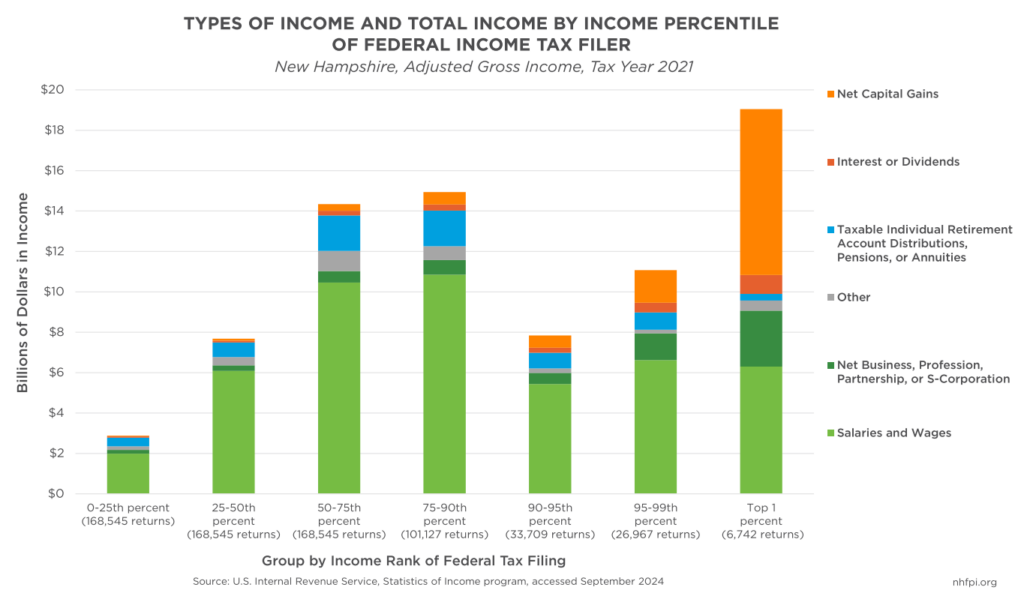

Data from the U.S. Internal Revenue Service suggest New Hampshire residents with the highest incomes, in the top one percent of tax filers, collected a disproportionately large share of income from both capital gains and business-related income. Of about $19.1 billion in total Adjusted Gross Income (AGI), or income after deductions, reported by the 6,742 New Hampshire federal tax filers that constituted the top one percent of state tax filers, $8.2 billion (43.1 percent) was from capital gains, while net business, profession, partnership or S-corporation income was $2.8 billion (14.6 percent). The share of AGI from capital gains dropped consistently as income decreased, and capital gains income only accounted for about 1.3 percent, on average, of reported AGI for earners in the bottom 50 percent of reported incomes. Net pass-through business-related income fell as well, dropping to about four percent for taxpayers in the middle 50 percent of the income scale. These data indicate business-based income and capital gains income are disproportionately larger sources of revenue for Granite Staters with higher incomes.

To learn more, see NHFPI’s September 2024 blog: Federal Policymakers Will Consider Tax Changes Benefitting Higher-Income Granite Staters in 2025.