The next two-year State Budget will fund State-supported services in an uncertain financial and economic environment. Substantial decreases in State revenue due to policy changes and national business conditions create the potential for significant changes in programs and services. Those national conditions include slower growth in corporate profits nationwide, which had accelerated substantially in the years following the start of the COVID-19 pandemic. State policy choices have also substantially reduced revenue, including the elimination of the Interest and Dividends Tax in 2025 and the reductions in business tax rates from 2015 to 2023.[1]

Other key expenditures may impact the State’s fiscal stability in the next two years. The costs of delivering services generally increase over time with inflation. However, significant new costs associated with decades of alleged abuses of children in the State’s care at the former Youth Development Center and contracted agencies, potential changes made to State obligations related to education financing commitments and policy currently being considered by the State Supreme Court, funding a new State prison for men, and any changes to federal funding that reduce resources available for the State of New Hampshire or its residents could impact both budget calculations and service needs.

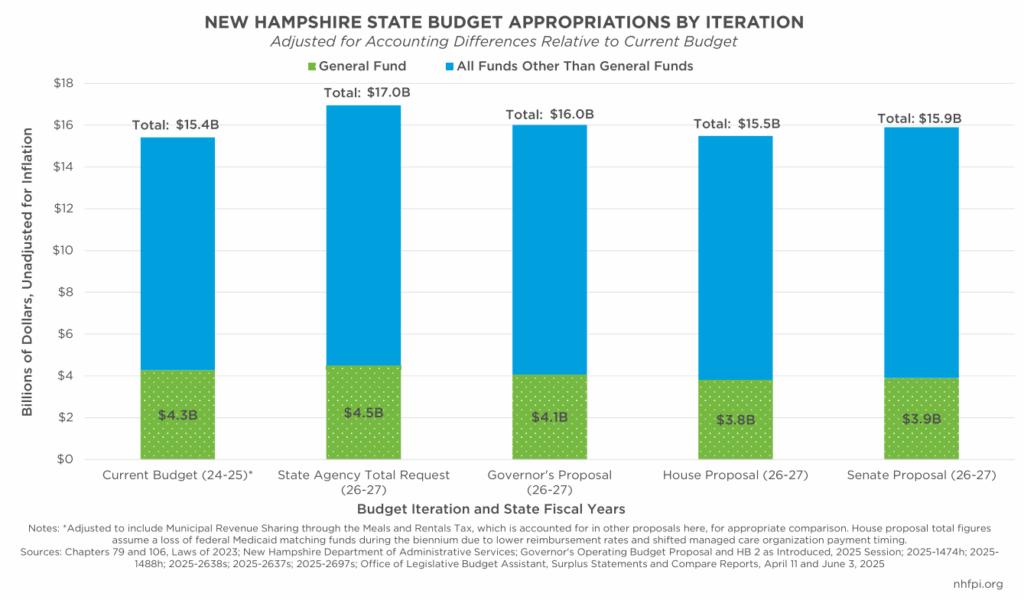

The New Hampshire State Senate’s version of the State Budget, crafted during the month of May and approved by the Senate on June 5, 2025, would appropriate approximately $15.9 billion. The Senate would make several key changes relative to the New Hampshire House’s $15.5 billion State Budget proposal that was passed by the House of Representatives on April 10, 2025. The Senate’s proposal for the next two State fiscal years would authorize the use of fewer resources for public services than the $16.0 billion Governor’s proposal from February 2025. The Senate and the House must reconcile the differences between their two budget proposals to produce a final version of the State Budget to be approved by the full Legislature.

This report examines the State Budget proposal as approved by the New Hampshire Senate on June 5, 2025. This report focuses on the changes between the House’s budget proposal and the Senate’s recommendations for the next two-year State Budget. It reviews topline figures associated with expenditures in the budget proposal, as well as expenditures and policy changes in each key policy area of the State Budget. This report examines proposed appropriations within each category of the State Budget, as well as for critical policy areas, such as housing and early care and education, that receive investments through the State Budget. This report follows two other reports that examined the differences between the current State Budget and the Governor’s proposal, as well as the differences between the Governor’s proposal and the House’s recommendations.[2]

Summary of Significant Changes Relative to the House's Proposal

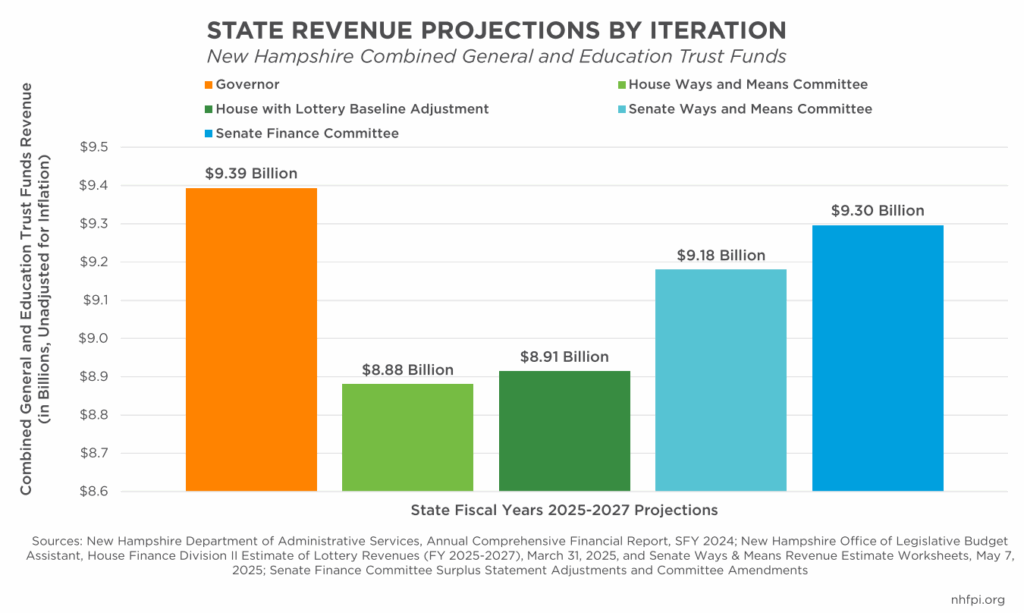

The Senate benefited from higher revenue projections than the House when constructing its budget proposal. The Senate Ways and Means Committee boosted projected revenues relative to the House by about $265.4 million, making that projection in early May and benefiting from more recent revenue data than the House had available for its February revenue projections. The Senate Finance Committee further revised revenue estimates for the biennium up by $116.7 million in late May, for a total increase of $382.1 million based on current revenue policy. As the House’s budget did, the Senate voted to increase revenues with changes to lottery and gaming policies, as well as fee increases, although the Senate’s versions of these revenue changes are not identical to the House’s proposal.

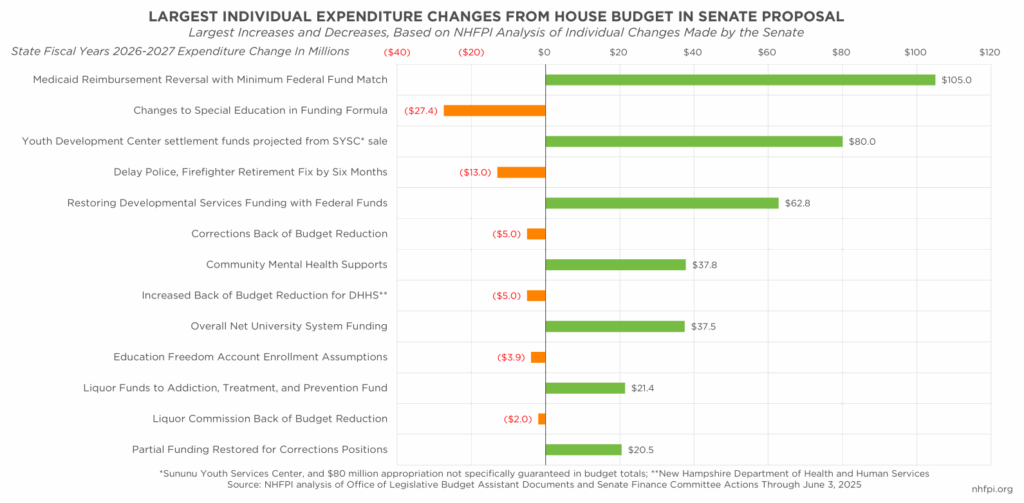

With these added revenues, the Senate made several key changes, including:

- Reversing the House’s proposed three percent Medicaid reimbursement rate reduction that would have impacted all providers, adding $52.5 million in State funds and at least an equivalent amount of federal funds back into the State Budget

- Increasing funding for developmental services back to the levels proposed by the Governor after a proposed reduction by the House, boosting funding by about $62.8 million in State and federal funds during the biennium, while also adding $10.0 million specifically for room and board supports for individuals with developmental disabilities

- Adding $37.8 million to community mental health supports, restoring levels to those proposed by the Governor after the House had proposed reducing those appropriations

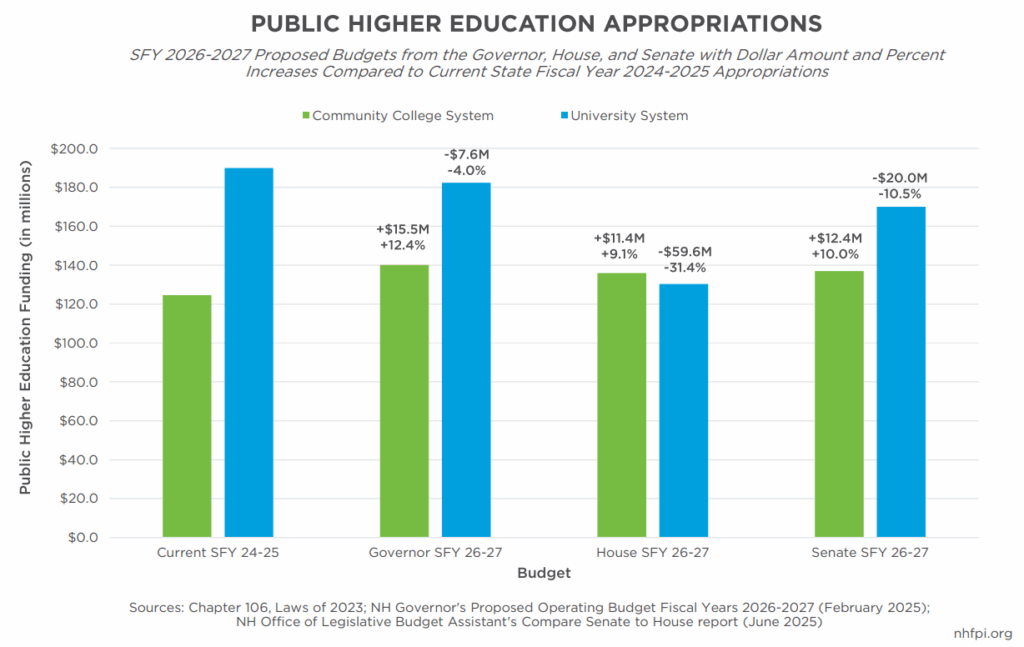

- Switching funding sources and boosting State General Fund support for the University System of New Hampshire, adding a net of $37.5 million to funding for the System relative to the House but falling short of the levels proposed by the Governor as well as current funding levels

