Temporary Assistance for Needy Families (TANF), otherwise known in New Hampshire as the Financial Assistance for Needy Families (FANF) program, provides funds for families with low incomes, mostly deployed in the form of cash assistance. New Hampshire has the highest benefit threshold for cash assistance in the country; however, enrollment in the program has been on a decline since the beginning of the COVID-19 pandemic, likely due to the increase in federal supports to offset financial and economic hardship during that time. While enrollment has been declining, the State’s ongoing balance of combined federal and State FANF funds has been growing. These federal funds are available for deployment to help Granite Staters though enhanced FANF outreach and assistance, and may be used to help ease financial hardships for families with lower incomes due to rising costs and expiring federal supports associated with the COVID-19 pandemic.

Income Thresholds, Program Requirements, and Benefit Limits

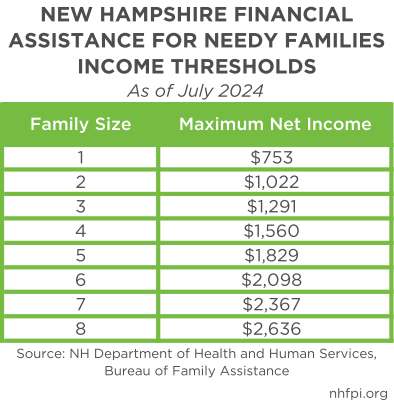

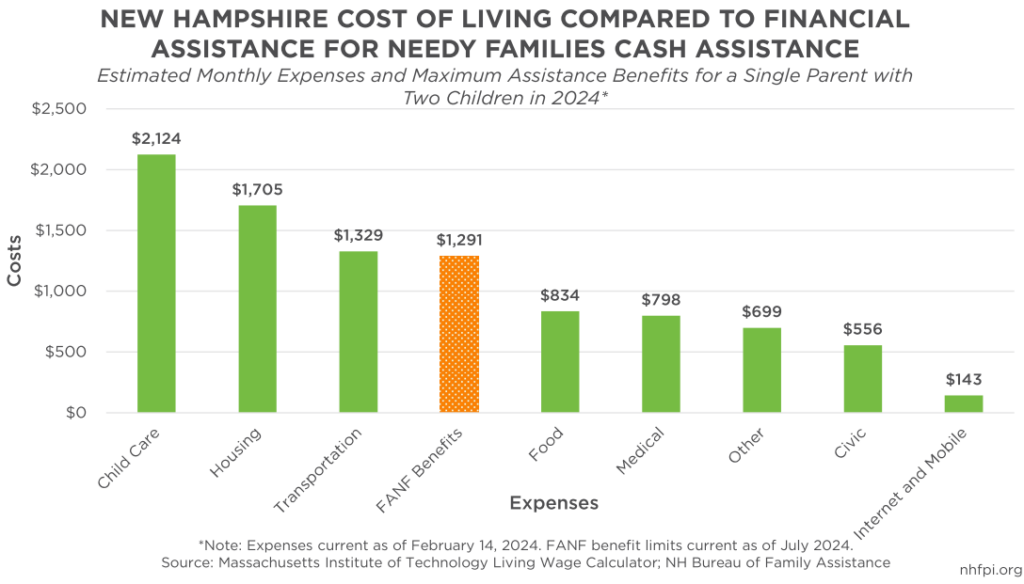

During its first year of enactment, State FANF income thresholds were a maximum of $550 monthly for a family of three, increasing to $675 by 2010, unadjusted for inflation. Following almost two decades of minor adjustments to FANF income thresholds, the State Fiscal Year (SFY) 2018-2019 Budget increased the income eligibility cap to 60 percent of the federal poverty guidelines, with annual adjustments to account for inflation. In 2017, a family of three earning less than $1,021 a month was eligible to receive benefits. As of July 2024, this threshold was $1,291, an increase of about two percent from seven years prior, and an increase of about 19 percent from 1996, adjusted for inflation.

