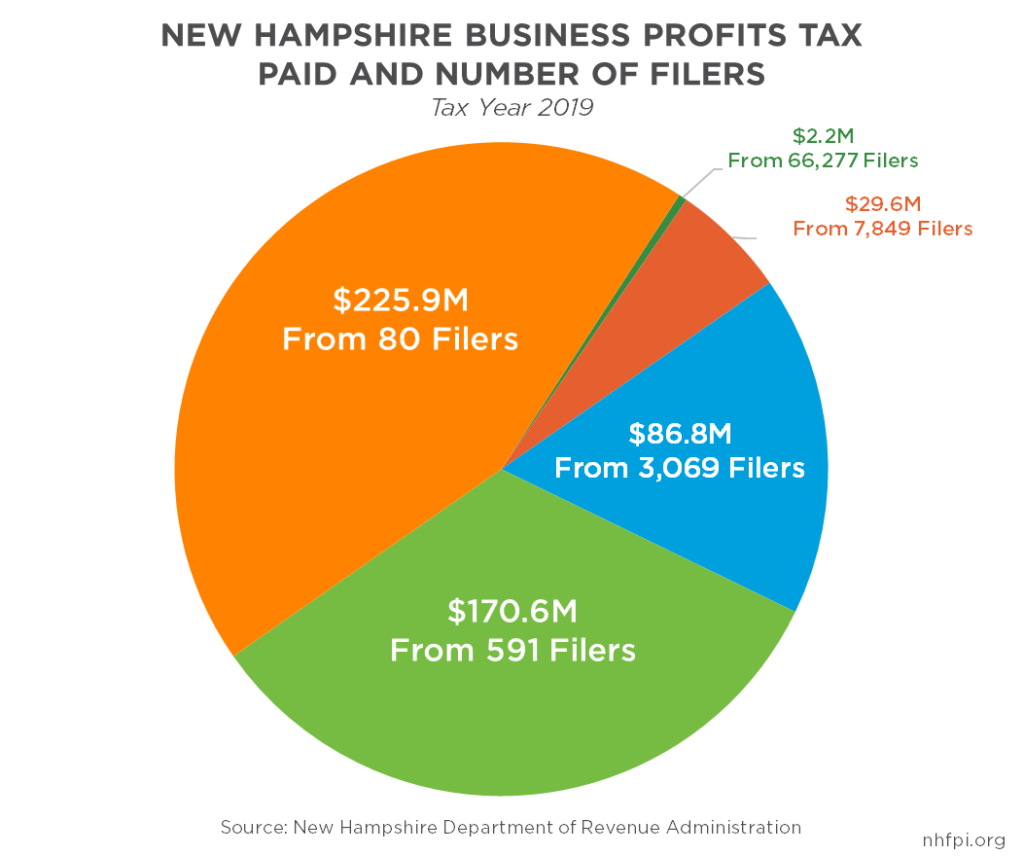

The New Hampshire Department of Revenue Administration reported 77,866 business entities filed Business Profits Tax returns for Tax Year 2019. Of these filers, 59,386 (76.3 percent) did not owe any Business Profits Tax, likely due to the application of credits against their tax liabilities, such as the credit based on payment of the Business Enterprise Tax. Entities owing tax paid about $515.1 million for Tax Year 2019. About 43.9 percent of the total tax revenue collected, or $225.9 million, was paid by 80 filers (0.1 percent), each owing more than $1 million to the Business Profits Tax. Another 591 filers (0.8 percent), each owing between $100,000 and $1 million in taxes, paid $170.6 million (33.1 percent) of the total tax revenue collected.