- Projecting, although not specifically budgeting for and not guaranteeing through an obligation of State appropriations, that $80.0 million would be generated by the sale of the Sununu Youth Services Center building, and that those dollars would be deployed to fund Youth Development Center-related legal settlements

- Adding $21.4 million in funds directly from the Liquor Commission to a renamed Addiction, Treatment, and Prevention Fund, which is currently known as the New Hampshire Governor’s Commission on Alcohol and Other Drugs

- Restoring about $20.5 million of the $35.3 million in funding for the Department of Corrections that the House had proposed reducing relative to the Governor’s appropriations

The Senate, however, also reduced funding in some areas relative to the House. The Senate eliminated a proposed $27.4 million increase in aid to school districts based on the special education status of pupils in the district, and would also delay the added retirement system funding for certain police and firefighting personnel by six months relative to the House. The Senate would also add to the number of unspecified funding reductions, savings, or revenues that State officials would have to find within their budgets from $95.5 million, as proposed by the House, to a total of $107.7 million.

The Senate also removed several separate policy bills the House had attached to its version of the State Budget. The Senate added in separate policy bills, including new policies to support maternal mental health, a funding mechanism for the 988 suicide and crisis prevention lifeline, more organizational support for children’s behavioral health, and restrictions on the sale of land to certain foreign governments or agents in certain parts of the state.

These funding and policy changes, as well as others, are detailed in the remainder of this Report.

The Topline Changes and Expenditure Differences by Category

The Senate’s State Budget legislation proposes appropriations totaling a projected $15.9 billion across State Fiscal Years (SFYs) 2026 and 2027. This total includes approximately $3.89 billion in General Fund appropriations, which are the most flexible dollars available for State policymakers to allocate and depend on State-raised revenue.

Relative to the State Budget proposed by the New Hampshire House of Representatives on April 10, the Senate’s version would appropriate approximately $413.4 million more in all funds, and $81.4 million in General Fund dollars alone. The Senate’s budget proposes appropriating about $107.4 million less in total funds, and $176.4 million less in General Funds, than the Governor’s February budget proposal. The Senate’s budget proposal is $1.04 billion short of the total aggregate agency budget request for the biennium, including $611.6 million in General Fund appropriations less than State agencies requested.

Relative to the current State Budget and unadjusted for inflation, the Senate proposal would increase total appropriations by about $489.4 million, adjusted for accounting differences associated with the prior iteration of the State Budget pulling the Meals and Rentals Tax distribution to municipalities off-budget. The Senate’s version would appropriate $377.1 million less in General Funds than the current State Budget’s legislation did, including one-time appropriations. These figures are not adjusted for inflation, and the value of the dollar to fund public goods and services will likely have changed significantly from SFY 2024 through SFY 2027.

Changes by Category

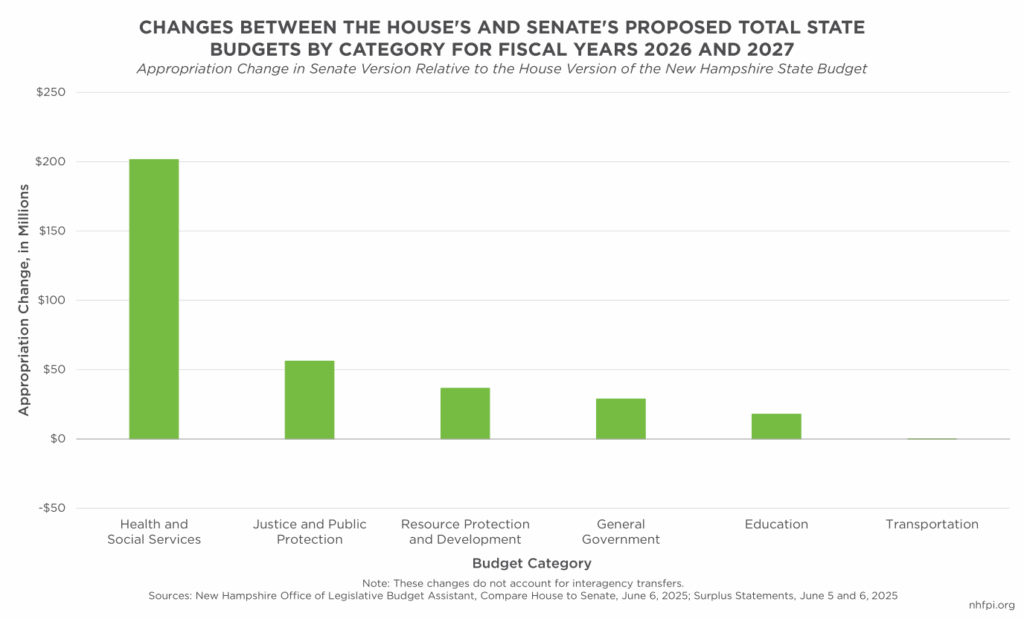

The State Budget divides all expenditures into six major categories, each representing a broad selection of departments and services. Shifts within these categories offer a general overview of changes in government spending. In order of funding size in the current New Hampshire State Budget, the categories are: Health and Social Services, Education, Justice and Public Protection, Transportation, Resource Protection and Development, and General Government.

The Senate’s largest proposed increase in funding relative to the House’s budget proposal would be in the Health and Social Services category. This increase is driven primarily by three significant changes the Senate made to the House’s proposed funding reductions included in the Governor’s proposal for three areas: Medicaid reimbursement rates, developmental services, and community mental health supports. However, a variety of other appropriations also contributed to this proposed relative increase from the House’s budget proposal.

The Senate also proposed increases in funding, relative to the House, for the Justice and Public Protection, Resource Protection and Development, General Government, and Education categories. Funding was trimmed, very slightly, in the Transportation category relative to the House’s version of the State Budget. The key components of these changes are detailed by category and State agency below.

Health and Social Services

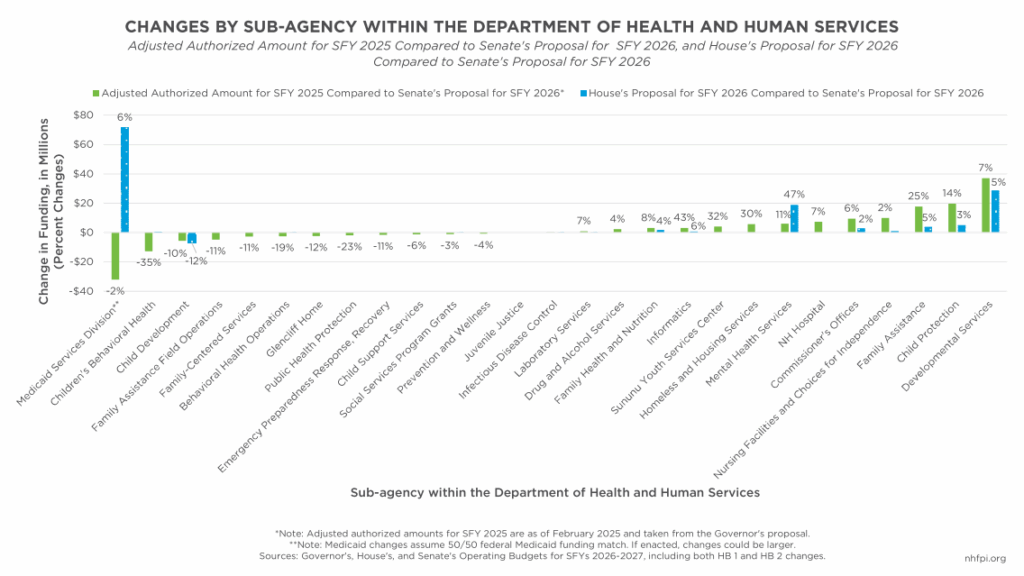

The Health and Social Services category of the State Budget is comprised almost entirely of the State Department of Health and Human Services (DHHS), which is responsible for several vital programs, including Medicaid, the Supplemental Nutrition Assistance Program (SNAP), the New Hampshire Child Care Scholarship Program (NHCCSP), child protection, public health services, and many other services.

Under the Senate’s State Budget proposal, funding increases supported several restored services compared to the House budget, as well as several newly established programs. In total, the DHHS would see a proposed increase of $220.1 million, including $141.5 million in General Funds, under the Senate’s proposal compared to the House’s proposal.

Medicaid Services

The largest monetary change included in the Senate’s budget relative to the House’s version was the repeal of the House’s proposed three percent Medicaid reimbursement rate reduction. This change would restore $52.5 million in General Funds for the biennium and at least equal amounts in federal funding to account for federal Medicaid match dollars relative to the House budget. This repeal restores Medicaid rates to the levels proposed by the Governor. As part of the SFYs 2024-2025 budget biennium, lawmakers had increased Medicaid rates by three percent for all service providers except hospitals, with higher targeted rates for certain services, including community mental health and long-term care.[3]

Included in its proposal, the Senate reinstated the use of Liquor Commission funds to support the Granite Advantage Health Care Trust Fund in the event of any funding shortfalls, while also removing the allowance of General Fund support for the Program, which was added by the House but is prohibited under current law.

