The United States Census Bureau American Community Survey data released September 2017 provides estimates, based on data collected in surveys conducted throughout 2016, of New Hampshire’s population characteristics. The survey data provide year-to-year comparisons of key indicators affecting the lives of Granite Staters.

Household Income

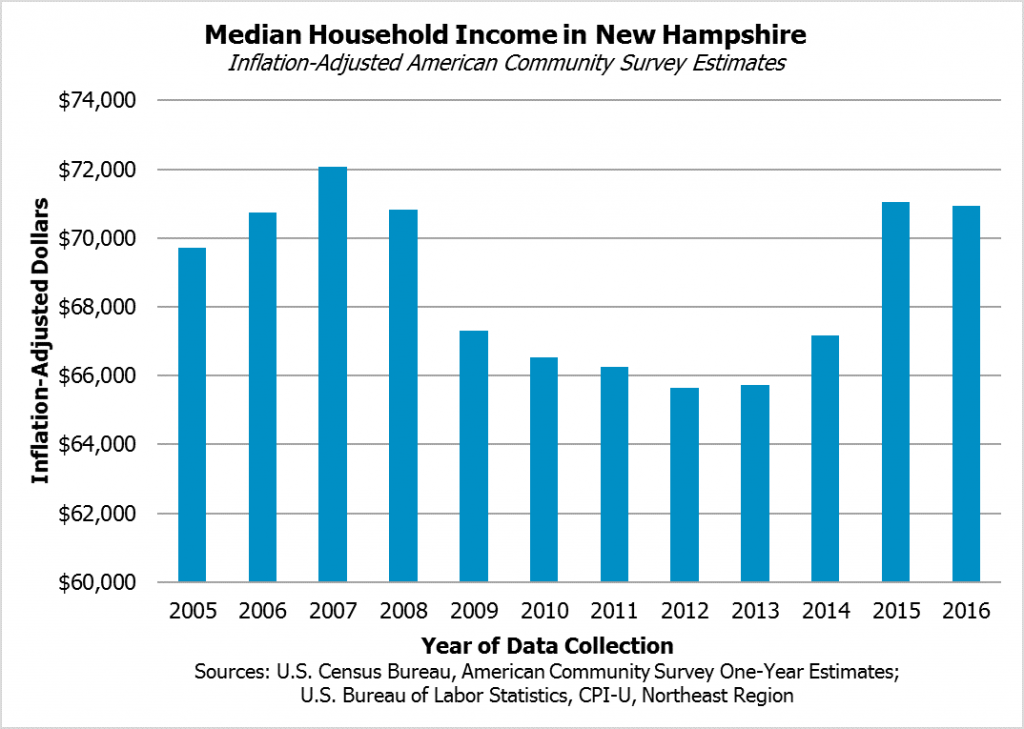

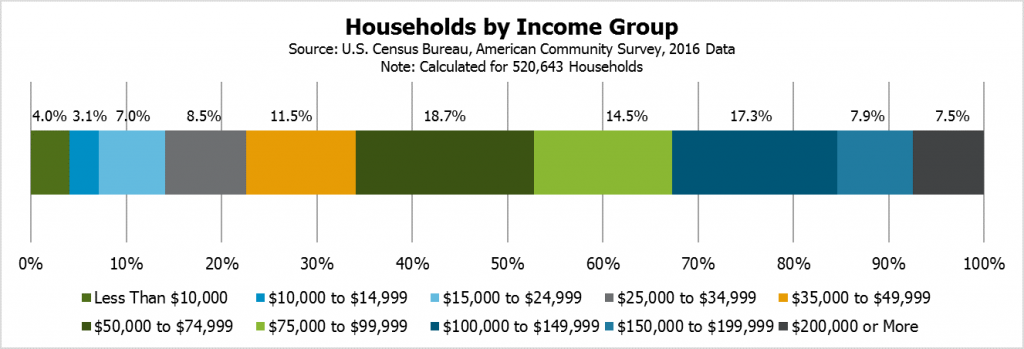

Median household income remained about the same for the New Hampshire data collected in 2016 as it did for 2015, at $70,936. While this figure is a new high, adjusting for inflation shows the state’s median household income has not returned to the estimated level seen in 2007, prior to the Great Recession. Relative to other states and the District of Columbia, New Hampshire has the eighth-highest median household income. About 22.6 percent of Granite State households, or more than one in five, had incomes less than $35,000, and approximately 20,800 households had less than $10,000.