In addition to meeting income requirements, households receiving benefits must also have dependent children who are under the age of 18 (or under 19 if they are a full-time high school student), have diminished support from at least one parent (due to death, separation, or disability), and currently live with a parent or relative. Additionally, Granite Staters receiving FANF cash assistance must also adhere to other requirements based on the type of program they are enrolled in. There are currently four types of FANF cash assistance programs administered by the State, including:

- The Family Assistance Program (FAP), which provides support for families with a relative who has a qualifying disability, is over the age of 60, or experiences obstacles to obtaining employment, such as caring for a relative.

- The New Hampshire Employment Program (NHEP), for families with a relative who is “abled bodied for employment” and must be employed, attending a job readiness program, or be actively looking for a job.

- The Interim Disabled Parent (IDP) program, for families with a parent who is experiencing a disability. Relatives experiencing a disability who are caring for children are ineligible for this program, and instead receive assistance from FAP.

- The Families with Older Children (FWOC) program, which provides assistance for households with a child aged 19 who is still attending high school, or an equivalent high school education.

The FANF program has lifetime limits, with enrollees eligible to receive benefits for up to sixty months, either consecutive or nonconsecutive. Exceptions are granted in certain cases for those who are experiencing unexpected unemployment, as well as those unable to work due to a health condition, certain disabilities, or inadequate child care, among other extenuating circumstances or hardships. Thus far, in 2024, the NHEP is the highest enrollment FANF program across the state, with the FAP being the second-most utilized.

As of July 2023, New Hampshire had the highest FANF monthly benefit limit among the 50 states and the District of Columbia. The median state, New Mexico, had a maximum benefit limit of about $549 for a family of three. New Hampshire’s thresholds are almost double that of neighboring Maine, with a family of three eligible to receive a maximum benefit amount of $665 a month. Although all New England states increased their maximum benefits between 2022 and 2023, other states in the region have maximum levels lower than New Hampshire; a family of three can receive up to $856 a month in assistance in Vermont, $833 in Connecticut, $783 in Massachusetts, and $721 in Rhode Island.

Federal Funding and the State's Continuing Balance

The State’s FANF program is funded by the federal TANF block grant, established in 1996 as part of the federal Personal Responsibility and Work Opportunity Reconciliation Act. The federal government disperses an annual total of about $16.5 billion in TANF funding, with New Hampshire awarded approximately $38.3 million each year. Despite the State’s automatic inflation adjustments to income thresholds, the federal block grant amount has not been adjusted since its enactment, contributing to a total value loss of about 47 percent between 1997 and 2023, according to the Congressional Research Service. States were also awarded one-time additional allocations for TANF through the American Rescue Plan Act, with New Hampshire receiving an extra $4 million in 2021. In addition to receiving federal funds, states are obligated to budget a minimum amount of funding towards TANF, also known as the Maintenance of Effort (MOE) requirement. In 2022, New Hampshire contributed $32,115,100 in MOE dollars, a decline of about $5.9 million from $38,072,519 in 2021. A state’s MOE contribution is set at 75 percent of the state’s previously required 1994 contribution to TANF’s successor, the Aid to Families with Dependent Children program. States who do not meet their required Work Participation Rate (WPR) are required to contribute 80 percent in MOE funds. In order to meet WPR requirements, at least half of families receiving TANF cash benefits must be employed at least 30 hours per week, or 20 hours for single parents with a child under six years old; for two-parent households, at least 90 percent of enrollees must work at least 35 hours per week.

The federal government grants states flexibility to spend TANF block grant funds in many ways, as long as the uses align with at least one of the program’s four key purposes. These four purposes, established by U.S. Congress in 1996, may be broadly characterized as:

- Providing assistance to families in need with the goal of keeping children supported with relatives

- Promoting financial independence of parents through efforts to promote job preparation, work, and financially-beneficial family structures

- Reducing instances of infants with a single parent, rather than two-parent households, for support

- Encouraging the formation and success of two-parent families

Outside of meeting these purposes, states are not permitted to transfer more than 30 percent of their funds to both the Child Care and Development Block Grant and the Social Services Block Grant (SSBG).