While there were no identified changes in funding for services, the Senate approved the movement of $67.9 million between budget lines to reflect the recent agreement between hospitals and the State regarding the Medicaid Enhancement Tax (MET) and the portion of funds that hospitals receive back in Disproportionate Share Hospital (DSH) Payments to support uncompensated care.[4]

The Senate added three Senate Bills to its State Budget proposal regarding the State’s Medicaid program. The first, Senate Bill 134, requires the DHHS to resubmit a federal Medicaid waiver to institute work requirements already outlined in state statute from the last time New Hampshire implemented such requirements. This amendment would require adults in the Granite Advantage program to work or participate in an eligible community engagement activity at least 100 hours per month, higher than the 80 hours proposed under Medicaid work requirements in the U.S. House of Representatives’ budget reconciliation bill.[5] The Senate also added Senate Bill 135, which requires the DHHS to annually set cost-reflective rate parity for Medicaid managed care services and allocates $2.3 million during SFY 2027 to establish those payment rates. Thirdly, the Senate attached Senate Bill 137, which requires the DHHS to establish an administrative day rate to cover hospital stays for Medicaid patients who no longer need acute care but cannot be discharged due to a lack of available placement; this amendment would also include Medicaid-funded hospital stays for postpartum mothers staying with substance-exposed newborns.

The Senate approved moving the implementation of the House’s proposed Medicaid incentive program from 30 days to 120 days in its version of the State Budget passage; this program would require managed care organizations to encourage Medicaid enrollees to seek the lowest cost outpatient procedure care when clinically appropriate.

In its budget proposal, the Senate added language requiring Medicaid to cover biomarker testing, while also removing the House’s proposed language prohibiting Medicaid from covering circumcisions.

Finally, the Senate allocated $3.8 million to the DHHS Division of Economic Stability to support a tier-one call center to process Medicaid eligibility determinations.

Copayment Requirements for Medicaid Enrollees

The Senate proposed changes to Medicaid premiums for the Granite Advantage Health Care Program and Children’s Health Insurance Program (CHIP) that were established in the Governor’s proposal and carried forward by the House. As established by the Governor and retained by the Senate, premiums would be required for Granite Advantage adults with incomes above the federal poverty guidelines (FPG), or $15,650 for a household of one, and for CHIP households with incomes above 255 percent FPG, or $53,933 for a household of two.[6]

Under the Senate’s changes, both Granite Advantage and CHIP premiums would be determined based on fixed dollar amounts, rather than a percentage of income as introduced in past proposals. Among the Granite Advantage program, premiums would be $60 per month for a household of one, $80 for two, $90 for three, and $100 for four or more during the second year of the biennium. For CHIP, families would be expected to pay higher premiums: $190 for a household of two, $230 for three, and $270 for four or more.

The Senate also added brief language to their Trailer Bill requiring the DHHS to establish hardship criteria around the administration of premiums, although they did not identify what those criteria would entail. All administrative changes to the State’s Medicaid program, such as who would be responsible for collecting premiums from beneficiaries, require Medicaid State Plan amendments and federal Medicaid waivers; these would still be required to be filed by January 1, 2026 for CHIP and by July 1, 2026 for Granite Advantage.

The Senate estimates that $5.0 million will be collected through Granite Advantage premiums during SFY 2027, which is $7.0 million less than the $12.0 million estimated by the Governor and House for their versions of the premiums. The Senate retained the same CHIP premium revenue estimates as proposed in prior iterations of the budget, totaling $3.3 million in SFY 2026 and $11.0 million in SFY 2027.

Developmental and Acquired Brain Disorder Services

Another significant monetary change from the House’s budget included in the Senate’s proposal was the restoration of funding for developmental disability Medicaid waiver services to the Governor’s proposed amount, adding $62.8 million in combined federal and General Funds across the biennium. This allocation primarily supports the State’s waitlist for new developmental disability services, including children aging out of school-based services, people moving into the state who would require supports, as well as anyone currently receiving services who may require enhanced or additional aid during the upcoming biennium.

In its State Budget proposal, the Senate included language allowing funding towards the developmental disability pilot program to lapse on June 30, 2025, which was reportedly an estimated $2.0 million out of an original $2.8 million appropriation from 2022; to help fill the gap resulting from lapsed funding, the Senate proposed $1.0 million towards the pilot program for the upcoming biennium.[7]

While no other changes were proposed for developmental disability services, the Senate retained unique organizational footnotes first proposed in the Governor’s State Budget and maintained by the House. These additions allow for the carryforward of unspent funds up to $30 million in SFY 2026 and $50 million in SFY 2027, likely to be matched with federal Medicaid dollars, to help ensure there is no waitlist for services. The DHHS would also be allowed to request additional funds through the Joint Legislative Fiscal Committee in the event of any funding shortfalls under the Senate’s budget.

Older Adults and Adults with Physical Disabilities

The Senate proposed several new allocations to support services for older adults and people with disabilities, including Medicaid-funded nursing facility care and the Choices for Independence (CFI) Medicaid Waiver program, which provides home- and community-based care to support independent living.

Under its proposal, the Senate allows for the carryforward of $10.0 million in unspent funds from SFY 2025 to support additional funding for community-based residential services for people with disabilities. This allocation was included in the DHHS’ agency budget request following the establishment of a Room and Board payment calculation in SFY 2024 to help ensure full funding for residential services.[8]

The Senate also allocated $3.0 million to support faster turnarounds for the backlog of Medicaid long-term care eligibility determinations. To help support this added allocation, the Senate temporarily increased annual nursing home licensing fees for the upcoming biennium only.

The Senate proposed several smaller appropriations to support services for older adults and people with disabilities. These included:

- $700,000 to fund congregate housing under the Medicaid waiver program

- $550,000 to establish 50 guardianship slots for individuals released from hospital settings who are legally incapacitated and require help making decisions around hospital discharge

- $211,718 to institute two percent rate increases each year of the upcoming biennium to support Medicaid-funded intermediate care for children with disabilities

- $200,000 to increase funding for the Alzheimer’s Disease and Related Dementias (ADRD) caregiver grant program

Finally, the Senate established a committee to study the potential integration of Medicaid-funded long-term care into the managed care system, with a report required to be submitted by the committee by October 1, 2025.

Mental Health and Substance Use Disorder Funding

A third significant monetary change proposed by the Senate included a $37.8 million allocation across the biennium to support the community mental health system, reversing a proposed reduction in the House budget and restoring allocations to a total amount of $50.4 million each year as proposed by the Governor. These additions help support non-Medicaid contracts within community mental health supports, as well as add back $10.0 million to support uncompensated care as included in the Governor’s proposal. Funding for community mental health supports several critical services, including supportive and transitional housing, rapid response and mobile crisis services, and the 988 hotline and other suicide prevention initiatives. The restoration of funding also helps the DHHS continue its efforts around the Mission Zero initiative, which seeks to eliminate psychiatric boarding in hospital emergency rooms and decrease wait times for people accessing services.

The Senate also reinstated the annual five percent transfer of dollars from the Liquor Commission’s revenues to support the Governor’s Commission on Alcohol and Other Drugs, reducing available General Funds to be used for other purposes by $21.4 million across the biennium. This funding transfer is deposited into the Alcohol Abuse Prevention and Treatment Fund, which the Senate renamed as the Addiction, Treatment, and Prevention Fund; this change would provide more flexibility for the Fund to accept and use Opioid Abatement Funds, a more restrictive form of revenue, in the future.

Separately, the Senate restored funding for two behavioral health-related programs that were eliminated under the House’s proposal. These include full funding of $400,000 across the biennium for the Friends of Aine peer grief support program and partial funding of $300,000 for the Choose Love Program, which provides socio-emotional learning for youth in schools across the state.

Finally, while no new appropriations were made compared to earlier iterations of the State Budget, the Senate extended lapsing funds for the Recovery Friendly Workplace Initiative.

Mental and Behavioral Health Initiatives

The Senate added two Senate Bills to its State Budget proposal regarding mental health. The first, Senate Bill 255, establishes a 988 Trust Fund to collect telecommunication surcharges to support the hotline, with an estimated $15 million in surcharge revenue to be collected across the upcoming biennium. The 988 Trust Fund would be overseen by the Behavioral Health Crisis Services Advisory Commission, with funding available to support staffing and training at call centers, infrastructure adjustments for the call center system, and data reporting across services, among other 988 supports.

The Senate also added Senate Bill 128, which establishes a Children’s Behavioral Health Association to coordinate mental health services for children under age 19 who are not covered through Medicaid, to its version of the State Budget. This Association would be funded through annual assessments collected from private insurers, generating an estimated $5 million in assessment revenue during the upcoming biennium.

Senate Bill 246, or “Momnibus 2.0,” was added to the Senate’s budget to help address needs resulting from the closure of labor and delivery units across the state and create necessary perinatal mental health supports for Granite State women. This maternal health package includes allocations of $150,000 for rural maternal health Emergency Medical Services training and $30,000 to support a study on reducing barriers and examining sustainability for independent birth centers. Additionally, insurance can opt to waive copays for mental health and substance use treatment for perinatal patients. The perinatal care and supports portion of this package also requires:

- Depression screens during well-child visits for pregnant or postpartum patients to be covered by private insurance and Medicaid

- Home visiting services during pregnancy and up to 12 months postpartum are to be covered by commercial insurance plans

- The creation of a perinatal psychiatric provider consult line in statute starting SFY 2028

- The DHHS will examine the development of a perinatal peer support certification program

- Employee protection for unpaid time off to attend up to 25 hours of postpartum care and pediatric appointments during the infant’s first year of life for employers with 20 or more employees

Public Health Services

The Senate restored partial funding for the Family Planning Program, which provides low- to no-cost preventive and reproductive health care to approximately 2,500 people annually at health centers across the state. The House had proposed defunding this program entirely. The Senate’s allocation of $1.0 million in General Funds across the biennium was $700,000 less than the $1.7 million proposed by the Governor, although all related federal funding ($2.0 million) for the program would be restored with the Senate’s change.

The Senate made two key changes for the State Loan Repayment Program (SLRP), which helps to recruit and retain health professionals to commit to working in rural or medically underserved areas in New Hampshire. The Senate’s proposal reverses the House’s proposal by allowing new participants to enter into the program during the upcoming biennium if General Funds are not used to support those new applicants. Through testimony to the Senate Finance Committee, the DHHS identified additional federal funding available to support the SLRP; the Senate’s change would likely allow for the use of those funds. The Senate also added a component of Senate Bill 244, appropriating $500,000 across the biennium to support a newly established Family Medicine Residency Program to recruit and train family physicians in the state’s North Country.

