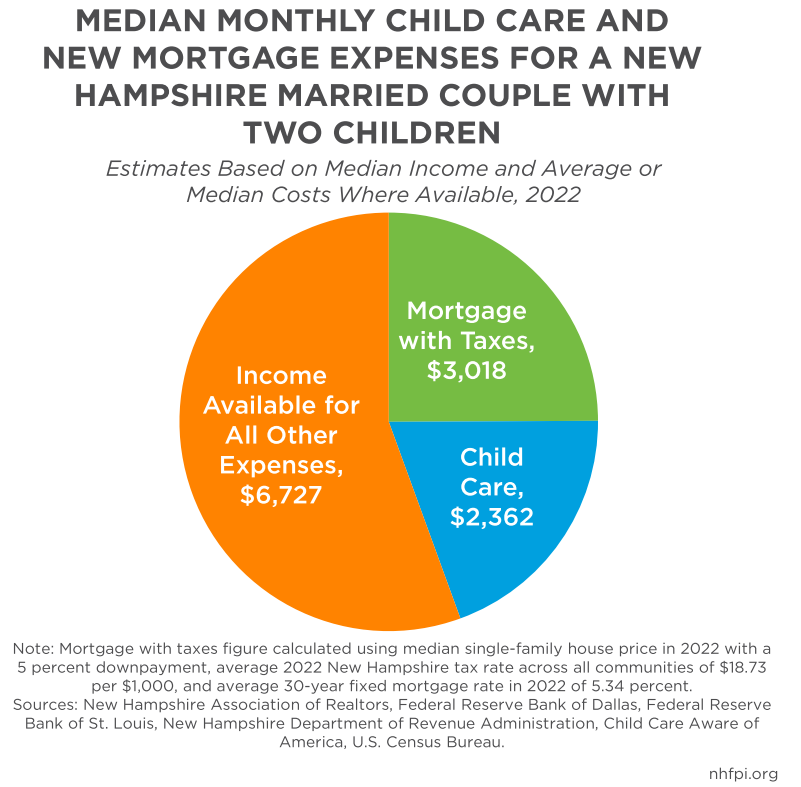

New Hampshire’s record-breaking house sale prices and high mortgage interest rates, along with expensive child care prices, mean families may need to devote a significant portion of their household income toward covering just these two expenses. For example, a median-income married couple family with children earned $145,289 annually ($12,107 monthly) in 2022. If this couple had two children under four in center-based child care, 2022 estimates suggest they paid, on average, $2,362 monthly for tuition. If this family purchased a median-priced single-family house in 2022 with a 5 percent down payment, an average 30-year fixed mortgage rate of 5.34 percent and an average New Hampshire tax rate of $18.73 per $1,000, they would have a monthly mortgage of $3,018 (including taxes). Altogether, this family would be spending about 44 percent of their household income on mortgage and child care payments alone, leaving only 56 percent ($6,727) for all other expenses.

Learn more in NHFPI’s May 2024 Issue Brief: The Fragile Economics of the Child Care Sector