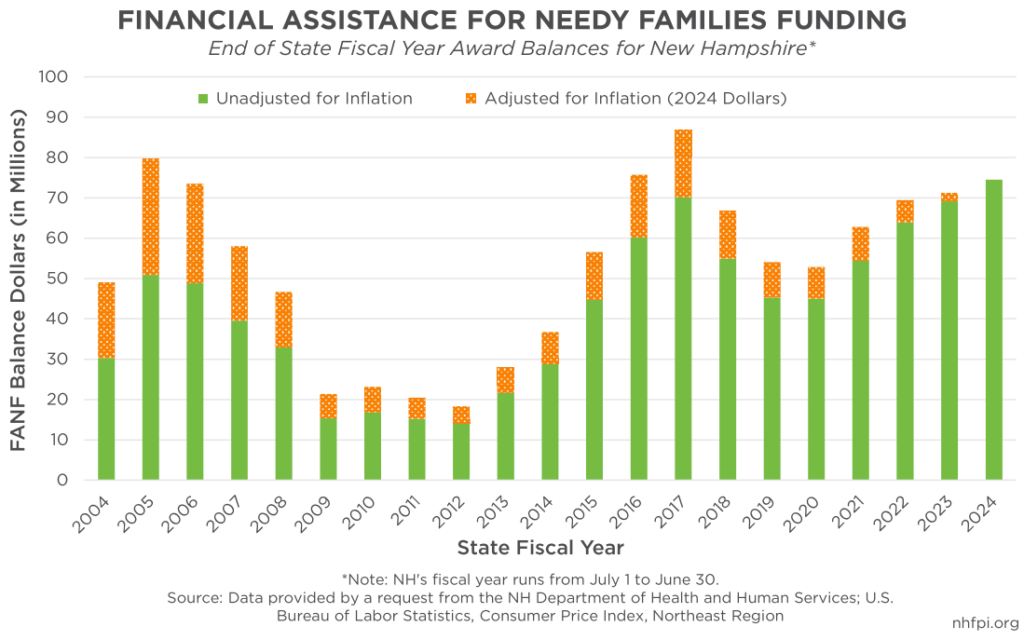

New Hampshire has had a continuing balance of unspent federal TANF dollars which are carried over each year. According to the New Hampshire Department of Health and Human Services (DHHS), at the end of SFY 2024, the State had a balance of $74,473,969, an increase of about $3.5 million from the year prior, adjusted for inflation. Based on the most recent data available, the Granite State spends about the same amount of combined federal and State TANF funds as the remaining federal dollars in the TANF balance. During Federal Fiscal Year (FFY) 2022, lasting from October 1, 2021 until September 30, 2022, New Hampshire spent about $61.2 million of its federal and State TANF funding. By June 30, 2022, New Hampshire had a remaining balance of $63,902,984 in federal funds.

Annual TANF balances are likely dictated by the number of enrollees receiving benefits each year and policy decisions directing the uses of these funds, as well as historic events occurring throughout the past two decades. Following the 2007-2009 recession, greater need among Granite State families likely contributed to a large decline in the TANF balance, lasting from 2009 to 2012. Although the balance increased from 2013 to 2017, New Hampshire saw a decline in its unspent TANF dollars in 2018, as an increasing number of Granite Staters enrolled in the program due to the expanded income thresholds. While the balance continued to decline over the next two years, the balance began to rise again in 2021 as the number of enrollees started to decline.