The Senate’s proposal allocates available federal funds to account for about $81.3 million in COVID-19 pandemic-related funding that was abruptly terminated by the federal government in March 2025. The total allocation of $1.9 million across the biennium would support various permanent and temporary positions within the Epidemiology and Laboratory Capacity (ELC) Program, the immunization program, and other public health infrastructure.[9]

While General Funds were not restored, the Senate allocated $1 towards the Tobacco Prevention and Cessation Program to maintain the program’s statutory status in case funds become available at a later date. The DHHS has identified that federal funds for the Tobacco Prevention and Cessation Program are not likely to be available in the future due to federal changes; $2.3 million in federal funds have been proposed and retained for the biennium.

Sununu Youth Services Center

Funding for the Sununu Youth Services Center (SYSC) remained the same between the House’s and Senate’s proposals, although funding did decline from the Governor’s State Budget. The Senate retained the House’s allocation of $33.6 million across the biennium, $4.9 million (13.0 percent) lower than the $37.8 million proposed by the Governor.

While no new funds were allocated, the Senate’s proposal allows for the use of General Funds to support the construction of the new SYSC replacement facility as long as appropriations are approved by the Joint Legislative Fiscal Committee. Under current law, only federal funds can be used for this purpose.

Finally, the Senate called for the sale of the SYSC during the biennium, with an estimated $80.0 million of sale revenue to be deposited into the Youth Development Center (YDC) Settlement Fund in SFY 2027. However, these funds were not specifically budgeted in total, as final revenues would be dependent on the sale price.

Youth and Family Services

The Senate’s budget reinstates the Office of the Child Advocate, which would be eliminated under the House’s budget, and restores approximately $1.6 million in funding for the office. The restored funds would result in four positions being abolished, rather than the nine proposed to be eliminated in the House’s version of the budget. Language was added that would affect the functioning of the Office, including:

- Language clarifying that there should be non-partisanship in oversight duties

- A nomination process that involves a nomination by the Governor and approval by the Executive Council, rather than a gubernatorial appointment without Council approval

- Requiring approval for out-of-state travel by the Joint Legislative Fiscal Committee, except travel that is required to ensure children are receiving appropriate services

- Limiting the Office’s access to children’s files for investigations to include only those involved with the State’s Division of Children, Youth and Families or who are in residential treatment facilities in the state

The Senate added the development of an Adverse Childhood Experiences (ACEs) Prevention and Treatment Program. ACEs can include physical, emotional, or sexual abuse, neglect, witnessing violence, experiencing homelessness, food insecurity, and household instability. According to the U.S. Centers for Disease Control, there is evidence to suggest that ACEs can contribute to chronic physical and mental health conditions across the lifespan.[10] Over the biennium, the Senate allocated $300,000 to support children born through age six who have experienced ACEs or other “severe emotional disturbances” through:

- Increases in Medicaid reimbursement for early childhood mental health care

- Increased salary levels or reimbursement rates for individuals with an early childhood and family mental health credential

- Funding for training and professional development in early childhood mental health care

- Creation of a five-year plan by DHHS to increase state workforce capacity

While it did not increase funding, the Senate approved the movement of $5.0 million from SFY 2027 to SFY 2026 to support youth residential placements, following a ten percent reduction for these placements as proposed by the House.

The Senate also reversed the House’s repeal of the foster grandparent program and suspended the program for the upcoming biennium only.

Other Proposed Changes Impacting Health and Social Services

The Senate proposed two key changes around services for Granite Staters experiencing food insecurity, including a $30,000 allocation towards the WIC Farmer’s Market Nutrition Program, which would be defunded by the House’s budget proposal, as well as $105,000 to support two positions to administer the newly established Summer Electronic Benefits Transfer (EBT) Program.

Finally, the Senate repealed the Prescription Drug Affordability Board (PDAB) in its entirety and retained the House’s position to eliminate all funds for the PDAB. Established in 2020, the PDAB was formed to help find prescription cost savings for public payers, while also ensuring that providers can still access the prescriptions they need to treat their patients.[11] While it has been eliminated, the Senate retained $2.5 million in generated revenue from prescription drug cost savings in SFY 2027, resulting from recommendations given by the PDAB.

Education

The Senate’s budget proposal includes a significant increase in funding for the University System of New Hampshire relative to the House’s version of the State Budget. The Senate also proposed curtailing a House-proposed change to the education funding formula that would have increased funding to school districts with more pupils with special education needs, as well as added requirements for obtaining permission for certain uses of federal funds for child care workforce supports.

Early Care and Education

The Senate’s budget modifies language from Senate Bill 243 to help remedy several challenges related to the New Hampshire Child Care Scholarship Program (NHCCSP), the state-federal partnership that provides subsidies to assist with child care for families with low and moderate incomes. The Senate allocated $100,000 to support a study on the child care scholarship application process, examining ways to simplify and improve the application process for families. The funding allocation is also intended to help address the following changes to the program:

- Removing requirements for providers to report hourly attendance

- Providing scholarship payments to providers before the start of the care period

- A presumptive eligibility two-year pilot program that would allow families to enroll in child care with a scholarship while their applications are still being processed by the State

The Senate kept a $15.0 million allocation in the State Budget for child care workforce grants that would be entirely funded through federal Temporary Assistance for Needy Families (TANF) reserve funding. These grants were established during the current budget cycle to support child care providers in recruiting and retaining a robust early care and education workforce, which is currently in short supply. The Senate added language that would require the New Hampshire DHHS to seek approval from the federal Department of Health and Human Services to use the federal TANF reserve funds for this purpose by August 1, 2025, and, if necessary, complete any required waivers to utilize the funds for the child care workforce grants.

K-12 Education

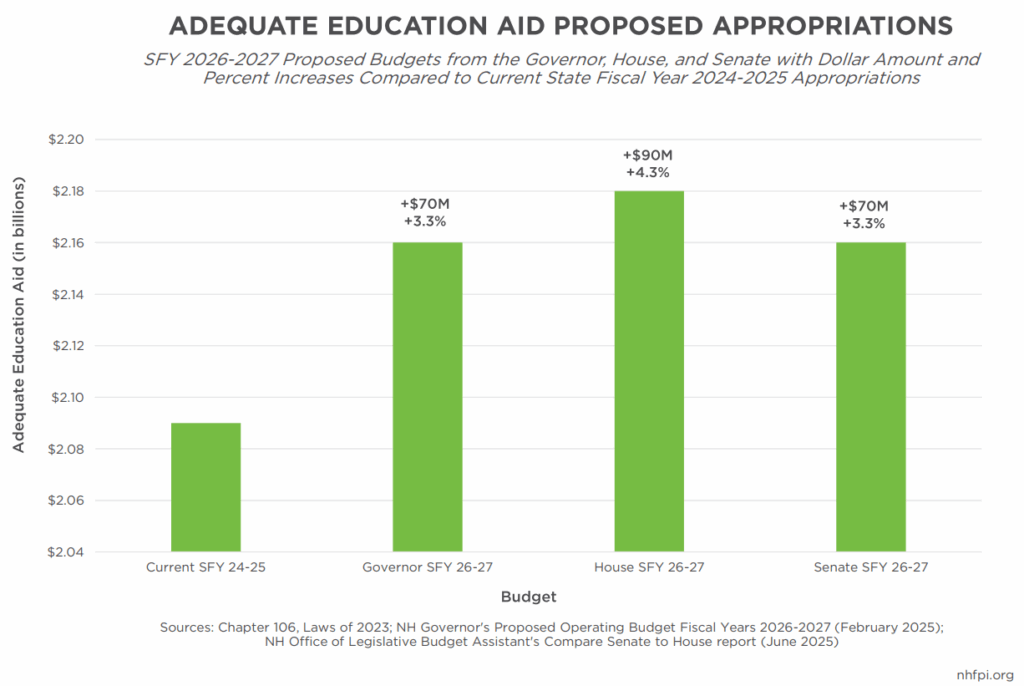

The Senate’s budget proposed an adjustment to the House’s version of the adequate education grants. The Senate retained current and House policy for the base per student grant ($4,351) and the differential aid adjustments for students eligible for free and reduced-price meals ($2,441), as well as for those who are English language learners ($849). However, the Senate reduced the amount for students receiving special education services by approximately $900 dollars relative to the House’s proposal by reverting to current policy, likely reflecting the continued 2 percent per year increase ($2,229).

The Senate also added nearly $7.6 million in anticipated federal grant funding from various sources including Safe and Supportive Schools, State Opioid Response, and Team Nutrition Training. Additionally, $3.0 million was appropriated from the Education Trust Fund over the biennium toward “…a learning platform that provides high-quality instructional materials across all content areas to ensure all K-12 students [in New Hampshire] have access to evidence-based and content-rich learning outcomes.” The Senate also amended the State Budget to provide additional state funding for adult education programs for certain students for $800,000 over the biennium.