Poverty

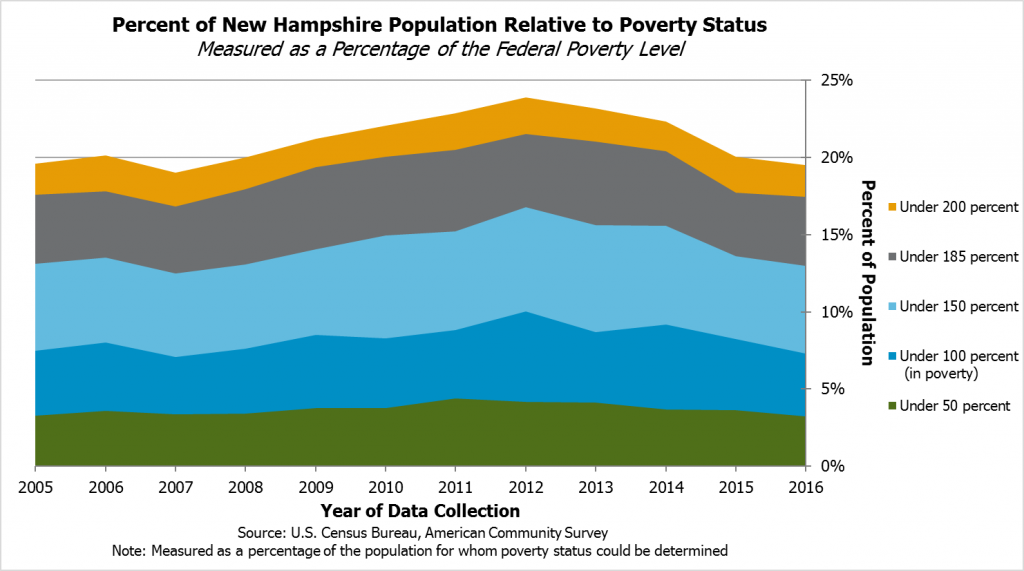

New Hampshire’s poverty rate declined from 8.2 percent in the 2015 data to 7.3 percent in the 2016 data, which is near to pre-Recession levels. The poverty rate for those under 18 years old declined from 10.7 percent to 7.9 percent and dropped from 6.1 percent to 4.6 percent relative to the 2015 data.

The poverty-level income threshold used by the Census Bureau for income collected in the 12 months preceding July 2016 is $12,391 for an individual less than 65 years old and $19,171 for a family of three with one child. An estimated 94,289 Granite Staters lived in poverty, which is roughly equivalent to the estimated 2016 populations of Concord, Portsmouth, Laconia, and Lebanon combined. Approximately 41,811 people live at less than half of poverty-level income, while 128,975 live at less than 125 percent of poverty-level income and 251,947 people live under twice that level. About 12.0 percent of people aged 16 to 64 working part-time and 0.9 percent working full-time, year-round were in poverty.

