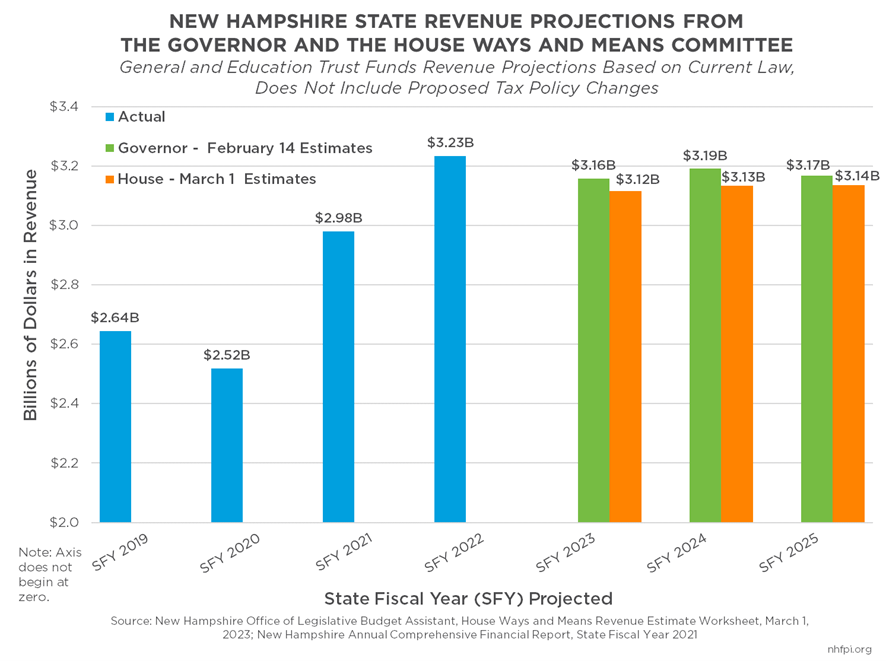

On March 1, 2023, the House Ways and Means Committee, which develops revenue projections for the House phase of the State Budget process, agreed on revenue projections for the remainder of State Fiscal Year (SFY) 2023 and for SFYs 2024 and 2025, which encompass the next State Budget biennium. The Committee’s projections indicate revenues to the General and Education Trust Funds would be $131 million lower across the three years than the revenues projected in the Governor’s State Budget proposal, based on current law and not accounting for any proposed revenue policy changes.

The Governor has proposed eliminating the Communications Services Tax, which would reduce revenues by $57.8 million during the State Budget biennium. The forgone revenue would be the equivalent of the current year’s State Budget funding for the Community College System of New Hampshire. If the House were to adopt the Governor’s proposal to eliminate the Communication Services Tax as well, the gap between the Governor’s and the House Ways and Means Committee’s revenue projections would remain $131 million, but would decline to $73.2 million relative to the Governor’s proposed policy changes if the House did not repeal the tax.

The Committee had higher revenue projections than the Governor for the Meals and Rentals Tax, but projected substantially lower receipts from the Real Estate Transfer Tax, the combined Business Profits and Business Enterprise Taxes, the Tobacco Tax, and the Utility Property Tax. This reduction in expected revenue suggests the House Finance Committee will have fewer dollars to deploy in its State Budget proposal than the Governor used to build his plan.

Learn more about State revenues on NHFPI’s Revenue & Tax topic page.