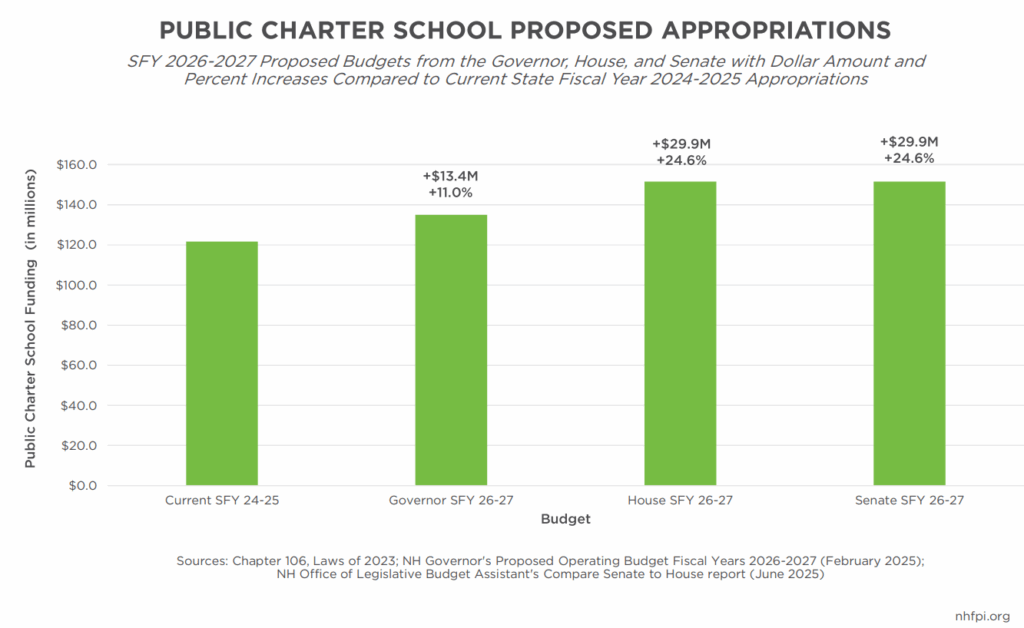

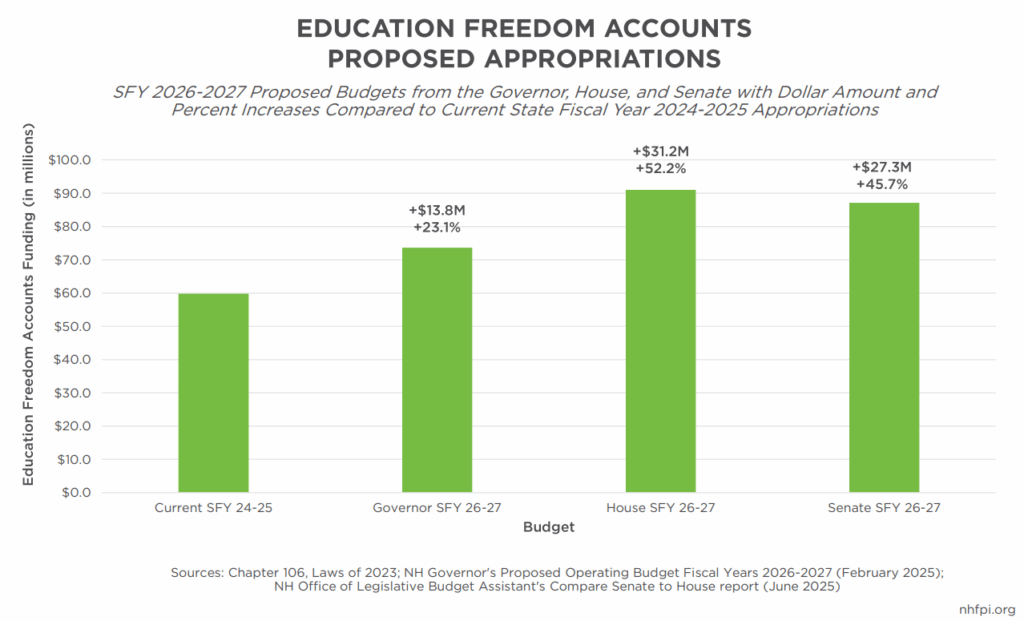

The Senate budget contains language to create universal eligibility for Education Freedom Accounts (EFAs) beginning in SFY 2026 (academic year 2025-2026) and reduced the allocation for EFAs by $3.9 million based on anticipated participation in the program in SFY 2027. The Senate changed State Budget policy language to reflect that “priority guideline students” would not be subjected to the enrollment cap, which will be 10,000 students for the 2025-2026 academic year. Priority guideline students include:

- Students currently enrolled in an EFA program

- Siblings of students currently enrolled in an EFA program

- A child experiencing a disability

- Students whose families have incomes less than or equal to 350 percent of the Federal Poverty Guideline

Since the Senate passed its budget proposal, this policy has been signed into law as the result of the passage of Senate Bill 295.

Separately, a floor amendment was approved by the Senate to allocate $460,000 to the Department of Education to be used for facilities-related spending in SFYs 2026, which offsets the result of reduced drawdown from the Rainy Day Fund in SFY 2025.

Public Higher Education

The Senate budget contains an allocation of $85 million each fiscal year to the University System of New Hampshire (USNH). In constructing this appropriation, the Senate removed $30 million in UNIQUE grant funds that were allocated to USNH in the House Budget over the biennium and replaced those funds with General Fund appropriations.

The UNIQUE grant program provides financial support to college students from families with low incomes to help subsidize their education. These grants can typically be used by any college student in the state, not just students attending institutions of higher education through USNH or the Community College System of New Hampshire. With the UNIQUE grant funding removed, the net allocation increase for USNH under the Senate’s budget is $37.5 million across the biennium.

Of the $30 million in UNIQUE funds removed from the USNH budget, the Senate recommended moving $12 million of the funds to the General Fund and restoring the remaining $18 million to UNIQUE grants over the biennium.

The Senate also increased the Community College System of New Hampshire’s appropriation by $1.0 million over the biennium to support dual and concurrent enrollment programs, which allow high school students in grades 10th-12th the opportunity to take college courses while they are enrolled in high school. This brings the total allocation to this program to $6 million over the biennium, consistent with the Governor’s proposed budget.

Diversity, Equity, and Inclusion Policy Changes

The House proposed an amendment as part of its State Budget that would prohibit diversity, equity, and inclusion (DEI) trainings, initiatives, and policies in certain public and publicly-funded organizations. The Senate retained the core of this policy initiative and proposed a language change regarding DEI prohibitions in public schools, including K-12, academic institutions, and institutions of higher education. The Senate’s budget replaces “…race, sex, ethnicity, or other group characteristics…” in the definition of DEI from the House’s budget with “…characteristics identified under RSA 354-A:1…” Characteristics identified under RSA 354-A:1 include, “age, sex, gender identity, creed, color, marital status, familial status, physical or mental disability…national origin…[or] sexual orientation.” Schools and institutions that do not comply with the prohibition may lose access to public funding until the violation is resolved.

Municipalities are also included in this amendment. However, the legislation does not suggest towns and cities would lose access to any funding if they do not comply with the DEI prohibition.

Housing

The Senate reinstated the Housing Appeals Board, which the House proposed eliminating in its State Budget proposal. The Housing Appeals Board would be administratively attached to the Board of Tax and Land Appeals. Both Boards would receive a slight funding reduction compared to the Governor’s proposal, under the Senate’s budget, to account for staffing and position changes. A total of $365,922 was allocated to the Housing Appeals Board for the biennium, and the Board of Tax and Land Appeals was funded at $2.1 million for the biennium.

In addition to a reduction in funding, the Senate also proposed administrative changes to the Boards’ decision-making processes. Under the new structure, members from opposite Boards can make decisions if a consensus cannot be reached. For example, two Board members would serve on the Housing Appeals Board and could bring in a third member from the Board of Tax and Land Appeals to make tie-breaking decisions if needed.

The Board of Tax and Land Appeals would also increase its filing fees, from $65 to $125, during the upcoming biennium under the Senate’s proposal.

While it did not allocate new funds, the Senate extended the lapse date to the end of SFY 2026 for funds supporting the Housing Champions Program, which was established in the current SFYs 2024-2025 budget and provides grants to municipalities to encourage zoning law changes to support the construction of new affordable housing.

The Senate also retained funding increases for homelessness services, including the maintenance of increased rates paid to shelters providing services, as passed as part of the current SFYs 2024-2025 budget. First introduced in the Governor’s proposal, the Senate also retained an allocation of $10.0 million in opioid abatement funds across the biennium to support people experiencing homelessness who also have an opioid-use disorder.

Justice and Public Protection

Key agencies within the Justice and Public Protection category of the State Budget include the judicial branch of State government, the Departments of Justice, Insurance, Safety, Banking, Military Affairs and Veterans Services, Energy, Labor, Corrections, Employment Security, and Agriculture, Markets, and Food. The Liquor Commission, Human Rights Commission, Judicial Council, and several other boards and offices are also within this category.

Relative to the House’s budget proposal, the Senate would fund the Department of Corrections at a higher level, and also add funding for legal settlements related to the Youth Development Center, the Judicial Branch, and the Department of Justice. The Senate would also retain, but modify, the Human Rights Commission, while the House version of the State Budget would repeal the Commission.

Department of Corrections

The State Senate voted to restore some of the positions eliminated, as well as the funding decrease, at the Department of Corrections that were proposed in the House budget.

While the House version of the State Budget would eliminate 190 filled and unfilled positions at the Department, the State Senate voted to eliminate 60 positions. The Senate voted to reinstate positions in various operations, including mental health services within the Department, that were proposed to be eliminated in the House budget. Four of the positions that provide mental health care would be restored but unfunded, which would give the Department flexibility to shift and prioritize funding among positions rather than abolish them.

In total, the House’s proposed $35.3 million reduction at the Department of Corrections relative to the Governor’s proposed budget would be reduced to a total cut of about $17.8 million in the Senate’s version of the State Budget. While positions were restored in the Senate’s version, the Senate also added a $5.0 million back-of-budget reduction to the Department of Corrections, requiring the Department to find savings elsewhere within its budget.

Liquor Commission Funding Changes and Law Enforcement Authority

While the House proposed removing law enforcement authority from the Liquor Commission, the Senate proposed retaining that authority with the Commission. Senators restored funding for the law enforcement positions, but also added a back-of-budget reduction of $1.0 million to the Liquor Commission.

Liquor Commission funds would continue to be used as a backstop for the non-federal share of Medicaid Expansion, also known as the Granite Advantage Health Care Program, and for contributions to the renamed Governor’s Commission on Addiction Treatment and Prevention.

Human Rights Commission

The Human Rights Commission is authorized by a statute passed in 1992. Per that statute, the Human Rights Commission exists “to eliminate and prevent discrimination in employment, in places of public accommodation and in housing accommodations because of age, sex, gender identity, race, creed, color, marital status, familial status, physical or mental disability or national origin…” This seven-member commission, administratively attached to the Department of Justice, receives complaints, holds hearings, conducts investigations, and issues publications related to the State’s laws against discrimination. In SFY 2023, the Commission reported receiving 767 inquiries and filing 243 charges.[12]

The Senate voted to continue the Human Rights Commission into the next budget biennium at a lower level than the Governor’s proposal. The House proposed eliminating the Human Rights Commission entirely in its budget proposal. Eliminating the Human Rights Commission would reduce General Fund appropriations by $3.2 million during the next biennium, as well as forgo an estimated $366,554 in federal funds, relative to the Governor’s budget proposal for the next biennium.

