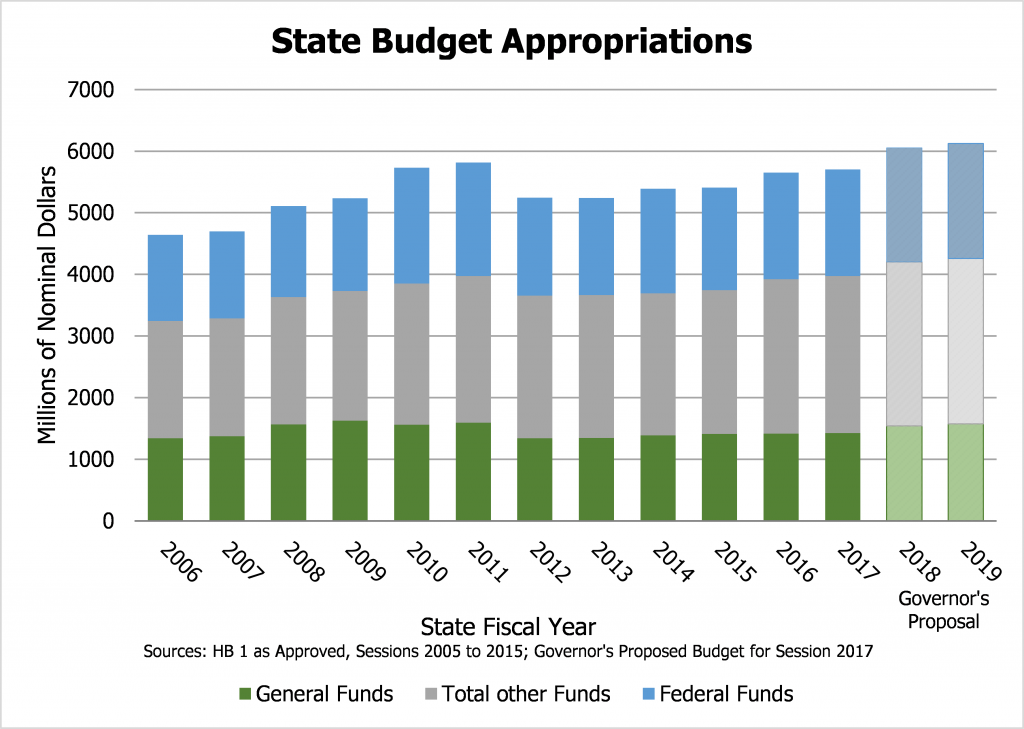

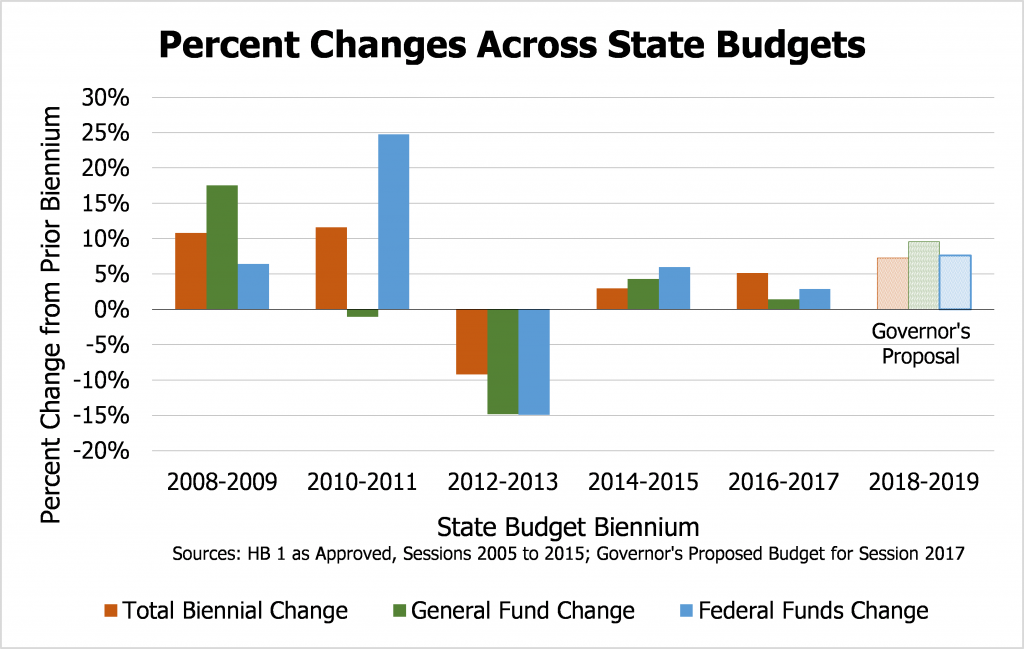

Looking at the top line numbers, Governor Sununu’s proposed plan to spend $12.179 billion over the next two State Fiscal Years (SFY, beginning July 1, 2017) continues a steady growth trend in nominal budgets, unadjusted for inflation or changes in the costs of delivering government services, seen since the SFYs 2012-2013 budget biennium. The overall budget, including spending from all sources of revenue, is nominally higher than the spending boosted by the influx of federal dollars in SFYs 2010-2011 following the Recession. In the Governor’s proposal, appropriations reliant on Federal Funds, or money transferred from the federal government through grants or matching programs, climb but remain just above 30 percent of all State budget funding. The General Fund, which receives most of its revenue from State taxes rather than fees, transfers, or dedicated funding sources, remains lower than in SFYs 2009 and 2011, but approximately $272 million higher in this biennial proposal than in the previous biennium’s final budget.

Growth, on a biennium-to-biennium basis, in proposed spending is slightly higher than the budgets that passed the Legislature in the last two budget cycles. Upward changes in revenue correlated with continued economic growth have benefited New Hampshire’s financial situation. While past budgets were acutely affected by the increased demand for services, decreased income from existing taxes, and policy choices made surrounding the Recession, the last two biennial budgets have shown moderate growth. Governor Sununu’s budget anticipates limited but continued revenue growth from modified existing sources (enabling General Fund growth) and growth in Federal Funds. Total growth in this proposed budget over the last biennium is 7.3 percent, with the portions in the General Fund and Federal Funds growing at faster rates (9.6 percent and 7.6 percent) than the budget as a whole.

This proposed appropriation growth does not incorporate all of the requests from State agencies. In the agency budget requests, State agencies included $12.3 billion in efficiency budget requests under the caps set by then-Governor Hassan and another $346 million in additional prioritized needs. Governor Sununu’s proposed budget falls $122 million short of the efficiency budget request, despite similar overall State tax revenue projections, and $467 million below the agency budget requests including the additional prioritized needs. Exactly how and why these dollars are shifted around between agencies and where efficiency budgets were trimmed will become clearer following more analysis and the release of House Bill 2.