Housing

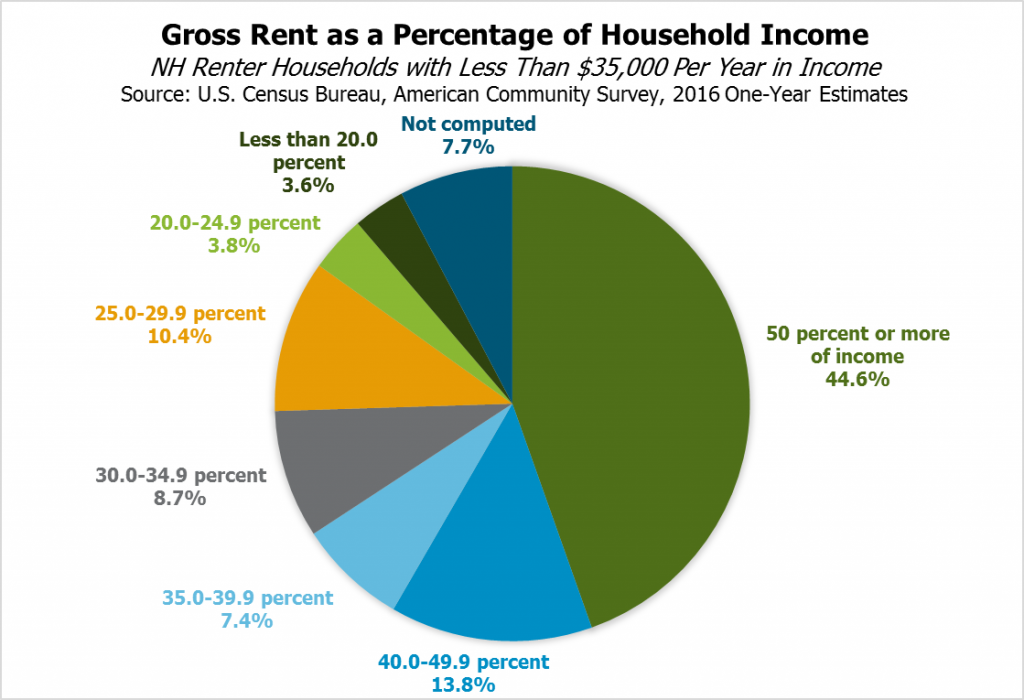

For those households that are renters, the Census Bureau measures gross rent, including utilities, as a percentage of household income. Gross rent exceeded 30 percent of household income, a common metric for affordability, for 74.5 percent of renter households, or roughly three out of every four, with less than $35,000 per year in income. For 44.6 percent of these households, gross rent totaled more than half of their annual incomes. For households making less than $10,000 per year, 65.6 percent, or nearly two out of every three, have gross rents higher than half of their incomes.

Health Insurance

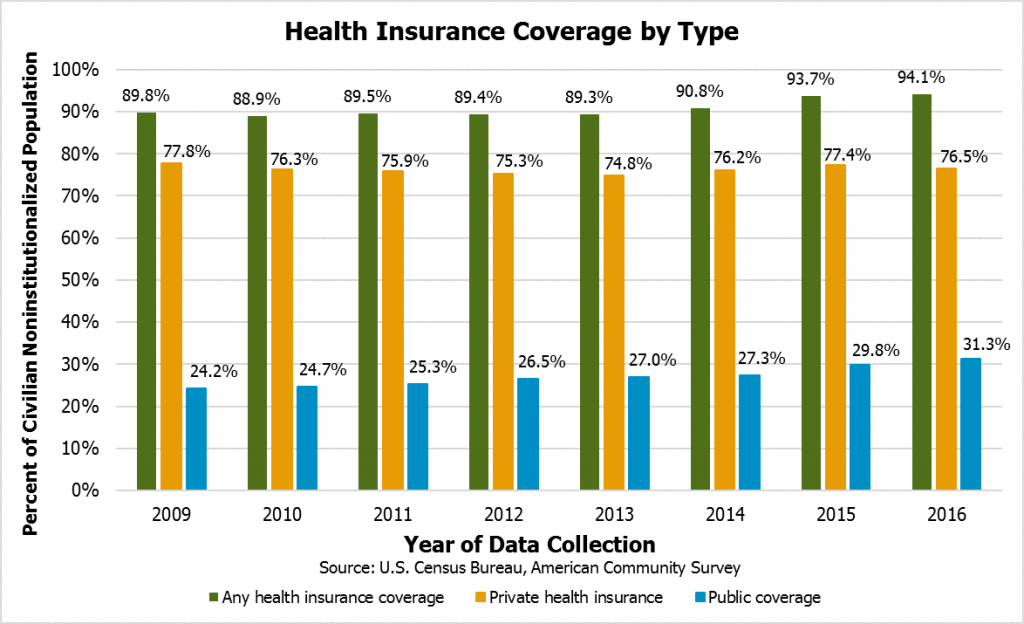

The percentage of Granite Staters with health insurance coverage rose to 94.1 percent, which is higher than when the federal Affordable Care Act or the New Hampshire Health Protection Program were enacted. Despite improvements, more than one out of every 20 Granite Staters lacks health insurance coverage.

See NHFPI’s Common Cents blog for more information, analysis, and resources related to Census Bureau data, including poverty-related and median household income data.

Updated March 19, 2018.