The Senate did not fully fund the Human Rights Commission at the Governor’s level, however. The Senate included a $521,000 back-of-budget reduction for the Human Rights Commission in its proposal. The Senate’s budget would also establish a one-year advisory committee to be attached to the Human Rights Commission and study, monitor, and support the Commission in implementing corrective actions identified in a 2025 audit by legislative staff.

Youth Development Center Settlements and Justice Department Funding

While the Governor’s budget proposal did not specifically set aside funds for settlements with victims of alleged abuse over decades at the Youth Development Center (YDC) and associated services, both the House and the Senate voted to devote resources to these settlements. However, neither chamber provided the $75.0 million per year that would be the maximum payout amount from the YDC Claims Administration and Settlement Fund established in current law.

The House’s budget proposal would devote $10.0 million each year of the biennium to the Youth Development Center Claims Administration and Settlement Fund. The Senate voted to retain that amount, but shift the full amount to the first year of the biennium.

The Senate also projected the sale of the Sununu Youth Services Center building, owned by the State and located in Manchester, to generate $80.0 million in SFY 2027, and proposed depositing that total amount into the Fund. However, those dollars are not appropriated specifically in the State Budget, so the Senate’s version of the State Budget would not specifically commit an $80.0 million appropriation to the Fund.

The Senate proposed statutory language, attached to its State Budget proposal, that would shift the Fund’s administration and oversight from the Judicial Branch to the Executive Branch, putting it under the purview of the Governor.

As with the House, the Senate appropriated $10.0 million to fund a specific settlement associated with a single YDC-related court case.

Renewable Energy Fund and the Department of Energy

The Department of Energy includes the Public Utilities Commission and its regulatory authority, and thus falls into the Justice and Public Protection category of the State Budget.

Under the Governor’s version of the State Budget, $10.0 million would be transferred from the Renewable Energy Fund into the General Fund to support overall State operations. The House proposed emptying the entire Renewable Energy Fund, after paying for certain administrative costs, into the General Fund for the biennium and restricting the use of Renewable Energy Fund dollars in future biennia to lowering per kilowatt-hour electric rates. The Senate proposed retaining $2.0 million in the Renewable Energy Fund, drawing $4.0 million per year out for the General Fund rather than $5.0 million per year, to support eligible projects; however, eligible projections would not include residential solar. The Senate would also not change the uses of the Renewable Energy Fund after this biennium is over; the House proposed dedicating all dollars collected in the Renewable Energy Fund, beyond certain administrative expenses, to reducing electric rates for all consumers on a per kilowatt-hour basis.

The Senate removed the alterations to the Renewable Portfolio Standard that the House proposed that would have eliminated the solar energy requirement from the Renewable Portfolio Standard. The Senate also voted to remove the House’s proposed State energy policy that would require a focus on market mechanisms and trends to guide energy policy.

Restrictions on Property Sales and Rental for Certain Foreign Entities

A Senate policy proposal, originally Senate Bill 162, attached to the Senate’s version of the State Budget would add requirements for people newly purchasing or renting properties within ten miles of certain locations within the state.[13]

People purchasing or renting within this radius of these “protected facilities” would have to verify with the State government that they are not representatives of, or otherwise under the control of, the governments of China, Iran, North Korea, Russia, or Syria. No government or government official from those governments, company or other entity with a principle place of business or organized under the laws of those governments, or employee or agents of those governments would be allowed to purchase or rent property within these zones.

The protected facilities include the National Guard and Army Aviation Support Facilities in Concord, the Readiness center of the 197th Artillery Brigade in Manchester, Pease Air Force Base and the Naval Shipyard in Portsmouth, and the New Boston Space Force Station.

All buyers and new renters within 10 miles of these sites would have to file an affidavit with the State Department of Justice, signed under penalty of perjury, attesting that they are not an owner forbidden under this new law. Failure to submit an affidavit could result in a $500 civil penalty, and if the property is determined to be rented or owned by someone from the forbidden group of renters or owners, the penalty would be a misdemeanor of felony, depending on the violator’s status.

Other Justice-Related Funding, Policy, and Fee Changes

Funding for other law enforcement and justice activities would also be increased under the Senate’s proposal relative to the House version of the State Budget, including:

- Eliminating the proposed back-of-budget reductions for the Judicial Branch and the Department of Justice

- Adding a total of $5.2 million in funding to the Judicial Branch for reimbursements to Sheriff’s offices, court security, and management of Youth Development Center cases

- Incorporating a $2 million contract for forensic examiners that the House had left out of its budget proposal

- Boosting funding for the public defender program by $3.8 million

- Restoring $650,000 in funding for the Goffstown and Hooksett courts, which would likely close under the House’s version of the State Budget

- Making a $600,000 appropriation to the Northern Border Alliance, which established a collaboration of law enforcement agencies to reduce illegal activities and support federal partners within 25 miles of the Canadian border[14]

- Adding $400,000 for legal counsel supports for people with involuntary mental health admissions

Several Department of Safety policies related to motor vehicles were added by the Senate relative to the House’s version of the State Budget. These proposed changes are discussed in the Transportation section below.

Transportation and Motor Vehicle Policies

The Transportation expenditure category in the State Budget is entirely comprised of the New Hampshire Department of Transportation (DOT) budget and does not include any other departments or agencies. In the Senate’s version of the budget, $3.5 million dollars over the biennium was moved from winter maintenance to the winter retention initiative. This adjustment may help to recruit and retain plow truck drivers to reduce the need for overtime or use of contracted plow drivers. The Senate proposed reducing several registration fees for heavy vehicles compared to the House’s version of the budget, resulting in a reduction of approximately $13.0 million in the Highway Fund and $540,000 in the Highway Fund block grants to municipalities over the biennium.

The Senate also added policy language from House Bill 133 that would require nonresident drivers who establish residency in the State to contact the Department of Safety if they do not formally become residents within 60 days or if their driver’s license from another state expires. The bill also requires that the Division of Motor Vehicles send violation notices to these individuals.

Inspections and License Plates

With regard to motor vehicle policies that are under the Department of Safety, the Senate recommended that vehicle safety inspection failures be limited to safety-related features, including malfunctioning brakes, horns, or lights, or rust resulting in structural deficits. Emissions testing would no longer be required, under the Senate’s proposal, provided the Department of Environmental Services is granted a waiver to excuse New Hampshire from federal emissions requirements. New cars would not require inspections for three years after purchase, but after three years, they would require annual inspections. The Senate’s changes to vehicle safety inspections compared to the House’s budget would result in an increase of $105,336 to the General Fund from inspection fees paid to the state and the restoration of eight inspection-related employee positions.

The Senate also proposed that the manufacturing of license plates be transferred from the Department of Corrections to the Department of Safety, that the manufacturing fee be increased from $4.00 to $6.00 per plate, and that the embossing requirements be removed. These changes are estimated to generate $1.8 million for the Reflectorized Plate Fund over the biennium.

Resource Protection and Development

The Resource Protection and Development category of the State Budget includes the Departments of Environmental Services, Natural and Cultural Resources, Fish and Game, and Business and Economic Affairs, as well as the Pease Development Authority.

Changes recommended by the Senate relative to the House include partly refunding the State’s support for the arts, making alterations to the proposal to establish a committee to help evaluate new landfill sites, and provide more funding to support municipal water infrastructure.

Alongside these major changes, the Senate also proposed to devote $20,000 to the New Hampshire-Ireland Trade Council, clarify funding flows from the Meals and Rentals Tax to the Division of Travel and Tourism Development, shift responsibility for a land stewardship program from the Department of Administrative Services to the Fish and Game Department, make changes to the House’s proposed changes of management of endangered species between State departments, and add proposed language that would identify Coos County as economically distressed for the purpose of coordinating resources and initiatives.

Division of the Arts

The House’s budget proposal would have defunded the Division of the Arts within the Department of Natural and Cultural Resources and removed the Division from statute. The Division of the Arts would remain in statute under the Senate’s budget proposal, but be funded at a lower level from direct State appropriations. The Senate added $300,000 in direct funding, which is lower than the Governor proposed. The Senate also proposed adding a 50 percent credit against the State’s Business Profits Tax and Business Enterprise Tax for business filers that donate money to the Granite Patrons of the Arts fund. Contributions to that fund could generate up to $700,000 more revenue for the Division of the Arts during the biennium, if businesses use the credit.

The Senate made the assumption that this level of funding would be sufficient to access federal matching funds totaling more than $2.0 million during the biennium, although such dollars are dependent on federal policy.

The Senate’s budget would also establish a committee to study the creation of the New Hampshire Office of Film and Creative Media, which would be required to issue a report on a potential Office and a related tax credit by November 2025.

Solid Waste

The House proposed generating revenue for a Solid Waste Management Fund through a $3.50 per ton surcharge on solid waste deposited in landfills or sent to incinerators, with revenue from the fund used to support municipal waste reduction and recycling efforts. The Senate modified the Solid Waste Management Fund from the House version to make payments to municipalities for source waste reduction and recycling efforts quarterly, rather than annually. The fine for failure to pay into the fund would also drop from $25,000 per day of violation to $1,000 per day in the Senate’s proposal relative to the House’s version.

The Senate also recommended changes to the proposed Solid Waste Facility Site Evaluation Committee. The revised language for the new Committee would require it to focus on the impacts of new landfills beyond the scope of the current reviews under the Department of Environmental Services, rather than both repeating that scope and including the broader economic and other impacts of new landfill sites as the House proposed. While the House version outlined the purpose of the Committee as to review the impacts of a new solid waste facility on “noise, odor, aesthetics, local and regional economic impacts, property value impacts, nature and source of waste, need, impacts on tourism, recreation and traffic, and other similar impacts,” the Senate’s version only identified “local and in-state regional economic impacts, property value impacts, and impacts on tourism and recreation” in the purpose statement.

Water Infrastructure

The Senate’s budget would require that $11.55 million be withdrawn from the Drinking Water and Groundwater Trust Fund for regional water infrastructure construction in towns in southern New Hampshire in SFY 2026. These funds would be used to support communities with groundwater impacted by Perfluoroalkyl and Polyfluoroalkyl Substances (PFAS). PFAS contaminants have been identified in the groundwater of several communities in southern New Hampshire.[15]

In its proposal, the Senate also removed language proposed by the House that would have restricted siting of landfills to avoid impacts on groundwater. The Senate added separate language that would add detail to the regulatory language related to landfills, including relative to groundwater.

