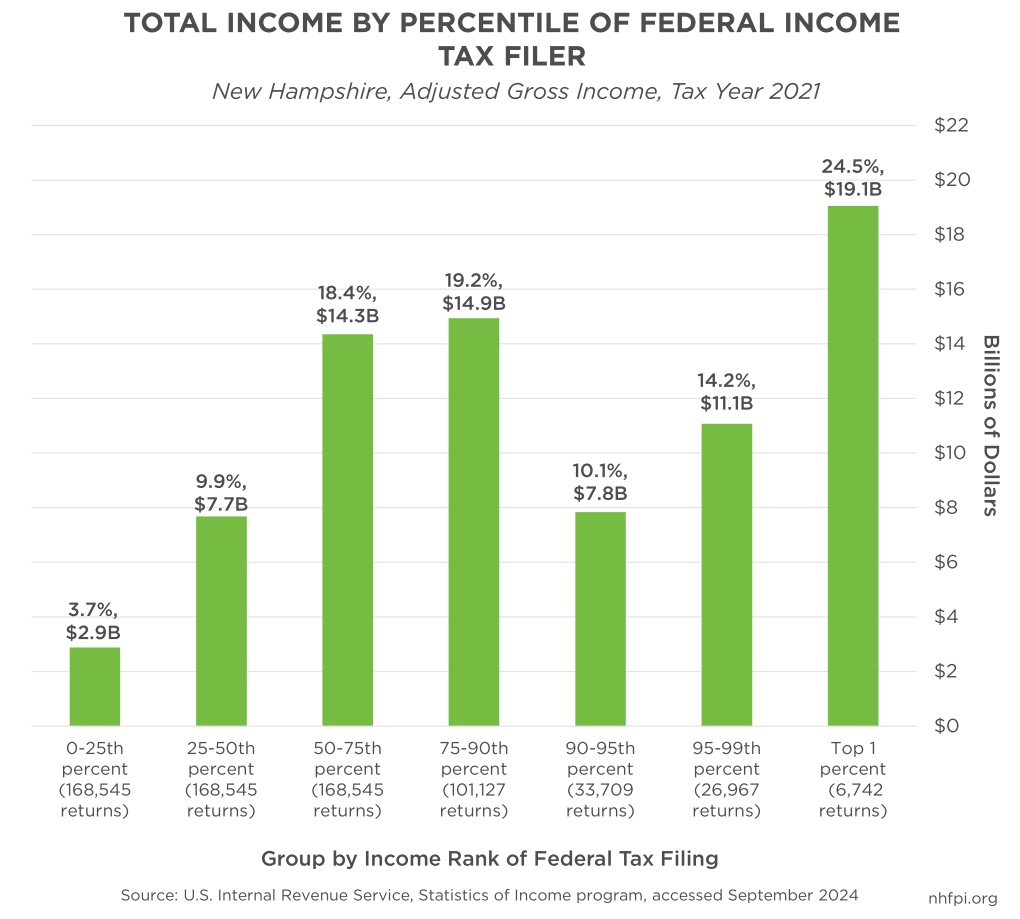

Data from the U.S. Internal Revenue Service suggest New Hampshire residents with the highest incomes, in the top one percent of tax filers, collected a disproportionately large share of income reported by New Hampshire households. On the federal income tax returns filed for tax year 2021, the most recently available detailed data, total Adjusted Gross Income (AGI), or income after key deductions, reported by New Hampshire federal tax filers was $77.8 billion spread across 674,178 tax returns from the state’s approximately 1.388 million residents that year. About $19.1 billion in AGI was reported by the 6,742 top one percent of tax filers, totaling about 24.5 percent, or nearly one quarter, of all AGI reported by Granite State residents. AGI for the top one percent increased 61.9 percent between 2020 and 2021 in New Hampshire, largely due to increases in capital gains income.

To learn more about the forms of earnings at different income levels and how these income distributions have changed over time, see NHFPI’s September 2024 blog: Federal Policymakers Will Consider Tax Changes Benefitting Higher-Income Granite Staters in 2025.