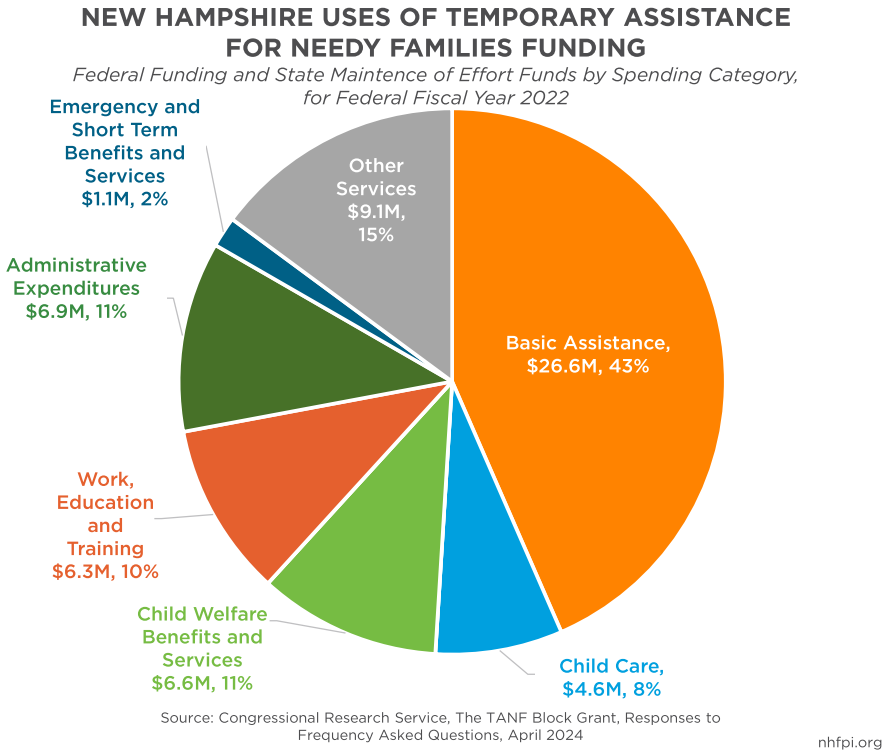

States are given the flexibility to spend TANF dollars in a variety of ways. Similarly to national trends, the majority of TANF funds in New Hampshire are spent on basic cash assistance. In FFY 2022, basic cash assistance accounted for about 43 percent of spent TANF dollars in the state, which included both MOE and federal allocations. New Hampshire also spent large percentages of TANF dollars on child welfare benefits and services (11 percent), administrative expenditures (11 percent), and other services (15 percent).

Basic cash assistance accounted for about 23 percent of spent TANF dollars across the country in 2022, which was the largest spending category during that year. Other spending categories included child care (16 percent); other services, such as transfers to the SSBG (15 percent); pre-k and early childhood services (10 percent); child welfare benefits and services (9 percent); refundable tax credits (8 percent); work, education and training (8 percent); administrative expenditures (7 percent); and emergency and short term benefits and services (4 percent). In 2022, New Hampshire did not spend any of its TANF dollars towards pre-k and early childhood services, or towards refundable tax credits.