Language attached to the Senate’s version of the State Budget would also require the creation of an application and approval process for PFAS-related funding for public water systems affected by the chemicals. This process will help manage the funds to the State generated by PFAS public water systems settlement agreements.

The Senate voted to support $5.0 million in State aid to local governments to fund wastewater infrastructure projects during the biennium. The Senate proposal also includes $325,000 specifically for the Pillsbury Lake Village District.

General Government

Within the agencies of the General Government category, some of the most significant changes resulted from eliminating agencies, consolidation of agencies, public employee retirement policies, and reductions in aid to municipalities and to potential college students.

The most significant policy and funding changes from the House version of the budget and proposed by the Senate for the General Government category were for public employee retirement funding, revenue sharing with municipalities, and to the funding and structure of the State Commission on Aging.

State Commission on Aging

The State Commission on Aging, established in 2019, exists to advise the Governor and the Legislature about policy and planning related to aging, and is attached to the Department of Administrative Services. The House voted to eliminate the State Commission on Aging in its budget proposal. Total proposed appropriations for the State Commission on Aging as structured in the Governor’s State Budget proposal would total $560,864, all in General Funds, for the next two-year biennium.[16]

Under the Senate’s version of the State Budget, the State Commission on Aging would continue with a flexible fund of $300,000, which would support compensation for the Executive Director and the Commission’s activities. The appropriation decisions were made after considering whether to make the Executive Director a part-time or full-time employee, and the final language does not specify whether the Executive Director must full time or part time.

The State Commission on Aging would have terms for membership extended from two years to three years under the Senate’s budget proposal. The Commission would also have an attached advisory council focused on the system of care for healthy aging in the state that would meet at least quarterly and make recommendations regarding the system of care.

Retirement System Funding and Policies

The Governor and the House both proposed boosting retirement benefits for certain police and firefighting personnel who had their anticipated retirement benefits altered after a 2011 law change and who were not vested in the retirement system by 2013.

The Governor proposed an additional $32.9 million to the New Hampshire Retirement System to fund these benefits in her budget proposal. The House proposed a larger amount of funding than the Governor during the upcoming biennium, supporting these benefits with a full $27.5 million in funds for each fiscal year from SFYs 2026 through 2034, totaling $55 million in General Funds during the biennium.

The Senate voted to delay implementation of the House’s policies by six months, which would reduce expenditures relative to the House by $13 million during the biennium. Appropriations in the Senate language would total $42.0 million during the SFYs 2026-2027 biennium, a larger amount than the Governor’s total, and be $27.5 million per year repeated through SFY 2034.

The Senate also proposed statute that would permit the current State Budget’s appropriations for the Department of Administrative Services Division of Risk and Benefits to be carried forward continuously into future State fiscal years to help fund the division for retiree health insurance, which would support the State’s self-insured health insurance.

Municipal Revenue Sharing

Both current law and the Governor’s budget proposal require the equivalent of 30 percent of revenue collected by the New Hampshire Meals and Rentals Tax to be distributed to municipalities on a per capita basis. The House’s proposal would suspend that statutory requirement for the biennium. Instead, the House would appropriate a fixed amount of $137.0 million per year for the municipal distribution. The SFY 2025 distribution was $136.6 million.[17]

The Senate voted to continue the current policy of devoting 30 percent of State Meals and Rentals Tax revenue to municipal aid, provided on a per capita basis. The House’s proposed $137.0 million per year would be slightly higher than the current year’s funding level.

The House also voted to repeal a statute, suspended since 2010, for a separate municipal revenue sharing formula. This formula was an evolution of the formula used in the 1990s, prior to the Adequate Education Aid funding structure. The Senate would continue the suspension of the statute, rather than repeal it.

House Policies Removed

The House version of the State Budget would have included a wide array of policies, many of which were removed in the proposal from the Senate. Key policies removed by the Senate include, but are not limited to:

- Open enrollment for school districts, permitting students to attend public schools with available space outside of their home school districts

- Permitting restrictions on bathroom use and sports activities based on biological sex under the State’s on-discrimination laws

- Restricting Medicaid coverage for circumcisions

- Limiting vaccination rulemaking authority and sunsetting certain vaccine requirements

- Permitting a renter’s lease termination to be considered sufficient reason for eviction

- Repealing the statutes requiring State-funded outreach for the Granite State Paid Family Leave Plan

- Changes to residential care and health facility licensing

- Policies restricting cell phone use in schools

- Increased penalties for knowingly reporting false claims of child abuse

- Restrictions on public officials’ electioneering

- Required increases in voter checklist verification frequency

- Policies permitting adults to have blackjacks, slung shots, or metallic knuckles

- A legal framework for producing and selling firearms in-state only

These policies may continue to exist in both the House version of the State Budget and, in several instances, in separate bills that have already been signed into law. Their existence in the House budget indicates they could continue to be a point of negotiation in the Committee of Conference.

Back of Budget Reductions

As noted elsewhere in this Report, the Senate’s proposed budget would require certain agencies to find savings in their budgets without identifying specific line items through “back-of-the-budget” reductions. While other funding reductions would reduce specific appropriations and line items in the State Budget, these reductions would rely on State agency personnel to reduce expenditures relative to their topline appropriations, or specifically their General Fund appropriations, relative to the sum of all individual appropriations allocated.

The House proposed a total of $95.5 million in back-of-budget reductions among State agencies, with $76.8 million of those reductions coming from General Funds.

The Senate’s proposed budget would modify these back-of-budget reductions. Total back-of-budget and other unspecified reductions from the Senate would be $107.7 million during the biennium. Back-of-budget or other unspecified reductions would be increased in a few key areas, including:

- Requiring that statewide savings or revenue would be identified by the Governor across the State government, generating $32.0 million in General Fund revenue or savings, with the Senate using this revenue to replace the House’s proposed 5 percent fee on dedicated funds eliminated from the Senate’s proposal

- Increasing the back-of-budget reduction proposed by the House for the Department of Health and Human Services back-of-budget by $5.0 million, to a total of $51.0 million in General Funds over the biennium

- A new General Fund back-of-budget reduction for the Department of Corrections of $5.0 million

- A new Liquor Commission back-of-budget reduction of $1.0 million in General Funds, with the authority to use revenue generated for the General Fund in SFY 2026 to offset this reduction in SFY 2027

- A new back-of-budget General Fund reduction for the re-established Human Rights Commission of $521,000

The Senate eliminated or altered back-of-budget reductions for:

- The Department of Justice, with a $14.7 million General Fund reduction in the House version, has no reduction in the Senate version

- The New Hampshire Retirement System, with a reduction of $8.7 million in Other Funds the House version, has no reduction in the Senate version

- The Judicial Branch, with a $7.9 million General Fund reduction in the House version, has no reduction in the Senate version

- The Department of Information Technology had the same $10 million reduction of all funds in the Senate version as in the House’s State Budget proposal, but was given authority to reduce all appropriations proportionally for all other State agencies it serves

Policy language in the Senate version would also grant the Governor the authority to add funding for operations, if General Fund revenues are sufficient, with approval from the Joint Legislative Fiscal Committee.

Revenue Projections and Policies

The Senate funded the appropriations it added to the House version of the State Budget in large part with a more optimistic revenue forecast and boosts in revenue collections. These increases were sometimes changes, but often modifications or additions, to the House’s revenue policy changes.

Changing Revenue Forecasts

In total, the Senate Finance Committee built a budget proposal with revenue projections for the combined General Fund and Education Trust Fund that forecast $382.1 million more across SFYs 2025, 2026, and 2027 than the House projected. That increased forecast came in two steps.

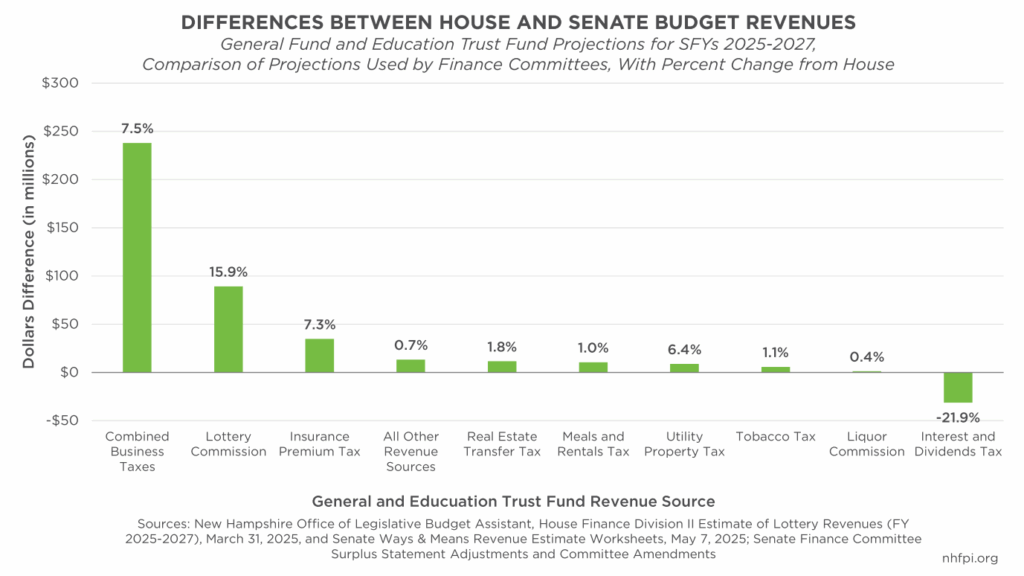

First, the Senate Ways and Means Committee projected about $265.4 million more in General and Education Trust Funds revenue for the three-year period than the House Finance Committee incorporated in its revenue projections. The House Finance Committee revised its own revenue estimates up from the House Ways and Means Committee by $34.2 million because of enhanced expected lottery revenues under current policy. The Senate Ways and Means Committee’s May 7 projections were substantially more optimistic on lottery revenues than the House’s estimates from February and March, and was more optimistic on combined business tax revenues, Insurance Premium Tax revenues, and Utility Property Tax receipts.

