New Hampshire’s single-family housing market is showing signs of cooling after years of record-breaking growth, though several counties continue to see sharp price increases.

NH home values nearly double since 2019

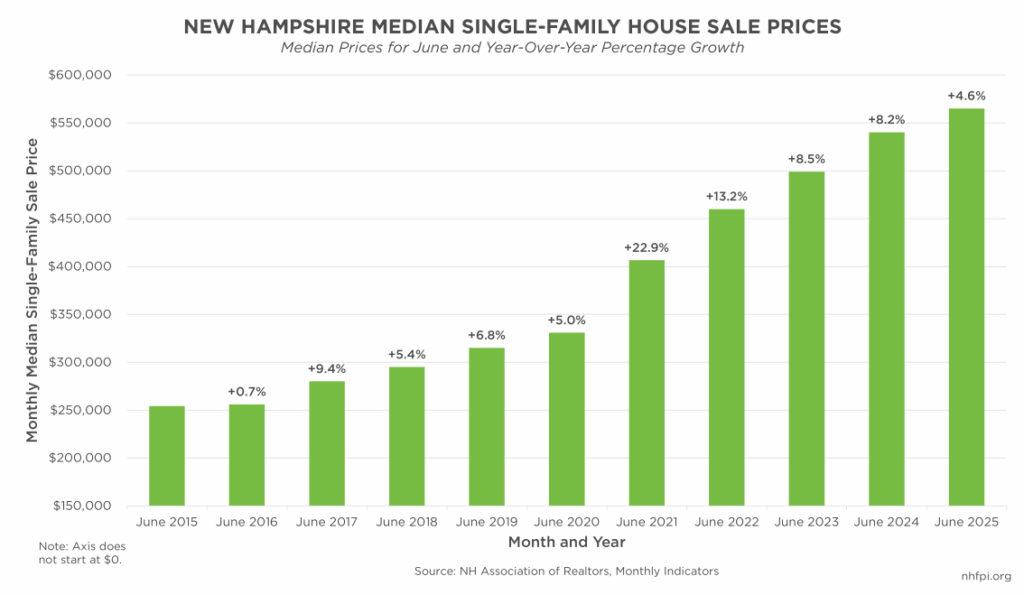

New Hampshire’s single-family housing market has experienced substantial growth over the past several years, with median prices reaching record highs since the start of the COVID-19 pandemic. According to recent market data from the New Hampshire Association of Realtors, the median cost of a single-family house rose to $565,000 in June 2025, a 79.4 percent increase from the same month in 2019. In comparison, the statewide median household income increased by 24.3 percent between 2019 and 2023, the most recent data available. While median prices historically peak in June, they remained elevated at $545,000 in July. Since March 2024, the median cost for purchasing a single-family house in the Granite State has consistently remained at or above half a million dollars.

While prices continue to rise, the pace of growth has slowed over the past year

From June 2024 to June 2025, the median price of a single-family house increased by 4.6 percent, which was the smallest year-over-year gain for June since 2016. In comparison, June 2020 to June 2021 saw a jump of 22.9 percent, a record for the past decade, and growth has topped 8 percent each June since then.

Low housing inventory and high interest rates have kept prices high, likely discouraging many Granite Staters from moving or purchasing homes. Slower price growth may reflect a gradual inventory increase. However, the monthly cost of owning a home continues to be elevated, as mortgage interest rates in 2025 remain higher than pandemic-era levels and are likely slowing both demand and ability to pay.

Housing price surge continues in some parts of the state

While increases in the median price of a single-family house have slowed statewide, not all counties and regions of New Hampshire have experienced the same stagnation.

The statewide median housing price increase masks major regional differences. Comparing the second quarters of 2024 to the same period in 2025:

- Grafton County saw a 12.4 percent increase, almost three times the statewide quarterly rate of 4.2 percent.

- Carroll (8.7 percent), Belknap (6.8 percent), and Cheshire (6.7 percent) also saw large housing price increases above the statewide rate.

- In contrast, Strafford (3.7 percent) and Merrimack (1.0 percent) Counties grew below the statewide rate.

- Coos (-9.2 percent), Sullivan (-6.9 percent), and Hillsborough Counties (-1.3 percent) were the only counties to see a decline in the median price of a single-family house between those quarters.

Rural counties have seen the fastest growth rates since the COVID-19 pandemic, a trend likely driven by remote work opportunities and retirees moving to the state. Although the southeastern counties still have the highest prices, in-migration, New Hampshire’s sole source of population growth since 2017, has likely increased demand in rural areas with limited housing stock.

Cooling prices won’t solve NH’s housing crunch

Despite slower price growth, high costs likely make purchasing a home unaffordable for many New Hampshire families. Using the June 2025 statewide median single-family house sale price of $565,000, an average 30-year mortgage interest rate of 6.82, the average property tax rate of $17.03 per $1,000 for 2024, and a five percent downpayment, a family purchasing a home in June 2025 would have a monthly mortgage payment of about $4,308. This was a 170.2 percent ($2,714) increase from the monthly mortgage payment of around $1,594 in June 2015, using the median sale price for that month, an average mortgage interest rate of 3.98, the average property tax rate of $20.95 per $1,000 for 2015, and a five percent downpayment.

New Hampshire’s housing market is showing signs of slowing after years of rapid price gains, but housing constraints continue, particularly in rural areas. With limited inventory, affordability challenges are likely to persist, placing continued strain on household budgets among Granite State families.

– Jess Williams, Policy Analyst