Impact for Granite Staters with Low Incomes

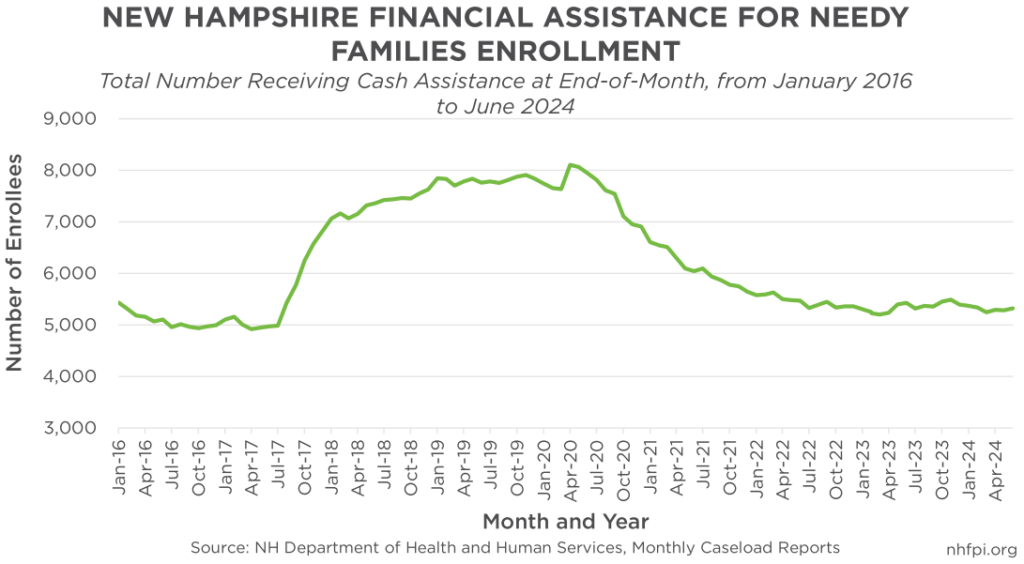

Despite having the highest income eligibility threshold in the country, New Hampshire has experienced declining FANF enrollment since the beginning of the COVID-19 pandemic. Following adjustments to the income eligibility threshold in the SFY 2018-2019 Budget, enrollment in the State’s FANF program increased by about 49 percent from July 2017 to July 2018, according to caseload data from the NH DHHS. In April 2020, FANF enrollment reached its most recent peak, with a total of 8,107 Granite Staters receiving cash assistance across the state. This number has declined since then, with 5,321 receiving assistance as of June 2024, about a 34 percent decline from April 2020. Declines in program enrollment during the COVID-19 pandemic follow similar trends seen nationwide during this time, with an approximate 3.3 percent decrease in enrollment of families with children across the country from 2022 to 2023. The number of applications for FANF benefits also declined during this time, from an average of about 655 applications a month in 2019 to about 477 a month in 2023. Lower TANF enrollment numbers could be due to increased federal support during the pandemic, such as an expansion to the Child Tax Credit in 2021, among other temporary benefits for families, which likely contributed to greater financial stability.

FANF enrollment numbers are much lower than other social assistance programs in the state, likely due to the higher income thresholds for such programs. To be eligible for the State’s Medicaid program, children must be under 318 percent of the federal poverty guidelines, and adults under 138 percent, in cases where no disabilities or other special circumstances trigger other categories of eligibility. Similarly, individuals may be eligible for the State’s Supplemental Nutrition Assistance Program (SNAP) if they earn under 200 percent of the federal poverty guidelines. In 2024, thus far, an average of 183,955 Granite Staters were enrolled in Medicaid each month, 76,922 in SNAP, but only 5,308 in FANF, according to caseload data from the NH DHHS. Increased income thresholds could mean that more Granite Staters with low and moderate incomes are able to access benefits.

Low FANF program enrollment could also be due to the relatively small amount of assistance received compared to the high cost of living in the state. For example, the estimated monthly cost of living in New Hampshire was $8,186 as of February 2024 for a single parent with two children, according to the Massachusetts Institute of Technology’s Living Wage Calculator. This same family would be eligible for up to $1,291 in FANF cash assistance if they have little to no monthly income, which equates to approximately 15.8 percent of the monthly estimated cost of living statewide in New Hampshire, not including taxes. The impact of FANF is also dependent on the cost of living where a family resides, with the highest monthly cost of living expected in Rockingham County at approximately $8,774 a month. Families enrolled in FANF may also be enrolled in other assistance programs which can help offset the high cost of living. For example, a family of three receiving FANF dollars would also be eligible for a monthly maximum amount of $766 in SNAP assistance.

Due to lower poverty thresholds and limited enrollment compared to other social assistance programs, as well as smaller benefit amounts relative to poverty thresholds and the cost of living, the impact of the State’s FANF program on reducing overall poverty or hardship statewide may be limited. Additionally, the State’s FANF program has likely reached only a small percentage of families that may be eligible to receive benefits. According to New Hampshire data collected from 2018 through 2022 by the U.S. Census Bureau, approximately 24,907 households with at least one child under the age of eighteen were living at or below 60 percent of the federal poverty threshold each year. During this time period, according to caseload data from the NH DHHS, an average of 3,163 households (13 percent) were receiving FANF benefits each month. According to this data, about 87 percent (21,744 households) of households with children living below 60 percent of the poverty guidelines would have been eligible for the program if they had met other specified program requirements; this percentage does not include families with children aged eighteen and nineteen who may also be eligible for benefits. Increased investments in outreach for social assistance programs, funded with the rising positive balance of funds, may help ensure that more families are aware of FANF and are able to access benefits if they are eligible. Additionally, enhanced or redesigned benefits, designed to address key rising costs for families such as food and child care, may help reduce hardship for enrolled families and contribute to the state’s economy.

– Jessica Williams, Policy Analyst