The Senate Finance Committee increased revenue projections relative to the Senate Ways and Means Committee’s estimates, mostly through one vote on May 28. The Finance Committee added $116.7 million in projected revenues for SFYs 2026 and 2027 in total, with boosts of $75 million in total to the projection for the two combined business taxes, $27.8 million to the Meals and Rentals Tax revenue projections, $5 million to the Real Estate Transfer Tax, and $200,000 to Medicaid recoveries. The Finance Committee had separately approved an increase of $8.7 million to the historic horse racing revenue estimates under the Lottery Commission.

Lottery Policy and Revenue Changes

The Senate’s budget would boost revenues relative to current policy by expanding gambling in New Hampshire. The Senate proposed changing the official name of the New Hampshire State Lottery Commission to the New Hampshire State Lottery and Gaming Commission. The Senate, with a different set of proposed policies than the House, adjusted anticipated Video Lottery Terminal (VLT) revenues to $83.5 million over the biennium, and changed the tax rate for VLTs to 31.25 percent. The Senate proposed allocating the revised VLT revenues as follows:

- Approximately $61.9 million to the General Fund

- Over $20.6 million to the Education Trust Fund

- About $1.0 million to the Governor’s Commission on Addiction Treatment and Prevention

The Senate also increased estimated revenues for historic horse racing machines compared to the amounts approved in the Senate Ways and Means Committee. This estimate revision would result in over $8.7 million in additional dollars for the Education Trust Fund over the biennium.

The Senate also recommended changes to current lottery rules including:

- Approval of high-stakes tournaments defined as buy-ins of $2,500 or more

- Removal of maximum wager cap (previously $50)

- Expanded hours for Keno to match the hours of a business’s operations

- Requiring municipalities to vote to prohibit Keno gaming rather than voting to adopt it

The Senate’s budget also creates an Elderly, Disabled, Blind, and Deaf Exemption Reimbursement Fund which would reimburse municipalities for tax exemptions beginning in SFY 2028 and be funded by VLT revenues. Additionally, the Senate proposed eliminating the Council for Responsible Gaming and transferring its work to the Division of Behavioral Health, which would result in a $500,000 increase in General Funds.

Other Revenue Policy Changes

The Senate voted to establish and institute a tax amnesty program to collect revenue from individuals and businesses with outstanding and unpaid taxes from prior years. The Senate projected that this program would generate nearly $4.0 million in net revenue, with a small administrative cost. The Senate’s revenue projections are lower than the revenue generated during the last major tax amnesty program by the State in SFY 2016, when the program generated $19.0 million in revenue.[18]

The Senate also voted to add two multi-state tax auditors to the Department of Revenue Administration’s staff, anticipating nearly $5.0 million in net revenue from those staff additions. The auditors were anticipated to bring in about $10.74 in General Fund and Education Trust Fund revenue for every dollar of General Fund expenditures spent on paying for their salaries and benefits.[19]

The Senate’s budget recommendation would increase State fees, including for the Board of Tax and Land Appeals, cremation certificates, the Office of the Chief Medical Examiner, vehicle license plates, and licenses for hospitals, nursing facilities, home health providers, laboratories, and certain other health-related facilities. These fees are in addition to the fees added by the House, which were left largely intact by the Senate.

Education Trust Fund Changes

The Governor, House, and Senate have all proposed changing the distribution of funds from four key revenue sources between the General Fund and the Education Trust Fund, but their proposals would impact the flow of funding to differing extents.

Currently, 41 percent of the revenue collected by the Business Profits Tax is sent to the Education Trust Fund, while the remainder supports the General Fund. The Business Enterprise Tax has the same percentage split, while the Real Estate Transfer Tax devotes about one-third of the revenue collected to the Education Trust Fund, and the Tobacco Tax has a split based on the tax rate for packs of 20 cigarettes that is applied to all tobacco products sold.

The Governor proposed devoting 34 percent of the revenue from all four taxes to the Education Trust Fund and the rest to the General Fund. The House would change that split to 30 percent from all four taxes.

The Senate proposed a higher percentage of revenue flow from these four tax revenue sources to the Education Trust Fund, setting the split at 35.5 percent for all four tax revenue sources. The Senate constructed this split after determining the amount of revenue that would be available from other revenue sources and building a budget with a mixture of General Fund and Education Trust Fund expenditures.

While the House budget’s revenue split change would divert $273.7 million during the biennium to the General Fund that would have otherwise flowed to the Education Trust Fund, the Senate’s revenue source split would lower that figure to $124.1 million during the biennium.

While the Senate’s version of the State Budget would spend down the projected SFY 2025 positive balance of $105.5 million in the Education Trust Fund, the Senate’s budget would leave a projected positive balance in the Fund at the end of the biennium. The House version of the State Budget would bring the Education Trust Fund into a $26.7 million deficit, requiring a transfer of that amount form the General Fund in SFY 2027, but the Senate Budget would maintain a projected $19.2 million positive balance in the Education Trust Fund at the end of the biennium.

The Senate also voted to maintain the current purposes for which funding from the Education Trust Fund could be used, and to expand purposes in several key areas. The uses of the Education Trust Fund would have been expanded under the Governor’s proposal, and restricted relative to current policy under the House’s budget proposal. The Senate would permit the funds to be used for:

- Public School Infrastructure Fund, a change from the current appropriation permissions

- Department of Education operating costs, which the Senate’s proposal would newly allow

- Students with court-ordered placements or placements for episodes of treatment, with modified language in statute proposed by the Senate

- The Adequate Education Aid payments as defined by the State’s education funding formula

- Special Education Aid

- Education Freedom Accounts and associated phase-out grants

- School Building Aid

- Low and Moderate Income Homeowners Property Tax Credit

- Tuition and Transportation Aid

- State testing, data collection, and administration

- Building Lease Aid for public charter schools

The Rainy Day Fund

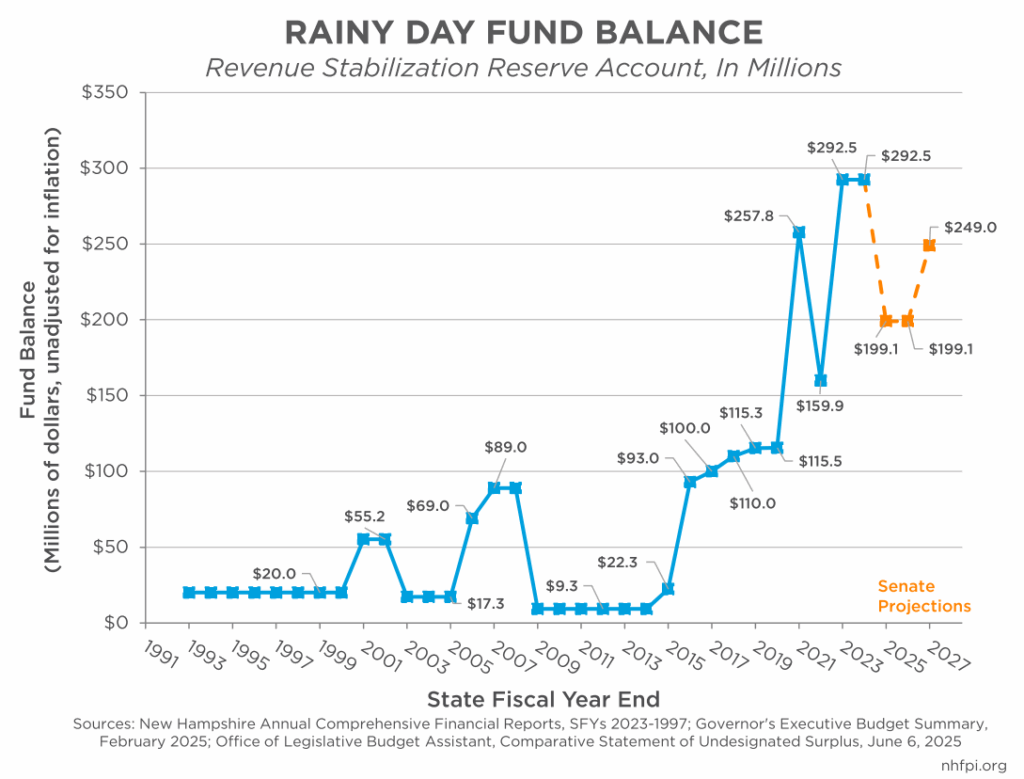

The House’s budget proposal would draw about $148.8 million from the Revenue Stabilization Reserve Account, also known as the Rainy Day Fund, at the end of SFY 2025. The Senate version of the State Budget would reduce that drawdown to $93.4 million, leaving a balance in the Rainy Day Fund of $199.1 million at the start of SFY 2026 on July 1, 2025.

The Senate’s proposal projected $50.0 million in otherwise unspent General Funds back to the Rainy Day Fund at the end of the biennium on June 30, 2027. These represent General Fund dollars that were not deployed for other purposes during the biennium, based on the Senate’s revenue projections and estimated expenditures.

The total Rainy Day Fund balance would be a projected $249.0 million at the end of the biennium. That total would be higher than either the Governor’s projected $222.0 million Rainy Day Fund balance at the end of the biennium, or the House’s $228.8 million projected ending balance. However, the Senate’s proposal forecast a lower projected balance than the current balance of $292.5 million.

The SFY 2025 Rainy Day Fund drawdown was mitigated for the Senate relative to the House by an increase in the Department of Health and Human Services’ lapse expectations for SFY 2025, which increased by $38 million to $60 million, according to the Office of Legislative Budget Assistant. The Senate also proposed policy steps to reduce the Rainy Day Fund drawdown at the end of SFY 2025, including shifting certain funding for the Police Standards and Training Council from SFY 2025 to SFY 2026.

Conclusion

With higher revenue estimates than those available to the House, the Senate made several key changes to the House’s version of the State Budget that would maintain key services for Granite Staters while providing more support, although not fully preserving, other services. The Senate’s version of the State Budget funds operations at a lower level than the Governor’s proposal, reflecting some reductions in, or modifications to, services compared to current levels. However, overall funding is substantially more robust than the House’s proposal, particularly for health services.

The Senate’s version of the State Budget would not include the proposed reductions in funding for Medicaid reimbursement rates, developmental services, and mental health supports that were some of the largest changes included in the House version. The Senate would also add mental health, behavioral health, and developmental services beyond some of the Governor’s proposed levels.